Get the free Federal Income Tax Withholding Methods

Get, Create, Make and Sign federal income tax withholding

How to edit federal income tax withholding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out federal income tax withholding

How to fill out federal income tax withholding

Who needs federal income tax withholding?

Comprehensive Guide to the Federal Income Tax Withholding Form

Understanding the federal income tax withholding form

The federal income tax withholding form, primarily the IRS Form W-4, is a crucial document for both employees and employers in managing tax obligations. This form enables taxpayers to inform their employers of their tax situation, which determines how much federal income tax should be withheld from their paychecks. It is essential for ensuring that employees are paying the correct amount of taxes throughout the year, thus avoiding any surprise tax bills or penalties come tax season.

Employers rely on this information to fulfill their payroll tax responsibilities accurately. Not only does it streamline the tax collection process for the federal government, but it also helps employees manage their income more effectively. Without proper completion of the federal income tax withholding form, employees could either overpay or underpay their taxes, leading to financial strain.

Purpose and functionality of the federal income tax withholding form

The primary purpose of the federal income tax withholding form is to facilitate accurate tax payments throughout the year. By collecting information about an employee's expected income and personal circumstances, the form helps employers calculate the correct amount of federal tax to withhold from each paycheck. This process protects both the employee from potential tax debts and the employer from liability for incorrect tax withholdings.

For employers, managing these withholdings is not just a bureaucratic obligation; it's integral to their payroll services and HR responsibilities. An incorrect withholding can lead to various issues, including penalties for the employer, financial strain on employees, and bureaucratic challenges with the IRS. Thus, both parties must take the completion and submission of the federal income tax withholding form seriously.

Who needs to fill out the federal income tax withholding form?

Generally, all employees are required to fill out the federal income tax withholding form, including full-time employees, part-time workers, and freelancers. It’s not just a one-size-fits-all form; rather, different employee categories might have distinct requirements. For instance, freelancers must accurately declare their expected tax liabilities to avoid hefty tax bills later on.

Special situations also warrant attention. Students and interns may need to consider their unique earnings structure, while retirees returning to the workforce may require adjustments based on their new income streams. Understanding these nuances ensures that taxes are withheld correctly, tailored to the individual's financial situation.

Essential information required for completing the form

When filling out the federal income tax withholding form, several key pieces of information are necessary. First, personal information such as name, address, and Social Security number are fundamental for the IRS to identify the taxpayer and their proper tax records. This basic information establishes the connection between the form and the individual’s tax profile.

Next, determining the filing status is crucial. Employees must declare whether they are single, married, or the head of a household, which directly impacts deductions and tax rates. Additionally, calculating withholding allowances helps in establishing how much tax should be withheld based on personal circumstances, such as dependent children or specific deductions. Finally, employees need to report any additional income or deductions they anticipate, allowing for a more accurate withholding calculation and promoting smarter tax planning.

Step-by-step instructions for filling out the federal income tax withholding form

To successfully complete the federal income tax withholding form, it is essential to follow a methodical approach. Start by gathering necessary documents, such as previous pay stubs, past tax returns, and any financial documentation relevant to income and deductions. This preparation ensures you have the information required for an accurate entry.

Next, fill out the form carefully, ensuring that each section is complete and accurate. Common mistakes include inaccuracies in personal information or miscalculations of withholding allowances. Therefore, it’s advisable to double-check your entries before submission. Once completed, submit the federal income tax withholding form to your employer, who will integrate this data into their payroll system, adjusting withholdings accordingly.

Making adjustments to your withholding

Life changes such as marriage, childbirth, or a new job can significantly impact your tax situation, necessitating an update to your federal income tax withholding form. Monitoring these pivotal moments is essential to ensure your withholding remains accurate. If adjustments are not made, you may either face an unexpected tax bill or not receive the refund you anticipated.

To update your federal income tax withholding form, first identify the changes in your financial situation that require a reassessment. Then, proceed to fill out a new W-4 form with the updated information and submit it to your employer. This proactive approach not only helps in aligning your withholdings with your current circumstances but also enhances overall tax planning strategies, giving you better control of your financial future.

FAQs about the federal income tax withholding form

Anticipating common questions regarding the federal income tax withholding form can demystify the process. For instance, what should you do if you lose your form? You should promptly request a new form from your employer to avoid delays in tax processing. Understanding how often to review or update your withholding is crucial; annual reviews or whenever a major life change occurs are advisable to ensure compliance.

For those wondering if they can opt out of federal income tax withholding, this generally isn't possible unless you are exempt from withholding altogether. Lastly, if your withholding is incorrect, it's imperative to take action by updating your form and addressing any discrepancies with your employer to rectify any potential financial repercussions.

