Get the free Online state hi Schedule D Form N-40 Rev 2010 ...

Get, Create, Make and Sign online state hi schedule

Editing online state hi schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online state hi schedule

How to fill out online state hi schedule

Who needs online state hi schedule?

How to Complete Your Online State HI Schedule Form: A Comprehensive Guide

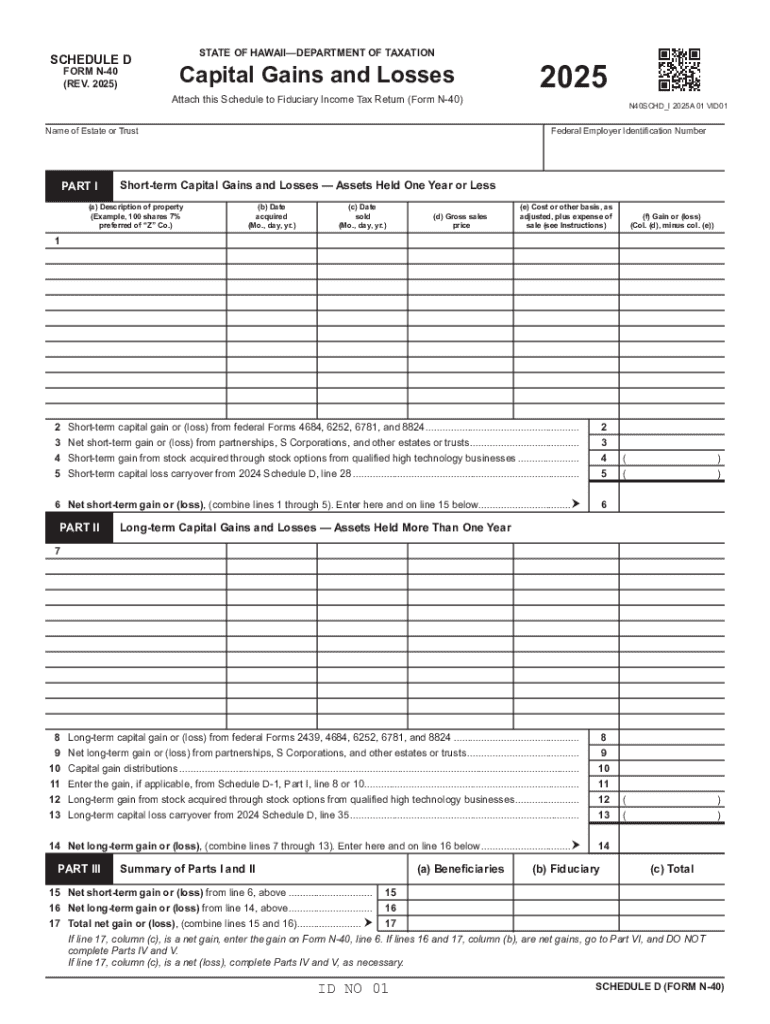

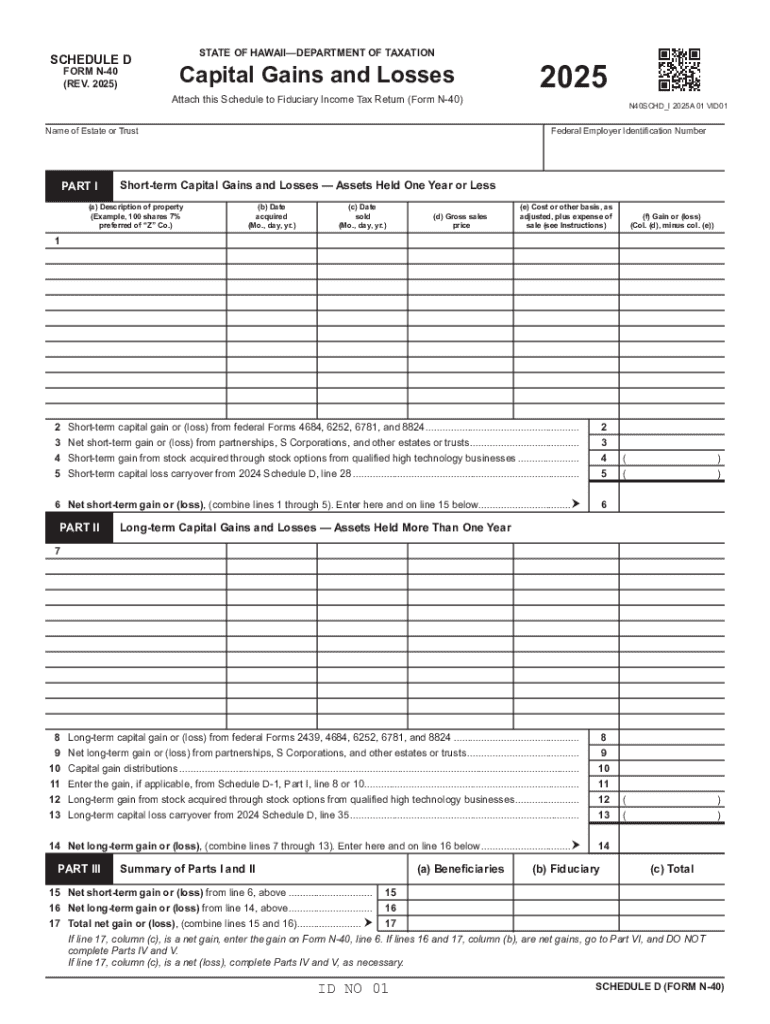

Overview of the Online State HI Schedule Form

The Online State HI Schedule Form is an essential document for individuals filing their state taxes in Hawaii. This form is used to report specific income and deductions to the Hawaii Department of Taxation, ensuring that taxpayers comply with local tax regulations. Filing this form accurately is crucial to avoid penalties and ensure that you receive any eligible credits.

Completing the HI Schedule correctly can significantly impact your tax return. By detailing income sources and applicable deductions, you can potentially lower your taxable income. The online format provides users with a streamlined process, allowing for easy access and the ability to fill out the form from anywhere, which is increasingly important in our mobile-centric world.

Understanding the State HI Schedule

The State HI Schedule is a specific form that accompanies your Hawaii state tax return. It is crucial for detailing sources of income that may not be reported on the standard tax forms. This includes various types of income such as rental, investment, and self-employment income. Understanding when and why to file this schedule can help ensure compliance with state tax laws.

Not all taxpayers need to file the HI Schedule. Primarily, individuals with varied income sources outside of regular employment need to report those figures on this schedule. This could include freelancers, business owners, or individuals earning passive income. Additionally, situations like claiming certain deductions or credits may also necessitate filing the HI Schedule.

