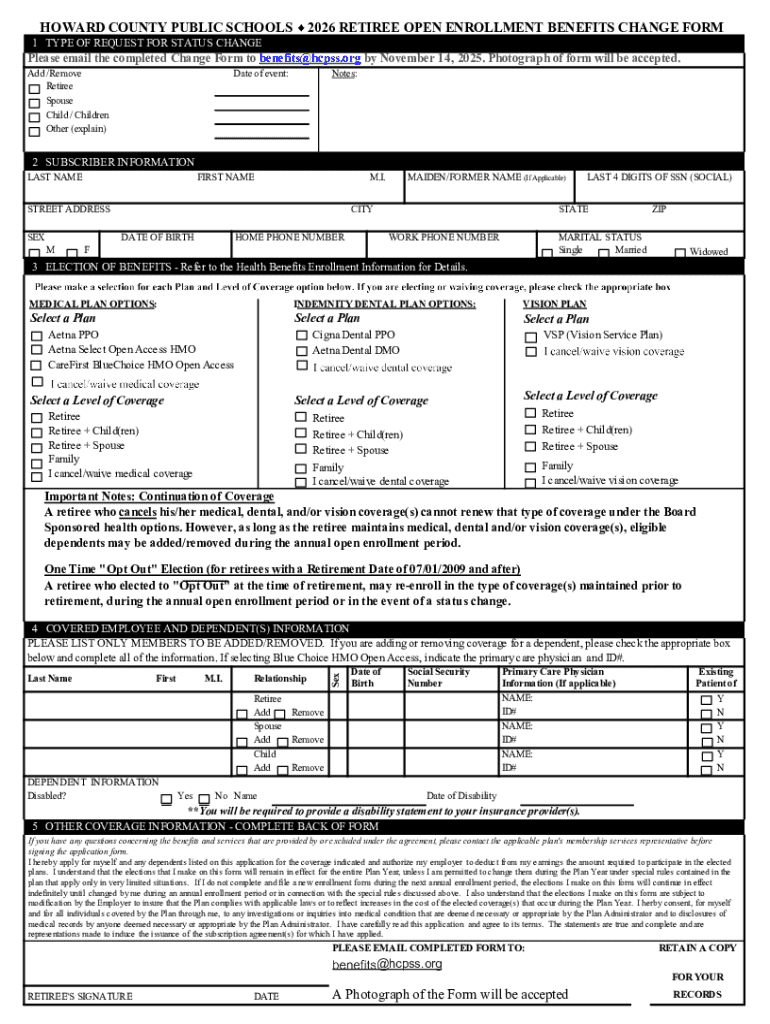

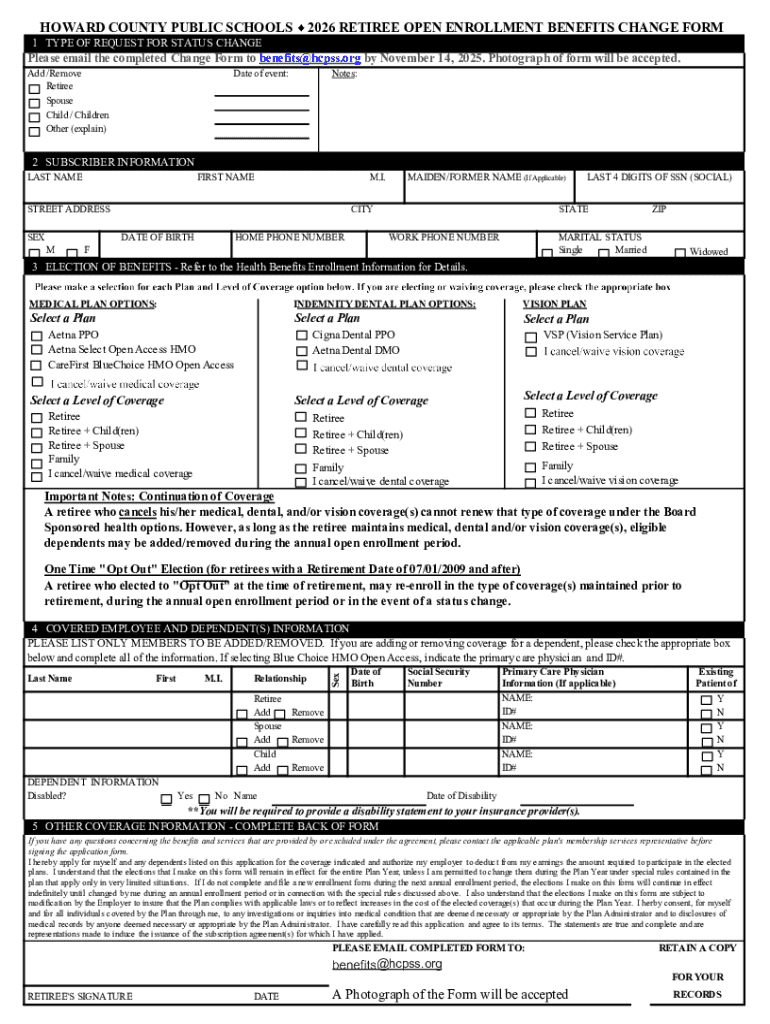

Get the free 2026 Retiree Open Enrollment Benefits Change Form

Get, Create, Make and Sign 2026 retiree open enrollment

Editing 2026 retiree open enrollment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 retiree open enrollment

How to fill out 2026 retiree open enrollment

Who needs 2026 retiree open enrollment?

A Complete Guide to the 2026 Retiree Open Enrollment Form

Understanding the 2026 retiree open enrollment process

The 2026 retiree open enrollment process is a unique opportunity for retirees to evaluate and select health plans that suit their needs. Unlike the open enrollment for active employees, retiree enrollment allows former workers to access specific health plans post-retirement. This period is critical, as it directly impacts healthcare access and costs for seniors who often have more health needs than younger populations.

Why is the 2026 enrollment period particularly notable? Retirees have witnessed various annual health plan changes, and staying informed is vital to making educated decisions regarding coverage. Key dates and deadlines assist members in planning and ensuring they meet submission timelines without any hassle.

Eligibility criteria for retiree open enrollment

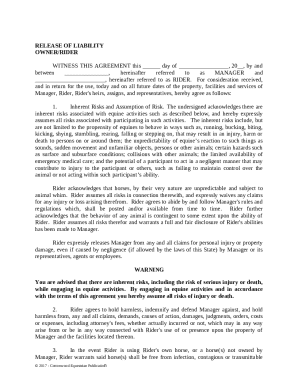

Understanding who can participate in the 2026 retiree open enrollment is essential. Generally, eligibility is extended to individuals who have retired from their positions and were covered under employer-sponsored health plans during their employment. Active members, on the other hand, engage in different enrollment guidelines designed for employees still in the workforce.

It’s also essential to recognize special enrollment opportunities. Under certain conditions, such as loss of other health coverage or significant life events, retirees might qualify for a special enrollment period. Understanding this can provide additional options for those who might have missed the standard enrollment window.

Health plan changes for 2026

The 2026 retiree open enrollment form brings noteworthy changes to available health plans. It is vital for retirees to understand these alterations as they will shape the coverage and costs for the upcoming year. Major changes often include adjustments in premiums, copayments, and included services across various plan options.

