Get the free Policy Cancellation (Surrender-Form)PDFLife Insurance

Get, Create, Make and Sign policy cancellation surrender-formpdflife insurance

How to edit policy cancellation surrender-formpdflife insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out policy cancellation surrender-formpdflife insurance

How to fill out policy cancellation surrender-formpdflife insurance

Who needs policy cancellation surrender-formpdflife insurance?

Comprehensive Guide to Policy Cancellation Surrender Form for Life Insurance

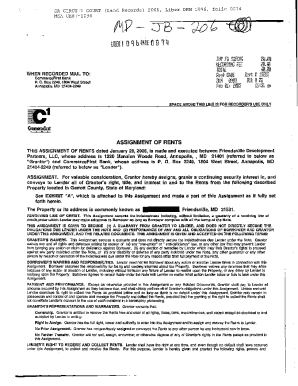

Understanding policy cancellation and surrender forms

Policy cancellation and surrender are crucial concepts in managing life insurance. Cancellation refers to ending a policy before its term is over, often due to non-payment or personal choice. Surrender, on the other hand, refers to voluntarily giving up a life insurance policy, typically in exchange for its cash value. Understanding these terms and the associated processes is vital for policyholders to make informed decisions that align with their financial goals.

Every life insurance policyholder should be aware of their options, especially regarding cancellation and surrender. The surrender process allows policyholders to access the cash value accumulated in their policy, while cancellation ends the insurance coverage completely. Familiarity with the nuances of these options can significantly affect long-term financial planning.

When to use a policy cancellation surrender form

Several situations may lead a policyholder to use a policy cancellation surrender form. Key scenarios include financial difficulties that require cutting costs, such as lost employment or unexpected expenses. Another common reason is a change in personal circumstances, like marriage or having children, prompting a reassessment of insurance needs.

It's essential to understand the differences between cancellation and surrender. Cancellation typically results in the loss of coverage without financial return, while surrender may provide cash value, depending on how long the policy has been in force. Understanding the financial implications of each option can affect future policy applications and eligibility.

