Get the free FORM 1120S ENGAGEMENT LETTER.docx

Get, Create, Make and Sign form 1120s engagement letterdocx

How to edit form 1120s engagement letterdocx online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1120s engagement letterdocx

How to fill out form 1120s engagement letterdocx

Who needs form 1120s engagement letterdocx?

Comprehensive Guide to the Form 1120S Engagement Letter

Understanding the Form 1120S Engagement Letter

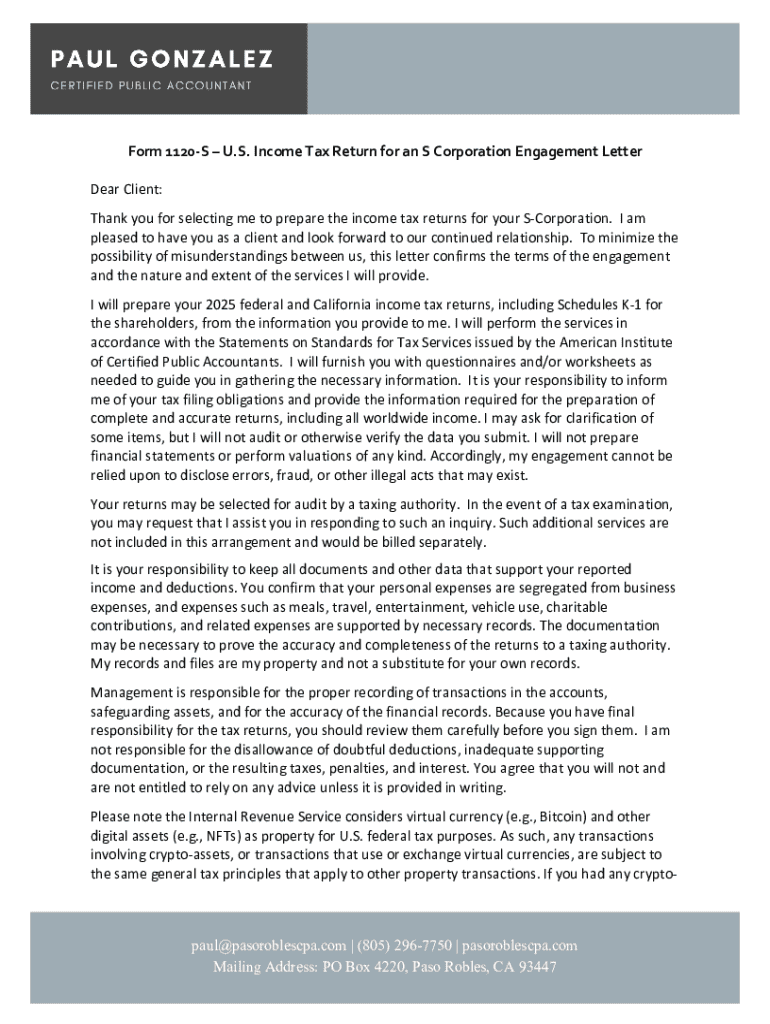

An engagement letter serves as a crucial document in the relationship between an accountant and an S-Corporation. Specifically pertaining to Form 1120S, which is the tax return for S Corporations, the engagement letter outlines the nature and scope of the engagement. It sets clear expectations for both parties and is vital in ensuring compliance with IRS regulations.

Key Components of the Engagement Letter

Every engagement letter should include several essential clauses. These typically encompass definitions of the services to be provided, fee structures, confidentiality agreements, and the terms of termination. Understanding the legal terminology is vital as well, as terms like 'scope of work' and 'deliverables' must be crystal clear to ensure proper governance.

When to use the Form 1120S Engagement Letter

In various contexts, the engagement letter is not only beneficial but often necessary. For instance, prior to preparing the Form 1120S return for an S-Corp, having an engagement letter formalizes the agreement. This is crucial for ensuring that the accountants adhere to professional standards while clearly outlining their obligations.

The primary users of the engagement letter include accountants, financial consultants, and business owners. Each of these parties has a vested interest in clearly outlining the expectations of engagement, particularly regarding tax liabilities and compliance with regulations.

Step-by-step guide to creating a Form 1120S engagement letter

Creating a sound engagement letter begins with gathering necessary information. This typically includes the client's organizational details, tax identification numbers, and any specific instructions or requests from the client. Additionally, it’s important to collect information on the expected timeline for services as well as any relevant deadlines.

