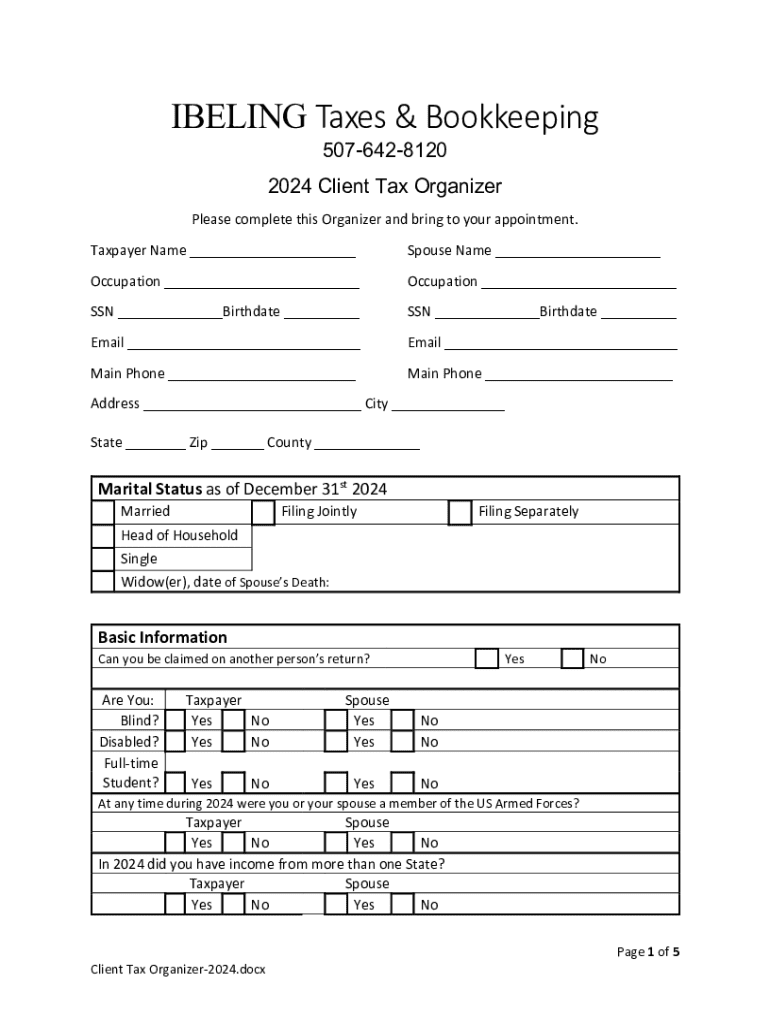

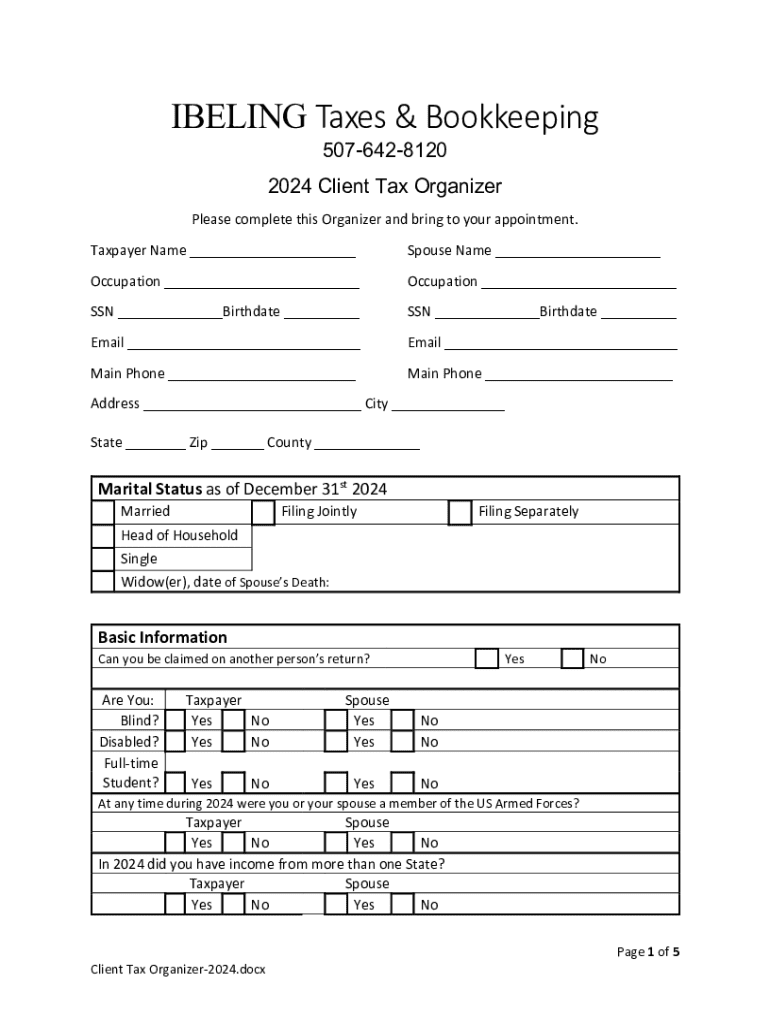

Get the free What To BringIbeling Taxes & Bookkeeping Services

Get, Create, Make and Sign what to bringibeling taxes

How to edit what to bringibeling taxes online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what to bringibeling taxes

How to fill out what to bringibeling taxes

Who needs what to bringibeling taxes?

What to bring when filing taxes

Understanding the importance of organizing your tax documents

Being organized when filing your taxes can significantly ease the process and reduce the stress that often accompanies it. Proper organization helps you ensure that you have all the necessary documents ready, minimizing the chances of missing important deductions or credits. This preparation is paramount because accurate and timely tax filing can prevent potential fines and ensure you maximize your refunds.

Using a centralized document management solution, such as pdfFiller, revolutionizes the organization of tax documents. It allows users to store all relevant files in a single location, ensuring easy access and retrieval. This approach can save both time and effort, transforming the daunting task of tax filing into a much more manageable experience.

Key documents you will need for tax filing

When preparing to file your taxes, knowing what to bring is crucial. Here’s a breakdown of essential documents you should gather to ensure a smooth filing process.

Specific tax situations requiring additional documentation

Depending on your personal circumstances, additional documentation may be necessary to ensure an accurate tax filing. Here are some specific scenarios and the documents needed to address them.

Digital tools for collecting and organizing your documents

Utilizing digital tools can simplify the process of collecting and organizing tax documents. pdfFiller is an excellent solution that allows users to manage their files effortlessly.