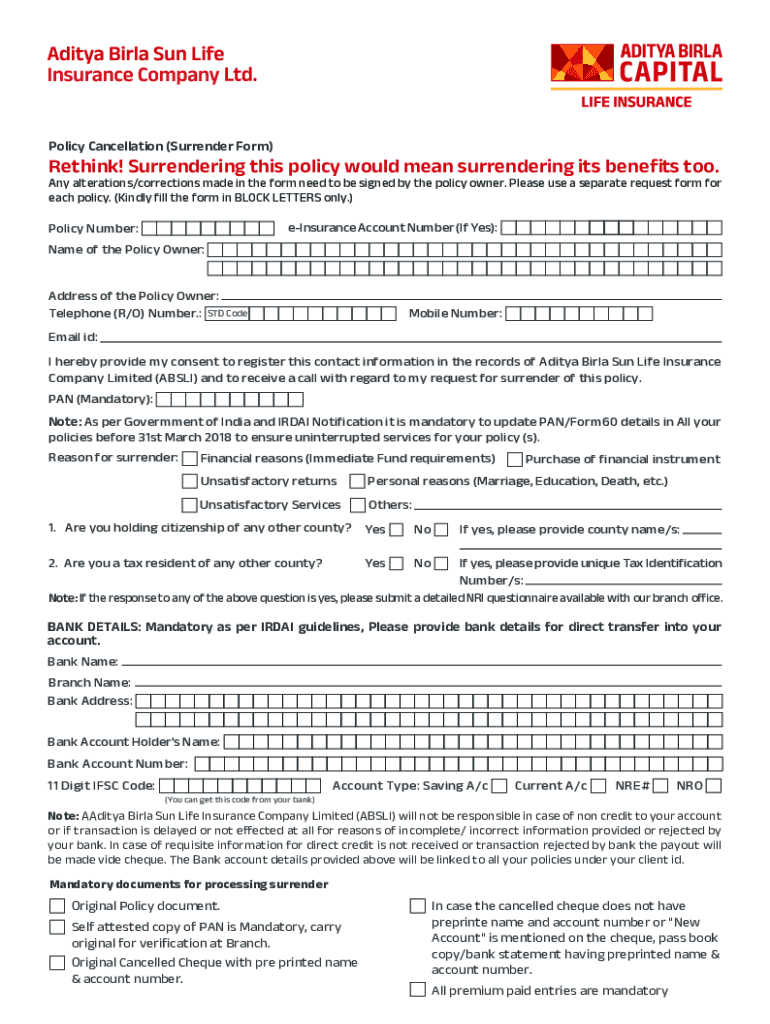

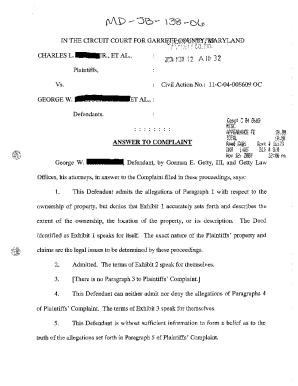

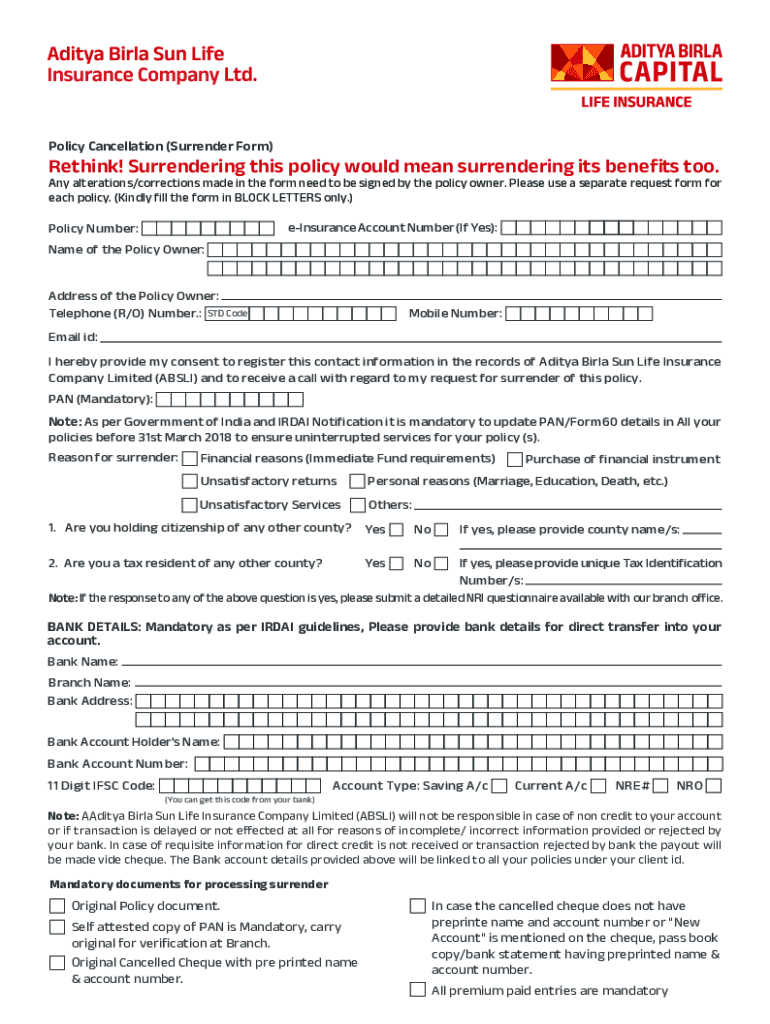

Exploring the required documentation

To properly complete the policy cancellation surrender form, several essential documents are required. Primarily, the original policy document is necessary to confirm your intent and provide the policy details. Additionally, you'll need proof of identity, such as a government-issued ID to verify your identity and authority to make this change.

Gathering these documents efficiently is crucial. Organizing them in advance can help streamline the process, thereby minimizing potential delays in your cancellation or surrender request.

Step-by-step instructions for completing the form

Filling out the policy cancellation surrender form can be straightforward if you follow a few key steps. Start with providing your personal information, including full name, address, and contact details. Ensure that all information matches the details on your original policy document to avoid any discrepancies.

