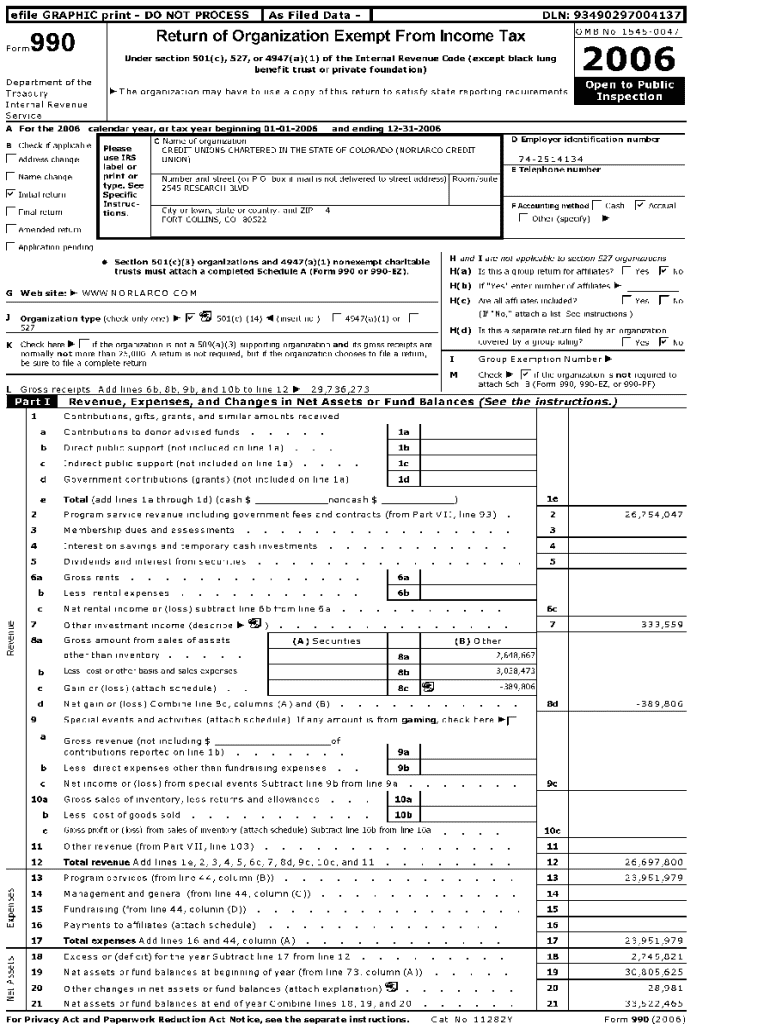

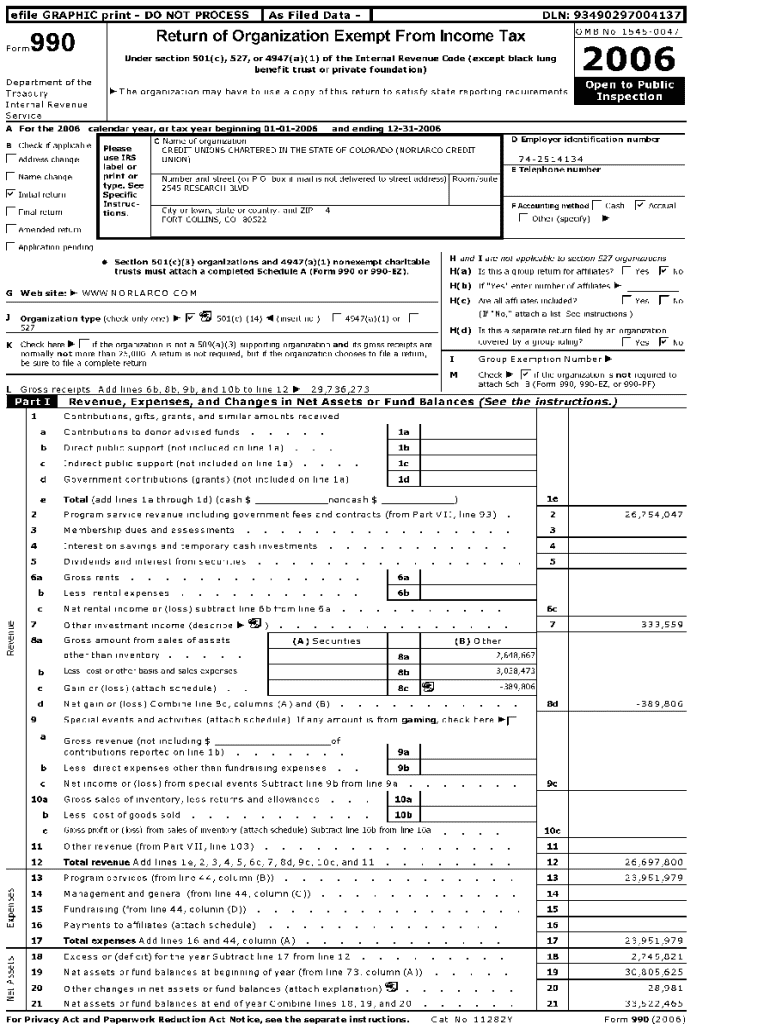

Get the free CREDIT UNIONS CHARTERED IN THE STATE OF COLORADO (NORLARCO CREDIT

Get, Create, Make and Sign credit unions chartered in

Editing credit unions chartered in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit unions chartered in

How to fill out credit unions chartered in

Who needs credit unions chartered in?

Credit unions chartered in form: A how-to guide

Understanding credit unions and their charters

Credit unions are member-owned financial cooperatives that provide a wide range of banking services to their members. They operate on the principles of mutuality, offering their services at competitive prices while ensuring profits are returned to members in the form of lower fees and better interest rates. Unlike traditional banks, credit unions are not driven by profit but by serving their member community.

