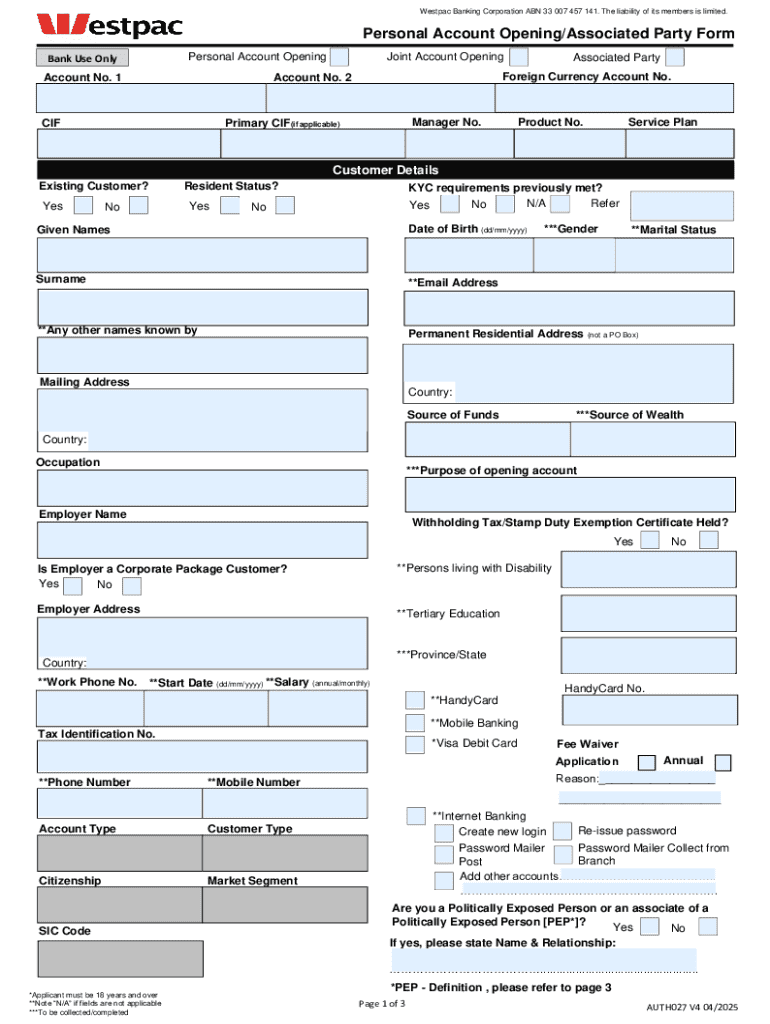

Get the free Personal Account Opening Form/Associated Party Form

Get, Create, Make and Sign personal account opening formassociated

Editing personal account opening formassociated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal account opening formassociated

How to fill out personal account opening formassociated

Who needs personal account opening formassociated?

