Get the free 83 01 1S W

Get, Create, Make and Sign 83 01 1s w

Editing 83 01 1s w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 83 01 1s w

How to fill out 83 01 1s w

Who needs 83 01 1s w?

Understanding the 83 01 1s W Form: A Comprehensive How-to Guide

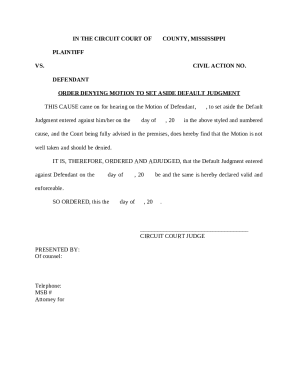

Understanding the 83 01 1s W Form

The 83 01 1s W Form is a critical document used for reporting specific tax-related information. Its primary purpose is to streamline the declaration process for various tax liabilities, ensuring accurate reporting and compliance with local government regulations. This form can be particularly beneficial for individuals and teams managing multiple financial obligations, including property taxes, sales taxes, and insurance premium taxes.

Understanding and utilizing the 83 01 1s W Form is fundamental for anyone involved in financial management, compliance, or tax reporting. It can help mitigate potential issues with the government, as filling out this form correctly ensures that you are taking advantage of available tax credits, such as the child care tax credits program or various scholarship funding organizations.

Individuals or organizations that need to report their income, property, and other financial details are required to use the 83 01 1s W Form. This includes anyone liable for different tax categories, such as ad valorem tax or utility services. By ensuring the form’s correct completion, taxpayers can avoid potential penalties and take full advantage of their tax obligations.

Key features of the 83 01 1s W Form

The 83 01 1s W Form includes several critical elements essential for accurate tax reporting. These features allow users to provide comprehensive information, from personal identification details to an overview of various tax liabilities. In many situations, using this form is mandatory when reporting income from different sources or when claiming tax benefits like the live local program contributions.

Some common situations where the 83 01 1s W Form is needed include annual income reporting, property transactions, and claiming various exemptions or credits. By utilizing this form, users can consolidate their tax reporting requirements, thus streamlining the overall process. Compared to alternative forms or reporting methods, the 83 01 1s W Form provides clarity and structure that can significantly reduce errors.

Step-by-step instructions for filling out the 83 01 1s W Form

Filling out the 83 01 1s W Form accurately involves several steps, each focusing on specific sections of the document, ensuring comprehensive and error-free submissions.

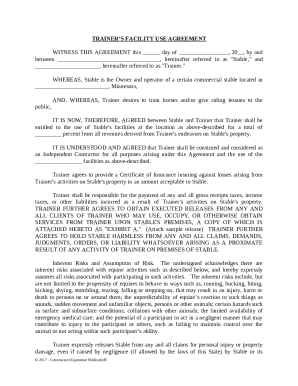

Section 1: Personal information

The first section requires key details such as your name, address, and contact information. It is imperative that this information is accurate, as it will be used for all official communications relating to your tax obligations.

Section 2: Financial overview

This section revolves around income reporting. You need to provide a comprehensive overview of your income sources, detailing any deductions you plan to claim. Pay close attention to listing applicable deductions like the documentary stamp tax or property tax, as these can significantly impact your net taxable income.

Section 3: Additional notes

The final section is an opportunity to provide contextual information that may influence your tax report. If there are unusual circumstances affecting your tax position, explaining these in the notes section can help in the assessment process.

To enhance accuracy and completeness, double-check each section before submission. Utilizing tools provided by platforms like pdfFiller can help ensure your form is filled out correctly without leaving any information blank.

