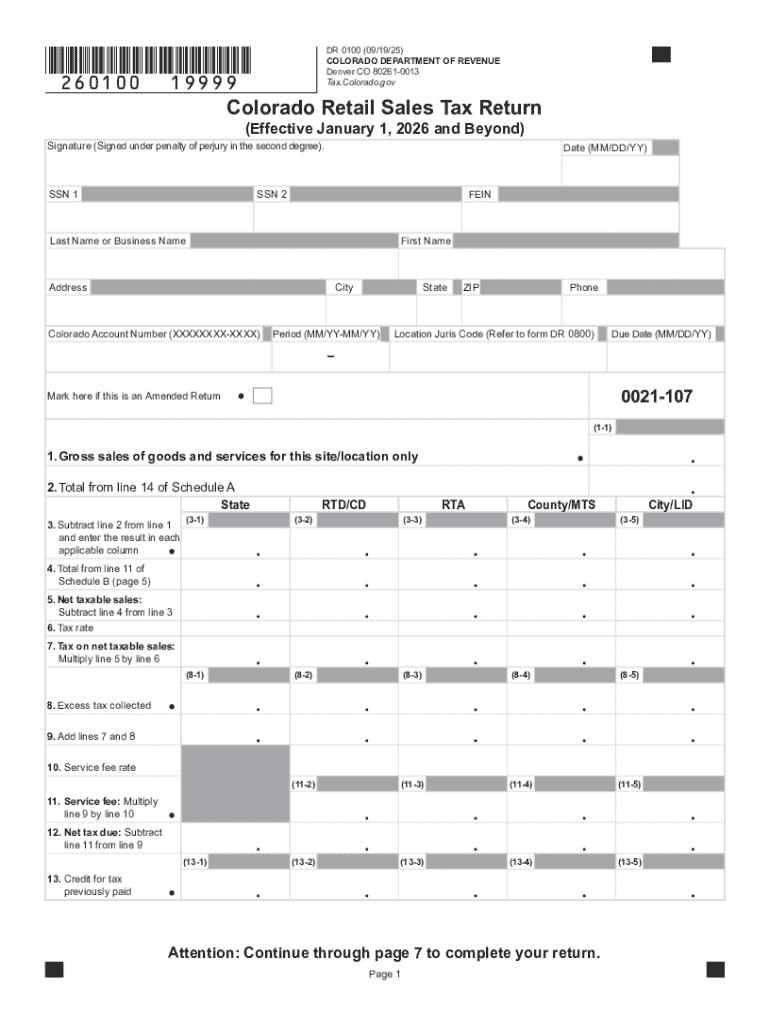

Get the free DR 0100 - Retail Sales Tax ReturnDepartment of Revenue

Get, Create, Make and Sign dr 0100 - retail

Editing dr 0100 - retail online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dr 0100 - retail

How to fill out dr 0100 - retail

Who needs dr 0100 - retail?

