Get the free Find Tax Forms and Instructions

Get, Create, Make and Sign find tax forms and

How to edit find tax forms and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out find tax forms and

How to fill out find tax forms and

Who needs find tax forms and?

Find tax forms and form: A comprehensive guide

Understanding tax forms and their importance

Tax forms are essential tools for taxpayers, enabling them to report their income, calculate tax obligations, and ensure compliance with local and federal regulations. Without the proper forms, submitting taxes can become a complex and overwhelming task. Each form serves a specific purpose, catering to various tax situations and statuses.

Commonly used tax forms include individual income tax forms, business tax forms, and employment tax forms, each designed to capture different aspects of taxation. Completing these forms accurately is crucial, as errors can lead to audits, penalties, and delayed refunds.

Key tax forms: A focused overview

Among the multitude of tax forms available, some stand out for their frequent use. Form 1040 is the standard individual income tax return form in the United States, utilized primarily by individuals to report their earnings and calculate taxes owed. Completing this form correctly is vital for accurate tax filing.

Form W-2, also known as the Wage and Tax Statement, is crucial for employees, as it summarizes their earnings, tax withholdings, and other vital information related to employment. Similarly, Form 1099 is issued for miscellaneous income, such as freelance work or interest income, and plays a significant role in ensuring that all income is reported.

Navigating tax form access

Finding the right tax forms is easier than ever, thanks to digital resources. The IRS official website remains the go-to source for downloading federal tax forms, as it offers the most up-to-date versions. Local tax offices often provide a selection of forms, especially during tax season, and community centers may also have physical copies available for residents.

Another effective resource for accessing tax forms is pdfFiller, which provides a user-friendly platform where you can search and find various tax documents in a matter of minutes. Utilizing their search functionality, users can easily locate specific forms or navigate through categories and filters to streamline the process.