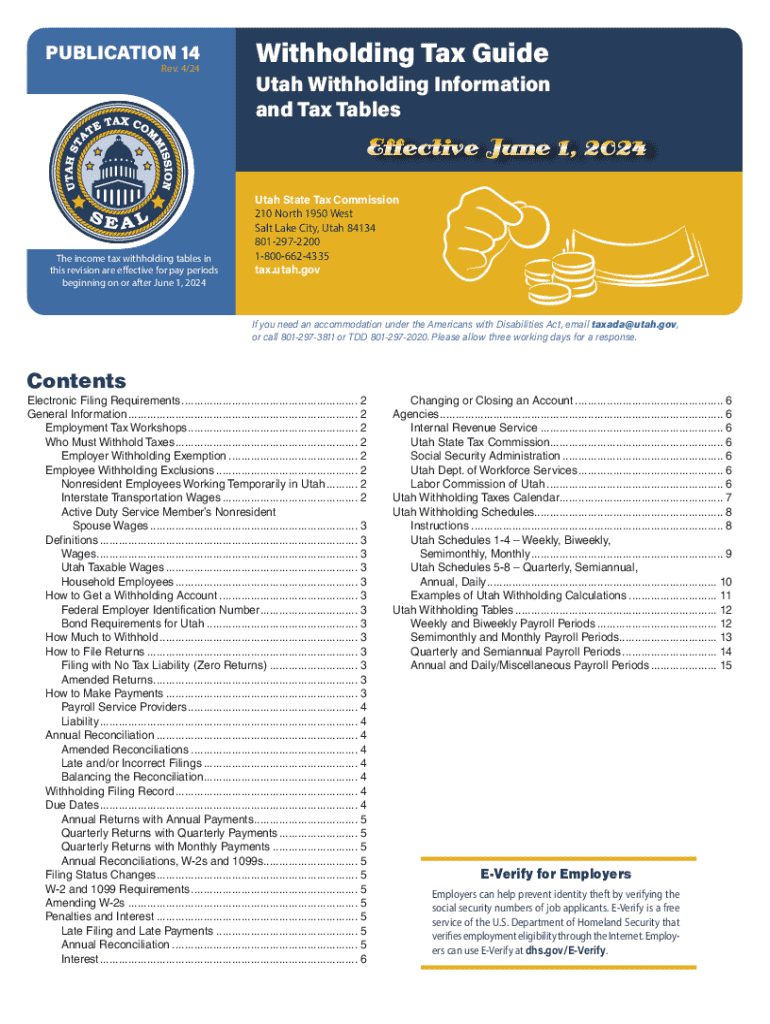

Tools and resources for managing your federal income tax

Leveraging interactive calculators and online tools can greatly aid in estimating your withholding amounts. Many platforms provide these calculators, allowing individuals to input their information and instantly see how adjustments may affect their tax obligations. This type of resource is invaluable in facilitating informed decisions related to withholding.

Moreover, using a solution like pdfFiller simplifies the entire process of managing federal income tax withholding forms. This cloud-based platform enables users to fill, edit, sign, and manage tax documents efficiently. pdfFiller’s all-in-one approach streamlines documentation processes, allowing both employees and employers to interact seamlessly with their required tax forms.

Best practices for document management and retention

Keeping track of your federal income tax withholding forms is critical for both compliance and personal financial management. Organizing these documents in a dedicated folder or digital storage solution will help you easily retrieve them when needed, particularly during tax season. Maintain copies of submitted forms, including any updates you make, to keep your records straight.

Additionally, conducting yearly reviews of your withholding situation can drastically enhance your financial stability. This annual assessment allows you to adjust your withholdings based on changes in income, personal obligations, or tax laws, ensuring your current withholding setup aligns with your financial objectives.

Final thoughts on navigating the federal income tax withholding process

Navigating the complexities of the federal income tax withholding form may seem daunting initially, but staying informed and proactive can lead to better financial outcomes. Understanding how to fill out this form accurately and make necessary adjustments is crucial in managing your finances effectively. By utilizing smart tools like pdfFiller, individuals can enhance their document handling experience, ensuring efficient management of their tax documentation needs.

Ultimately, informed decisions about withholding not only influence your tax obligations but also have lasting impacts on your overall financial health. Engaging with reliable resources and platforms can serve to simplify this process, promoting a smoother tax experience and aiding in truly understanding personal financial responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify federal income tax withholding without leaving Google Drive?

Can I create an eSignature for the federal income tax withholding in Gmail?

How do I fill out the federal income tax withholding form on my smartphone?

What is federal income tax withholding?

Who is required to file federal income tax withholding?

How to fill out federal income tax withholding?

What is the purpose of federal income tax withholding?

What information must be reported on federal income tax withholding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.