With pdfFiller, you can upload and store documents securely, ensuring that you have everything you need at your fingertips. Its document editing features allow for quick customization of your tax forms, while eSigning capabilities ensure that you can get necessary approvals without delay.

Additionally, if you’re working with a team or financial advisor, pdfFiller’s collaborative tools make sharing documents easy. This streamlined sharing means everyone involved can track changes and comments, enhancing communication and efficiency throughout the filing process.

Step-by-step guide to preparing your tax filing

To ensure a comprehensive approach to your tax filing, following a step-by-step guide can be invaluable. Here is how you can effectively prepare your tax documents.

Common mistakes to avoid when filing taxes

As you prepare for tax filing, it’s essential to be aware of common pitfalls that can impact your returns. Awareness of these mistakes can help you navigate the process more effectively.

Frequently asked questions (FAQs)

Many individuals have questions regarding the tax filing process. Here are some of the most frequently asked questions to help clarify common concerns.

Best practices for future tax seasons

To enhance your tax filing experience in future years, consider implementing these best practices that can create a smoother process during the next tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify what to bringibeling taxes without leaving Google Drive?

How do I execute what to bringibeling taxes online?

How do I make edits in what to bringibeling taxes without leaving Chrome?

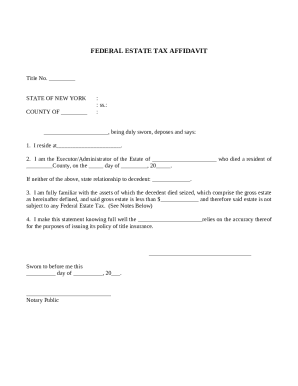

What is what to bringibeling taxes?

Who is required to file what to bringibeling taxes?

How to fill out what to bringibeling taxes?

What is the purpose of what to bringibeling taxes?

What information must be reported on what to bringibeling taxes?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.