Preparing to complete the online State HI Schedule Form

Before diving into the form, it’s important to gather all necessary documentation. This ensures a smooth and efficient filing process. You will need to provide personal information, which includes your name, address, social security number, and information about your income, deductions, and credits.

Having your financial records at hand will greatly ease the process. Collect income statements, tax documents, and other relevant paperwork such as W-2s and 1099s. Keeping these documents organized in one place will help you avoid delays and minimize the chances of making errors on your form.

Step-by-step guide to filling out the online State HI Schedule Form

Accessing the HI Schedule form is as simple as visiting the pdfFiller website. Once there, navigate to the section for state tax forms and locate the HI Schedule. The user interface is designed for seamless navigation, making it easy to find the form you need.

As you begin filling out the form, pay attention to each section. Start with your personal information, ensuring all details are accurate. Next, move to the income section where you will report earnings from various sources. Dedicate time to the deductions section as this can significantly affect your taxable income. Lastly, make sure to sign the form electronically to validate your submission.

Editing and modifying your online State HI Schedule Form

After submitting your online State HI Schedule Form through pdfFiller, you might realize you need to make changes. Fortunately, pdfFiller offers robust editing tools that allow users to modify their forms easily. This feature enhances the user experience considerably, allowing for corrections and updates even after submission.

