Get the Free Printable Living Trust Form PDF

Get, Create, Make and Sign printable living trust form

Editing printable living trust form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out printable living trust form

How to fill out printable living trust form

Who needs printable living trust form?

Comprehensive Guide to Creating a Printable Living Trust Form

Understanding the printable living trust form

A living trust is a legal document that allows you to place your assets into a trust during your lifetime, with the intention of transferring them to your beneficiaries upon your death. By creating a printable living trust form, you gain significant control over how those assets are managed and distributed without the complexities often associated with a traditional will. This form serves as a critical tool for estate planning, ensuring your wishes are upheld and your loved ones are provided for.

Using a printable living trust form is pivotal because it allows you to outline your wishes clearly, making it easier to manage your estate. This document encompasses not just the assets you possess but also provides guidance on how you wish to handle various matters regarding those assets, thus ensuring that they are administered according to your preferences.

Benefits of a printable living trust

Creating a printable living trust offers numerous advantages that can greatly enhance your estate management. One of the primary benefits is streamlined asset management, allowing you to maintain control over your assets effectively. With a living trust in place, you can specify how your assets will be utilized during your lifetime and how they should be passed on to your beneficiaries.

Moreover, avoiding probate is a significant reason many opt for a living trust. Probate can be a lengthy, public process that slows down the distribution of your estate. By utilizing a printable living trust form, your estate can bypass probate, enabling a faster and private transition of assets to your loved ones. This also serves to maintain confidentiality regarding your estate.

Types of living trusts

Understanding the different types of living trusts is essential when deciding which one best meets your estate planning needs. The two predominant forms are revocable and irrevocable trusts. Revocable trusts allow you to make changes or revoke the trust during your lifetime, offering flexibility in how your assets are managed. In contrast, irrevocable trusts cannot be altered after creation, providing additional protection from creditors and potential tax advantages.

Beyond these, specialized living trusts, such as special needs trusts and asset protection trusts, provide tailored solutions for unique family situations. A special needs trust ensures that a beneficiary with disabilities can receive support without compromising their government assistance, while asset protection trusts are designed to shield your assets from creditors and legal claims.