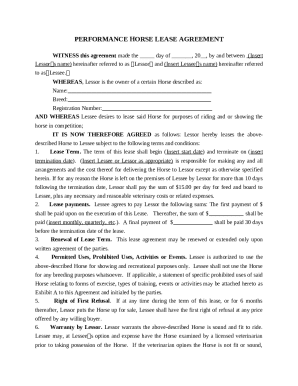

Editing the 83 01 1s W Form using pdfFiller

Editing the 83 01 1s W Form is simplified through pdfFiller’s user-friendly interface. Accessing the form is straightforward; users can upload existing documents or create new ones directly on the platform. The ability to modify and update the form easily is crucial for individuals who may need to correct or amend their reports.

pdFiller also provides interactive tools that let users add text, checkboxes, or signatures to the form. If you're working in a team, you can invite colleagues to collaborate on the document, which is particularly useful for organizations handling multiple forms or extensive reporting processes.

The compliance features of pdfFiller guarantee that your form remains accurate and adheres to the latest tax regulations. By utilizing provided templates and resources, you can easily ensure that you're aware of any changes in local or state tax laws, such as updates to tourist development tax rates or sales tax.

Signing and submitting the 83 01 1s W Form

Once the 83 01 1s W Form is complete, it's crucial to sign and submit it properly. pdfFiller makes this process seamless with its eSignature feature, allowing users to sign documents electronically with just a few clicks. This method not only speeds up the submission process but also ensures that your form is legally binding.

When it comes to submission options, you have the choice of online or offline methods. Online submissions are often quicker and may provide immediate confirmation of receipt, while offline submissions require mailing the signed form, which can sometimes lead to delays. Ensure to be aware of submission deadlines to avoid penalties.

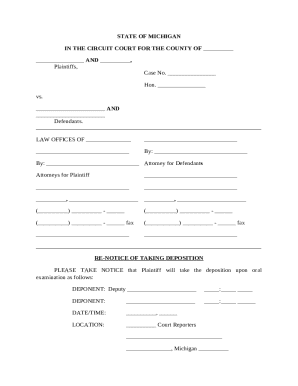

Managing your 83 01 1s W Form with pdfFiller

Managing the 83 01 1s W Form post-submission is equally important. pdfFiller offers robust organizational tools allowing you to categorize documents into folders and use tags for quick retrieval. This feature is particularly beneficial for teams handling numerous tax documents, as it enhances workflow efficiency.

Tracking changes is another critical feature, with version control ensuring that you have access to previous versions of your form if needed. This can be particularly helpful when revisiting or comparing data across tax cycles. Plus, with the cloud-based structure of pdfFiller, you can access your documents from anywhere, allowing for flexible work arrangements regardless of your location.

Frequently asked questions (FAQs) about the 83 01 1s W Form

Addressing common concerns about the 83 01 1s W Form can greatly enhance user experience. For instance, many individuals make simple mistakes such as omitting key information or misreporting incomes, which can lead to complications with the government. To avoid these pitfalls, reviewing the form multiple times before submission is essential.

Another frequent question is about the amendment process if changes are needed after submission. If alterations are necessary, it is crucial to follow the correct procedures for amending tax documents, ensuring compliance with local regulations.

Users also often encounter technical issues during form completion or submission. pdfFiller provides detailed troubleshooting resources and customer support to assist users in resolving any problems they might face.

User experiences: testimonials and tips from the pdfFiller community

Listening to the experiences of others can provide significant insights into effectively utilizing the 83 01 1s W Form. Many users report that integrating pdfFiller’s platform into their processes has saved them considerable time and reduced anxiety associated with tax filing.

Additionally, community tips often emphasize the importance of starting the form early, allowing ample time to gather all necessary documentation and avoid last-minute stress. Real-life use cases illustrate how leveraging the collaborative tools of pdfFiller can streamline group submissions, especially for teams handling complex financial scenarios.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 83 01 1s w on a smartphone?

How do I fill out 83 01 1s w using my mobile device?

How do I edit 83 01 1s w on an Android device?

What is 83 01 1s w?

Who is required to file 83 01 1s w?

How to fill out 83 01 1s w?

What is the purpose of 83 01 1s w?

What information must be reported on 83 01 1s w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.