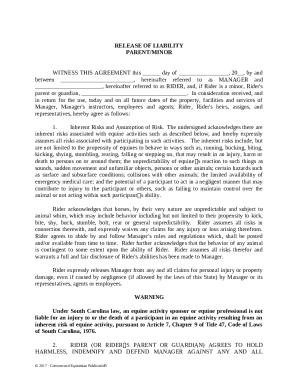

Get the free 8300 form

Get, Create, Make and Sign 8300 form

How to edit 8300 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 8300 form

How to fill out 8300 form

Who needs 8300 form?

A comprehensive guide to the 8300 form

Understanding the 8300 form

The 8300 form is a crucial tax document utilized for reporting cash transactions exceeding $10,000. It’s primarily used by businesses and individuals engaged in cash exchanges, ensuring transparency in financial dealings related to large cash payments. The form aims to prevent money laundering and other illicit financial activities by creating a paper trail of significant cash transactions.

The importance of the 8300 form cannot be overstated. By filing this form, businesses demonstrate their compliance with IRS regulations, thus upholding legal standards in cash transactions. Accurate reporting not only safeguards your business against potential audits but also contributes to a more transparent financial ecosystem.

Who needs to file the 8300 form?

Any individual or business receiving cash payments of $10,000 or more in a single transaction must file the 8300 form. This includes sellers, service providers, and any entity that regularly deals in high-value transactions. It is crucial for businesses with substantial cash dealings, such as car dealerships, real estate brokers, and casinos, to be aware of their obligation to report.

Exceptions exist for individuals and businesses involved in regular transactions who may not need to file each instance if they keep track of their cash payments under other documentation. Always consult with a tax professional to ensure compliance.

Form 8300 guidelines

Filing the 8300 form comes with specific rules and regulations to adhere to. The IRS mandates timely submissions, typically by the 15th day of the month following the transaction. Failing to submit this form accurately can lead to severe penalties, including fines of up to $100,000 for serious infractions.

Common mistakes to avoid include not capturing all necessary details of the transaction, such as the name and address of the individual paying with cash, which are crucial for IRS identification and tracking. Accurate recordkeeping can mitigate these errors and uphold compliance with regulations.

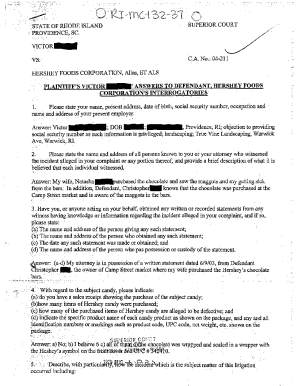

What information is required on the 8300 form?

The 8300 form requires a detailed breakdown of information to ensure proper reporting. Necessary fields include identifying information of the filer, transaction specifics, and recipient details. It's essential to gather complete information beforehand to avoid any discrepancies.

Before filing, gather all necessary documents that support your cash dealings. Ensure that you have detailed and accurate records, as this eases the filing process and helps maintain your financial integrity.

How to fill out the 8300 form

Filling out the 8300 form correctly is vital for compliance with IRS regulations. Follow these step-by-step instructions for seamless completion. Start by ensuring you have all required documents reviewed and readiness for the form.

For guidance, visual aids and examples can be highly beneficial. pdfFiller offers interactive tools that enable users to effectively fill out, edit, and manage their forms. Utilize these resources to enhance your completion experience.

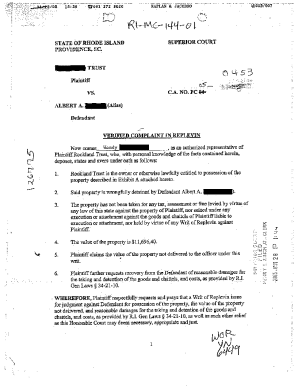

Submitting the 8300 form

After completing the 8300 form, you have multiple options for submission. You can choose between paper filing or electronic filing, with electronic options typically being more efficient and timely. This helps in immediate processing by the IRS, reducing your wait time.

Ensure you adhere to deadlines, filing by the 15th day of the month after the transaction took place. After submission, you can expect to receive a confirmation providing assurance of your filing status.

What happens after filing the 8300 form?

Once the 8300 form has been submitted, the IRS processes the information provided. This usually takes a few weeks during which they analyze the data for any discrepancies or compliance issues. As a filer, understanding the outcome of your filing can aid in efficient record management.

Potential follow-up actions can involve additional requests for clarification or audits, particularly if inconsistencies are found. Maintaining rigorous documentation will fortify your case should any issues arise.

Frequently asked questions about the 8300 form

Understanding the 8300 form can lead to various questions, particularly relating to specific situations. Common queries include how to amend a previously filed 8300 form and what to do if a transaction does not clearly meet the $10,000 threshold.

Gaining clarity on these issues can greatly ease the filing process. When in doubt, consult your tax professional who can provide guidance tailored to your circumstances.

Resources for filing and managing the 8300 form

Utilizing effective tools can enhance your experience with the 8300 form. pdfFiller provides resources to create, edit, and e-sign forms efficiently. Their platform supports seamless document management from anywhere, making it ideal for individuals and businesses.

For accurate and compliant form management, having the right tools and information at your fingertips can make all the difference in adhering to regulations.

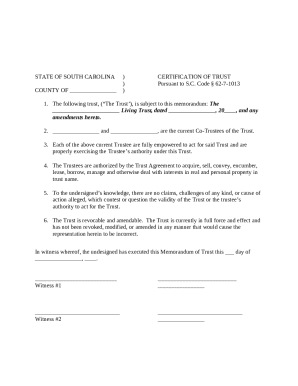

Exploring related forms and documents

In addition to the 8300 form, other IRS forms and documents may also pertain to cash transactions. Forms such as 1099 series for miscellaneous income might overlap in certain reporting circumstances. Understanding the broader landscape will aid in comprehensive compliance.

Understanding the synergy between these forms allows for better management of your business's financial documentation. Be sure to consult IRS resources for each form's specific requirements and implications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 8300 form?

Can I create an eSignature for the 8300 form in Gmail?

How do I edit 8300 form on an iOS device?

What is 8300 form?

Who is required to file 8300 form?

How to fill out 8300 form?

What is the purpose of 8300 form?

What information must be reported on 8300 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.