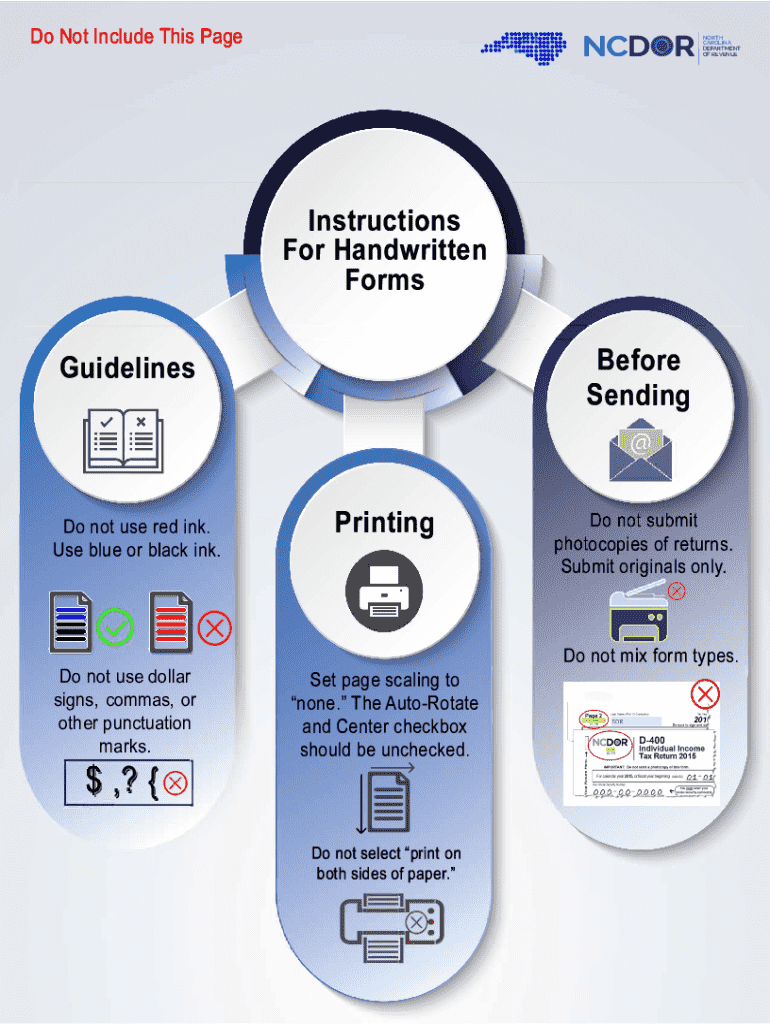

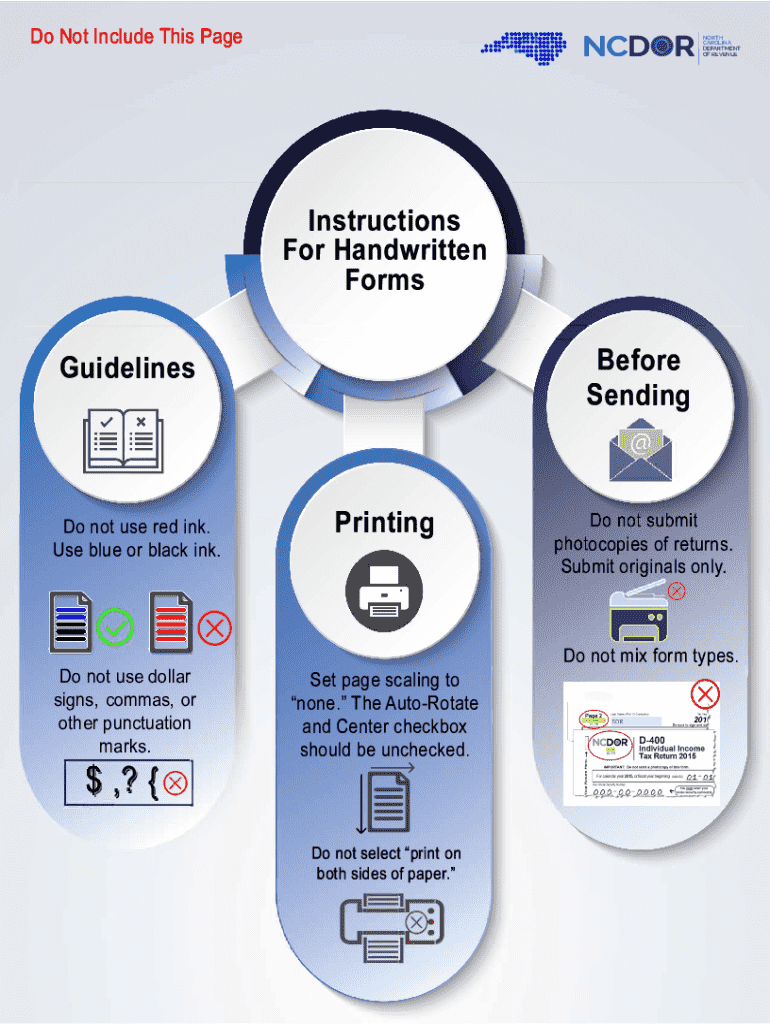

Essential instructions for filling out tax forms

Filling out tax forms can be daunting. A step-by-step approach can help ease this process, particularly for Form 1040. Start by gathering your financial documents, including W-2s, 1099s, and any 1098 forms that report interest payments. Next, follow the form's instructions carefully, ensuring you fill in your information accurately across all sections.

Key sections of Form 1040 include personal information, income detailing, and deductions. Common mistakes to watch out for include misreporting income amounts, neglecting to sign the form, or forgetting to double-check Social Security numbers.

Utilizing pdfFiller enhances this experience, as it allows users to edit fillable fields directly and provides a user-friendly interface to simplify the tax form completion process.

Tips for editing and managing PDF tax forms

Editing completed tax forms can be necessary for making corrections or adjustments. With pdfFiller, users can easily add signatures to their forms with just a few clicks. Making corrections to any completed information is straightforward through the platform's intuitive editing tools.

