Get the free 0001644378-25-000043. Form 10-K filed on 2025-11-12 for the period ending 2025-09-30

Get, Create, Make and Sign 0001644378-25-000043 form 10-k filed

How to edit 0001644378-25-000043 form 10-k filed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 0001644378-25-000043 form 10-k filed

How to fill out 0001644378-25-000043 form 10-k filed

Who needs 0001644378-25-000043 form 10-k filed?

Understanding the 0001644378-25-000043 Form 10-K Filed Form

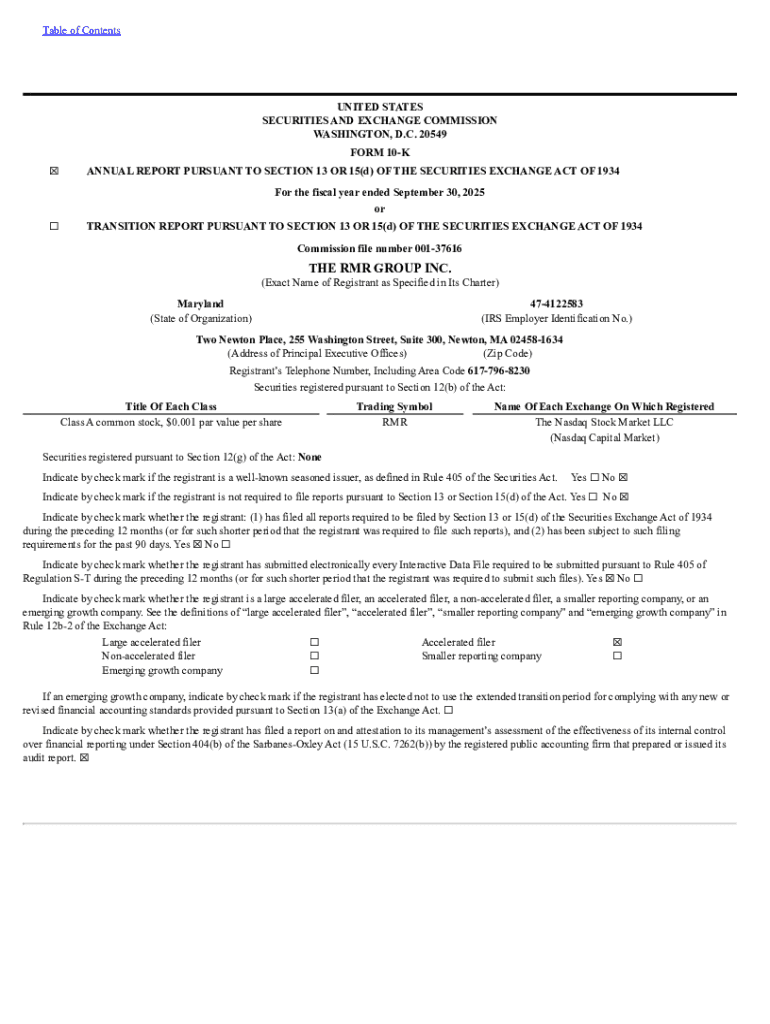

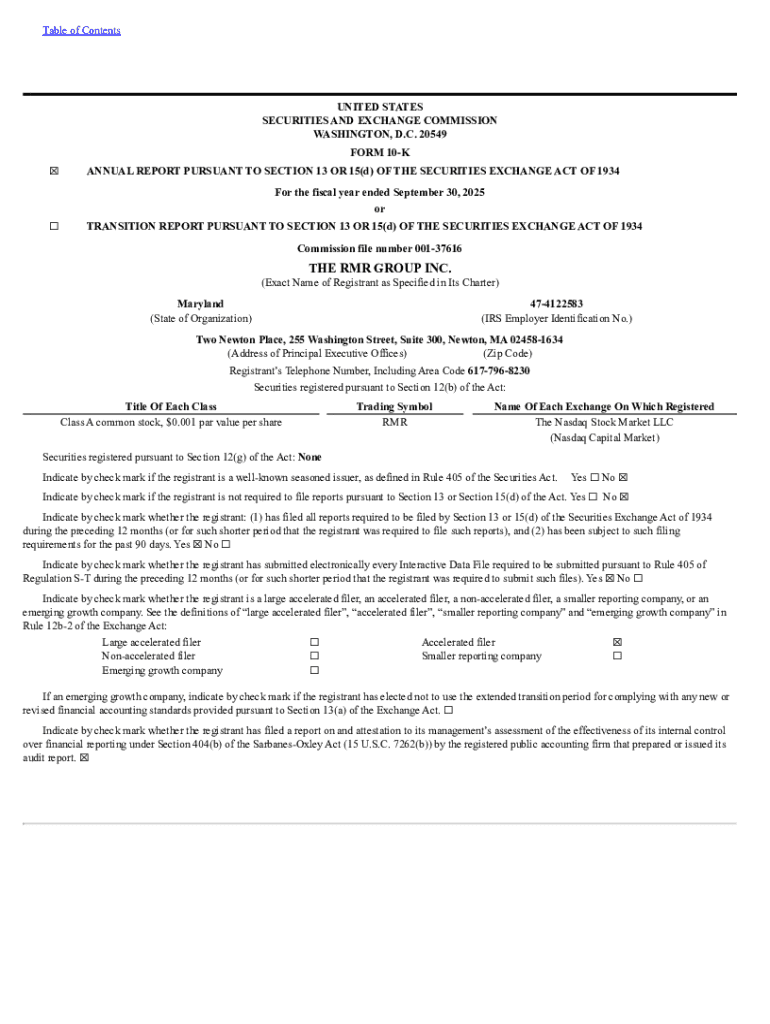

Understanding the Form 10-K

The Form 10-K is a comprehensive annual report filed by public companies to the U.S. Securities and Exchange Commission (SEC). It serves a vital purpose in providing detailed information about a company’s performance, financial health, and operational outcomes over the previous fiscal year. Notably, the 10-K is mandatory for publicly traded companies, making it a key document in the world of corporate finance and governance.

The importance of the Form 10-K lies in its ability to offer transparency to investors, creditors, and other stakeholders. By presenting a thorough overview of a company's business strategies, risks, and financial condition, it helps stakeholders make informed investment decisions. Furthermore, the 10-K includes extensive information on a company's operational metrics, competitive landscape, and market conditions, thereby reflecting its annual performance accurately.

Components of the Form 10-K

A typical Form 10-K is structured with several essential components, each providing specific types of information that help build a complete picture of the company's business. The primary components include a company overview, financial statements, Management’s Discussion and Analysis (MD&A), and various disclosures related to risk factors and compensation.

The company overview includes a detailed business description and its organizational structure, offering insight into the operations and the strategic vision of the enterprise. Financial information section includes pivotal financial statements such as the income statement, balance sheet, and cash flow statement. Each of these elements reveals crucial data regarding revenue, expenses, profits, and liquidity.

