Get the free Online Form 5500: Annual Return/Report of Employee ...

Get, Create, Make and Sign online form 5500 annual

How to edit online form 5500 annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online form 5500 annual

How to fill out online form 5500 annual

Who needs online form 5500 annual?

How to Complete the Online Form 5500 Annual Form

Understanding the Form 5500: A comprehensive overview

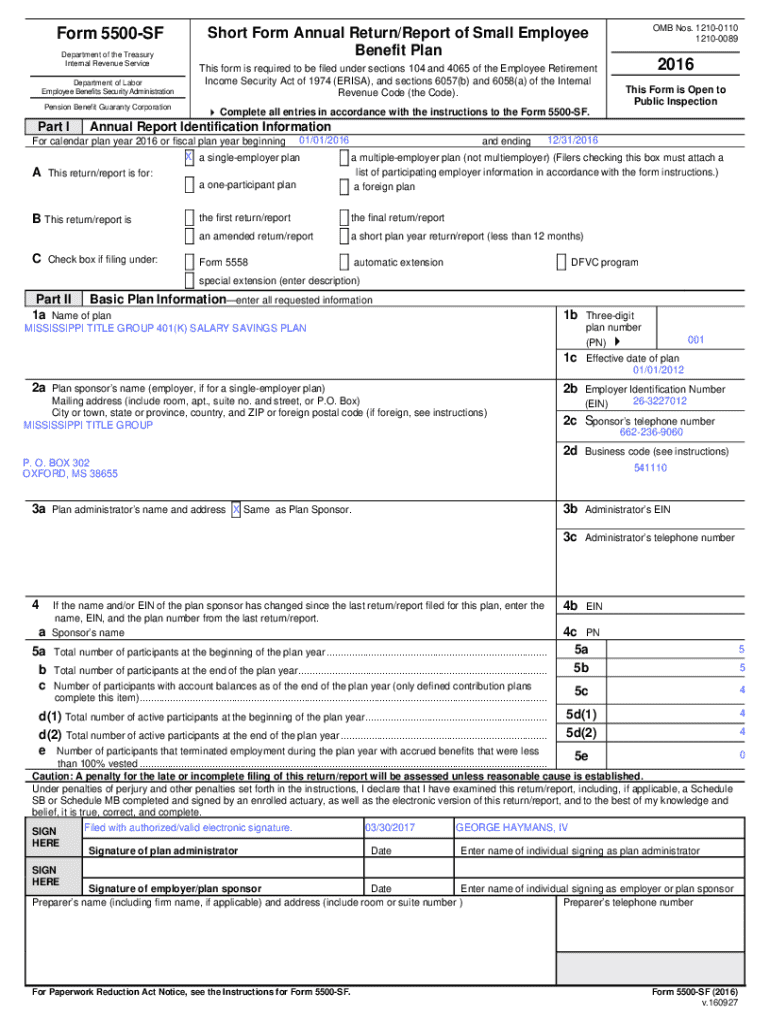

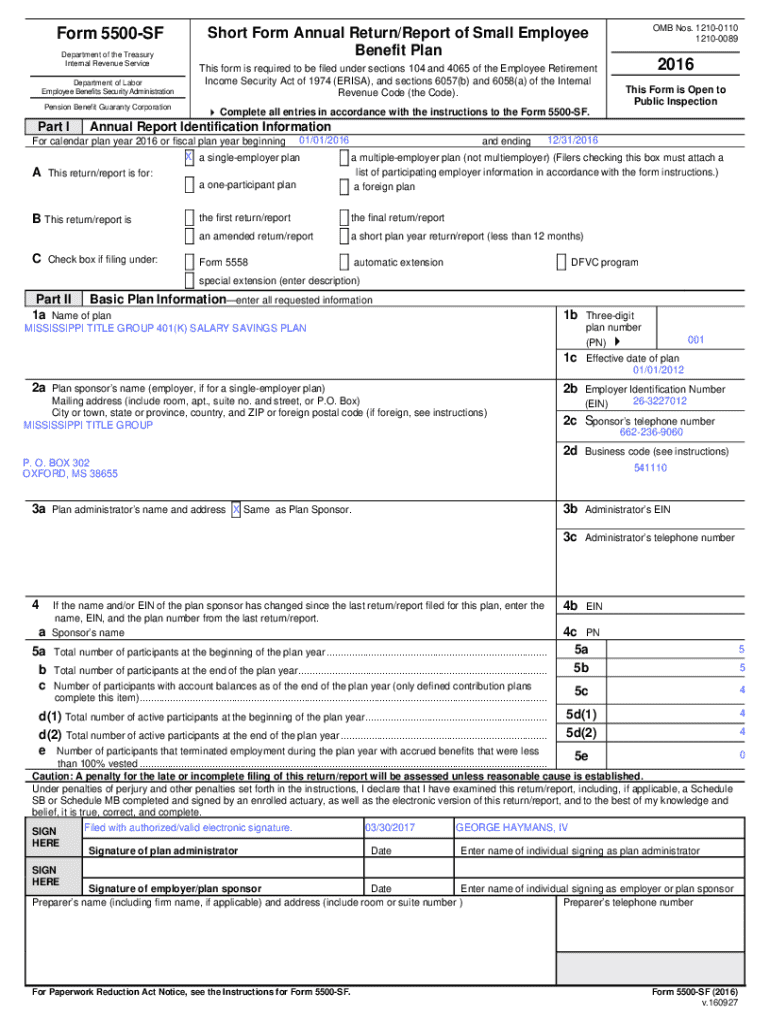

Form 5500 is a critical document used in the United States, primarily for reporting annual information on employee benefit plans. This form serves various purposes, including compliance with the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code (IRC). It ensures transparency in how employee benefits are managed and provides essential information to the Department of Labor (DOL), the Internal Revenue Service (IRS), and plan participants.

Compliance with Form 5500 is vital for businesses offering employee benefit plans. Failure to file the form correctly can lead to significant penalties and fines. Key participants required to file Form 5500 include affiliate employers, plan sponsors, and administrators of employee benefit plans, ensuring they adhere to all necessary regulations.

Types of Form 5500: options available

There are different versions of Form 5500 tailored to meet the needs of various employee benefit plans. The standard Form 5500 is for large plans, the Form 5500-SF (Short Form) is designed for smaller plans with fewer than 100 participants, and the Form 5500-EZ is catering to one-participant plans. Understanding which form to use is crucial for compliance.

When deciding which form to utilize, consider the number of participants, financial aspects, and whether the plan is a single participant or larger. Supplemental schedules and attachments may also be required based on the type of plan. These documents provide additional details regarding plan operations and finances.

