Get the free Form MO-NRI - Missouri Department of Revenue - dor mo

Get, Create, Make and Sign form mo-nri - missouri

Editing form mo-nri - missouri online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form mo-nri - missouri

How to fill out form mo-nri - missouri

Who needs form mo-nri - missouri?

Everything You Need to Know About Form Mo-NRI - Missouri Form

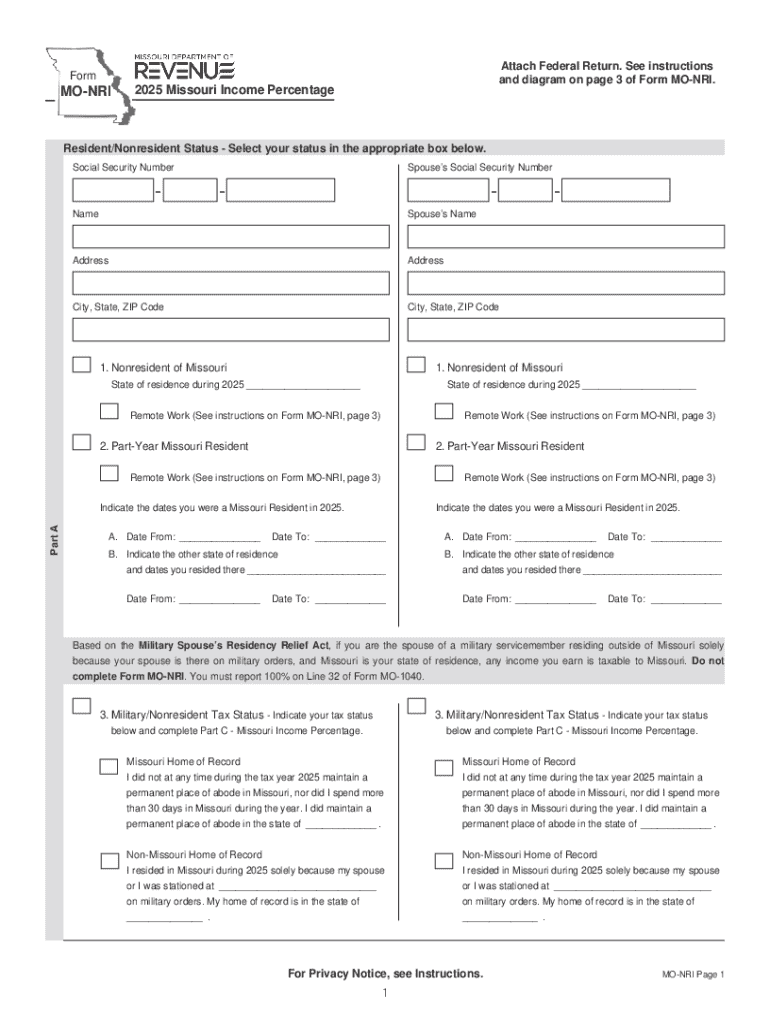

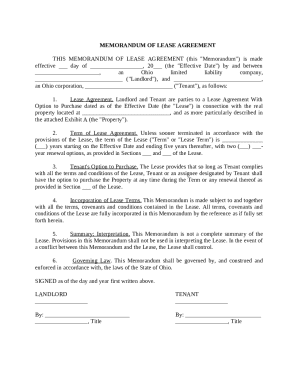

Overview of Form Mo-NRI

Form Mo-NRI is a state tax form used by non-residents of Missouri to report Missouri-source income. Designed specifically for those who earn income within the state but reside elsewhere, it facilitates proper tax reporting and compliance with Missouri tax laws. The primary users of Form Mo-NRI include individuals with jobs in Missouri, those who own property in the state, or anyone receiving income derived from Missouri sources while maintaining residency in another state.

Accurate completion of Form Mo-NRI is crucial. Errors can lead to delayed processing times, audits, or even penalties imposed by the Missouri Department of Revenue. Failure to correctly report taxable income could result in owing additional taxes, interest, or fines. Keeping meticulous records and ensuring precision while filling out this form can save you significant hassle in the future.

Understanding the structure of Form Mo-NRI

Form Mo-NRI comprises several key sections, each designed to gather specific information necessary for filing taxes accurately. Understanding these sections is paramount to completing the form correctly.

Familiarity with the common terms used within the form will also aid in comprehensive understanding. Terms like 'adjusted gross income', 'non-resident', and 'taxable income' are crucial for accurate reporting and fulfilling obligations.

Step-by-step instructions for completing Form Mo-NRI

To ensure a successful filing, it's essential to follow a systematic approach to completing Form Mo-NRI. Start by gathering all required information. This may include previous year’s tax returns, W-2 forms, 1099 forms, records of any deductions, and your SSN or ITIN.

