Get the Free IRS Form 1099-INT - PDF - eForms

Get, Create, Make and Sign irs form 1099-int

Editing irs form 1099-int online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 1099-int

How to fill out irs form 1099-int

Who needs irs form 1099-int?

A comprehensive guide to IRS Form 1099-INT

Understanding IRS Form 1099-INT

IRS Form 1099-INT is a crucial tax form used to report interest income. This form is essential for individuals and entities that earn interest, such as from bank accounts, bonds, or other financial instruments. The IRS requires this form to ensure that all interest income is accurately reported and taxed accordingly. The main purpose of the 1099-INT is to inform the IRS of the amount of interest income that taxpayers have received, thereby preventing underreporting of income.

Understanding terms like 'interest income' and 'payers' is vital. Interest income refers to the income generated from lending money or depositing funds in interest-bearing accounts. Payers, typically financial institutions, are responsible for issuing Form 1099-INT if they pay out $10 or more in interest to an individual or business during the tax year.

Who needs to file a 1099-INT?

Certain taxpayers need to be on the lookout for Form 1099-INT. Individuals who have received taxable interest income, totaling at least $10 in a calendar year, should expect this form from their financial institutions. This also includes interest from savings accounts, CDs, bonds, or other investments. It's essential for these individuals to include this income on their tax returns to avoid penalties.

Besides individual taxpayers, businesses and organizations that pay interest must also be aware of their responsibilities regarding the 1099-INT. Payers must issue this form to recipients of interest payments, adhering to the $10 threshold. If a business pays more than this amount in interest to a recipient for a given year, it must file Form 1099-INT and possibly submit a copy to the IRS as well.

When is Form 1099-INT issued?

Form 1099-INT is typically issued at the end of the calendar year, with specific deadlines in place to ensure timely tax reporting. Payers must provide recipients with the completed forms by January 31 of the year following the reporting year. This means individuals receiving interest payments during the previous year should expect to receive their forms promptly by the end of January. Furthermore, any 1099-INT forms that must be filed with the IRS are due by February 28 if filing via mail or March 31 for electronic filing. This timeline allows enough time for taxpayers to accurately report their interest income.

Common scenarios for issuance include interest payments from various financial institutions, such as banks, credit unions, or the U.S. Department of the Treasury for savings bonds. It’s crucial for these institutions to monitor and report applicable interest payments, thereby ensuring recipients are aware of their tax obligations.

Components of Form 1099-INT

To effectively report interest income, understanding the components of Form 1099-INT is essential. Each box contains important information that taxpayers must use when filing their taxes. Box 1 reports the total interest income earned during the year, which is the primary focus for taxpayers. Box 2 accounts for any early withdrawal penalties that might apply if interest was earned on funds withdrawn early from a certificate of deposit.

Other crucial sections include Box 3, which details interest earned on U.S. savings bonds and Box 4, which indicates any federal income tax withheld from the interest payments. Understanding these components ensures that taxpayers can accurately report their income, manage deductions, and comply with IRS regulations.

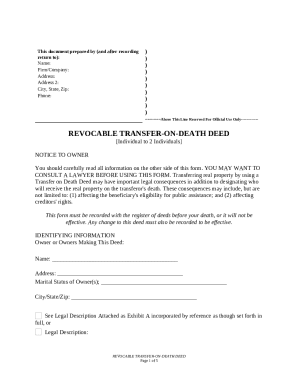

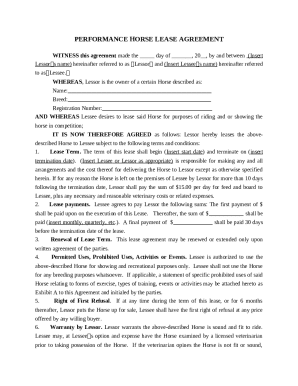

How to fill out IRS Form 1099-INT

Filling out Form 1099-INT can seem daunting, but it can be manageable with a structured approach. Start by gathering necessary information, including the recipient's name, address, and Taxpayer Identification Number (TIN) or Social Security Number (SSN). These details ensure that the form is accurate and is associated with the right individual or business.

