Get the free Guide to the W-4 Tax Form: Employee's Withholding Certificate

Get, Create, Make and Sign guide to the w-4

Editing guide to the w-4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out guide to the w-4

How to fill out guide to the w-4

Who needs guide to the w-4?

Guide to the W-4 Form

Understanding the W-4 Form

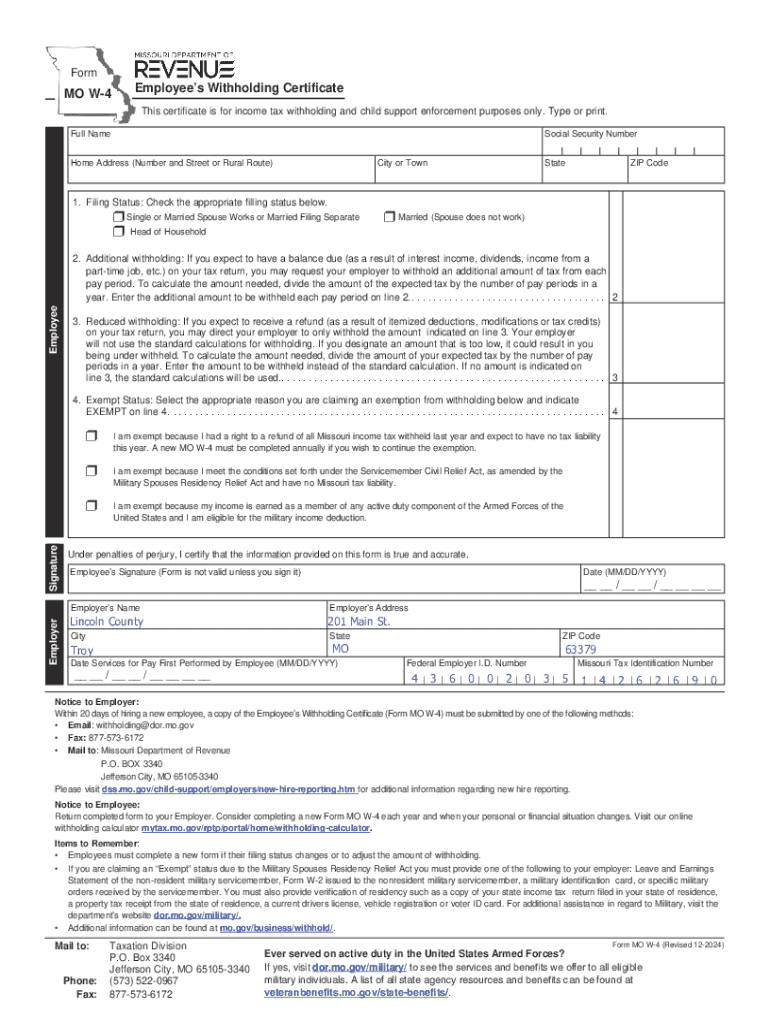

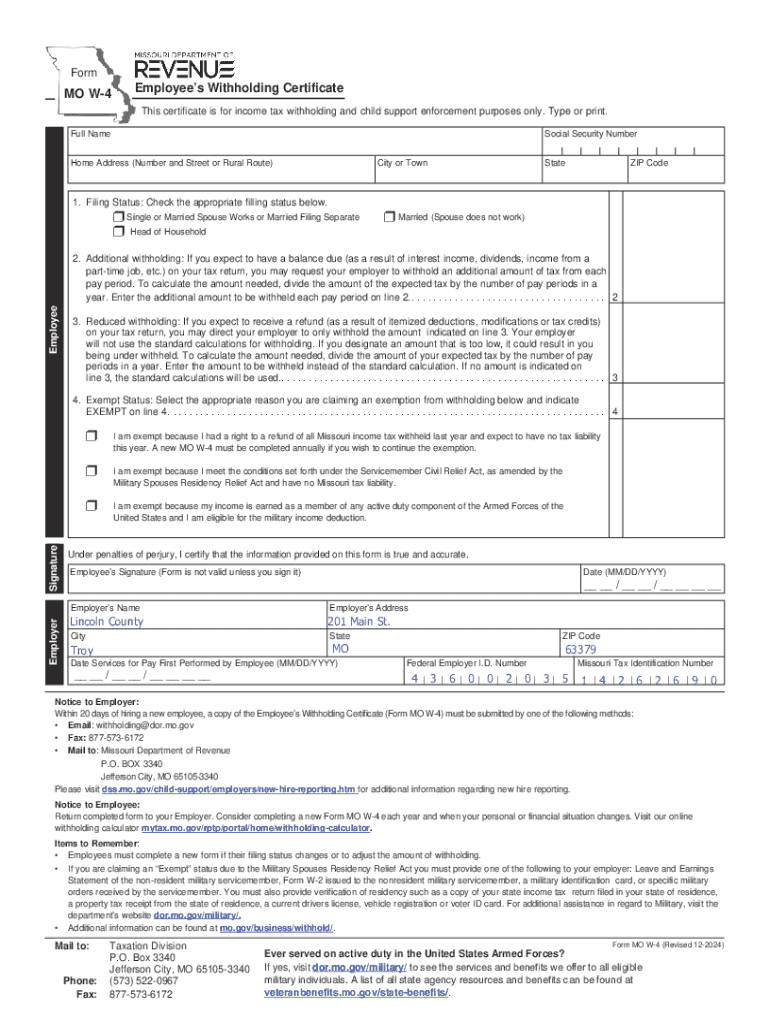

The W-4 Form is a crucial document in the United States tax system, primarily used to inform your employer about your tax withholding preferences. Its purpose is to ensure that the correct amount of federal income tax is withheld from your paycheck, thereby minimizing tax liabilities during the tax season. When filled out accurately, the W-4 helps prevent under-withholding, which can lead to unexpected tax bills, or over-withholding, which effectively lends the government an interest-free loan. Proper utilization of the W-4 form can enhance financial planning and impact your overall tax return positively.

In 2023, the W-4 form saw significant revisions aimed at simplifying the process for employees. One of the key changes includes the elimination of allowances, which were often confusing for many filers. Instead, the form now emphasizes direct entries related to income and dependents. These alterations not only streamline completion but also enhance accuracy in determining tax withholding. For individuals, being informed about these changes is essential as they directly affect financial planning and tax obligations.

Who needs to fill out the W-4?

Anyone who earns income as an employee in the United States is required to fill out a W-4 Form. This includes not only new employees but also existing employees who experience significant life changes. For instance, when you switch jobs or encounter life milestones such as marriage, divorce, or the birth of a child, it becomes essential to update your W-4. These events can drastically alter your tax situation, thereby necessitating a reassessment of your withholding amounts.

Failing to submit a W-4 or neglecting to update it can lead to complications. Without an accurate W-4, you might face either excessive tax withholdings or a sizable tax bill during filing season. This can be financially burdensome and cause unnecessary stress. Thus, understanding your obligations regarding the W-4 is vital in maintaining compliance and ensuring financial peace.

How to fill out the W-4 form

Filling out the W-4 form correctly is crucial for accurate tax withholding. Here’s a step-by-step guide to completing the form:

For precision, double-check your entries. Common mistakes include inaccuracies in social security numbers or incorrect filing statuses, which can distort your tax situation.

Adjusting your W-4

Life events can significantly impact your financial situation, making it necessary to review and adjust your W-4 regularly. Whenever you experience major changes—such as marriage, divorce, or the birth of a child—it is wise to revisit your W-4. An annual review is also beneficial, even if no major changes have occurred, to ensure that withholdings align with your current financial status and tax liabilities.

To update your W-4, fill out a new form and submit it to your employer. It is advisable to keep a copy for your records. After submission, confirm with your employer or payroll department that the changes were processed correctly. This helps alleviate concerns about accurate withholdings in subsequent paychecks.

