Get the free Error Code F990-913-01 How do I resolve it? - Support

Get, Create, Make and Sign error code f990-913-01 how

How to edit error code f990-913-01 how online

Uncompromising security for your PDF editing and eSignature needs

How to fill out error code f990-913-01 how

How to fill out error code f990-913-01 how

Who needs error code f990-913-01 how?

Understanding Error Code F990-913-01: How to Form 990 Correctly

Overview of IRS error codes related to form 990

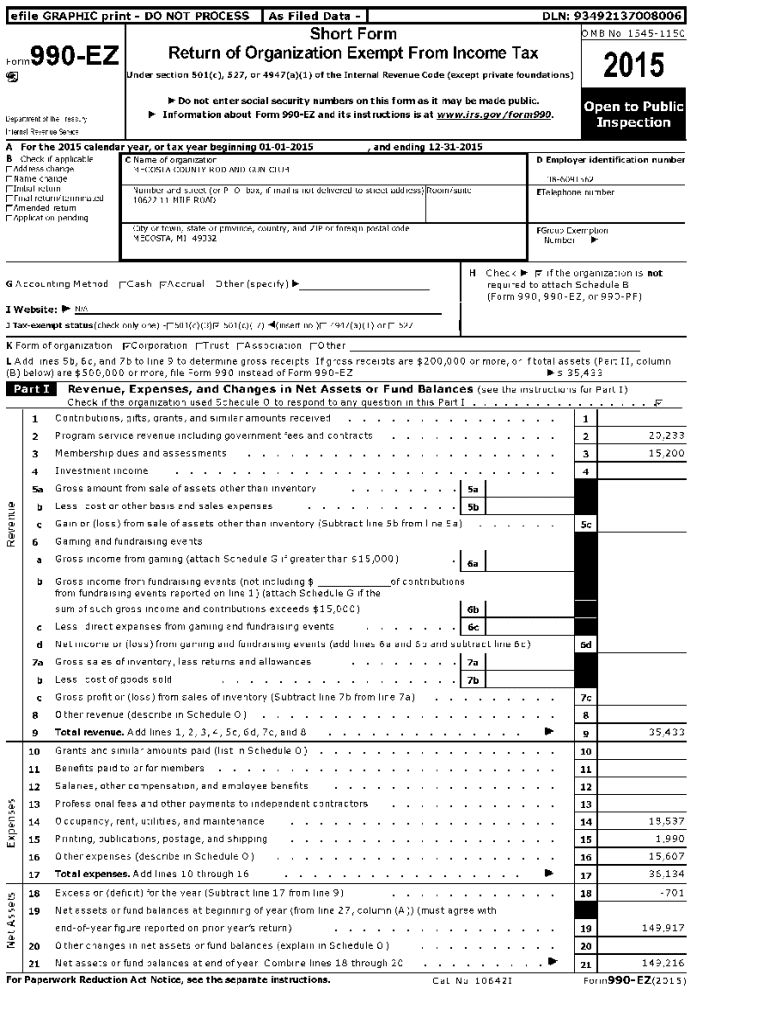

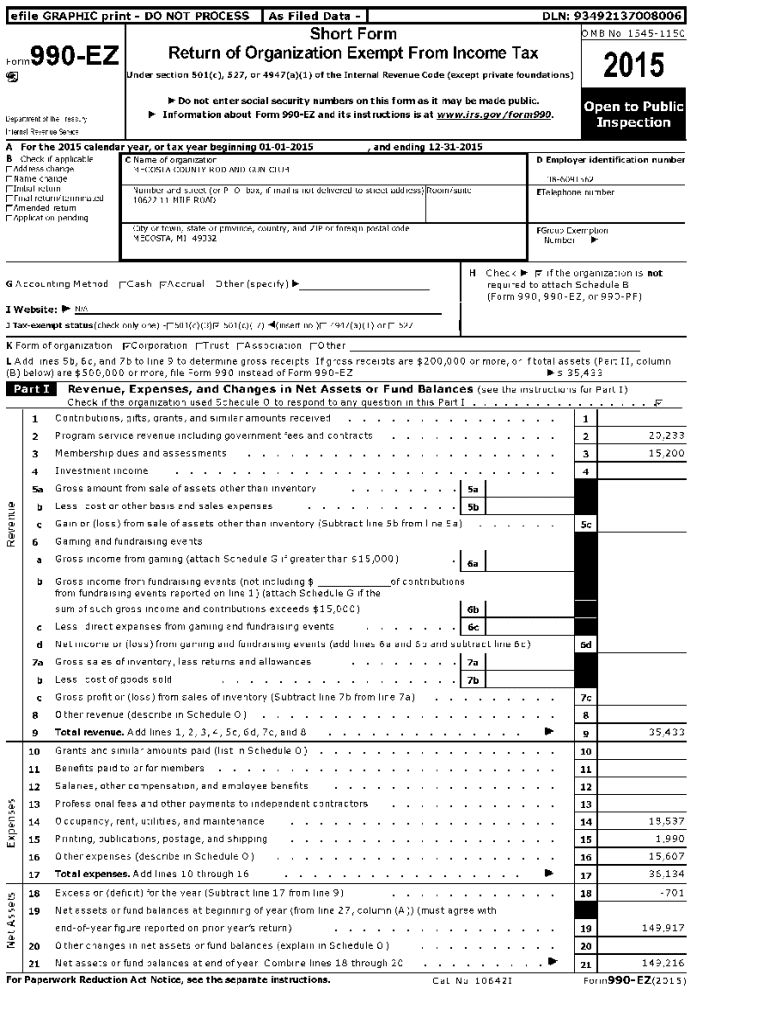

Form 990 is the IRS's primary tax form used by nonprofits, charities, and other tax-exempt organizations to provide the IRS and the public with information about their mission, activities, and finances. Submitting an accurate Form 990 is crucial, as any errors can lead to potential penalties and complications when maintaining tax-exempt status. Nonprofits often encounter various IRS error codes when filing this form, which signal specific issues with the submitted documentation.

Detailed insight into error code F990-913-01

Error Code F990-913-01 refers to specific discrepancies found in a submitted Form 990, typically indicating missing or inconsistent data that does not meet IRS standards. This error code often emerges due to common mistakes made during data entry, leading to either missing sections or inconsistency in reported figures. Understanding its causes is vital for rectifying the error effectively and ensuring compliance.

Common mistakes leading to Error Code F990-913-01 include improperly filled out sections such as Part I, which requires a summary of revenue and expenses, or inaccuracies in Part III, detailing the organization's program service accomplishments. If left unresolved, nonprofits may face penalties, delayed processing of their tax forms, and possible jeopardy to their tax-exempt status.

Step-by-step guide to resolving error code F990-913-01

Resolving Error Code F990-913-01 requires a systematic approach to ensure that your Form 990 is corrected and resubmitted properly. Here’s a streamlined guide to navigate the resolution process.

Tips for preventing future error codes on form 990

Preventing future error codes like F990-913-01 involves proactive measures and best practices. Regularly updating your knowledge of IRS regulations is important, as IRS rules can change.

Further, consider employing the following strategies to enhance the accuracy of your Form 990 filings:

Leveraging pdfFiller for seamless document management

pdfFiller is an invaluable tool for organizations looking to streamline the Form 990 submission process. Several features offer significant benefits when filling out this essential form.