When comparing 2026 plans with previous years, retirees should look at factors such as provider accessibility, covered medications, and benefit structures. Toolkits comparing these plans can streamline the decision process, ensuring that individuals choose a health plan that best fits their specific health and financial circumstances.

Important considerations during enrollment

As retirees prepare to fill out their 2026 retiree open enrollment forms, several important reminders must be kept in mind. First and foremost, evaluating current health needs is critical—a thorough understanding of one's health requirements ensures that individuals select plans that will cover necessary services. It's also beneficial to account for any upcoming medical procedures or specific prescriptions that may need coverage.

In addition, preventive services and coverage inclusions should be reviewed. Many plans emphasize preventive care, such as yearly wellness checks or screenings. Being well-informed regarding these offerings can enhance health maintenance and potentially reduce costs associated with untreated health concerns.

Behavioral health & wellness programs

Behavioral health programs are increasingly relevant for retirees seeking comprehensive wellness support. In 2026, many plans include access to mental health services, offering valuable programs aimed at supporting emotional and psychological health. These mental health supports can range from counseling services to telehealth options which have broadened in recent years, allowing for easier access to care.

The benefits of mental health support are vast, particularly for seniors who may face isolation or chronic stress. Navigation through these resources is essential, as many retirees may not be fully aware of the support available to them. Educational resources, including webinars, can connect retirees with options that match their mental health needs.

Dental & vision coverage options

As dental and vision health significantly impact overall well-being, the 2026 retiree open enrollment form also presents specific options in these areas. Various dental plans for retirees are available, covering routine check-ups, major dental work, and orthodontic services, depending on chosen providers.