By methodically following these steps, you can eliminate common mistakes that might complicate tax filing.

Interactive tools to aid in form completion

Utilizing modern technology can significantly streamline the form-filling process. pdfFiller provides various interactive tools designed to aid users in completing Form Mo-NRI.

Leveraging these tools not only enhances accuracy but also makes the administrative burden much lighter.

Common issues and troubleshooting tips

Even the most diligent filers can encounter issues when completing Form Mo-NRI. Knowing common pitfalls can save time and prevent errors.

If issues arise after submission, contact the Missouri Department of Revenue directly for guidance on how to rectify concerns regarding your filing.

Resources for further assistance

If you require additional assistance with Form Mo-NRI, it’s crucial to know where to seek help. The Missouri Department of Revenue offers resources and contact information for filers.

Utilizing these resources can greatly facilitate the process of filing Form Mo-NRI and resolving any inquiries.

Benefits of using pdfFiller for Form Mo-NRI

pdfFiller has become a go-to solution for individuals and teams handling various forms, including Form Mo-NRI, due to its numerous advantages.

These features not only save time but also promote efficiency and reduce the likelihood of errors, enabling a smoother filing process.

Real user experiences

Testimonials from users reveal the effectiveness of pdfFiller when it comes to completing Form Mo-NRI. Countless individuals appreciate the intuitive interface and the time saved in the form-filling process.

These experiences underline the emphasis on ease and efficiency, providing a solid reason to utilize pdfFiller for tax forms.

Additional features of pdfFiller relevant to Form Mo-NRI

Besides supporting Form Mo-NRI, pdfFiller offers several unique features that set it apart from other document management solutions.

These capabilities ensure that when it comes to forms like Mo-NRI, users are well-equipped for a seamless experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form mo-nri - missouri in Chrome?

Can I create an eSignature for the form mo-nri - missouri in Gmail?

How can I edit form mo-nri - missouri on a smartphone?

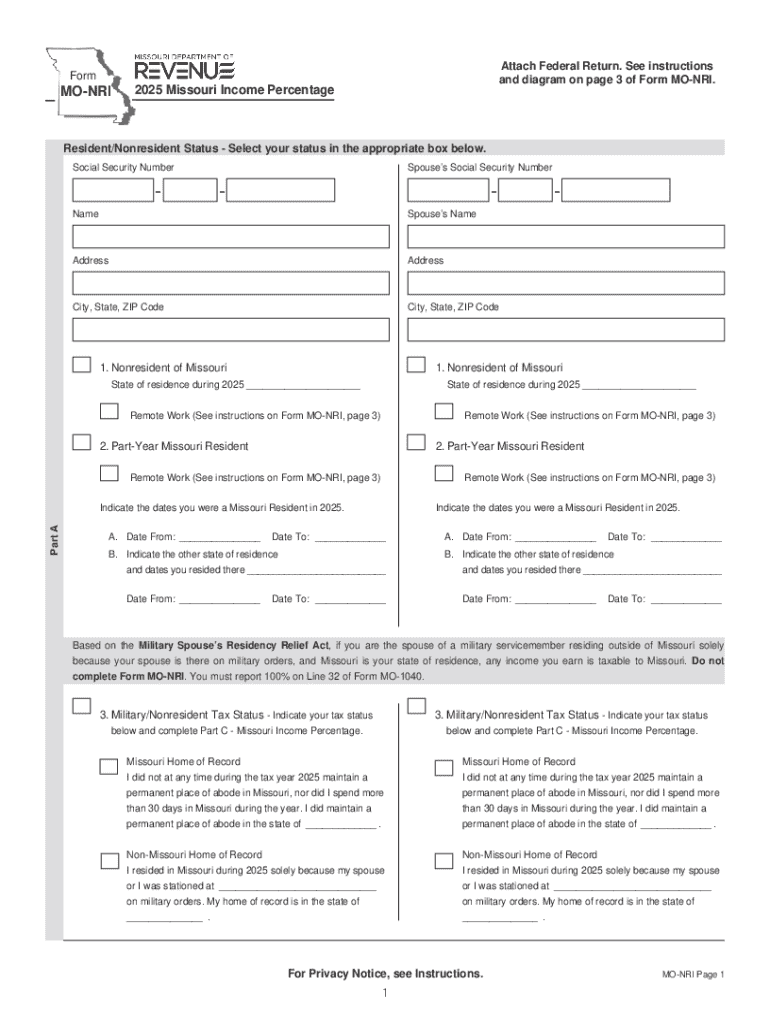

What is form mo-nri - missouri?

Who is required to file form mo-nri - missouri?

How to fill out form mo-nri - missouri?

What is the purpose of form mo-nri - missouri?

What information must be reported on form mo-nri - missouri?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.