To edit your form, navigate to your document storage within pdfFiller, select the form, and utilize the editing features available. Keeping track of revisions is also straightforward, as pdfFiller maintains a history of all changes made to your documents. This is particularly useful if you need to refer back to earlier versions for any reason.

Signing the online State HI Schedule Form

Once your form is filled out and ready for submission, adding your eSignature is a crucial step. eSigning is a legally valid way to authenticate your document, ensuring that your form is completed and validated under Hawaii law. pdfFiller provides an intuitive platform for signing documents electronically.

To add your eSignature, simply follow the prompts within the pdfFiller interface. Make sure to check the accuracy of your signature before finalizing, as it represents your consent to the contents of the form. Understanding the process of eSigning not only facilitates swift filing but also ensures compliance with current regulations.

Submitting your completed HI Schedule Form

With your online State HI Schedule Form signed and reviewed, it’s time to submit it. pdfFiller offers several submission methods, allowing you to choose the option that fits your needs best. Whether you prefer electronic submission via email or uploading your completed form directly to the Hawaii Department of Taxation’s website, you have flexibility.

It’s vital to be aware of important deadlines when submitting your form to avoid penalties. Upon submission, confirming that your form has been successfully filed is equally crucial. This can usually be done through a confirmation email or by checking your submission status on the Hawaii Department of Taxation’s website.

Managing your online State HI Schedule Form

One of the remarkable features of using pdfFiller is the ability to manage and track your online State HI Schedule Form after submission. You can easily check the status of your form, ensuring that your tax information is processed as expected. This is particularly beneficial during tax season when many individuals are filing simultaneously.

Moreover, pdfFiller's cloud storage means you can access and download your forms anytime, anywhere. This flexibility allows you to maintain updated records and respond promptly to any inquiries from tax authorities. Ensure you store your forms safely to protect your sensitive information.

Frequently asked questions (FAQs)

As with any document filing process, you may encounter questions or technical issues while filling out the online State HI Schedule Form. Common inquiries include what to do if you face technical difficulties, whether you can save your progress, and how to ensure your information remains secure.

Understanding the answers to these FAQs can ease worries and streamline your filing experience. For example, pdfFiller typically allows users to save their progress, meaning you don't have to complete the form in one sitting. Secure storage options further protect your sensitive data from unauthorized access.

Troubleshooting common issues

If you run into issues while filling out your online State HI Schedule Form, pdfFiller is equipped to help you resolve them swiftly. Whether you need to recover your account, reset your password, or troubleshoot a technical error, clear instructions are available on their platform.

Additionally, their customer support team is accessible for those requiring immediate assistance. This proactive approach to problem-solving helps users navigate any challenges and enhances the overall filing experience.

Benefits of using pdfFiller for your HI Schedule Form

Using pdfFiller to manage your online State HI Schedule Form delivers numerous advantages. Its cloud-based structure empowers users with the flexibility to create, edit, and sign documents from any location. This is especially important for individuals and teams who may be working remotely or traveling.

Additionally, pdfFiller enhances collaboration, allowing multiple users to work on the same document simultaneously. This is particularly useful for teams working together to complete tax filings or other essential documents. Lastly, pdfFiller offers comprehensive document management features, all integral to simplifying your filing process.

Additional notes on the State HI Schedule

It's vital to stay informed about any potential changes in tax laws or requirements for the State HI Schedule. As tax regulations are subject to periodic updates, you should regularly check for the latest guidelines from the Hawaii Department of Taxation.

Keeping abreast of new information, changes to filing procedures, or updates to forms can directly impact your filing experience and obligations. By staying educated, you can ensure that your forms are compliant with the latest requirements and deadlines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my online state hi schedule in Gmail?

How can I send online state hi schedule for eSignature?

How do I edit online state hi schedule on an iOS device?

What is online state hi schedule?

Who is required to file online state hi schedule?

How to fill out online state hi schedule?

What is the purpose of online state hi schedule?

What information must be reported on online state hi schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.