Storing your tax forms securely is just as important as filling them out. Take advantage of cloud storage capabilities to keep copies of your documents safe yet accessible. This allows you to retrieve your forms from anywhere, ensuring you always have the necessary paperwork at your fingertips.

eSigning tax forms: A modern approach

eSignatures are revolutionizing how we handle tax forms, providing a legally valid option for signing without physical paperwork. This process enhances efficiency and keeps your workflow smooth, especially when collaborating with others in teams. Using pdfFiller, eSigning tax forms is a simple step-by-step process—just ensure that you understand the legal implications and requirements associated with eSignatures.

During the eSigning process, it's important to ensure that the data entered remains secure and compliant. pdfFiller employs robust encryption methods, providing peace of mind that your sensitive information is well-protected.

Collaborating with teams on tax form preparation

When working with a team to prepare tax forms, clear communication and streamlined collaboration are essential. pdfFiller offers several features that facilitate effective document management, including real-time editing and the ability to leave comments and feedback. This collaborative approach can help eliminate confusion and ensure that all team members are on the same page.

For best practices in team collaboration, establish clear roles for each member regarding which forms they will handle and set deadlines to minimize last-minute rushes. Leveraging the commenting features within pdfFiller can also enhance discussions around specific entries or sections, leading to better outcomes in form completion.

Getting help with tax forms

Navigating tax forms can be challenging, and questions or issues often arise. Most likely, pdfFiller users will have access to live chat options for quick support, alongside comprehensive email support for more detailed inquiries. Additionally, community forums and frequently asked questions can provide valuable insights and assistance from fellow users who may have faced similar challenges.

When seeking help, it is vital to articulate the problem clearly, providing all necessary details related to your issue. Whether you are experiencing technical difficulties with the pdfFiller interface or need guidance on filling a specific form correctly, don’t hesitate to reach out to their support team.

Legal considerations when handling tax forms

Handling tax forms comes with several legal considerations, particularly regarding confidentiality and data protection. It is important for taxpayers to understand the implications of sharing sensitive information, especially when working in collaborative environments or utilizing cloud-based solutions like pdfFiller.

Furthermore, staying up to date with changes in tax form regulations is crucial for compliance. Regularly reviewing guidelines and maintaining accurate record-keeping practices can help prevent legal complications come tax season.

Exploring additional tax topics

As you delve into tax forms, it is also essential to understand related topics, such as tax deductions and upcoming deadlines. Tax deductions can significantly reduce your taxable income, so being well-informed about eligible deductions is vital for maximizing your potential refund. Moreover, planning ahead for key tax deadlines can save you from last-minute scrambles.

Seasonal tips for filing taxes efficiently include organizing financial records throughout the year, ensuring clarity on your filing method, whether electronic or paper-based, and seeking professional advice when facing complex scenarios.

Connecting with tax professionals

Certain tax situations warrant the expertise of a professional. Not everyone is equipped to handle complex tax limitations or deductions, which is where a tax professional comes into play. Identifying when to seek outside help and how to find a qualified expert can ease the burden during tax season.

To locate a qualified tax professional, consider using professional associations or online directories that offer reviews and ratings. Online consultations present a convenient option for obtaining assistance without needing to visit offices physically, saving you time and hassle.

Conclusion on efficient tax form management

Managing tax forms efficiently requires understanding their purpose, how to access them, and the best practices for completion and storage. With resources like pdfFiller, you can streamline the entire process, from filling out to eSigning and collaborating with teams. Regularly review the information provided in this guide to stay informed and prepared for your tax obligations.

Whether you are an individual filing your taxes for the first time or a professional overseeing a team of taxpayers, effective tax form management can alleviate stress and promote accuracy. Leveraging technology not only simplifies these tasks but also enhances collaboration and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the find tax forms and electronically in Chrome?

How do I fill out the find tax forms and form on my smartphone?

How can I fill out find tax forms and on an iOS device?

What is find tax forms and?

Who is required to file find tax forms and?

How to fill out find tax forms and?

What is the purpose of find tax forms and?

What information must be reported on find tax forms and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.