Get the free Non-Profit Authorization Form

Get, Create, Make and Sign non-profit authorization form

How to edit non-profit authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-profit authorization form

How to fill out non-profit authorization form

Who needs non-profit authorization form?

Non-Profit Authorization Form: A Comprehensive How-to Guide

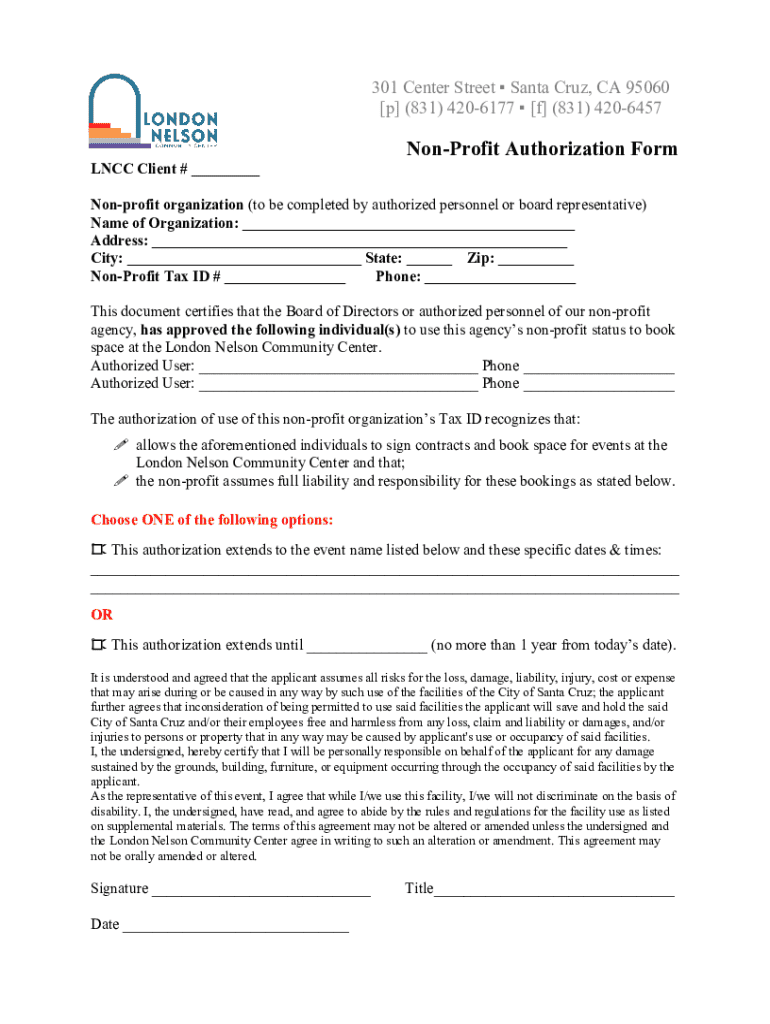

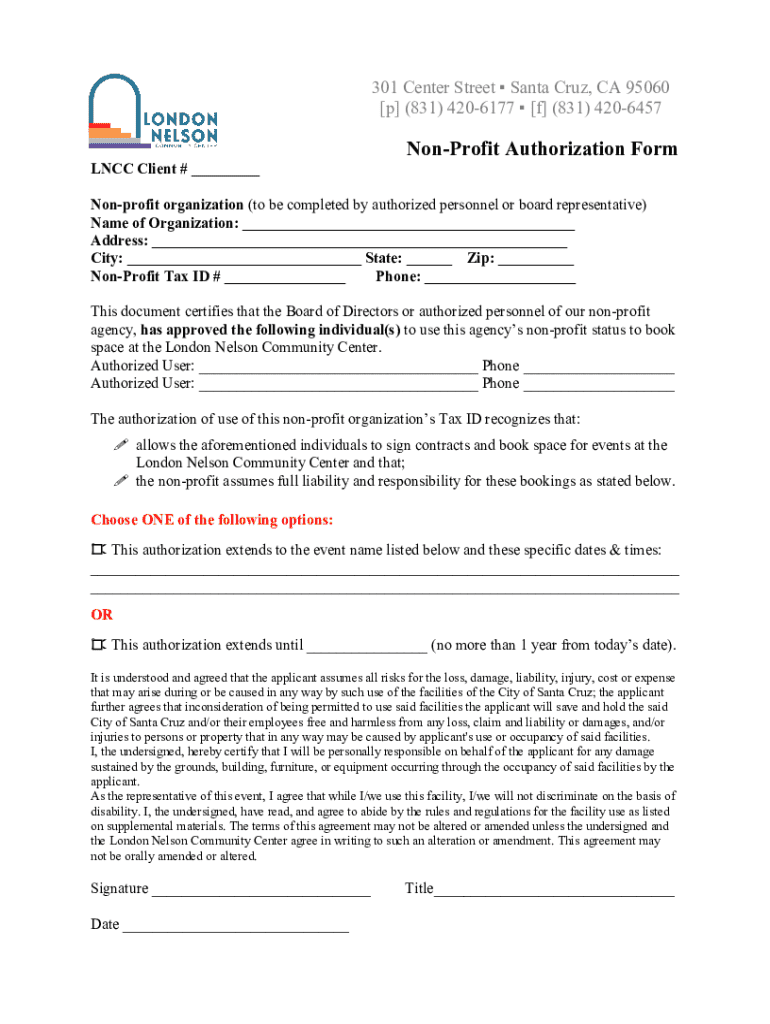

Overview of the non-profit authorization form

A non-profit authorization form serves as a critical document for organizations seeking to operate within a legal framework. It provides formal acknowledgment of the organization’s intent to accomplish its charitable, educational, or social objectives. The importance of this form lies not only in compliance with state and federal regulations but also in strengthening the legitimacy of the organization within a community.

Key uses of the non-profit authorization form include applying for tax-exempt status, enabling fundraising activities, and establishing bank accounts. By filing this form, organizations can access grants, receive donations, and form partnerships with other entities. The authorization form plays an essential role in establishing a trustworthy reputation, which is often a prerequisite for acquiring funding and support from larger bodies.

Understanding the requirements for non-profit authorization

Eligibility criteria for obtaining a non-profit authorization can vary significantly based on the organization’s mission and structure. Typically, non-profits must demonstrate a clear purpose that serves the public interest. Organizations that operate primarily for profit-making purposes will not qualify for non-profit status. Furthermore, they must meet specific state and federal criteria to gain authorization.

In order to apply for authorization, various essential documents are required, including Articles of Incorporation, a governance structure, and a detailed mission statement. It is a common misconception that non-profits do not require extensive documentation; however, the thoroughness of these requirements is crucial to ensure compliance and legitimacy.

Step-by-step guide to filling out the non-profit authorization form

Filling out the non-profit authorization form can seem overwhelming, but following a structured process can simplify the task.

Interactive tools and resources for non-profit authorization

Utilizing interactive templates and fillable forms is an excellent way to simplify the non-profit authorization process. pdfFiller offers advanced features that can facilitate effective collaboration and feedback among team members involved in the application.

Examples of completed forms available through pdfFiller serve as valuable references during the application process. They can provide insights into how to properly structure your responses and the type of information that is required.

