Get the free RETURNS FILED: FISCAL YEAR 2024 AND FISCAL YEAR 2025

Get, Create, Make and Sign returns filed fiscal year

Editing returns filed fiscal year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out returns filed fiscal year

How to fill out returns filed fiscal year

Who needs returns filed fiscal year?

Returns filed fiscal year form: A comprehensive guide

Understanding returns filed for the fiscal year

A fiscal year, defined as a 12-month period used for accounting purposes, often differs from the standard calendar year. Its importance lies in its ability to align financial reporting and operational strategies with the actual business cycle. Many organizations choose a fiscal year that complements their revenue patterns, particularly in industries where seasonal variations drastically influence profits.

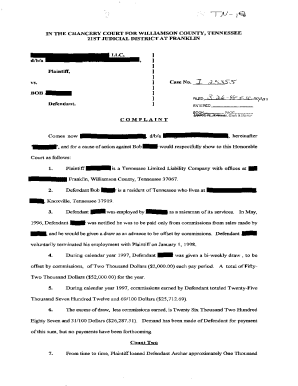

Returns filed during the fiscal year serve a variety of purposes, from income declarations to tax obligations based on generated earnings. There are several types of returns that may be pertinent depending on the entity filing; individuals typically utilize Form 1040, while corporations may use Form 1120. Each return has specific implications and must be understood clearly to ensure compliance and accuracy.

Step-by-step guide to filing fiscal year returns

Filing your fiscal year returns can seem intricate, but with a systematic approach, it can be streamlined effectively. Start by gathering all necessary documentation, which includes income statements, previous tax returns, and any pertinent forms required for the current filing. Nonprofits and corporations should also ensure they have their financial statements ready for review.

Gathering necessary documentation

Essential documents are paramount for successful filing. You'll need your financial records, relevant statements from clients or employable tax professionals, and any forms from the IRS that require completion.

Determining the correct form to use

Choosing the correct form is vital. Individuals typically file Form 1040, while partnerships use Form 1065. Corporations must utilize Form 1120. The fiscal year form is particularly relevant if your business operates on a fiscal year basis.

Completing your return

Carefully fill out your chosen form using the gathered documentation. Each field must be accurate to avoid issues like audits or penalties. Ensure you’re claiming all eligible deductions and credits. A common pitfall during this process is neglecting to double-check entries, which can lead to significant errors.

Filing methods: E-filing vs. traditional filing

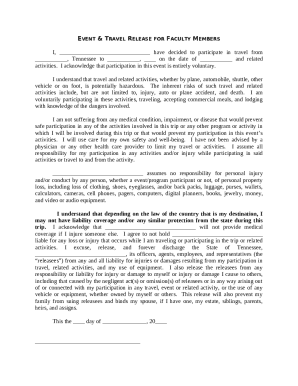

When it comes to filing your returns, you have two main options: e-filing or traditional paper filing. E-filing is quickly becoming the preferred method for many taxpayers, due to its convenience and speed. With pdfFiller, users can submit their forms seamlessly and receive confirmation instantly.

Benefits of e-filing returns

E-filing provides numerous benefits, including a faster submission process and integrated tools that assist with calculations. Many users find that electronic submission makes it easy to avoid mistakes, as the system often provides alerts for potential errors.

Traditional filing: When and why it may be necessary

Some situations may require traditional paper filing, such as when certain forms are not available online or if you prefer to keep a physical copy. To ensure a successful submission, double-check that the appropriate forms are enclosed and included with the envelope to the IRS.

Editing and managing your returns with pdfFiller

Managing tax documents is critical in today's tax environment. pdfFiller allows easy access and editing of your fiscal year return directly on its user-friendly platform. By uploading your documents digitally, you can streamline the editing process.

How to access and edit your fiscal year return on the pdfFiller platform

To get started, upload your fiscal year return document to pdfFiller. Once uploaded, users have full access to a suite of editing tools — from adding annotations to making real-time edits.

Collaborating with team members

Collaboration is key, especially for teams managing multiple returns. With pdfFiller, users can share documents effortlessly for team-based editing. Best practices suggest employing clear file naming conventions and maintaining open communication regarding edits.

Signing and submitting your returns

Once your return is complete and reviewed, it must be signed and submitted accordingly. With pdfFiller, e-signatures can be integrated seamlessly into your workflow, ensuring compliance with legal requirements.

Options for eSigning your fiscal year return

E-signing through pdfFiller is straightforward — simply select the signature box, choose your signature style, and place it on your document. This method is not only quick but legally recognized in various jurisdictions, making it a preferable choice.

Submitting your return: What to expect

After eSigning, you can submit your return directly through pdfFiller's integrated services. Expect a confirmation email with tracking details should any issues arise during the process.

Post-filing: Managing your documents

Proper organization of filed returns is crucial for future reference and audits. Upon completion of your return, ensure that all necessary documents are saved in an easy-to-access format. pdfFiller recommends categorizing these submissions into designated folders for simplicity.

Understanding possible audits and how to prepare

Being selected for an audit is not uncommon, but understanding the process can alleviate some anxiety. Have your records organized and easily accessible. Additionally, you can utilize tools and services within pdfFiller for audit assistance, ensuring that you are ready to defend the information provided.

Resources for further assistance

For individuals planning to file fiscal year returns, having access to reliable resources is crucial. Regularly updating knowledge concerning tax regulations, especially for unique fiscal year circumstances, can be highly beneficial.

Frequently asked questions about fiscal year returns

Common inquiries typically revolve around eligibility, filing deadlines, and documentation required. Utilizing a comprehensive FAQ section on pdfFiller's website can provide quick answers to these pressing concerns.

Contacting pdfFiller support for help

Should issues arise during the filing process, pdfFiller offers robust customer support. Contacting customer service for assistance with document-related inquiries can facilitate smoother filing experiences.

Using pdfFiller to stay compliant

Keeping abreast of changes in tax laws that affect fiscal year returns is crucial. pdfFiller provides updates and relevant information to help users remain compliant with the latest tax requirements digitally and seamlessly.

Subscription options and features to enhance your filing experience

pdfFiller offers various subscription plans. Each tier includes unique features aimed at enhancing the user experience, including access to a suite of collaboration tools, cloud storage options, and integration capabilities with other digital services.

Success stories and testimonials

Many users have shared positive experiences regarding how pdfFiller assisted in their fiscal year return filings. With testimonial highlights pointing towards improved workflow and stress alleviation, you can gauge how others in similar situations found success using the platform.

Impact of pdfFiller on streamlining the filing process

The ease of managing forms and collaborating as a team has led many fiscal year return filers to laude pdfFiller's effectiveness. From editing to secure signing, users appreciate how the platform facilitates smoother transactions.

Optimizing your workflow with pdfFiller

Integrating pdfFiller with other productivity tools can enhance your overall workflow. For users who frequently engage with tax forms, maximizing your usage of pdfFiller's features alongside other productivity resources helps streamline the overall process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get returns filed fiscal year?

How do I make changes in returns filed fiscal year?

How can I edit returns filed fiscal year on a smartphone?

What is returns filed fiscal year?

Who is required to file returns filed fiscal year?

How to fill out returns filed fiscal year?

What is the purpose of returns filed fiscal year?

What information must be reported on returns filed fiscal year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.