The platform allows for easy editing of PDF documents, enabling quick amendments to your Form 990. With user-friendly interactive tools, teams can collaborate efficiently, making it possible to complete the form accurately and uphold compliance.

Commonly encountered related errors and fixes

Apart from Error Code F990-913-01, other related errors can also complicate the filing of Form 990. Understanding these errors and how to fix them can enhance your filing strategy.

For instance, Error Code F990-912-01 typically identifies missing information in various sections of the form, similar to the challenges faced with F990-913-01. Addressing this error involves ensuring that all sections are completed accurately.

Engaging with IRS support

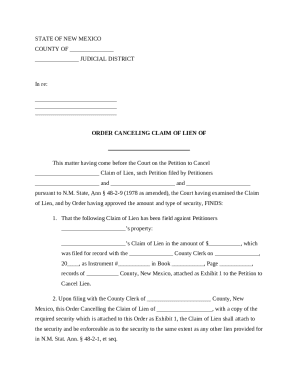

In instances where error codes remain unresolved or if you require clarification on submissions, contacting IRS support is an important step. Knowing when and how to reach out can be beneficial.

When communicating with IRS representatives, present all documentation clearly and be prepared with specific questions regarding your Form 990. The credibility of your inquiries often hinges on the accuracy of your records and the clarity of your explanations.

Document the conversation with IRS agents and retain notes about any guidance provided, ensuring that you have a comprehensive record for future reference.

Additional considerations for nonprofits submitting form 990

Nonprofits submitting Form 990 must also consider additional schedules that may be required depending on the organization's activities. Each schedule, including Schedules A through D, plays a significant role in providing detailed information regarding various aspects of the organization's operations.

Furthermore, understanding financial disclosures is critical to ensuring transparency and compliance with IRS mandates. Misreporting financial data can lead to severe penalties or even jeopardize your nonprofit status.

Accurate reporting ensures that your nonprofit maintains its standing and serves its mission effectively, while also ensuring compliance with laws and regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit error code f990-913-01 how from Google Drive?

How can I send error code f990-913-01 how for eSignature?

Can I create an electronic signature for signing my error code f990-913-01 how in Gmail?

What is error code f990-913-01 how?

Who is required to file error code f990-913-01 how?

How to fill out error code f990-913-01 how?

What is the purpose of error code f990-913-01 how?

What information must be reported on error code f990-913-01 how?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.