Get the free 2026 CLERGY/MINISTER COMPENSATION FORM

Get, Create, Make and Sign 2026 clergyminister compensation form

How to edit 2026 clergyminister compensation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 clergyminister compensation form

How to fill out 2026 clergyminister compensation form

Who needs 2026 clergyminister compensation form?

Complete Guide to the 2026 Clergy/Minister Compensation Form

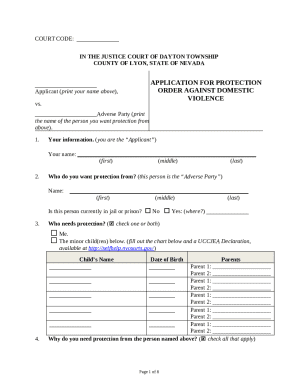

Understanding the 2026 clergy/minister compensation form

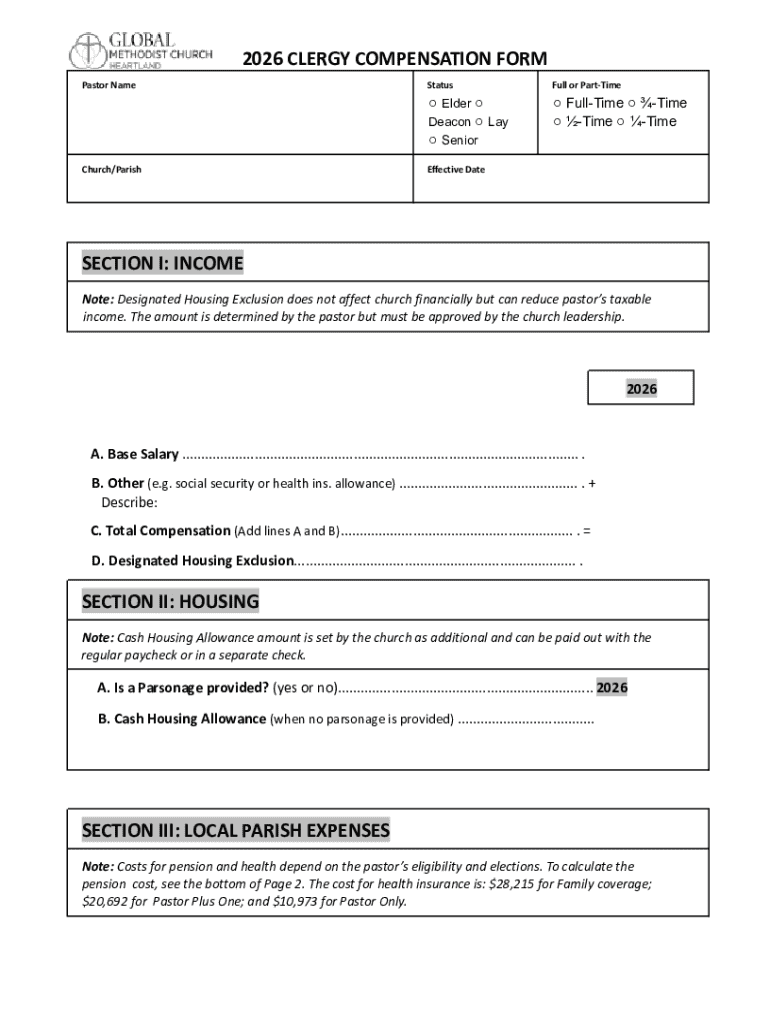

The 2026 clergy/minister compensation form is a vital document used by churches and religious organizations to report the compensation of their clergy and ministers accurately. This form serves several important functions, including ensuring tax compliance and providing transparency in church finances. As clergy members often have unique compensation structures compared to standard employee models, it’s essential to fill out this form correctly to avoid any potential tax liabilities and ensure the church maintains its tax-exempt status.

Accuracy in reporting is crucial because misreporting can lead to significant penalties for both the individuals and the church. Furthermore, proper compensation reporting fosters trust within the congregation and reflects good stewardship.

Key changes in the 2026 form

The 2026 form incorporates several notable updates aimed at improving clarity and functionality for users. For example, the form now includes additional clarification on housing allowances, which have often been a source of confusion. By outlining the allowable deductions more explicitly, the changes aim to simplify completion and reduce common errors. Additionally, the form has been streamlined to eliminate redundant sections, making it quicker to complete.

These updates mean that clergy and church administrators must familiarize themselves with the new guidelines to ensure compliance. Understanding these changes ahead of time can prevent costly mistakes during the tax season.

Benefits eligibility

Identifying eligible benefits is crucial, as these can significantly enhance a clergy member's compensation package. Clergy often have access to benefits such as health and dental insurance, retirement plans, and professional development allowances. Each of these benefits contributes to the overall well-being of the clergy member and their family and can provide significant financial advantages.

