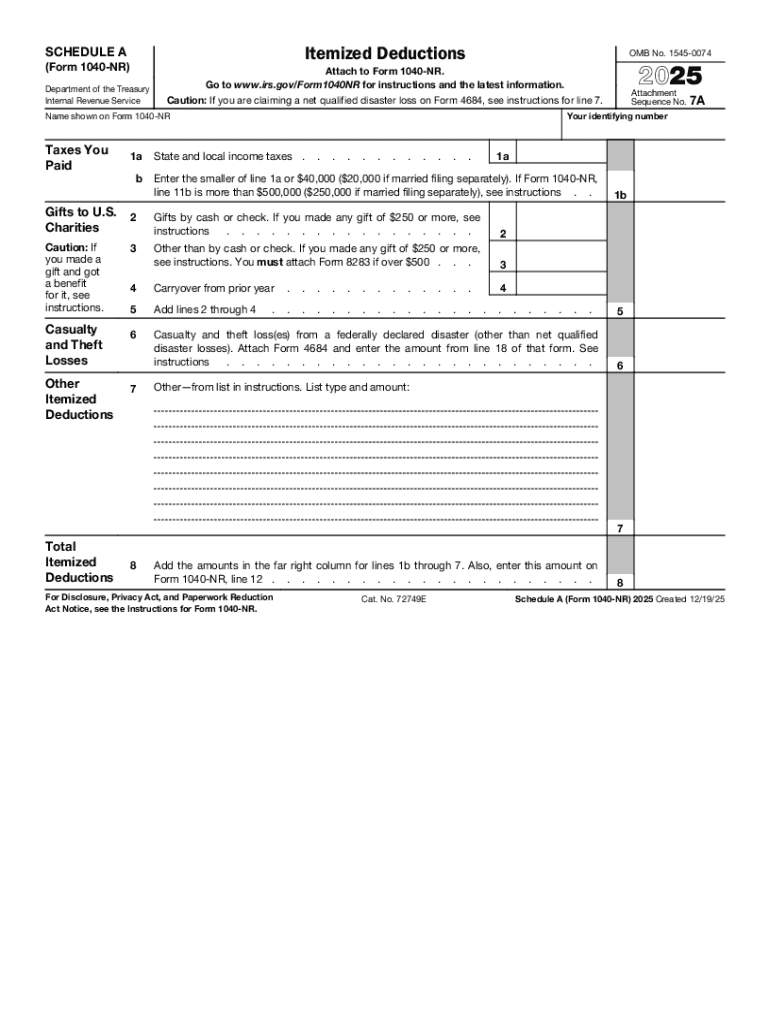

IRS 1040-NR - Schedule A 2025-2026 free printable template

Get, Create, Make and Sign IRS 1040-NR - Schedule A

Editing IRS 1040-NR - Schedule A online

Uncompromising security for your PDF editing and eSignature needs

IRS 1040-NR - Schedule A Form Versions

How to fill out IRS 1040-NR - Schedule A

How to fill out 2025 schedule a form

Who needs 2025 schedule a form?

