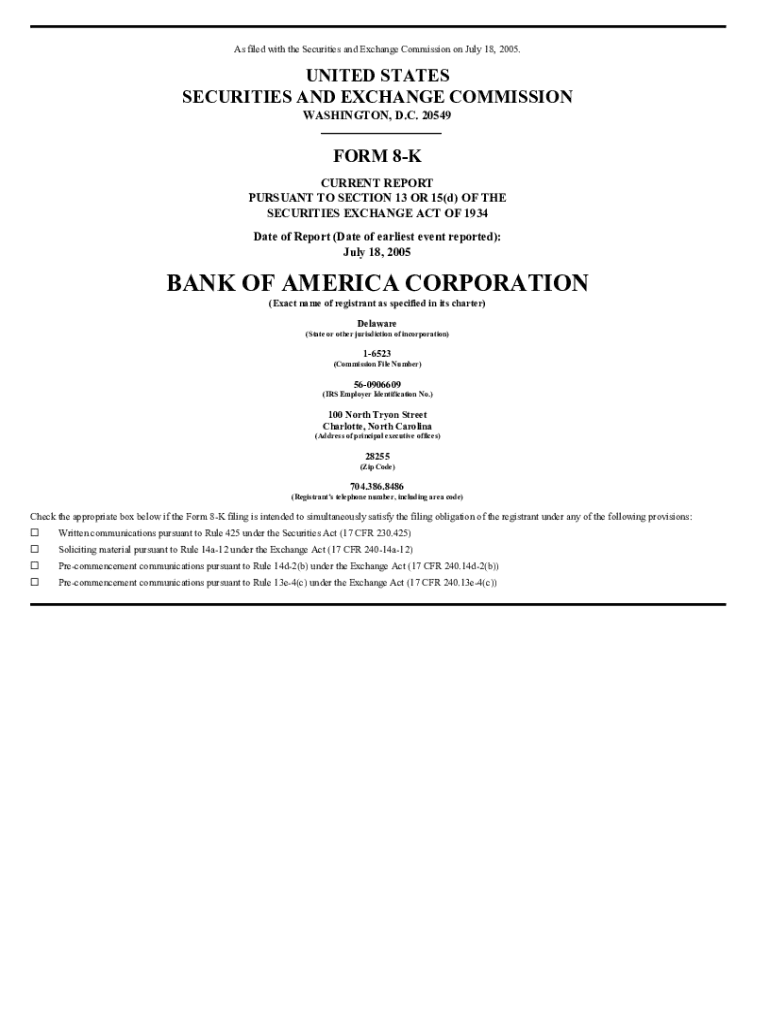

Get the free Form 8-K Current Report - Investor Relations - Analog Devices

Get, Create, Make and Sign form 8-k current report

How to edit form 8-k current report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k current report

How to fill out form 8-k current report

Who needs form 8-k current report?

A comprehensive guide to Form 8-K Current Report Form

Understanding Form 8-K

Form 8-K serves as a critical reporting tool for publicly traded companies, enabling them to disclose significant events on a timely basis. Each 8-K filing provides a clear glimpse into key business developments, facilitating transparency and accountability in corporate governance. This form holds particular significance for investors and stakeholders as it allows for informed decision-making based on the latest company activities.

The legal framework governing Form 8-K is outlined by the U.S. Securities and Exchange Commission (SEC). Non-compliance with these regulations can lead to severe penalties, including fines and increased scrutiny from regulatory bodies. Therefore, companies must adhere strictly to the deadlines and contents mandated by the SEC.

What is Form 8-K?

Form 8-K is specifically designed for the disclosure of certain significant events that could impact an investor's decision-making process. This form must be filed as soon as possible following a triggering event, usually within four business days. Companies are obligated to disclose a variety of events, including but not limited to:

The structure of the Form 8-K includes several essential components such as a cover page, specific items requiring disclosure, and a signature block. Attachments, exhibits, and other supporting documents can also be included to provide further context.

Key aspects for corporate legal teams

Corporate legal teams have specific responsibilities regarding Form 8-K filings. The primary obligation is to ensure that the form is submitted within the prescribed timeframe following the occurrence of a reportable event. Failure to submit on time can trigger penalties and undermine investor confidence.

