Get the free 1099 WORKSHEET.docx

Get, Create, Make and Sign 1099 worksheetdocx

How to edit 1099 worksheetdocx online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1099 worksheetdocx

How to fill out 1099 worksheetdocx

Who needs 1099 worksheetdocx?

A Comprehensive Guide to the 1099 Worksheetdocx Form

Understanding the 1099 form

The 1099 form serves as a critical tool in the realm of tax reporting, particularly for individuals and businesses that have made various types of payments throughout the tax year. Unlike W-2 forms, which are used by employers to report wages and salaries, 1099 forms are intended for reporting income received by non-employees. This distinction is important for tax compliance, as the Internal Revenue Service (IRS) requires accurate reporting of all income to ensure proper taxation.

There are several variations of the 1099 form, each fulfilling a unique purpose based on the nature of the payments made. The most commonly known type is the 1099-MISC, which has been widely used for reporting miscellaneous income, including payments made to independent contractors. In recent years, however, the IRS introduced the 1099-NEC, specifically designated for payments to non-employees, further streamlining the reporting process.

When to use the 1099 form

Several scenarios prompt the need for filing a 1099 form. One main eligibility criterion is based on the amount paid to a non-employee; if this exceeds $600 in a calendar year, the tax obligation exists to report this income using the appropriate 1099 variant. Understanding the thresholds and conditions is crucial for compliance and avoiding potential penalties.

Common situations that necessitate filing a 1099 include payments made to freelancers or independent contractors for services rendered, rents collected by property owners, and payments made for royalties. Additionally, renters may be required to file to document rental income revenue, which contributes to accurate tax reporting across various sectors.