Specific sections of the Form 10-K

Beyond the fundamental components, the Form 10-K contains specific sections that provide critical insights into various aspects of a company’s operations and risks. Notably, the risk factors section elaborates on common and industry-specific risks, which can significantly affect the company's performance. Legal proceedings outline any ongoing litigations or regulatory challenges that the company faces, revealing potential legal vulnerabilities and their implications.

The executive compensation section discloses the remuneration packages for key executives, highlighting management's incentives tied to performance. Additionally, quantitative and qualitative disclosures cover market risks that might impede the company's financial outcomes. With the increasing importance of digital security, the cybersecurity disclosures section addresses recent trends and threats in cybersecurity, detailing how they impact the company. Lastly, corporate governance provides crucial data regarding the board of directors and various committees overseeing company management.

Filing process for Form 10-K

Filing a Form 10-K requires adherence to a structured process that ensures compliance with SEC regulations. Companies must prepare and file the report by a set deadline, which is typically 60 to 90 days after the end of the fiscal year, depending on their category as large accelerated filers, accelerated filers, or non-accelerated filers. The filing process is primarily a digital submission, where companies upload the document to the SEC’s Edgar database.

pdfFiller streamlines this filing process by allowing companies to create, edit, and digitally sign their 10-K reports through a user-friendly platform. Users can customize their PDFs, ensuring all sections are accurately filled out and compliant. Moreover, the eSignature capabilities ensure that necessary sign-offs are collected swiftly, minimizing delays.