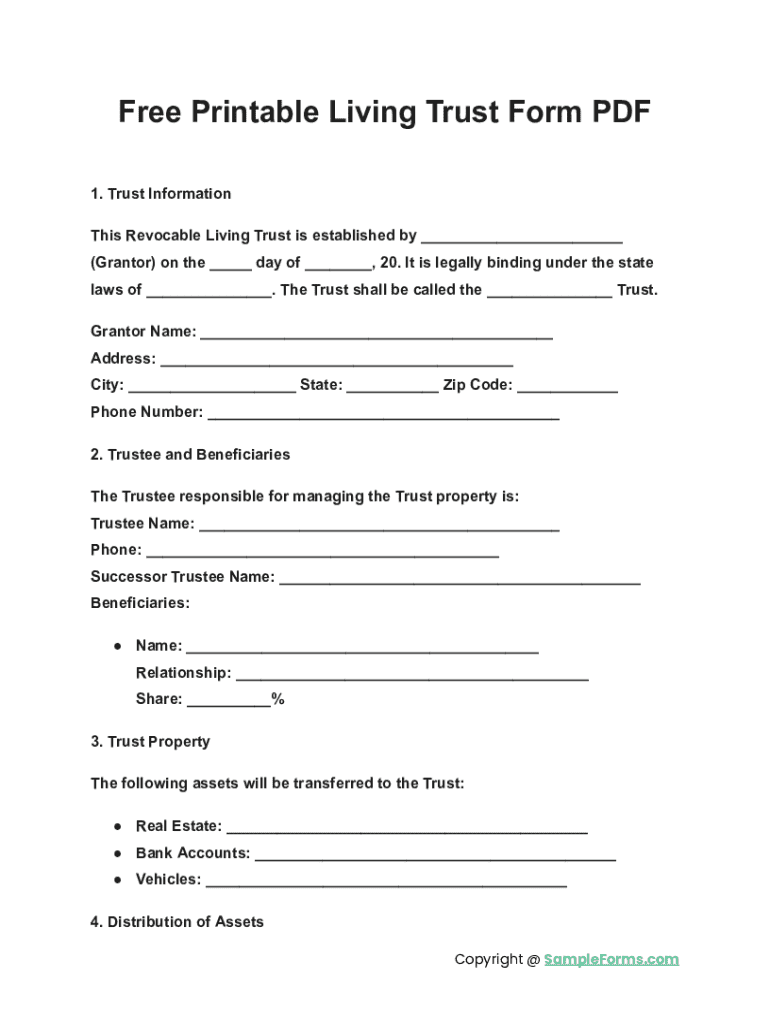

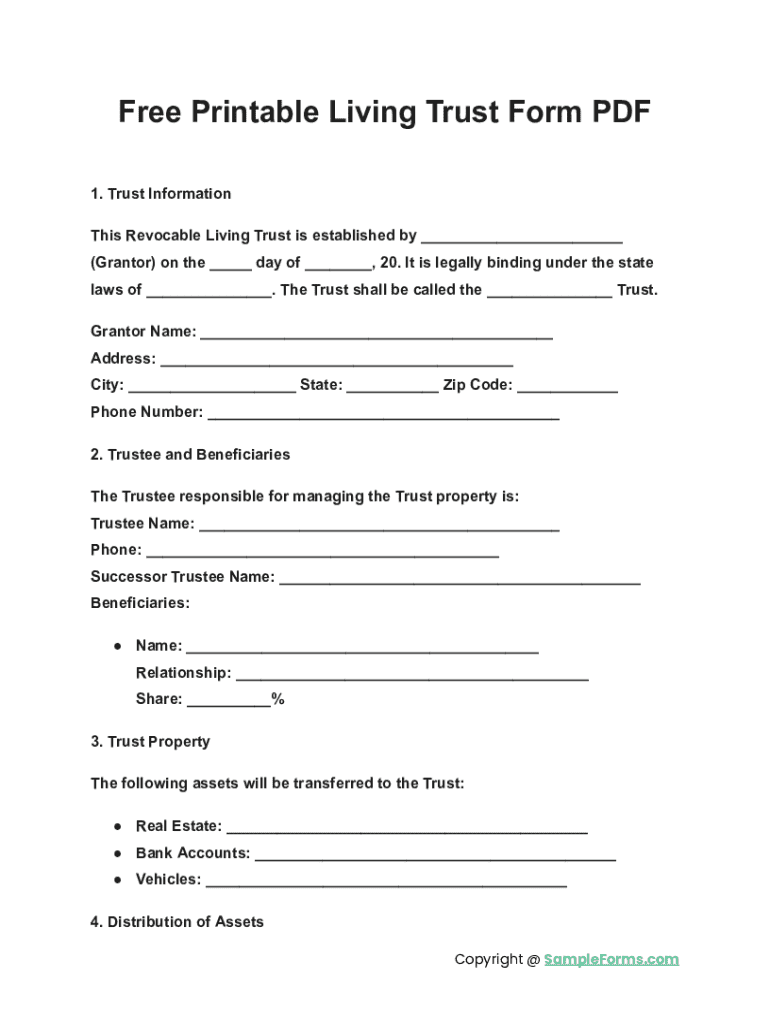

Key components of the printable living trust form

When creating a printable living trust form, several key components must be included to ensure the document is complete and legally binding. The essential sections involve grantor information, trustee designation, and a listing of beneficiaries. It's crucial to specify the grantor's name—the person creating the trust—along with the trustee, who will manage the trust in accordance with your wishes.

In addition, you should detail the beneficiaries listed in the trust and provide a comprehensive asset description. This ensures each beneficiary understands what they will receive. Optional clauses can also be added for customized instructions on asset management, distribution rules, or any specific conditions that must be met.

How to fill out the printable living trust form

Filling out your printable living trust form requires careful attention to detail. Begin by gathering all required information, including details about your assets, potential beneficiaries, and chosen trustees. Having this information readily available will streamline the process and prevent any lapses in documentation.

Next, proceed to complete each section of the form. Ensure that each beneficiary's information is accurate and that you provide a thorough description of the assets involved. After filling out the form, take the time to review your entries for accuracy before finalizing it, as even small errors can lead to complications down the line.