To accurately document these benefits on the form, begin by listing each benefit under the appropriate section. Describe the eligibility criteria for each benefit, being careful to note any conditions that may affect coverage or contribution. It’s essential to check the specific guidelines and requirements associated with each benefit to ensure proper reporting and compliance.

Common pitfalls in this section include failing to document all contributions or misclassifying benefits. Best practices involve reviewing eligibility criteria against church policies and ensuring all entries are complete and accurate.

Cash salary & allowances

Understanding the components of a minister's compensation package involves recognizing the difference between cash salary and allowances. While cash salary is the fixed amount paid to clergy, allowances can be more variable and include accommodations like housing, travel, and education expenses. It is crucial to distinguish these categories as they have different tax implications.

To calculate total cash compensation accurately, begin by adding the base salary to each allowance category. This total provides a comprehensive view of the financial package offered to clergy, which is essential for both reporting and personal financial planning. For example, if a clergy member receives a base salary of $50,000 along with $10,000 for housing and $5,000 for travel, the total compensation would be $65,000.

Filling out the salary section requires careful documentation to ensure all figures are entered correctly. Be sure to review each allowance and ensure that non-monetary benefits are also acknowledged in the final reporting.

Housing considerations

Clergy members often have unique housing arrangements that can include church-provided housing or housing allowances. Church-provided housing typically involves the church owning or renting a property, while housing allowances enable the clergy to choose their own residence. Each arrangement has distinct implications for taxation and reporting.

Understanding the tax implications of housing allowances is critical. For instance, clergy members can often exclude housing allowances from their taxable income, which can significantly reduce overall tax burden. However, it is essential to accurately report these amounts for exemption eligibility; otherwise, the IRS may reclassify these allowances as taxable.

When completing the housing section of the form, list all applicable details such as the type of arrangement, address, and any associated costs. This section often trips people up, so being thorough and exact can help avoid common mistakes.

Total clergy/minister compensation

Combining all components of compensation into a total amount is essential for accurate reporting. This includes summing cash salaries, allowances, and benefits to present a clear picture of total compensation. Understanding this total is critical for both internal records and external reporting to ensure transparency.

To calculate total compensation accurately, break down each component as previously outlined, and ensure that all figures are verified before submission. Common errors in total calculations can lead to discrepancies and potential penalties, so it's essential to conduct checks to avoid mistakes.

Following these steps ensures a comprehensive understanding of total compensation and aligns with financial transparency goals for both clergy and church leadership.

Local church expenses for clergy/ministers

Local church contributions to a minister's compensation can cover a range of expenses, including travel costs, professional development, and other ministry-related expenditures. Knowing what qualifies as local church expenses is important for correct reporting on the compensation form.

Common expenses might include costs for attending conferences, travel for church functions, or professional training. Accurate documentation of these local church expenses is vital; not only for compliance but also for financial accountability. Retaining receipts and maintaining detailed records can support these claims and provide clarity in case of queries from tax agencies.

When reporting local church expenses on the compensation form, ensure that all claimed expenses are supported with appropriate documentation to streamline the review process. This careful approach helps maintain clear accountability and trust within the church community.

Common mistakes and FAQs

Completing the compensation form can present various challenges, and understanding frequent errors can prevent oversight. Common mistakes include miscalculating total compensation, misreporting benefits, or failing to document local church expenses adequately. Accuracy in these areas is critical, not only for compliance but also for maintaining trust within the church community.

To avoid these pitfalls, ensure that all figures are double-checked and that receipts are organized and maintained for any expenses claimed on the form. Additionally, prompting clergy members to review the form together with church administrators can facilitate accuracy and consistency.

Frequently asked questions often revolve around details on allowable deductions, proper classification of income, and queries regarding documentation requirements, reflecting the complexities clergy face in compensation reporting. Providing clear answers to these questions can facilitate smoother completion of the form.

Tools and resources for effective form management

Using accessible tools for document creation and management enhances the efficiency of completing the 2026 clergy/minister compensation form. A platform like pdfFiller offers invaluable features designed to simplify the paperwork process. This cloud-based solution allows users to easily edit, sign, and manage forms, ensuring that all documents remain organized and accessible from anywhere.

To utilize pdfFiller effectively, users can start by creating an account and accessing the interactive tools available. Step-by-step guides facilitate the process of filling out forms, whether as an individual or as part of a team. Collaborative features also allow for real-time feedback and adjustments, making it easy to ensure that everyone is on the same page regarding compensation documentation.

Investing time in familiarizing oneself with these tools can significantly streamline the form completion process and enhance overall accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2026 clergyminister compensation form directly from Gmail?

How can I send 2026 clergyminister compensation form to be eSigned by others?

How can I edit 2026 clergyminister compensation form on a smartphone?

What is 2026 clergyminister compensation form?

Who is required to file 2026 clergyminister compensation form?

How to fill out 2026 clergyminister compensation form?

What is the purpose of 2026 clergyminister compensation form?

What information must be reported on 2026 clergyminister compensation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.