Next, fill out the payer's details, including the name, address, and TIN. After that, calculate the interest earned during the relevant tax year and input this amount in Box 1. Remember to calculate any penalties for early withdrawal and enter them in Box 2, if applicable. For accuracy, double-check all entries to minimize errors. Finally, provide signed copies to both the 1099-INT recipient and the IRS, making sure to adhere to the established filing deadlines.

Electronic filing of 1099-INT

As cumbersome as tax season can be, electronic filing offers a streamlined process for submitting IRS Form 1099-INT. Using e-filing options such as specialized software can significantly simplify this task. Services like pdfFiller enable users to electronically fill out and file their forms with precision. The availability of user-friendly platforms eliminates the stress associated with traditional paper forms.

The benefits of using a cloud-based solution like pdfFiller extend beyond mere convenience. Users can easily access, edit, and eSign documents from anywhere, making it easier to collaborate with colleagues, especially in a remote environment. The step-by-step guide to uploading and submitting forms using pdfFiller ensures that the necessary information is accurately conveyed, and all forms are submitted in a timely manner.

Common mistakes to avoid

When filling out IRS Form 1099-INT, it's essential to be aware of common mistakes that could lead to inaccuracies or delays. Some frequent errors include incorrect names or addresses of recipients, miscalculating interest income, or failing to report all necessary data. Such inaccuracies can result in penalties from the IRS and could also flag your return for potential audits.

To avoid issues, adopt best practices for verification before submission. Double-check names, TINs, and amounts reported to ensure they align with the institution's records. Establish a checklist of required information and use it while preparing the form. Investing time in this process will lead to a smoother filing experience and greater confidence in compliance.

What to do after receiving 1099-INT

Upon receiving Form 1099-INT, taxpayers must report the interest income on their tax returns, typically within the income section. It’s essential to retain a copy of the 1099-INT for personal records, as it serves as proof of reported income should any questions arise from the IRS. This record-keeping is a fundamental step in ensuring compliance.

If you do not receive the form by the deadline, whether due to a lost form or incorrect information on file, you should take immediate action. Contact the payer to request a copy, and if adjustments are needed, ask for a corrected form. Failure to address this could lead to complications during tax season, making proactive communication crucial.

Managing your tax documents with pdfFiller

Managing your tax documents, including IRS Form 1099-INT, is seamless with pdfFiller. The platform allows you to edit, fill out, and eSign forms at any time, providing flexibility not offered by traditional filing methods. Whether you need to amend a mistake or update information, pdfFiller has all the tools for efficient document management in one cloud-based location.

With features like collaboration options and accessible editing capabilities, pdfFiller is ideal for individuals and teams working together on tax-related documents. You can access your forms from anywhere, making it easier to manage various tax documents throughout the year. This accessibility ensures users stay organized and prepared as tax deadlines approach, ultimately enhancing their experience with filing and record-keeping.

Frequently asked questions about Form 1099-INT

Many taxpayers have questions about IRS Form 1099-INT, and understanding these can alleviate concerns. A common query revolves around who is required to receive this form. Any recipient of interest income exceeding the $10 threshold for the tax year should receive a 1099-INT from the payer; if they don't, it's essential to follow up with the payer promptly.

Navigating complex interest income situations can also be challenging. Taxpayers often wonder about aggregating multiple sources of interest income or handling discrepancies. Documenting all interest payments accurately throughout the year and approaching these challenges with clear records can prevent misunderstandings and ensure that all tax obligations are met effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit irs form 1099-int from Google Drive?

How do I make edits in irs form 1099-int without leaving Chrome?

How do I edit irs form 1099-int on an iOS device?

What is irs form 1099-int?

Who is required to file irs form 1099-int?

How to fill out irs form 1099-int?

What is the purpose of irs form 1099-int?

What information must be reported on irs form 1099-int?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.