Get the free Form 1023 EZ Download Help: Find & Complete Easily

Get, Create, Make and Sign form 1023 ez download

How to edit form 1023 ez download online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1023 ez download

How to fill out form 1023 ez download

Who needs form 1023 ez download?

An In-Depth Guide to Form 1023 EZ Download Form

Understanding Form 1023 EZ

Form 1023 EZ is a streamlined application used by small nonprofit organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. Its primary purpose is to simplify the application process, encouraging more organizations to engage in nonprofit work without the burden of extensive documentation.

This form is tailored for organizations with gross receipts of $50,000 or less and total assets that do not exceed $250,000. By using the Form 1023 EZ, qualifying applicants can save time and resources.

Key benefits include reduced paperwork, lower filing fees, and faster processing times compared to the traditional Form 1023. Notably, Form 1023 EZ differs significantly from Form 1023, which requires more detailed financial data and comprehensive narrative descriptions.

In summary, Form 1023 EZ serves as a simplified path for eligible organizations to obtain tax-exempt status, enhancing their capability to serve their communities effectively.

Accessing the form

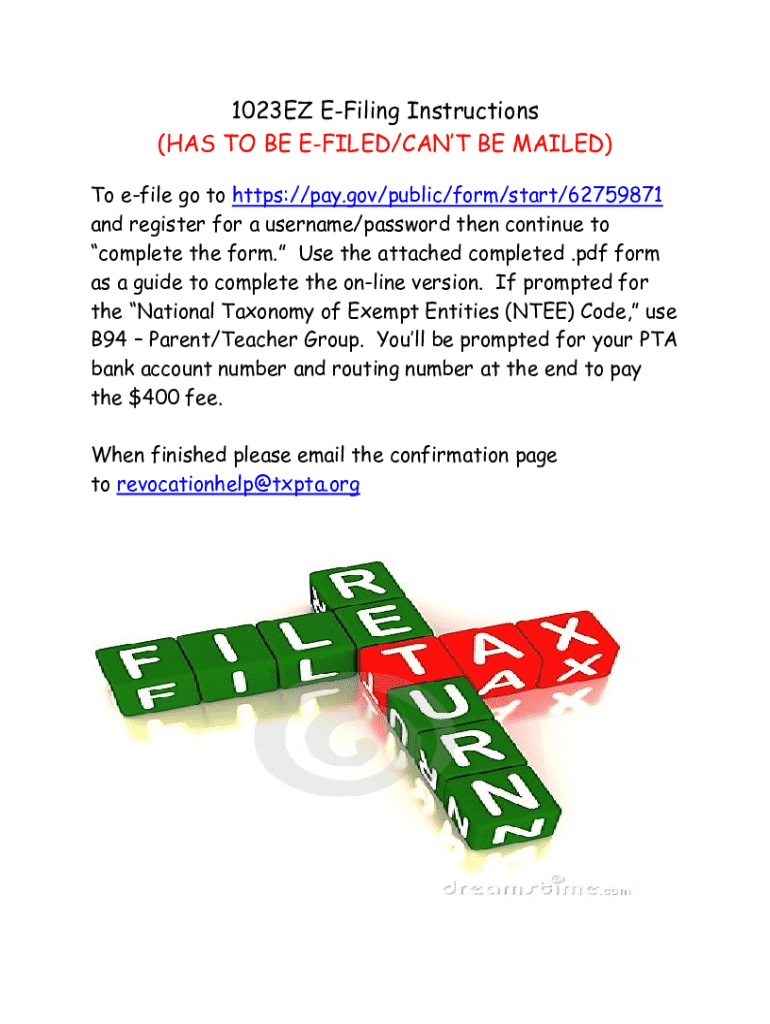

To download Form 1023 EZ, you'll want to follow a straightforward process that ensures you get the correct version quickly. Start by visiting the pdfFiller platform, where the form is readily available.

Here’s a step-by-step guide to access the form on pdfFiller's platform:

Form 1023 EZ is available in multiple formats, such as a PDF for offline use and an editable online form for ease of filling. Choose the one that best suits your document management needs.

Filling out form 1023 EZ

Completing Form 1023 EZ requires you to provide specific information about your organization. Understanding what information is required will ease the process.

Here's a section-by-section breakdown of the information you need to gather:

It’s essential to be meticulous when filling out the form to avoid common mistakes like incomplete sections or misinformation. Double-check each entry before submission.

Editing the form with pdfFiller

After downloading Form 1023 EZ, using pdfFiller's editing tools can enhance your experience significantly. PdfFiller provides a robust platform for editing PDF documents seamlessly.

Here’s how you can edit your Form 1023 EZ with pdfFiller’s tools:

After making your edits, ensure to save your changes. PdfFiller allows you to save in multiple formats, ensuring you can keep a record of modifications.

Signing the form

Once your Form 1023 EZ is completed, it requires a signature for validation. Ensuring a secure electronic signature is vital for your submission.

Follow these step-by-step instructions to eSign your document securely using pdfFiller:

Understanding the importance of signatures on submissions is crucial to avoid delays. If your organization requires multiple signatures, ensure that all involved parties have signed before submission.

Managing your form submissions

Proper management of your form submissions is essential to stay organized and on top of your application progress. PdfFiller offers tools to help you manage your documents effectively.

Within pdfFiller, you can organize your documents as follows:

Staying organized can greatly enhance your efficiency and facilitate subsequent forms or applications.

Troubleshooting common issues

While preparing to fill out Form 1023 EZ, certain common issues may arise. Understanding these can save you time and frustration.

Here are a few common errors and solutions:

Proactively addressing these issues can ensure a smoother experience with the Form 1023 EZ.

Frequently asked questions (FAQs)

Many users have questions about Form 1023 EZ. Addressing these queries can clear up any confusion regarding the form.

These FAQs aim to empower applicants, making the process less daunting and more transparent.

Testimonials and user experiences

Hear from users who successfully navigated the Form 1023 EZ process with pdfFiller. Their experiences can provide valuable insights.

These testimonials illustrate how pdfFiller empowers users to manage forms and documents effectively.

Additional features of pdfFiller

Beyond editing and signing, pdfFiller offers a variety of additional features that can enhance your document management experience.

These features make pdfFiller a comprehensive solution for individuals and teams seeking effective document solutions.

Final tips for a smooth filing experience

Preparing your Form 1023 EZ for submission requires attention to detail and organization. Use this checklist to ensure a smooth filing experience.

Following these tips will position you favorably for a successful application process through pdfFiller and Form 1023 EZ.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out form 1023 ez download using my mobile device?

Can I edit form 1023 ez download on an iOS device?

How do I complete form 1023 ez download on an Android device?

What is form 1023 ez download?

Who is required to file form 1023 ez download?

How to fill out form 1023 ez download?

What is the purpose of form 1023 ez download?

What information must be reported on form 1023 ez download?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.