Electronic filing requirement: navigating the regulations

Both the IRS and DOL mandate electronic filing for Form 5500. This requirement aims to streamline the filing process and reduce errors. It’s important for users to familiarize themselves with the online platforms where the form is hosted. Best practices include keeping updated software, ensuring a stable internet connection, and reviewing the instructions carefully before starting the filing process.

Understanding your computer requirements is essential. You'll need a modern browser and access to reliable digital tools that aid in form completion, like pdfFiller, which simplifies document editing and submission. Familiarize yourself with these regulations to avoid complications while filing.

Preparing your information: essential data collection

Prior to filing Form 5500, gather the necessary information to ensure a smooth process. Key data includes plan identification information, financial statements reflecting the plan's condition, and participant data detailing the number of individuals involved with the plan. Having all relevant information ready ensures that you won’t encounter delays or errors during the completion of the form.

In an increasingly digitized environment, organizing your documents is crucial. Use tools like pdfFiller’s Document Management tools to categorize and access documents easily. This not only saves time but also reduces the chances of misplacing important information.

Step-by-step guide to filling out the online form 5500

Accessing the online form via pdfFiller is user-friendly, allowing for clear navigation throughout the process. Upon entering the site, users will find an interactive interface that guides them step-by-step through the filling process. It’s beneficial to familiarize yourself with each section.

