Get the free Wisconsin Tax Bulletin #69

Get, Create, Make and Sign wisconsin tax bulletin 69

Editing wisconsin tax bulletin 69 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wisconsin tax bulletin 69

How to fill out wisconsin tax bulletin 69

Who needs wisconsin tax bulletin 69?

Understanding the Wisconsin Tax Bulletin 69 Form

Overview of the Wisconsin Tax Bulletin 69 Form

The Wisconsin Tax Bulletin 69 Form is a crucial document for taxpayers who need to report certain financial information and tax obligations. This form is specifically tailored for individuals and businesses operating within Wisconsin, aiming to comply with state tax laws. The extensive guidelines incorporated in the bulletin assist taxpayers in understanding their responsibilities and the information required for accurate filing.

The significance of this form lies in its role as a reporting tool that ensures taxpayers inform the Wisconsin Department of Revenue (DOR) about their earnings and deductions accurately. Proper completion of the Wisconsin Tax Bulletin 69 Form aids in avoiding penalties or fines from the DOR, thus ensuring that individuals and businesses remain compliant.

Recent updates to the Wisconsin Tax Bulletin 69 Form reflect adjustments in tax rates and regulations. Understanding these changes is paramount, as they can directly impact the amount of tax owed or refunds expected. Taxpayers need to familiarize themselves with these updates to minimize financial liabilities and streamline the filing process.

Who needs the Wisconsin Tax Bulletin 69 Form?

The Wisconsin Tax Bulletin 69 Form is required primarily for individuals and businesses that fall under Wisconsin tax filing mandates. This includes residents and non-residents earning income within the state. Self-employed individuals, freelancers, and contractors are common types of taxpayers who must utilize the form to report their earnings, ensuring they meet state tax obligations.

Moreover, businesses that have operational ties to Wisconsin—whether through sales, services, or other economic activities—must pay particular attention to this form. Organized entities, including corporations and partnerships, need to ensure they file the Wisconsin Tax Bulletin 69 Form to accurately assess their tax obligations and remain compliant with Wisconsin tax law.

Key details to keep in mind

When filling out the Wisconsin Tax Bulletin 69 Form, it's imperative to include accurate identification details. Taxpayers must provide their Social Security number (SSN) or Employer Identification Number (EIN), ensuring that the DOR can effectively match the submitted form to their tax records.

In addition to personal identification, financial data is crucial for accurate reporting. This includes total income earned, deductions taken, and taxable amounts. The clarity and precision of these financial details can significantly impact the tax amount owed, thus it is important for taxpayers to gather all necessary documentation before starting the filling process.

Step-by-step guide to filling out the Wisconsin Tax Bulletin 69 Form

Completing the Wisconsin Tax Bulletin 69 Form requires a systematic approach to ensure accuracy and compliance. Here’s a step-by-step guide to assist taxpayers through the process:

1. **Gathering required documents**: Before diving into the form, collect all necessary documents, including W-2s, 1099s, and any receipts or records supporting your deductions. Organizing these documents by type will facilitate a smoother entry of information.

2. **Filling in your information**: Carefully enter your personal details in the designated sections of the form. Pay close attention to spelling and numbers to avoid common errors that could lead to issues with your filing.

3. **Calculating your tax obligations**: Use the appropriate formulae to calculate your total taxable income and any deductions. Reference current tax rates from the Wisconsin DOR to ensure your calculations are up-to-date and accurate.

4. **Reviewing your form**: After completing the form, take a moment to double-check each entry against the gathered documentation. Utilize a checklist to verify that all necessary information is included and correctly stated.

5. **Submitting your form**: Once you are confident in your form's accuracy, submit it through your preferred method—whether electronically or by mailing a physical copy. Note the submission deadline to avoid penalties.

Managing updates and changes

It's essential for taxpayers to stay informed on any updates regarding the Wisconsin Tax Bulletin 69 Form. Changes to state tax law can significantly affect how taxpayers report income and determine tax liabilities. Regularly checking official sources or subscribing to tax updates can keep you informed about pertinent changes.

