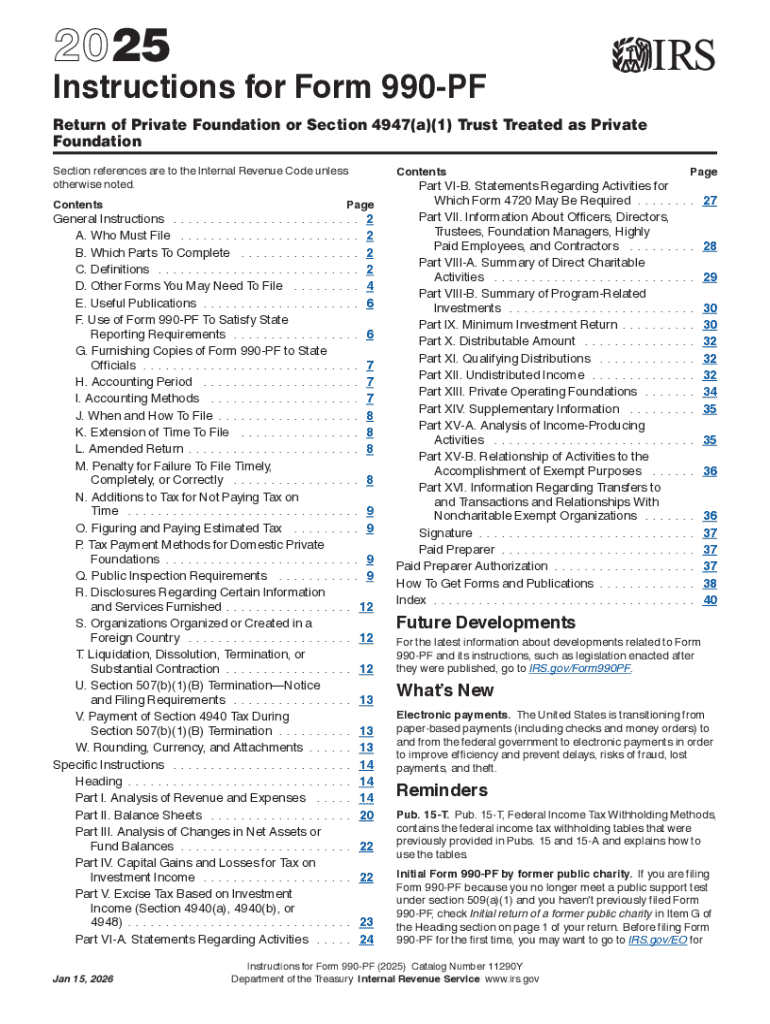

IRS 990-PF Instructions 2025-2026 free printable template

Get, Create, Make and Sign IRS 990-PF Instructions

Editing IRS 990-PF Instructions online

Uncompromising security for your PDF editing and eSignature needs

IRS 990-PF Instructions Form Versions

How to fill out IRS 990-PF Instructions

How to fill out 2025 instructions for form

Who needs 2025 instructions for form?