The Essential Guide to Personal Account Opening Form Associated Form

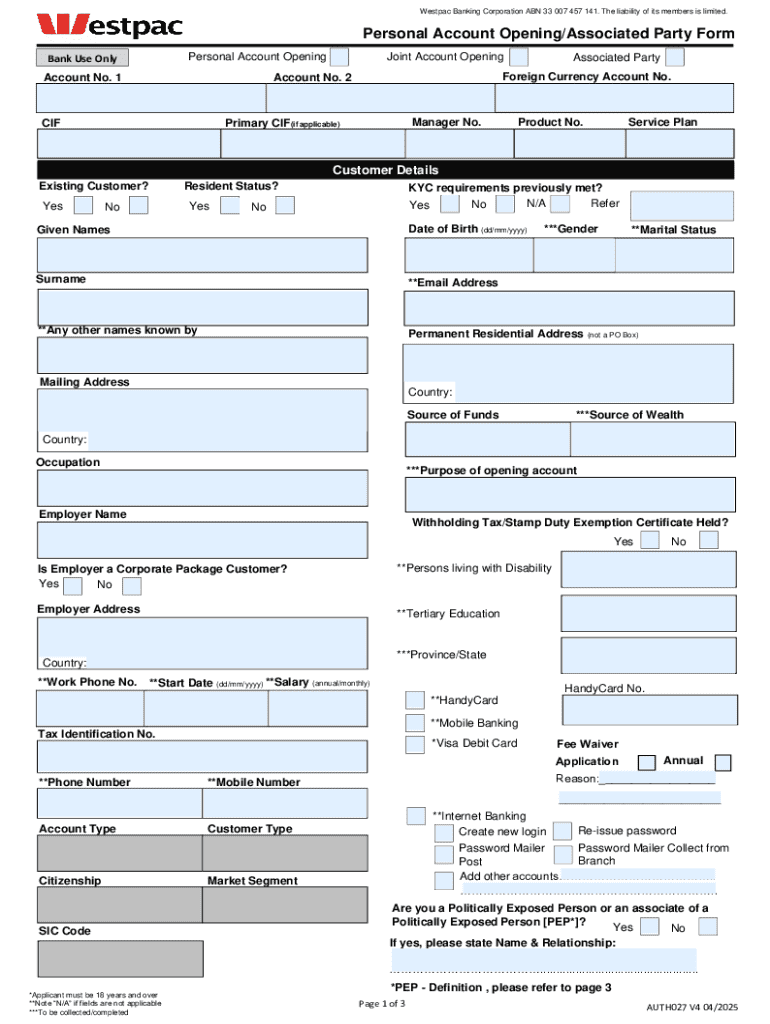

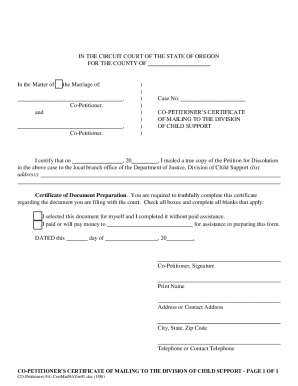

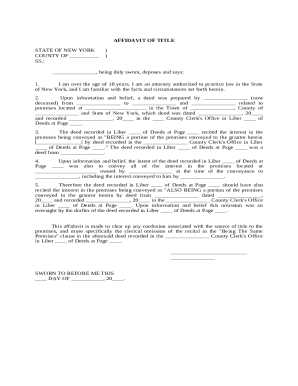

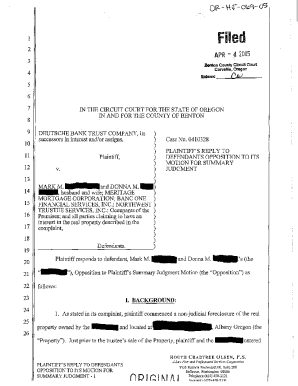

Understanding the personal account opening form

A personal account opening form is a crucial document utilized by financial institutions, banks, and credit unions to gather essential information from individuals who wish to open a new account. This form serves as the foundation for establishing a banking relationship and ensuring compliance with regulatory mandates. Accurate completion of the personal account opening form is vital, as it affects the approval process, the integrity of the account, and future customer interactions.

In the age of technology, variants of the personal account opening form exist—particularly online forms and manual paper formats. While both types collect similar information, online forms tend to be more user-friendly, offering validation checks and instant processing to streamline the account-opening process.

Key components of the personal account opening form

The personal account opening form consists of several key components that ensure all relevant information is captured. The first section typically contains personal information, where applicants are required to fill out essential details such as their full name, current address, and phone number. Optional fields may include vital identifiers like Social Security Numbers and dates of birth, which help banks verify identities.

The financial information section follows, where applicants provide their income, employment status, and any other financial assets or liabilities that the bank may consider for account approval. Providing complete and accurate details in this section reflects an applicant’s financial stability.

Supporting documents play a significant role in verifying the information presented. Commonly required documents include proof of identity (like a government-issued ID), address verification (such as recent utility bills), and employment confirmation. It is crucial to follow guidelines for document submission to ensure that all required materials are presented adequately.

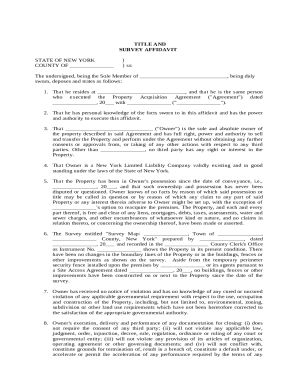

Step-by-step guide to filling out the personal account opening form

Filling out the personal account opening form can be made simpler by following a structured approach. First, gather all necessary information and documents you’ll need, which may include personal IDs, proof of address, employment details, and tax information.

Common mistakes to avoid when filling out the form

While filling out the personal account opening form can seem straightforward, several common mistakes can undermine the process. Firstly, incomplete information can lead to delayed processing or rejection of the application.

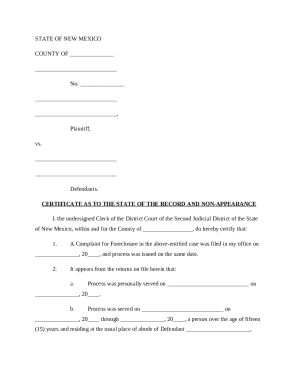

Editing and updating your personal account opening form

Life circumstances frequently change, necessitating updates to the personal account opening form. Major life events such as marriage, relocation, or changes in financial status should prompt individuals to revisit their account details.

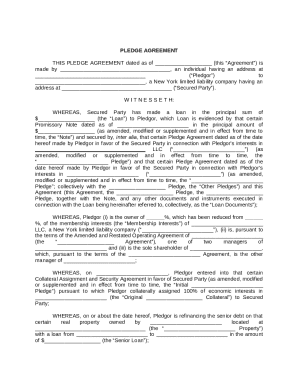

Signing and securing your personal account opening form

Signing the personal account opening form is a formal commitment to the information presented, and eSigning options have gained popularity due to their efficiency. Using platforms like pdfFiller, users can easily sign their forms electronically, expediting the process.

Managing your personal account post-submission

Once you have submitted your personal account opening form, it's essential to stay proactive in managing the application process. Tracking your application status and maintaining open lines of communication with the financial institution can streamline any potential hiccups in processing.

Troubleshooting common issues

It’s not uncommon for applications to face issues such as rejections or delays. In these instances, knowing how to troubleshoot can save time and frustration. If your personal account opening form is rejected, first, seek to understand the reasons behind the decision.

Utilizing interactive tools for form management

In managing your personal account opening form, interactive tools can significantly enhance the experience. Platforms such as pdfFiller offer diverse features that facilitate the editing, saving, and eSigning of forms. By utilizing these dynamic features, applicants can manage forms efficiently and securely.

Best practices for future form management

Maintaining a structured approach to form management can prevent oversight and promote efficiency. Keeping digital copies of your forms ensures you have quick access to necessary information when required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my personal account opening formassociated in Gmail?

Can I create an electronic signature for signing my personal account opening formassociated in Gmail?

Can I edit personal account opening formassociated on an iOS device?

What is personal account opening form associated?

Who is required to file personal account opening form associated?

How to fill out personal account opening form associated?

What is the purpose of personal account opening form associated?

What information must be reported on personal account opening form associated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.