Best practices for completing the Form 10-K

Creating a Form 10-K requires diligence, accuracy, and compliance to ensure that the report is both effective and transparent. Collaborating with cross-functional teams is crucial. During this process, utilizing platforms like pdfFiller enhances teamwork by providing tools for collaborative editing and reviewing, ensuring that every critical detail is captured.

Furthermore, ensuring accuracy in the data presented is of utmost importance, as incomplete or incorrect information can lead to regulatory repercussions and loss of stakeholder trust. Conducting a year-over-year analysis of historical changes in filings can provide valuable insights into the company's trajectory, ensuring that the report is not just a formality but a document reflecting real business progress.

Tools and features of pdfFiller

pdfFiller enhances the Form 10-K completion process through its array of interactive tools designed for efficient document management. With features such as pre-filled templates and the ability to store and retrieve past filings, users can dramatically reduce the time spent preparing their reports. By offering an organized repository of previously submitted Forms 10-K, pdfFiller makes it easy for users to reference historical data quickly.

Security is another critical aspect that pdfFiller emphasizes. The platform ensures document integrity and confidentiality through robust encryption measures. As sensitive financial data is handled, users can have peace of mind knowing that their documents are safe from unauthorized access.

Analyzing past 10-K filings

Access to historical data is invaluable for evaluating a company's performance and making informed decisions. By using pdfFiller, users can efficiently retrieve past 10-K filings, which serve as critical resources for trend analysis. Investors and analysts often study these filings to gauge a company’s revenue growth, operational efficiency, and shifts in strategic direction, enhancing their understanding of the firm’s financial health.

Identifying trends through historical filings allows stakeholders to recognize patterns in revenue and expenses, offering insights into how the company has managed different economic conditions. This analysis is crucial for investor relations, as it emphasizes transparency and demonstrates the company’s commitment to providing stakeholders with accurate and timely information.

Common mistakes to avoid

When filing the Form 10-K, companies must be aware of common pitfalls that could jeopardize their compliance or lead to misleading reporting. Incomplete or inaccurate information is one of the most significant issues that can arise. Errors in financial data can lead not only to regulatory scrutiny but also damage to the company’s credibility with investors and stakeholders.

Another common mistake is misunderstanding SEC requirements, which can lead to omissions or misinterpretations in the filing. Timeliness of submission is also critical; delayed filings might attract regulatory penalties or generate negative sentiments among investors. pdfFiller helps mitigate these risks by offering features that ensure fields are completed accurately and submissions are made punctually.

Frequently asked questions (FAQs)

Publicly available information often leads to questions about the significance of the Form 10-K and its role in corporate governance. The significance of a 10-K filing extends beyond a simple reporting requirement; it represents a commitment to transparency and accountability in financial reporting. Every public company is required to file Form 10-K, which includes not only financial statements but also strategic insights and operational updates. This differentiates the 10-K from other SEC reports, such as the 10-Q, which provides quarterly updates but lacks the exhaustive detail encapsulated in a 10-K.

pdfFiller offers resources tailored to assist companies in navigating these filings, streamlining the filing process and ensuring that they remain compliant while presenting clear and accurate data.

Additional considerations

As regulatory requirements evolve, companies must stay informed about potential changes to the SEC filing requirements. Effective communication and timely updates are necessary to ensure compliance. Additionally, technology plays a crucial role in streamlining document management, making it easier for companies to keep up with these changes while maintaining compliance. pdfFiller stays ahead in providing relevant tools and resources that empower users to manage documentation efficiently while adhering to regulatory standards.

Emphasizing the role of technology in document management not only improves operational efficiency but also enhances the overall stakeholder experience by providing accurate and timely information. By utilizing modern tools, companies can reduce the burden of compliance and focus more on strategic initiatives that drive business growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 0001644378-25-000043 form 10-k filed in Chrome?

Can I create an eSignature for the 0001644378-25-000043 form 10-k filed in Gmail?

How do I edit 0001644378-25-000043 form 10-k filed on an iOS device?

What is 0001644378-25-000043 form 10-k filed?

Who is required to file 0001644378-25-000043 form 10-k filed?

How to fill out 0001644378-25-000043 form 10-k filed?

What is the purpose of 0001644378-25-000043 form 10-k filed?

What information must be reported on 0001644378-25-000043 form 10-k filed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.