Drafting the Engagement Letter

When drafting the engagement letter, it is essential to adhere to a clear and structured layout. Begin with an introduction stating the purpose of the letter, followed by sections detailing the scope of work, client responsibilities, and payment terms. Make sure that the language is professional yet accessible, avoiding overly technical jargon that may confuse the client.

Template Usage

Using templates can expedite the drafting process and ensure that no key elements are overlooked. Reliable templates can be found on tax preparation websites, professional accounting associations, or document management platforms like pdfFiller. These templates often come pre-equipped with standard clauses that can be customized to fit specific situations.

Customizing the Engagement Letter

Personalizing an engagement letter contributes significantly to building a strong client relationship. Customization should reflect the client's specific needs, concerns, and preferences. For instance, if a client has unique issues related to their industry, these should be specifically addressed in the engagement letter. Tailoring the content helps to foster trust and makes clients feel valued.

Reviewing and Finalizing the Engagement Letter

Before sending the engagement letter, it's crucial to go through key legal considerations. For example, check compliance with state and federal requirements, and reassess language to avoid ambiguity or potential pitfalls. An unclear engagement letter can lead to disagreements that could impact business relationships.

Getting Client Approval

Once the engagement letter is finalized, the next step is to present it to the client. Consider using a collaborative approach by discussing the contents in a meeting or over video conferencing. Allowing clients to ask questions encourages open dialogue and can lead to enhancements in the engagement process. Seeking feedback demonstrates that you value their input and want to ensure clarity.

Managing the Engagement Process

Effective document management is key in overseeing the engagement process. Tools such as pdfFiller allow accountants to store, share, and manage engagement letters and associated documents in one place. Such tools enhance efficiency while also providing a centralized solution for tracking engagement correspondence.

eSigning and Sharing the Engagement Letter

Implementing eSigning solutions greatly simplifies the process of getting client approval. This method allows for a quicker turnaround, eliminating the need for physical signatures. Platforms like pdfFiller offer secure eSigning features that enhance document integrity and streamline sharing processes, making it easy to send letters via email or through secure links.

Frequently Asked Questions about the Form 1120S Engagement Letter

Common mistakes often stem from vague language or failing to include specific clauses. It's essential to be thorough in addressing both parties' expectations and responsibilities. Engaging in proactive communication mitigates risks and fosters positive relations.

Best Practices for Engagements

Maintaining transparency and timely communication are best practices that help reinforce client confidence. Stay diligent about following legal and regulatory updates that may affect your engagements. Developing a structured process for creating and managing engagement letters will also yield positive outcomes over time.

Interactive Tools and Resources

Utilizing an Engagement Letter Builder can simplify your document creation process. pdfFiller's tool offers step-by-step guidance, allowing you to customize an engagement letter that meets your specific needs. This interactive tool helps you focus on content while maintaining the necessary legal standards.

Staying Updated on Tax Regulations

Staying informed about changes in tax regulations is essential for accountants managing S-Corporation returns through Form 1120S. Keeping abreast of these changes can avoid pitfalls during the filing process and enhance client service.

Where to Find Updates

Numerous resources exist for ongoing education, including accounting associations, government publications, and online tax compliance platforms. Engaging with these resources regularly can enhance your understanding and application of tax rules applicable to S-Corporations.

Share Your Experience

Encouraging community engagement through shared experiences and testimonials can yield invaluable insights for both seasoned accountants and newcomers. By sharing best practices and lessons learned, professionals can foster collaborative relationships that enhance overall efficiency within the industry.

Social Media Links and Connect

Connecting with pdfFiller on various social media platforms can keep you informed of updates and new features. Following a professional community not only offers resources but also provides networking opportunities that are vital for career growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 1120s engagement letterdocx directly from Gmail?

How do I complete form 1120s engagement letterdocx on an iOS device?

How do I complete form 1120s engagement letterdocx on an Android device?

What is form 1120s engagement letterdocx?

Who is required to file form 1120s engagement letterdocx?

How to fill out form 1120s engagement letterdocx?

What is the purpose of form 1120s engagement letterdocx?

What information must be reported on form 1120s engagement letterdocx?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.