The form includes critical sections: General Information, Financial Information, and Compliance Questions. It’s vital to provide accurate information in these areas. Common pitfalls include omitting details, miscalculating figures in the financial section, or misunderstanding compliance questions. Careful attention to detail minimizes errors and enhances the quality of the submission.

Editing and customizing your form

Once the preliminary form is filled, you can utilize pdfFiller’s editing tools to refine your submission. Ensuring clarity and conciseness in all entries improves the effectiveness of your document. Moreover, e-signature integration allows users to add signatures securely, making the form legally binding and compliant.

Leveraging collaborative options is essential, especially for teams working on the same project. With pdfFiller, different team members can contribute effectively, providing real-time feedback and editing options that streamline the process.

Reviewing your form: quality checks before submission

Before submitting Form 5500, conduct a thorough review using a detailed checklist. Ensure accuracy by verifying all provided financial data aligns with underlying statements. Additionally, double-check compliance questions to guarantee that all necessary requirements have been duly answered.

This process of double-checking is essential as filing inaccuracies can lead to significant penalties or delays in processing. A meticulous approach here will not only enhance the quality of your submission but also increase your compliance with regulatory standards.

Submission process: final steps to filing

The submission process involves a few final steps after reviewing your Form 5500. Once you've confirmed that all information is accurately entered, you can proceed to file the form electronically. It’s crucial to understand the submission process structure to avoid last-minute complications.

After submitting, tracking your submission through pdfFiller is essential to confirm that it has been received appropriately. Expect a confirmation of filing from the relevant authority, which you should retain for your records. This confirmation serves as proof of compliance with filing requirements.

Key dates and deadlines: staying compliant

Annual filing recommendations dictate specific due dates for Form 5500, which can vary based on the plan year. Understanding these timelines is critical to maintaining compliance and avoiding penalties. For example, forms are typically due on the last day of the seventh month following the plan year end. If the plan runs on a calendar year, the due date would be July 31.

In the event of a filing delay, significant consequences could arise. Understanding the penalties attached to late filing can motivate timely submissions. However, if an extension is necessary, knowing how to file for an extension is equally critical. Extensions provide additional time but come with their own requirements.

Responding to common issues and audits

Should you find yourself facing an audit, being prepared is essential. Audits can arise from various actions taken on the filed Form 5500, and knowing what to expect can facilitate a smoother experience. If audited by the IRS, having organized documentation makes responding to inquiries more manageable.

Developing a comprehensive set of records and engaging with resources such as pdfFiller's Help Center can provide valuable support during this process. Ensuring that your information is readily available and presented comprehensively can mitigate any issues arising from audits.

Essential updates: navigating changes in regulations

Regulatory changes frequently occur, and it’s crucial to stay informed about modifications to Form 5500 reporting requirements. Being aware of these changes ensures that your filings remain compliant with the latest standards, avoiding potential pitfalls associated with outdated information.

Future trends in employee benefit plan reporting may shift based on evolving regulations and government guidelines. Staying informed through your network, as well as using resources like pdfFiller, can provide insights into these shifts, enabling proactive compliance strategies.

Enhancing your filing experience with pdfFiller

Utilizing pdfFiller offers numerous benefits for completing your online Form 5500. The comprehensive suite of interactive tools allows for an efficient filing experience, enabling seamless document management, editing, and collaboration. Users can easily navigate complex forms while ensuring compliance with government requirements.

Real-life case studies show how organizations have benefited from pdfFiller. Users have reported increased filing accuracy, quicker processing times, and reduced stress during filing periods. These insights into the power of pdfFiller highlight its effectiveness in simplifying the filing process, making it an invaluable tool for anyone dealing with Form 5500.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute online form 5500 annual online?

Can I sign the online form 5500 annual electronically in Chrome?

How can I edit online form 5500 annual on a smartphone?

What is online form 5500 annual?

Who is required to file online form 5500 annual?

How to fill out online form 5500 annual?

What is the purpose of online form 5500 annual?

What information must be reported on online form 5500 annual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.