Developing a thorough internal checklist is vital for efficient file preparation and submission. Assigning distinct roles and responsibilities to team members enhances the filing process's efficiency. Collaboration across various departments—including accounting, compliance, and legal—is essential to gather and verify information.

Utilizing cloud-based platforms like pdfFiller can further streamline these processes, allowing teams to edit, sign, and share documents effortlessly. This collaborative approach ensures that all parties have real-time access to critical information leading to accurate and timely filings.

Best practices for Form 8-K compliance

To optimize Form 8-K compliance, leveraging technology is essential. Platforms like pdfFiller offer comprehensive editing features and e-signature integration, which make the filing process significantly more efficient. Real-time collaboration tools also enable teams to work synchronously on completing disclosures.

Accuracy is paramount when completing Form 8-K. Establishing methods to verify information before submission—such as cross-referencing figures and consulting with relevant departments—minimizes the risks associated with inaccuracies. Maintaining a record of past filings can also aid in establishing consistency and building a knowledge base within the company.

Continuous education and training for legal teams are crucial components for staying informed of regulatory changes. Regularly attending workshops and utilizing online resources can ensure that your team remains updated on the latest compliance requirements.

Filling out Form 8-K: Step-by-step guide

Filling out Form 8-K requires a systematic approach that begins by gathering essential information and documentation. Collect data about the triggering event and any relevant agreements, and ensure you have a clear understanding of the implications. Pinpointing the exact nature of the reportable event simplifies the subsequent steps.

When completing the form, follow the SEC's instructions closely using each section of the 8-K. Focus on providing concise, clear information while adhering to legal specifications. Using e-signature solutions can enhance the submission process, as electronic signatures are legally valid and expedite official filings.

Finally, ensure that the completed Form is submitted through the SEC’s EDGAR system. Familiarize yourself with the submission interface to avoid any last-minute complications.

Common challenges when filing Form 8-K

One of the primary challenges faced when filing Form 8-K is identifying which events require disclosure. Distinguishing significant events from those that are less impactful can sometimes be subjective. Companies must implement clear criteria to guide their judgement during this process.

Timeliness is another hurdle; ensuring that disclosures are made within the required timeframe often tests corporate response capabilities. To navigate this successfully, it can be helpful to establish standard operating procedures that promote efficient communication and decision-making.

Additionally, dealing with SEC inquiries can be daunting. In the event of a request for further clarification, companies should prepare to provide detailed responses and supporting documentation quickly. Understanding your obligations and anticipating potential SEC follow-up can mitigate the stress associated with these inquiries.

Case studies: Real-world applications of Form 8-K

Analyzing notable 8-K filings from various companies allows stakeholders to glean insights into best practices and pitfalls. For instance, a case study involving a high-profile merger can illustrate both the positive impacts of transparency and the negative ramifications of delayed or insufficient disclosure.

Companies that manage Form 8-K filings effectively often share commonalities, such as a champions' network that advocates for timely disclosures and robust internal policies outlining necessary actions during significant corporate events. Learning from these exemplary firms can foster a culture of compliance within your organization.

Tools and resources for improved Form 8-K management

Tools such as pdfFiller are invaluable in assisting users to prepare and manage Form 8-K filings. Features such as document editing and eSignature integration improve efficiency and accuracy throughout the process, making compliance easier to attain.

Beyond technological solutions, leveraging additional resources can enhance understanding and insight into the regulatory landscape. Engaging with attorney editors and participating in relevant community forums can offer important perspectives and strategies.

Future trends regarding Form 8-K filings

The regulatory environment surrounding Form 8-K is continuously evolving. Anticipating potential revisions to SEC requirements is essential for companies aiming to maintain compliance. Discussions around increasing the transparency of non-GAAP financial measures and broadening the scope of reportable events are likely to shape future compliance strategies.

The role of technology in corporate compliance is anticipated to expand further. Innovations in document management solutions, such as advanced data analysis and enhanced reporting capabilities, promise to simplify the preparation and submission of Form 8-K filings, enabling companies to adapt swiftly to changing regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 8-k current report straight from my smartphone?

How do I fill out the form 8-k current report form on my smartphone?

How do I complete form 8-k current report on an iOS device?

What is form 8-k current report?

Who is required to file form 8-k current report?

How to fill out form 8-k current report?

What is the purpose of form 8-k current report?

What information must be reported on form 8-k current report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.