Vision coverage typically includes eye exams, corrective lenses, and sometimes coverage for contact lenses or surgical procedures like LASIK. By comparing different dental and vision plans, retirees can ensure they choose comprehensive policies that cater specifically to their needs, enhancing their quality of life.

Completing your 2026 retiree open enrollment form

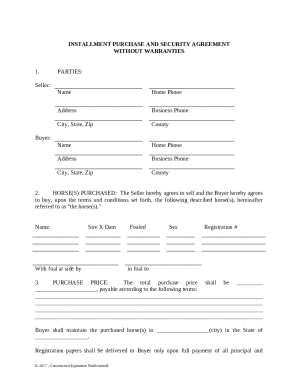

Completing the 2026 retiree open enrollment form requires attention to detail and preparation. A step-by-step approach can simplify the process. Begin by reviewing the available health plans and determining your preferred options before filling out the form. Consider recording any unique health-tracking information that may aid in selecting coverage.

Moreover, gathering necessary documents—such as your retirement ID or previous coverage details—can streamline the process. To avoid common mistakes during submission, double-check your entries, especially in fields that request specific details about your coverage choices or medical needs.

Signature and finalization

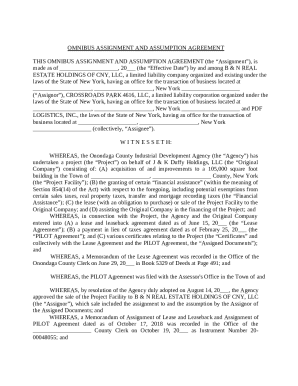

Once the enrollment form is completed, understanding the signing and finalization process is crucial. Many providers now offer electronic signatures (eSigning) for convenience. Utilize this feature to ensure a seamless submission. Ensure you have all required consent forms filled out for electronic submission to avoid delays.

After eSigning, consider submitting your form through multiple methods. Online submissions, mail, or even in-person appointments can enhance the chances of a timely submission. Tracking your enrollment submission through electronic confirmation helps provide peace of mind during this busy period.

Post-enrollment: What to expect

After submitting the 2026 retiree open enrollment form, the next step involves confirming your enrollment process. Participants should receive a confirmation notification that acknowledges enrollment choices made during the selection period. Familiarizing oneself with the new plan options is essential, as it aids in understanding coverage, co-pays, and accessing different services.

Additionally, retirees should be aware of where to find contact information for follow-up questions. Knowing who to reach out to for clarifications or concerns about coverage can alleviate any worries about the newly selected health plans.

Interactive tools and resources

Utilizing online tools and resources during the 2026 retiree open enrollment can enhance the overall experience. pdfFiller offers cloud-based document management solutions, making it easy to access, edit, and manage important forms. Retirees can rely on these tools to maintain control over their health-related documents, ensuring ease of use.

When using pdfFiller, many seniors find it beneficial to take advantage of FAQs and informational webinars, which help clarify aspects of the enrollment process. Familiarization with these elements aids users in navigating the digital landscape more effortlessly.

Additional support and guidance

Knowing where to find assistance during enrollment is essential for retirees aiming to ensure they make informed choices regarding healthcare coverage. Contact information for assistance, as well as community resources and support groups, can provide added security during this potentially overwhelming process.

Additionally, participating in tailored webinars and informational videos can be crucial. These sessions typically provide essential insights into specific features of the plans available, further empowering retirees with the knowledge needed to choose wisely.

Future steps after enrollment

Once enrollment is complete, understanding your rights as a retiree is crucial. This knowledge allows you to advocate for your healthcare needs and ensures you know precisely what services you can access. Annual reviews of your health plan can also be a game-changer, as they give you the opportunity to assess how well your current plan meets your healthcare obligations and needs.

Moreover, maintaining updated personal information is vital for future enrollments. Regularly revisiting your preferences ensures that when the next enrollment period arises, you're prepared and can make changes without feeling rushed or confused.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2026 retiree open enrollment directly from Gmail?

How can I send 2026 retiree open enrollment to be eSigned by others?

How do I execute 2026 retiree open enrollment online?

What is 2026 retiree open enrollment?

Who is required to file 2026 retiree open enrollment?

How to fill out 2026 retiree open enrollment?

What is the purpose of 2026 retiree open enrollment?

What information must be reported on 2026 retiree open enrollment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.