Next, include your policy details, such as the policy number and the date of issue. This information is critical for the insurance company to locate your policy efficiently. Following that, you'll be required to provide signatures, confirming that you understand the implications of canceling or surrendering your policy.

Before submitting the form, double-check all filled details for accuracy. Errors or omissions can lead to processing delays or rejection of your request.

Common mistakes to avoid when filling out the form

Filling out the cancellation surrender form correctly is crucial. Some frequent errors include typos in personal information, incorrect policy numbers, and failing to sign the form. Each of these mistakes can result in processing issues, so it's important to ensure every detail is accurate.

Moreover, understanding the terms and conditions provided by the insurance company can help prevent misunderstandings. Be aware of any implications regarding cash values and potential tax consequences when surrendering a policy. Clear and precise documentation can alleviate potential complications down the road.

Submission process for the policy cancellation surrender form

Once your form is accurately completed, the next step is submission. Many insurance companies offer several options for submitting the form, including online platforms, mailing it in, or delivering it in person at a local branch. Each method has its own advantages; online submission can be quicker, while in-person visits allow for immediate confirmation.

Be sure to check if there are any associated fees with the cancellation or surrender. Sometimes, policies may have penalties for early cancellation, affecting your decision-making process. Lastly, inquire about expected timelines for processing your request, as this varies by insurer.

Managing your policy post-cancellation or surrender

After you submit the policy cancellation surrender form, it’s essential to understand what to expect next. The insurer will process your request and send you confirmation, usually along with any applicable cash value payments if it was a surrender. Maintaining clear records of these transactions is crucial for your financial documentation.

Additionally, consider the implications for your future insurance needs. Cancelling or surrendering a policy means you will need to look into alternative coverage options or adjust your financial strategy accordingly. Using any surrendered funds wisely, perhaps by investing or saving, can help mitigate the loss of coverage.

Frequently asked questions (FAQs) about policy cancellation and surrender forms

Understanding commonly asked questions can assist policyholders in feeling more confident about the cancellation surrender process. For example, can one cancel a policy without submitting a surrender form? Generally, most companies require formal documentation for a valid cancellation. What if you change your mind after submission? Policies differ; some allow a grace period for reversal of surrender, while others do not.

Another frequent question pertains to penalties associated with early cancellations. Many policies impose fees for canceling before a specified time; being aware of these details beforehand can help you avoid financial pitfalls. It’s always wise to consult your insurance provider for clarity on procedures and potential consequences.

Utilizing pdfFiller for your policy cancellation surrender form

pdfFiller streamlines the process of filling out the policy cancellation surrender form. This online platform allows users to edit, sign, and collaborate on documents easily from any location. By using pdfFiller, policyholders can access essential tools for managing their forms efficiently and securely.

Some key features include the ability to edit documents directly, utilize electronic signatures, and share forms with family members or advisors for collaborative management. Real-world case studies highlight how users have saved time by eliminating printing and scanning while ensuring their documents are correctly filled out, enhancing overall efficiency.

Additional tips for document management

Once you've completed your cancellation surrender process, it's critical to manage your insurance documents effectively. Organizing these documents allows for easy access when needed and ensures valuable information isn't lost. Adopting a structured digital filing system can enhance this process.

pdfFiller's tools come in handy for securely storing and managing these important files. Its cloud-based platform ensures that your documents are not only accessible but protected. As needs change, regularly updating and reviewing your documents will help you stay aligned with your financial goals and obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my policy cancellation surrender-formpdflife insurance directly from Gmail?

How can I send policy cancellation surrender-formpdflife insurance to be eSigned by others?

Can I sign the policy cancellation surrender-formpdflife insurance electronically in Chrome?

What is policy cancellation surrender-formpdflife insurance?

Who is required to file policy cancellation surrender-formpdflife insurance?

How to fill out policy cancellation surrender-formpdflife insurance?

What is the purpose of policy cancellation surrender-formpdflife insurance?

What information must be reported on policy cancellation surrender-formpdflife insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.