Get the free Personal Estate Planning Kitthe University of Maryland

Get, Create, Make and Sign personal estate planning kitform

Editing personal estate planning kitform online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal estate planning kitform

How to fill out personal estate planning kitform

Who needs personal estate planning kitform?

A Complete Guide to Your Personal Estate Planning Kitform: Simplify Your Future Today

Understanding personal estate planning

Estate planning is the process of anticipating and arranging for the management and disposal of a person's estate during their life and after death. It involves making critical decisions about how your assets—like money, property, and investments—will be distributed amongst your loved ones. Many individuals overlook the importance of estate planning, often considering it something reserved for the wealthy. This misconception can lead to heartache and conflict among families, particularly when unexpected events occur.

A personal estate planning kitform helps to demystify this process by providing a structured format to organize your wishes. It's essential for anyone, regardless of financial status, to engage in personal estate planning. Failing to formalize your wishes could lead to legal disputes, excessive taxes, or assets going to unintended beneficiaries.

Components of an estate planning kitform

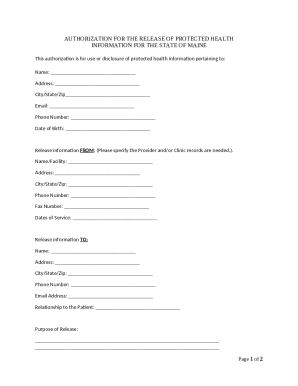

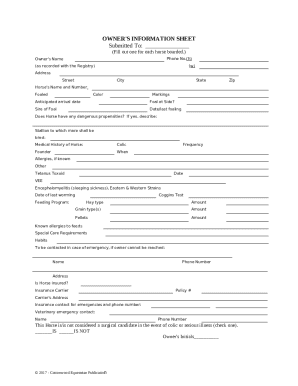

A comprehensive personal estate planning kitform includes several key documents that form the backbone of any effective estate plan. They help facilitate the distribution of your belongings and ensure your wishes are respected. The most commonly included documents are wills, trusts, powers of attorney, and healthcare directives.

A will outlines how to distribute your assets upon death and can also name guardians for minor children. Trusts allow you to control how your assets are distributed and can reduce tax implications. Powers of attorney designate someone to make financial decisions on your behalf if you become incapacitated. Healthcare directives convey your medical preferences if you're unable to communicate them.

Customizing your personal estate planning kit is crucial. Your kit should reflect your unique life circumstances, family dynamics, and individual preferences. Consulting with financial and legal advisors can provide insights tailored to your specific needs and help structure your estate plan effectively.

Step-by-step guide to filling out your kitform

Before diving into filling out your personal estate planning kitform, proper preparation is essential. Start by gathering necessary information about your assets and liabilities. This means compiling a list of all your bank accounts, properties, vehicles, and any debts you may have.

Once you have this information, you can begin completing the specific documents in your kit. Pay close attention to detail, ensuring that names, dates, and instructions are accurate. Each document should be completed as follows:

Best practices also include proper document management. Store your documents securely in a fireproof safe or a secure online platform like pdfFiller, ensuring they are accessible to your loved ones when needed. Regularly review and update your personal estate planning kit as life circumstances change.

Interactive tools for estate planning

Utilizing online resources such as pdfFiller can significantly simplify your estate planning process. pdfFiller offers interactive fillable forms that allow you to complete your personal estate planning kitform online, minimizing the chance of errors and maximizing efficiency. With features for document sharing and collaboration, you can include input from family members and advisors seamlessly.

pdfFiller also streamlines the process through eSigning capabilities, allowing you to sign documents digitally. This means you no longer have to print, sign, and scan back any paperwork. The added cloud-based document management ensures your information is always accessible, so you can make changes as needed from anywhere.

Common questions and pitfalls in estate planning

One question often asked is, 'What happens if I don’t have an estate plan?' The answer can be unsettling: without an estate plan, the state may dictate how your assets are distributed, potentially leading to results that go against your wishes. Additionally, the probate process can be lengthy and costly for your family.

Regularly reviewing your estate plan is critical. A common pitfall is neglecting to update your documents after significant life changes, such as marriage, divorce, the birth of children, or changes in financial circumstances. Moreover, communicating with your family about your plans is essential to prevent misunderstandings and ensure they are aware of your wishes.

Real-life scenarios and case studies

Many success stories exist of individuals who took the time to plan ahead. These individuals often find financial peace of mind, knowing their loved ones are taken care of and that their wishes will be honored. They have avoided lengthy probate processes, minimizing stress and freeing their family from making difficult decisions during an emotional time.

Conversely, there are numerous lessons learned from those who did not invest time in creating an estate plan. For example, families facing dysfunctional disagreements over asset distribution, or worse, situations where children are left without care arrangements due to a lack of a designated guardian in a will. Engaging in professional assistance for creating your estate plan can often yield better outcomes than a do-it-yourself approach.

Getting started with your personal estate planning kitform

Taking the first steps with a personal estate planning kitform may feel overwhelming, but breaking it down makes it manageable. Begin by considering the important aspects of your life that the estate plan should address, such as your existing financial framework, your wishes for healthcare, and your family dynamics.

You can find your kitform easily through platforms like pdfFiller, which houses a variety of pre-designed templates tailored to meet diverse needs. Using these templates will not only save you time but will also guide you through the complex language often found in legal documentation, ensuring clarity in your directives.

Ongoing management of your estate plan

Once your personal estate planning kitform is complete, ongoing management is vital. Set reminders to review your estate plan regularly, ideally once a year or after significant life events. These reminders should prompt you to examine whether your documents still reflect your current wishes and circumstances.

Engaging family in the planning process promotes a better understanding of your wishes and responsibilities. Open conversations with your loved ones about your estate plan can alleviate future conflict and ensure everyone is on the same page regarding their roles and expectations.

Conclusion

A personal estate planning kitform simplifies a potentially complex process, ensuring that your wishes are honored and your loved ones are cared for. By taking the time to develop a detailed estate plan, equipped with essential documents, you lay a foundation for peace of mind, both for yourself and for your family.

Embarking on your estate planning journey with the right tools, such as pdfFiller, allows you to manage your documents efficiently. Start today, and take the proactive steps necessary to secure your legacy for the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit personal estate planning kitform online?

Can I create an eSignature for the personal estate planning kitform in Gmail?

How do I fill out the personal estate planning kitform form on my smartphone?

What is personal estate planning kitform?

Who is required to file personal estate planning kitform?

How to fill out personal estate planning kitform?

What is the purpose of personal estate planning kitform?

What information must be reported on personal estate planning kitform?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.