Utilizing the W-4 calculator

To accurately estimate your tax withholding, utilizing a W-4 calculator can be incredibly beneficial. Here’s how you can navigate this tool effectively:

Understanding the results from the W-4 calculator enables you to make informed decisions regarding your tax strategy. Proper adjustments can lead to better cash flow throughout the year.

State tax withholding forms

While the W-4 form addresses federal income tax, it’s essential to be aware of state-specific tax withholding requirements. Many states have their own W-4 forms, which may differ significantly from the federal version in structure and requirements. For instance, certain states might also allow or require you to declare additional deductions, exemptions, or credits.

To find your state’s specific tax withholding form, visit your state’s tax agency website or consult your employer for guidance. Ensuring that your state and federal forms align helps maintain compliance and provides a more holistic approach to your tax strategy. This congruence in withholding practices aids in avoiding unexpected tax liabilities at both state and federal levels.

FAQs about the W-4 form

Several commonly asked questions can help clarify your understanding of the W-4 Form and its importance:

Managing your W-4 forms with pdfFiller

pdfFiller provides a seamless document management solution for handling your W-4 forms. With its features, you can effortlessly edit, sign, and store important documents, including the W-4. The platform is user-friendly, allowing you to access your forms from anywhere, ensuring convenience and efficiency.

Additionally, pdfFiller enables team collaboration, making it an excellent choice for teams managing multiple employee W-4 forms. This streamlined approach allows for reduced errors as multiple eyes can review each form. Effortlessly integrating your tax preparation strategy with pdfFiller empowers users to maintain control over their documents while facilitating compliance and organization.

Next steps after submitting your W-4

Once you have submitted your W-4 form, it is essential to monitor your subsequent paychecks for accuracy in withholding. The payroll department should update your withholdings based on the information provided. Generally, you should see changes reflected in your paycheck within one to two pay cycles, depending on your employer's processing schedule.

As you receive your paychecks, regularly check the tax withholding amounts against your expectations. Discrepancies should be addressed promptly by contacting your employer’s payroll department. This proactive approach guarantees that your withholding aligns with the anticipated amounts based on your updated W-4, ultimately assisting in better tax management throughout the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit guide to the w-4 in Chrome?

Can I sign the guide to the w-4 electronically in Chrome?

How do I fill out guide to the w-4 on an Android device?

What is guide to the w-4?

Who is required to file guide to the w-4?

How to fill out guide to the w-4?

What is the purpose of guide to the w-4?

What information must be reported on guide to the w-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.