2025 Schedule A Form: Your Comprehensive How-to Guide

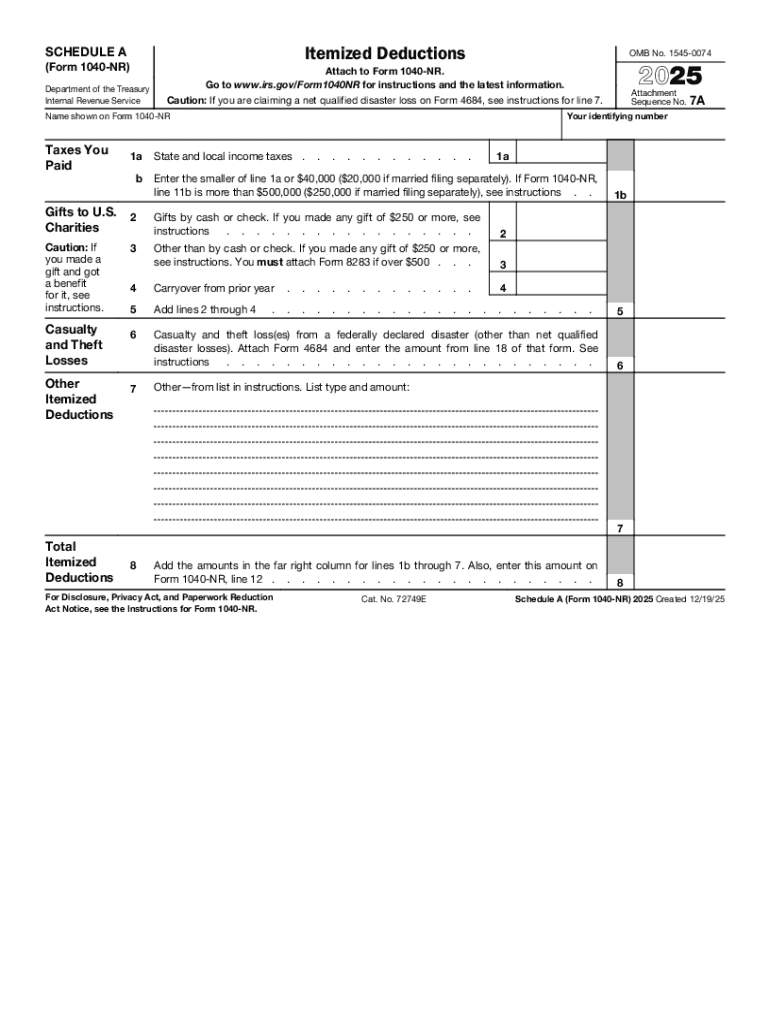

Understanding Schedule A: Your roadmap to itemized deductions

Schedule A is a crucial form used by taxpayers to report itemized deductions, which can significantly reduce taxable income. Instead of taking the standard deduction, taxpayers can choose to outline their deductible expenses in detail using this form. For the 2025 tax year, the significance of Schedule A cannot be overstated, as it provides a pathway for individuals to maximize their tax savings by accurately reflecting their qualified expenses.

Itemized deductions cover a variety of expenditures, from mortgage interest to charitable contributions. Understanding how to leverage these deductions effectively can lead to substantial tax benefits. Deciding whether to itemize or take the standard deduction involves comparing the total amount of your itemized deductions against the standard deduction for your filing status, allowing taxpayers to choose the option that offers them the best financial outcome.

Key changes for the 2025 tax year

The 2025 tax year brings significant updates to the Schedule A form, influenced by recent legislative changes designed to enhance potential deductions for taxpayers. Understanding these updates is essential for effectively navigating your taxes, especially amidst evolving tax codes.

One of the notable changes in 2025 is the introduction of new deductions aimed at specific expenses not previously covered. Additionally, some thresholds and limits have been adjusted, making it pertinent for taxpayers to stay informed on which expenses qualify and how they can impact their itemized deductions compared to previous tax years.

Who should consider filing Schedule A?

Determining whether to file Schedule A involves evaluating your financial situation and the deductions available to you as an individual or household. The eligibility to itemize deductions primarily depends on a few key factors, including total expenses and changes in income, which can vary greatly from one year to the next.

Certain scenarios indicate that itemizing is more advantageous. For example, homeowners with significant mortgage interest or those with substantial medical expenses often find that itemizing deductions provides a larger tax benefit compared to the standard deduction. Additionally, individuals who regularly donate to charity or have incurred high state or local taxes may also benefit from this option.

Step-by-step guide to filling out the 2025 Schedule A form

Filling out the 2025 Schedule A form can seem overwhelming at first, but a systematic approach can simplify the process. Let's break it down into actionable steps to ensure you cover all necessary components.

Step 1: Gather necessary documentation

Before you start filling out the form, collect all relevant documents that support your deductions. This will streamline the process and help ensure accuracy. Here are the crucial documents you will need:

Step 2: Understand the categories of deductible expenses

Deductible expenses on Schedule A are categorized, making it easier to understand where to report each expense. Some of the main categories include:

Step 3: Filling out the form - line by line instructions

Now, with your documentation in hand and an understanding of the categories, it's time to fill out the 2025 Schedule A form. Be meticulous to avoid common mistakes, which can lead to processing delays or audits.