Preparing to complete the 1099 worksheetdocx form

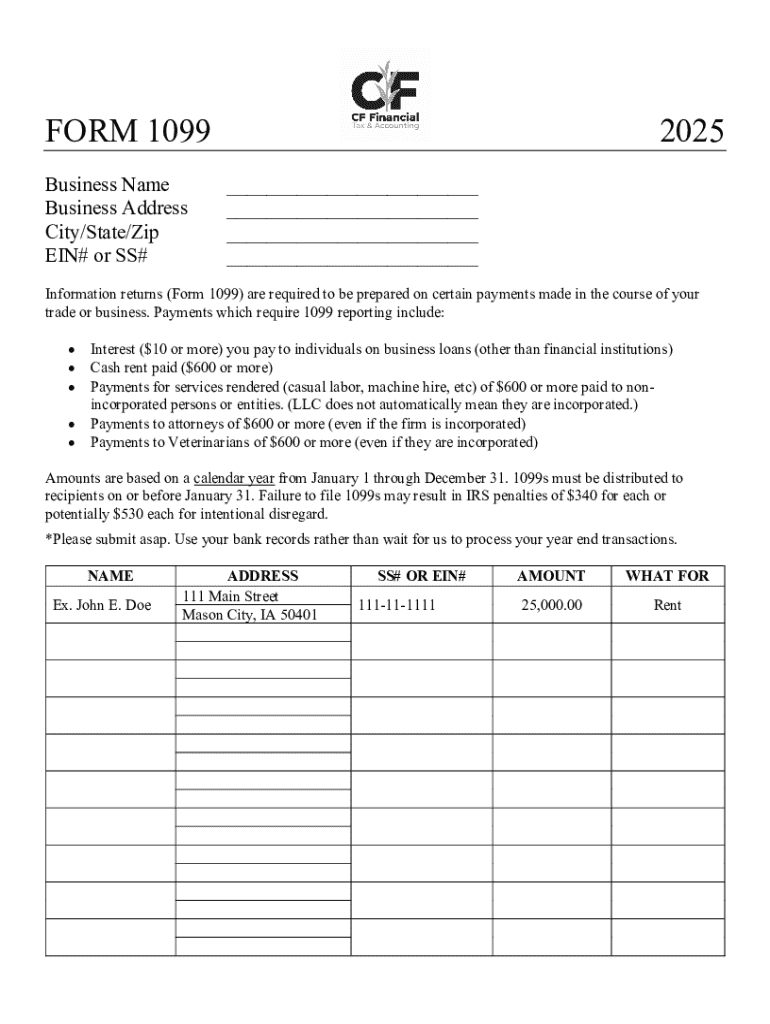

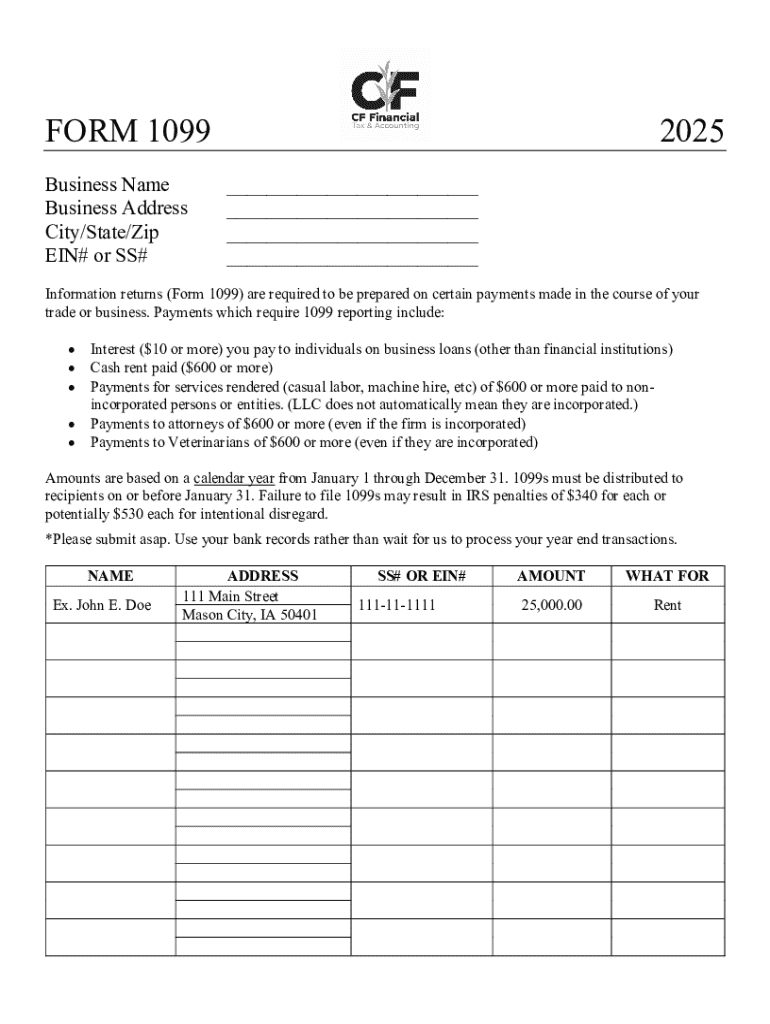

Before diving into filling out the 1099 worksheetdocx form, it is essential to gather all the necessary information. This includes identifying the details of both the payer and the recipient, ensuring that you have accurate Tax Identification Numbers (TINs) like Social Security Numbers (SSNs) or Employer Identification Numbers (EINs). Collecting this information ahead of time can help streamline the process and reduce the likelihood of errors.

When choosing the right version of the 1099 worksheetdocx form, consider your specific needs. There are various templates available that cater to different scenarios—from those for reporting business expenses to forms for interest income. Selecting the right template will simplify your task, allowing you to focus on accurately providing the required information.

Step-by-step instructions for filling out the 1099 worksheetdocx form

Filling out the 1099 worksheetdocx form may seem daunting at first, but following a systematic approach can ease the process. Here’s a step-by-step breakdown:

Editing and customizing your 1099 worksheetdocx form

Once you've filled in the necessary information, pdfFiller provides robust editing features that allow you to customize your 1099 worksheetdocx form effortlessly. This includes uploading your document to pdfFiller, where editing functions enable you to make text adjustments, format changes, and more, as needed. Additionally, the user-friendly interface ensures that these edits are simple and intuitive.

Adding signatures and initials to the 1099 worksheetdocx form is essential for legal compliance. PdfFiller facilitates this process, allowing you to eSign your form with a few clicks. You can also engage multiple parties in collaborative signing, ensuring that all required personnel can review and approve the document seamlessly.

Managing and storing your 1099 forms

Document management is a crucial aspect of tax planning and compliance. By utilizing cloud-based management solutions like those provided by pdfFiller, users can benefit from easy access to their documents from anywhere, reducing the risks associated with physical paperwork. Cloud storage not only offers convenience but also provides a layer of safety against potential data loss.

Security remains a primary concern when handling sensitive information like 1099 forms. Engaging best practices for document security is essential, such as opting for encrypted storage options and controlled sharing settings. Being proactive about security can safeguard against identity theft and unauthorized access.

Common questions and troubleshooting

It’s normal to have questions or encounter issues when filing your 1099 forms. Common clarifications involve understanding what qualifies as reportable income and the appropriate forms to use. Navigating tax regulations can be complex, but addressing FAQs can illuminate the process, reducing stress and confusion.

Should you run into common problems, such as submitting a form with incorrect information, it's crucial to know how to troubleshoot. Checking for missing details, verifying the accuracy of payment amounts, and ensuring compliance with deadlines are practical steps that can resolve many issues before they necessitate corrections or resubmissions.

Resources for filing your 1099 form

Accessing the right resources can simplify the 1099 filing process significantly. Platforms like pdfFiller offer pre-filled templates, allowing for quick completion with minimal hassle. By using these resources, you can streamline your tax filing process and avoid common pitfalls that could lead to errors.

Additionally, reaching out to tax support services can provide personalized assistance. Having contact information readily available for customer support regarding tax-related issues ensures that you’re never left in the dark when navigating tax obligations.

Final review checklist before submission

Completing and filing the 1099 worksheetdocx form requires careful attention to detail before submission. A final review checklist is invaluable for ensuring you haven’t overlooked essential information. Essential steps include verifying that all the information is complete, confirming accurate TINs, and tracking submission deadlines to avoid late filing penalties.

Whether you opt for electronic submission or paper filing, understanding the pros and cons of each method can inform your decision. E-filing is often faster and allows for easier tracking, while paper submission may suit your needs if you prefer tangible documents.

Key takeaways for successful 1099 filing

In conclusion, managing the 1099 worksheetdocx form efficiently can simplify your tax process significantly. By keeping thorough records, revisiting best practices for filing, and utilizing tools like pdfFiller, you can strengthen your tax compliance efforts. Staying organized throughout the year will not only facilitate the 1099 preparation process but will also ensure you’re better prepared for any future tax obligations.

Ultimately, creating an organized approach to managing your tax documentation will provide peace of mind and bolster your confidence when approaching tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 1099 worksheetdocx directly from Gmail?

How do I edit 1099 worksheetdocx online?

How do I make edits in 1099 worksheetdocx without leaving Chrome?

What is 1099 worksheetdocx?

Who is required to file 1099 worksheetdocx?

How to fill out 1099 worksheetdocx?

What is the purpose of 1099 worksheetdocx?

What information must be reported on 1099 worksheetdocx?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.