Should a taxpayer need to revise and resubmit their filed form, understanding the correct procedure is crucial. Begin by gathering your original documents, making note of the errors, and following the outlined steps by the Wisconsin DOR for corrected submissions. This may involve filling out a new form and including a detailed explanation of the changes made.

Utilizing interactive tools for ease of use

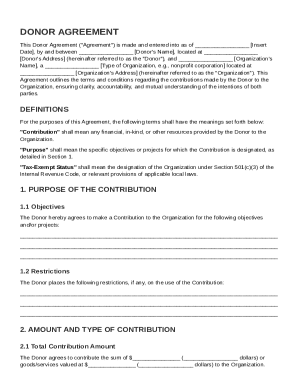

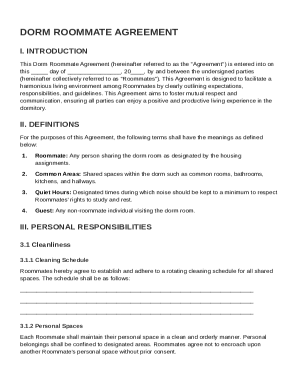

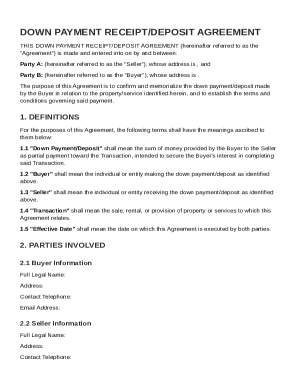

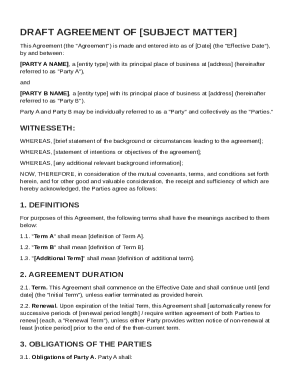

pdfFiller offers an array of features to enhance the experience of managing the Wisconsin Tax Bulletin 69 Form. Utilizing cloud-based solutions allows users to create, edit, and eSign documents from anywhere, making the filing process more convenient and efficient. Users can also benefit from an integrated workspace that streamlines document management.

With pdfFiller, taxpayers can take advantage of various tools for filling out forms seamlessly. Editing features enable quick modifications, ensuring accuracy, while eSigning options facilitate faster approvals. Furthermore, the ability to collaborate with team members enhances communication and efficiency when preparing tax filings.

Leveraging support and resources

If taxpayers encounter difficulties with the Wisconsin Tax Bulletin 69 Form, assistance is readily available. pdfFiller offers a customer support system where individuals can inquire about specific questions or concerns. Engaging with support teams can alleviate confusion and ensure that all issues are promptly addressed.

In addition to direct support, sharing insights with the community can provide valuable tips and strategies. Online forums and social media groups often discuss common concerns among taxpayers filling out the Wisconsin Tax Bulletin 69 Form, offering a platform for candid discussions and shared experiences.

Conclusion: Maximize your filing experience

Utilizing pdfFiller for managing the Wisconsin Tax Bulletin 69 Form not only enhances efficiency but also ensures that taxpayers are well-equipped to handle their filing obligations. The cloud-based platform empowers users to leverage document management tools that streamline the process, making taxing tasks manageable and straightforward.

By taking advantage of pdfFiller's capabilities, taxpayers can foster a productive filing experience and ensure they remain compliant with Wisconsin tax laws. Exploring the features provided by pdfFiller will undoubtedly benefit those looking to manage documents effectively and efficiently.

Have questions? We’re here to help!

For any additional inquiries regarding the Wisconsin Tax Bulletin 69 Form or related tax processes, feel free to reach out for assistance. Engaging with support teams ensures personalized guidance and fosters an informed filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wisconsin tax bulletin 69 for eSignature?

How can I get wisconsin tax bulletin 69?

How can I edit wisconsin tax bulletin 69 on a smartphone?

What is Wisconsin Tax Bulletin 69?

Who is required to file Wisconsin Tax Bulletin 69?

How to fill out Wisconsin Tax Bulletin 69?

What is the purpose of Wisconsin Tax Bulletin 69?

What information must be reported on Wisconsin Tax Bulletin 69?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.