Start from the top, entering your information as indicated, and move through each section systematically. Pay special attention to ensure that the values you report align with your supporting documentation.

Maximizing your deductions: tips and tricks for the 2025 Schedule A

To truly leverage Schedule A, it's essential to maximize your deductions effectively. Various strategies can help you identify expenses that you might have overlooked, which contributes to lowering your taxable income. The following tips can aid effectively in maximizing deductions.

Furthermore, taxpayers often miss common deductions. Familiarizing yourself with these can substantially impact your bottom line. For example, unreimbursed employee expenses—such as those incurred by teachers—may be deductible. Plus, moving expenses for active-duty military members may also qualify, providing additional opportunities for deductions.

The importance of record keeping and organization

Proper record keeping is vital to supporting your deductions. Maintaining organized records not only provides peace of mind during tax season but also ensures you comply with IRS guidelines. Good record-keeping practices are vital for self-filed taxes, as mistakes can lead to paid penalties or deny rightful deductions.

Using physical folders for documents can work but adopting digital solutions elevates efficiency and accessibility. Tools like spreadsheets can aid in tracking overall deductions, while dedicated tax software can collect and organize information automatically.

pdfFiller excels in document management. It allows seamless editing and signing, ensuring that your tax forms, including the 2025 Schedule A, are readily accessible and easy to update. By leveraging the capabilities of pdfFiller, you can keep necessary documents organized and ensure you are prepared for tax season.

The role of pdfFiller in managing your 2025 Schedule A form

pdfFiller stands out as an instrumental tool for taxpayers navigating the 2025 Schedule A form. With its variety of features tailored to enhance productivity, users can effortlessly manage their documents from anywhere. The ease of editing and signing forms online minimizes the hassle associated with traditional paperwork.

Moreover, collaboration tools allow users to share documents with tax professionals seamlessly or with family members, facilitating a hassle-free review process. Cloud storage adds an additional layer of convenience, ensuring quick access to your important financial documents when needed.

User testimonials resonate with the effectiveness of pdfFiller in simplifying tax preparation. Many individuals cite it as a game-changer for reducing anxiety during tax filing, enhancing their overall experience and confidence in managing their Schedule A form.

FAQ: Common questions about Schedule A

Taxpayers often have questions concerning the intricacies of Schedule A. Understanding eligibility requirements, documentation needed, and troubleshooting common issues can significantly ease the process. Here’s a selection of frequently asked questions that may address your concerns.

In addition to these, many taxpayers are unaware of myths surrounding itemization. It's essential to consult reliable sources, such as IRS guidelines or professional advisors, to demystify the sense of confusion that can often accompany tax planning.

Exploring alternatives: when not to use Schedule A

While filing Schedule A can offer numerous benefits, certain situations might warrant electing the standard deduction instead. Understanding when the standard deduction is more beneficial can save you time and stress during tax season.

For taxpayers with minimal deductible expenses—such as renters or individuals with few qualifying expenditures—the standard deduction presents a more straightforward and effective option. Furthermore, life changes like marriage or retirement might also influence the strategy of choosing the standard deduction over itemizing.

Ultimately, taxpayers should assess their circumstances effectively, and if necessary, be flexible in transitioning back to the standard deduction in subsequent years to align with financial changes.

People Also Ask about

How do I generate a 1040NR?

Can you electronically file form 1040NR?

What is schedule a form?

What is US 1040 NR Schedule A?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the IRS 1040-NR - Schedule A in Gmail?

How can I edit IRS 1040-NR - Schedule A on a smartphone?

Can I edit IRS 1040-NR - Schedule A on an iOS device?

What is 2025 schedule a form?

Who is required to file 2025 schedule a form?

How to fill out 2025 schedule a form?

What is the purpose of 2025 schedule a form?

What information must be reported on 2025 schedule a form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.