Common pitfalls and how to avoid them

Common pitfalls in the non-profit authorization application process often include missing documentation, using incorrect information, or failing to meet deadlines. These errors can lead to delays or, in some cases, a denial of authorization.

Managing your non-profit documents effectively

Effective management of your non-profit documents can significantly impact your organization’s efficiency. Implementing a structured document organization system helps ensure that all pertinent files are readily accessible.

Using a cloud-based document management system such as pdfFiller can provide a secure way to store, track, and manage multiple authorization forms. With features for categorization and quick retrieval, maintaining compliance with filing requirements becomes straightforward.

Frequently asked questions (FAQs)

When applying for a non-profit authorization form, several questions often arise. Understanding the answers to these FAQs can alleviate concerns and clarify the process.

Legal considerations for non-profit organizations

Navigating the legal landscape for non-profit organizations involves understanding numerous obligations related to documentation and compliance. Maintaining correct filings and status with both federal and state regulatory bodies is paramount.

Organizations should seek legal advice when drafting or modifying documents such as bylaws and operational policies to ensure conformity with existing state regulations. Resources provided by local non-profit support networks can offer specific guidance tailored to regional legal requirements.

Navigating related non-profit resources

Understanding the regulatory environment surrounding non-profit management can be enhanced through various government resources. Websites such as the IRS provide vital information regarding tax-exempt statuses and other essential non-profit requirements.

Additionally, leveraging partnerships with local community organizations can foster support networks that assist in navigating various challenges. Engaging with these resources can improve the capabilities of non-profits seeking effective strategies for growth and compliance.

Tips for sustaining your non-profit's success

To ensure long-term sustainability, non-profits should regularly review their authorization status and organizational structure. Best practices in fund management, along with meticulous record-keeping, are essential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute non-profit authorization form online?

How do I make changes in non-profit authorization form?

How do I edit non-profit authorization form in Chrome?

What is non-profit authorization form?

Who is required to file non-profit authorization form?

How to fill out non-profit authorization form?

What is the purpose of non-profit authorization form?

What information must be reported on non-profit authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.