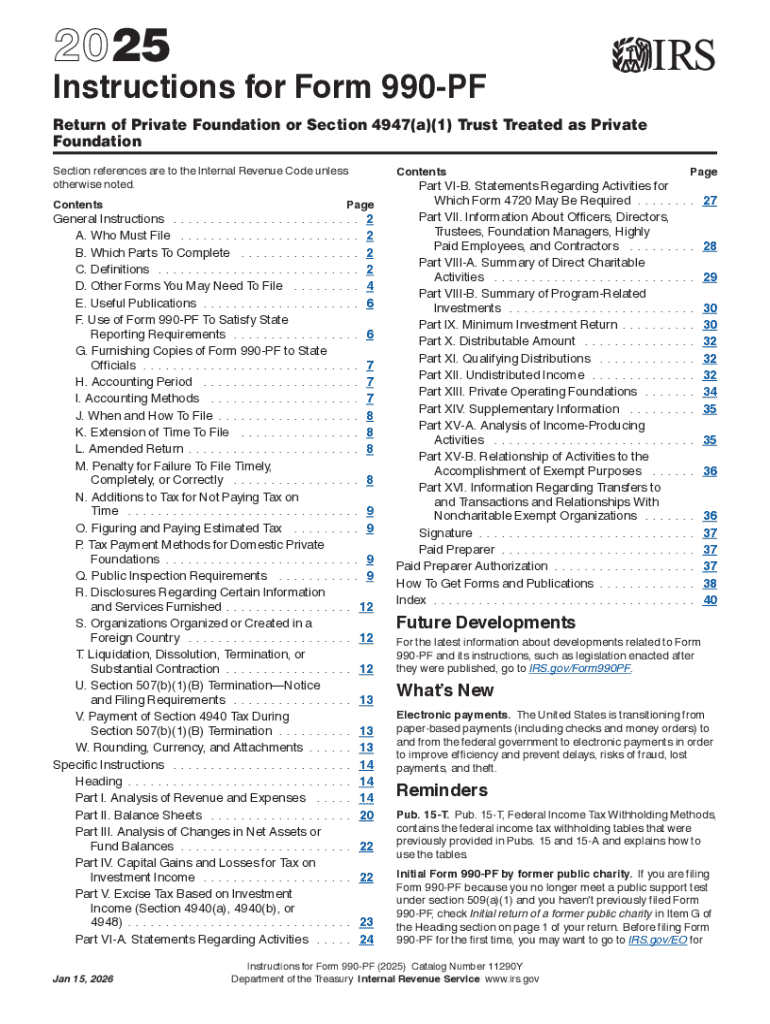

2025 Instructions for Form: A Comprehensive Guide

Understanding the 2025 form

The 2025 Form is an essential document used primarily for reporting information related to various financial statistics and regulatory obligations. It serves as a standardized format for individuals and entities to declare pertinent data, facilitating governance, compliance, and transparency in financial reporting. Whether you are a professional, a small business owner, or part of a large organization, understanding this form is crucial for navigating the complexities of tax regulations and public information reporting.

Accurate submission of the 2025 Form is imperative. Errors in filing can lead to penalties, delayed approvals, and even audits. On the flip side, correctly completed forms pave the way for smoother financial operations and compliance. Valuable time can be saved, and potential issues can be mitigated by paying careful attention to this crucial document.

Key features of the 2025 form

The 2025 Form consists of various sections, each targeting specific information needed for comprehensive reporting. Understanding these sections is paramount for a successful submission. Typically, it includes personal information, financial data, and organizational details, which are critical to the public information report and ownership information report requirements under the tax code section.

Required information for the form usually includes your taxpayer information part, with necessary documentation to validate the claims made. Common issues arise from incomplete information, making it essential to prepare thoroughly. Typical mistakes include overlooking required fields or misinterpretations of the financial data submissions which can lead to rejections or queries.

Step-by-step instructions for completing the 2025 form

Before diving into filling out the 2025 Form, equipping yourself with the right information is crucial. Gather all necessary documentation, such as gross receipts, previous tax filings, and any relevant reports that pertain to your financial activities for the reporting year. Consider utilizing tools like pdfFiller, which offers a user-friendly interface for filling out forms efficiently.

In the personal information section, commonly required fields might include your name, address, and taxpayer identification. For the financial section, provide accurate reporting of revenue and any pertinent gross receipts. Finally, consider using the review tools available on pdfFiller to ensure you haven't overlooked critical information before finalizing your submission.

Editing and finalizing the 2025 form

Suppose you've completed your form and need to make edits. PdfFiller allows you to edit your document easily without losing prior work. You can navigate through the sections efficiently, modifying any fields as needed. This ensures that any last-minute changes reflect accurately in your submission.

Additionally, electronic signing has become a staple in modern document management. By leveraging pdfFiller's e-signature capabilities, you can simplify the signing process, eliminating the hassle of printing, signing, and scanning. Securely sign and save the document in one seamless step, ensuring that your form is finalized and ready for submission.

What to do after submission

Once your 2025 Form has been submitted, tracking the status of your submission becomes vital. Regularly monitoring the progress helps ensure your filing has been received and is being processed. Typical status updates may include accepted, under review, or rejected, with specific notes indicating any required actions.

In case your form faces rejection or queries arise, it’s essential to act promptly. Reviewing the provided notes will guide you on how to address the issue. You can utilize pdfFiller not only for re-filing but also for amending the submitted information easily. By keeping all the necessary documentation on hand and using the features available through pdfFiller, resolving issues can be a breeze.

Additional tips and best practices for using the 2025 form

Staying updated on any changes to the 2025 Form is crucial, especially as tax regulations continuously evolve. Leverage resources such as IRS announcements and updates on the pdfFiller platform to ensure you're utilizing the latest version of the form. Doing so not only aligns with compliance measures, but also maximizes your chances for accurate submissions.

Implementing interactive tools available in pdfFiller can significantly enhance your experience with the 2025 Form. From auto-fill features to collaborative capabilities for teams working together, these tools can streamline the process, making it less daunting and more efficient for all parties involved. By learning from user experiences and best practices shared within the platform, perseverance in using the form can yield excellent outcomes.

Conclusion and next steps

Navigating the 2025 Form can seem overwhelming, but with the right tools, such as pdfFiller, the process can be manageable. This guide serves as your roadmap to understanding form requirements, completing submissions efficiently, and managing your documents securely. By leveraging the capabilities provided by pdfFiller, you are empowered to handle not only the 2025 Form but also a variety of other document needs in your financial reporting journey.

FAQs about the 2025 form

Frequently asked questions often arise regarding specific aspects of the 2025 Form. Many users wonder about the necessary supporting documents, tips for avoiding common pitfalls, and how to effectively utilize pdfFiller for form completion.

People Also Ask about

Does 990-PF have to be filed electronically?

What is the purpose of a grant 990-PF?

What is about 990-PF instruction?

Where do capital gain distributions go on 990-PF?

What is the minimum investment return on a 990-PF?

What is a 990-PF form for capital gains?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 990-PF Instructions to be eSigned by others?

Can I create an electronic signature for signing my IRS 990-PF Instructions in Gmail?

How do I complete IRS 990-PF Instructions on an iOS device?

What is 2025 instructions for form?

Who is required to file 2025 instructions for form?

How to fill out 2025 instructions for form?

What is the purpose of 2025 instructions for form?

What information must be reported on 2025 instructions for form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.