A charter is essential for credit unions as it grants the institution the legal authority to operate. It establishes the credit union's structure, governance, and compliance obligations. Charters can be classified into two main categories: federal charters, issued by the National Credit Union Administration (NCUA), and state charters, provided by local state regulators. The choice between these two affects operational oversight and regulatory compliance.

The process of chartering a credit union

Chartering a credit union is a multifaceted process that involves several critical steps. It begins with defining the credit union's field of membership, which shapes who can join and use the credit union’s services. After this, an organizing committee is essential for building a solid foundation and steering the application.

A well-developed business plan is crucial, outlining the credit union’s goals, financial predictions, and operational strategies. Once the business plan is complete, the charter application must be submitted to either a federal or state authority for review. This submission initiates an evaluation process, helping regulators assess the credit union's sustainable framework before allowing it to operate.

Required documentation for chartering

Aspiring credit unions must prepare a range of documentation during the chartering process. Essential documents include the application form, which details the intent and operational scope of the credit union, and a comprehensive business plan that lays out the financial viability and a roadmap for the institution. Financial projections detailing expected revenues, expenses, and member growth are also critical components.

In addition, providing proof of community need and member support through surveys or demographic studies can strengthen the application. In cases where the credit union targets specific demographics or non-profit organizations, additional forms may be required to address unique considerations.

Submitting the charter application

When it's time to submit the charter application, accuracy and thoroughness are paramount. The application form should begin with personal information about the organizers, detailing their backgrounds, and qualifications, and ending with the selected charter's purpose. Be meticulous in outlining your operational goals and how your credit union intends to serve its member base.

Include all necessary attachments meticulously; failure to do so can lead to unnecessary delays. Common pitfalls include vague descriptions, insufficient financial data, or lack of community support evidence. Diligence at this stage sets the foundation for a smoother review process.

What happens after submission?

Following the submission of your charter application, anticipate an extensive review process that typically spans several weeks to a few months. Regulators carefully assess your application against established guidelines and may provide feedback requesting revisions or additional information.

Engagement with the review board is crucial during this phase. Mismatch between proposed operations and the expected regulations might lead to delays or modifications. Understanding the approval ratings during this time helps you gauge how well you meet the necessary criteria and what steps to take next.

Launching your credit union

Once your charter application is approved, the next steps involve setting up operations, staffing appropriately, and initiating marketing efforts. Transparent communication with your community is vital at this stage to instill trust and actively encourage member enrollment. Detailed strategies for member engagement can help ensure your credit union starts strong post-launch.

Creating a presence in your targeted community through informative outreach initiatives can bolster relationships. Consider leveraging local events or digital marketing strategies to raise awareness about membership benefits, fostering a cooperative spirit.

Compliance and regulatory considerations

Ongoing compliance with federal and state regulations is a critical responsibility for every credit union post-launch. Regular audits, reviews, and reporting to oversight bodies ensure that the institution operates within structured guidelines, safeguarding member interests. Keeping abreast of evolving regulations is essential to mitigate risks and maintain operational integrity.

Additionally, understanding member rights and responsibilities fosters a transparent relationship between your credit union and its members. Offering educational resources can empower members and ensure they are well-informed about their entitlements and obligations.

Utilizing pdfFiller for documentation and collaboration

pdfFiller plays a pivotal role in streamlining the chartering process. Its robust platform allows users to edit and customize essential documents efficiently, ensuring that every component of the application is precise and tailored. With eSigning capabilities, approvals can be obtained rapidly, minimizing delays during the chartering process.

Collaborative tools offered by pdfFiller enable seamless input from team members, encouraging cohesive efforts toward finalizing documentation. After the charter is granted, pdfFiller can assist in managing your documents, ensuring that your credit union remains compliant and organized.

Additional resources for chartering a credit union

A wealth of resources is available for individuals and teams embarking on the journey of chartering a credit union. The NCUA's website provides comprehensive guidance regarding federal regulations, while state resources offer localized support specific to various jurisdictions. Example business plans and applications can also serve as invaluable tools in shaping your chartering strategy.

User testimonials regarding successful chartering initiatives provide real-world insights into best practices and potential pitfalls to avoid. Leveraging these resources can enhance preparedness and increase the likelihood of a smooth chartering journey.

Latest news and trends in credit union chartering

The credit union landscape is evolving as new trends emerge that affect charter applications. Increasing interest in member-focused products and cooperative banking solutions is shaping how new credit unions structure their services. Sustainability practices and digital banking innovations are becoming essential in attracting younger demographics.

Case studies showcasing successful new credit unions offer illustrative examples of innovative strategies that have yielded positive results. Analyzing such cases can provide insights into operational efficiency, community engagement, and sustainable growth, helping aspiring credit unions navigate their journeys more effectively.

Frequently asked questions (FAQs)

There are several common concerns surrounding the chartering of a credit union. Applicants often wonder about the differences between federal and state charters, especially regarding regulatory oversight and compliance obligations. Addressing misconceptions about credit union regulations and operational frameworks is also crucial, as potential organizers can sometimes feel overwhelmed by the perceived complexity of the chartering process.

Providing clear and concise answers to frequently asked questions can empower aspiring credit union organizers, ensuring they feel informed and confident as they move forward with their plans. Such information can demystify the process and highlight the opportunities that await in the credit union space.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit unions chartered in?

How do I edit credit unions chartered in online?

Can I create an eSignature for the credit unions chartered in in Gmail?

What is credit unions chartered in?

Who is required to file credit unions chartered in?

How to fill out credit unions chartered in?

What is the purpose of credit unions chartered in?

What information must be reported on credit unions chartered in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.