Understanding the DR 0100 - Retail Form: A Comprehensive Guide

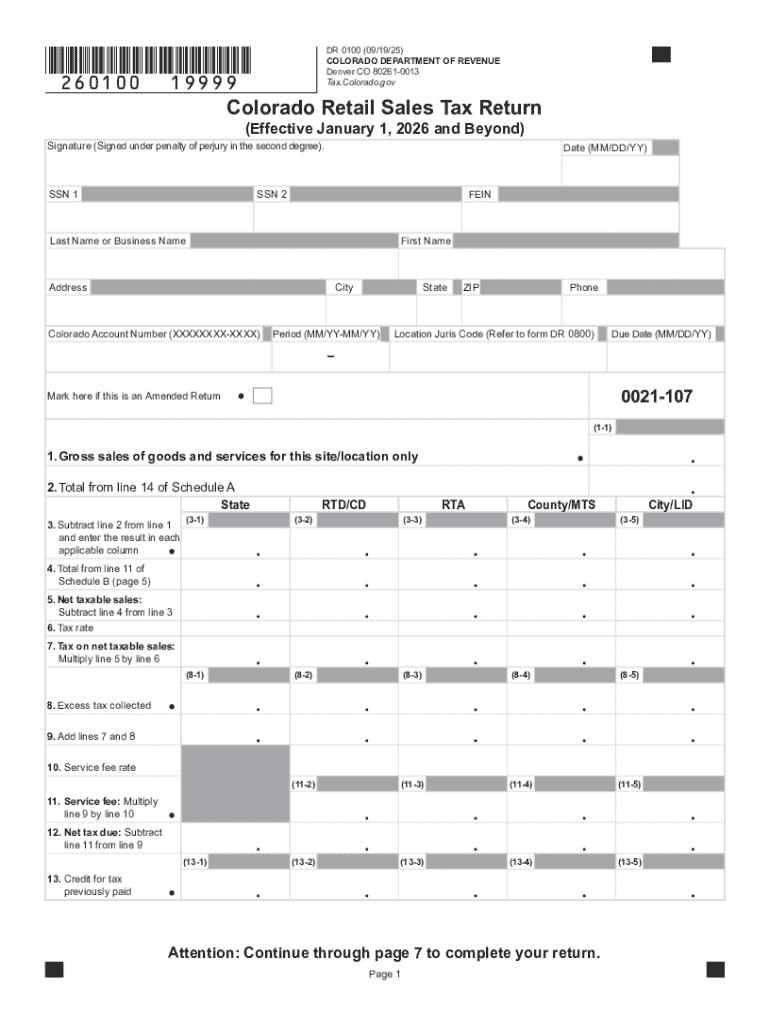

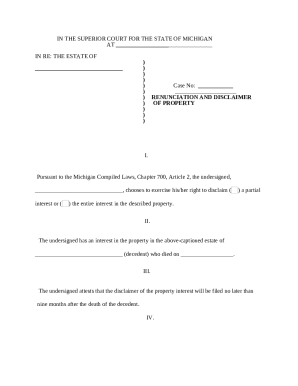

Overview of the DR 0100 - Retail Form

The DR 0100 Form, or Retail Sales Tax Return, is essential for retailers in many areas. This form is the primary document used to report and remit sales tax collected on taxable sales. It represents a critical component of tax compliance for businesses, ensuring that they meet their state obligations for sales tax payment.

The importance of the DR 0100 extends beyond mere compliance; it serves as a transparent mechanism for local governments to generate revenue that supports public services. Retailers must understand who needs to file this form, as compliance varies based on sales volume and type.

Key components of the DR 0100

The DR 0100 Form consists of several critical sections that need to be completed accurately. Understanding each segment will help prevent errors that could lead to penalties or unwanted audits. These typically include Personal and Business Information, Sales Information, Deductions and Credits, and a signature section.

At its core, this form captures vital data about the retailer's sales activities. It also includes terminology specific to sales tax returns, which may confuse first-time filers. Familiarity with terms like 'taxable sales,' 'exempt sales,' and 'deductions' is crucial when completing the form.

Step-by-step guide to filling out the DR 0100

Filling out the DR 0100 may seem daunting, but breaking it down into manageable steps simplifies the process. Start by gathering all necessary documentation, such as sales records, tax exemption certificates, and previous tax returns that can help clarify the data you need.

Once you have your documents in hand, complete the form using accurate sales data. Be sure to clearly distinguish between taxable and non-taxable sales and calculate deductions meticulously.

Editing and customizing your DR 0100 form

In today's digital age, editing and customizing forms like the DR 0100 is more accessible than ever. Solutions like pdfFiller offer a straightforward platform where users can upload their DR 0100 form and make any necessary adjustments in real time.

Using cloud-based solutions also allows users to save their progress and collaborate with team members for enhanced accuracy. This flexibility increases efficiency and aids in the overall submission process.

eSigning and submitting the DR 0100

After completing the DR 0100 form, the next step is to electronically sign your document. The eSigning functionality in pdfFiller streamlines this process significantly, allowing users to sign their forms securely without needing to print.

Submission options typically include online submission through the state portal or conventional methods like print and mail. Keeping track of your submission status is crucial; monitoring your application can prevent potential issues down the line.

Common mistakes and how to avoid them

Many businesses encounter pitfalls when filing the DR 0100 form. Common errors such as entering incorrect sales figures or miscalculating deductions could lead to audits or penalties. Understanding these mistakes allows you to plan better and submit a flawless return.

To ensure accuracy, it’s advisable to implement best practices during the filing process. Reviewing all entries and maintaining meticulous financial records are essential steps to avoid future troubles with tax authorities.

Frequently asked questions (FAQs) about the DR 0100

Filing the DR 0100 can raise various queries, particularly concerning deadlines and submission procedures. One recurring question is what happens if you file late; typically, this can incur penalties or interest fees, so timeliness is crucial.

Amendments may also raise concerns; knowing how to revisit and adjust submitted forms is important for maintaining compliance with tax authorities. Additionally, inquiries about assistance sources for completing the form are common.

Use cases and testimonials

Understanding how others have successfully filed their DR 0100 forms can provide valuable insights. Retailers who streamline the process through electronic means often recount smoother experiences, highlighting that utilizing platforms like pdfFiller facilitates accuracy and efficiency.

Testimonials from actual users emphasize the user-friendly interface and the benefits of real-time collaboration. Such insights serve as encouragement for others to embrace digital solutions for tax compliance.

Additional tools and resources

Utilizing interactive tools available on pdfFiller can greatly enhance your efficiency when working with the DR 0100. For instance, calculation tools can help determine your taxable base and any applicable service fees, ensuring you accurately report your sales tax returns.

PdfFiller also offers a comprehensive template library that includes not only the DR 0100 but also related forms needed for tax compliance, empowering users with the means to manage their paperwork effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in dr 0100 - retail without leaving Chrome?

Can I create an eSignature for the dr 0100 - retail in Gmail?

How do I edit dr 0100 - retail on an Android device?

What is dr 0100 - retail?

Who is required to file dr 0100 - retail?

How to fill out dr 0100 - retail?

What is the purpose of dr 0100 - retail?

What information must be reported on dr 0100 - retail?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.