Editing and customizing your living trust form with pdfFiller

Using pdfFiller, you can effortlessly modify your printable living trust form, enhancing its versatility and usability. Its user-friendly platform allows for easy editing, ensuring that you can adjust any parts of the document as needed. Whether it's updating beneficiary information or asset details, pdfFiller enables swift revisions.

Collaboration becomes simplified as well, allowing team input on the document. Additionally, since pdfFiller operates entirely in the cloud, you can access and edit your form anytime, anywhere. This flexibility is especially beneficial for those looking to manage their estate documents on the go.

Signing your living trust form

After completing your printable living trust form, the next crucial step involves signing it. With pdfFiller, you can utilize their eSigning feature for a seamless execution process. This allows you to sign your document electronically, ensuring that it is both quick and legally valid.

Moreover, it’s essential to understand any witness requirements or notarization protocols that may apply in your state. While some states do not require a notary, others mandate that your living trust form must be notarized to be legally recognized. Make sure to familiarize yourself with these regulations to ensure your trust is fully compliant.

Managing your living trust after creation

Establishing your printable living trust form is only the beginning; managing it effectively post-creation is equally important. Regularly updating your trust document is key to ensuring it continues to reflect your current wishes and circumstances. This includes keeping track of changes in beneficiaries, asset holdings, and any applicable state laws that may require modification.

As life evolves with additional assets or changes in family dynamics, it's prudent to revisit your trust periodically. Regular reviews prevent discrepancies between your actual estate situation and what is outlined in your living trust, safeguarding your intent and the best interests of your loved ones.

Common mistakes to avoid when creating a living trust

Creating a living trust is a proactive approach to estate planning, yet it's essential to navigate this process carefully. One common mistake individuals make is failing to fund their trust, which means not transferring assets into the trust. Without this step, the trust becomes ineffective as the assets remain subject to probate.

Another frequent misstep involves including incomplete or incorrect information in the trust. Ensuring accuracy with names, asset descriptions, and percentages allocated to beneficiaries is crucial. Additionally, many people neglect periodic reviews, leading to outdated information that might not reflect their current wishes or family dynamics.

Frequently asked questions about printable living trust forms

As you navigate the creation of a printable living trust form, several questions may arise. For instance, what happens if you change your mind after establishing the trust? With a revocable trust, you're afforded the flexibility to make changes or revoke it entirely, adapting to your changing circumstances.

Another common inquiry pertains to how a living trust impacts your taxes. Generally, living trusts do not affect your taxes during your lifetime, but your estate may face tax implications upon your deceased, depending on its value and state of residence. Finally, many wonder if printable living trust forms are suitable for residents in other states—most are designed to be applicable across various jurisdictions, but it’s crucial to adhere to specific state laws.

Real-life examples of printable living trusts in action

To illustrate the effectiveness of a printable living trust form, consider a case study involving a family dealing with the loss of a loved one. Thanks to their established living trust, the family was able to save substantial time and legal fees that typically accompany the probate process. They enjoyed a smoother asset transition, demonstrating how proactive estate planning benefits heirs during emotionally charged times.

Additionally, testimonials from pdfFiller users highlight the user-friendly experience of creating a living trust. Users often praise the platform for simplifying the process, making legal documentation accessible for individuals who are not familiar with such formalities. This accessibility empowers families to take control of their estate planning, making the task less daunting and more manageable.

Transitioning from a will to a living trust

Transitioning from a traditional will to a printable living trust can be a smart decision for those looking to streamline their estate planning. One key difference to consider is that a will only takes effect after death, while a living trust is active during your lifetime, managing your assets even when you are incapacitated. This proactive approach can prevent unnecessary legal hurdles for your family.

Moreover, living trusts often allow for more comprehensive control over your estate. They can incorporate specific instructions for asset management and distribution that a will may not accommodate. Transitioning to a living trust involves creating the trust document, converting relevant assets into the trust's name, and reviewing your heirs' rights and expectations, ensuring everyone understands the plan and their roles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute printable living trust form online?

Can I edit printable living trust form on an Android device?

How do I fill out printable living trust form on an Android device?

What is printable living trust form?

Who is required to file printable living trust form?

How to fill out printable living trust form?

What is the purpose of printable living trust form?

What information must be reported on printable living trust form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.