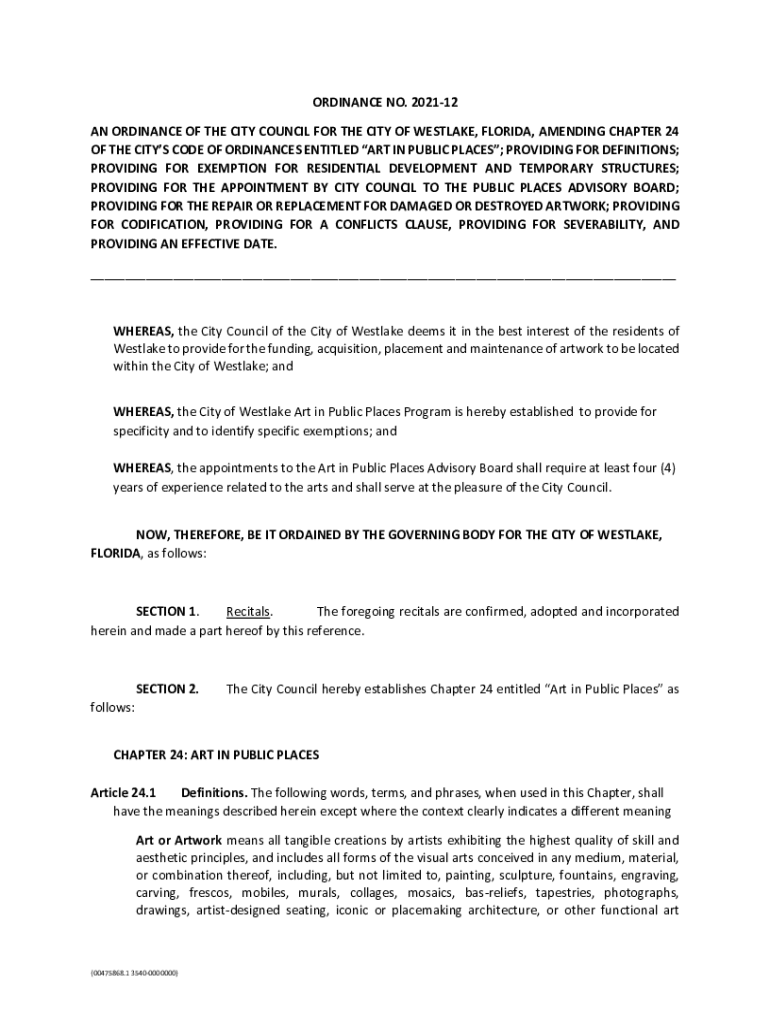

Get the free Amending Chapter 24 of the City's Code of Ordinances ...

Get, Create, Make and Sign amending chapter 24 of

How to edit amending chapter 24 of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out amending chapter 24 of

How to fill out amending chapter 24 of

Who needs amending chapter 24 of?

Amending Chapter 24 of Form: A Comprehensive How-To Guide

Understanding Chapter 24: Overview and Purpose

Chapter 24 plays a critical role in tax regulations, specifically addressing the rules and guidelines that govern income tax at source. This chapter simplifies tax collection processes, making it easier for both the government and taxpayers to navigate their responsibilities. It establishes crucial frameworks that ensure a transparent and efficient taxation process.

Key elements covered under Chapter 24 include the definitions of taxable income, various tax rates applicable, and procedures for tax collection. Its primary purpose is to create a standardized approach to tax regulations that stakeholders must adhere to, thereby minimizing confusion and improving compliance.

Individuals, businesses, and organizations benefiting from this framework are substantially affected by the regulations outlined in Chapter 24. Every entity engaged in income-generating activities must familiarize themselves with these provisions to ensure compliance and avoid penalties.

Identifying the need for amendments

There are several common reasons for amending Chapter 24. The landscape of taxation is fluid; thus, it often requires revision to keep pace with new legislation and evolving tax structures. For instance, a change in government fiscal policies might necessitate updates to Chapter 24 to reflect new tax brackets or credits.

Another impetus for amendments stems from stakeholder feedback, revealing gaps or complexities that could hinder compliance. Taxpayers often voice concerns about specific provisions that may be outdated or cumbersome, prompting the need for adjustments that are more aligned with current economic realities.

Key definitions related to Chapter 24

Key terms associated with Chapter 24 are essential in understanding how regulations function. For example, 'Income Tax At Source' (ITAS) is a core concept, referring to the principle wherein tax is deducted directly from an individual’s income by the employer before it is received by the employee. This mechanism ensures timely tax collection while reducing the burden on individuals to manage their own tax submissions.

Other crucial definitions include terms like 'taxable income' and 'withholding tax,' each having specific implications on tax obligations for both individuals and businesses. Understanding these terms and their interactions within the chapter is vital for accurate compliance and optimal tax planning.

Steps to amending Chapter 24

Amending Chapter 24 involves several critical steps that must be executed meticulously. The first step is to gather relevant information and necessary documents required for amendments. This includes existing forms, proposals, and any supporting documentation that captures the rationale for the changes.

Next, it is essential to consult legal and tax professionals. Their expertise provides crucial insights into the legal implications of the proposed amendments and ensures that the changes align with overarching tax laws.

Reviewing existing provisions is equally important. A comprehensive analysis will help identify which areas of Chapter 24 require modification and why. Once that is established, you can proceed to draft proposed amendments concisely and clearly, ensuring that your language is precise and unambiguous.

Subsequently, submit proposed changes through the appropriate channels and ensure to follow any necessary timelines for submission. Timely follow-up on the proposals is crucial to ensure they are being reviewed and not overlooked.

Special considerations in amending Chapter 24

Amending Chapter 24 can have varied impacts on different categories of stakeholders. For instance, businesses may need to recalibrate their payroll systems to comply with new tax withholding requirements, while individuals might find themselves benefiting from new tax credits or deductions.

Legal compliance and regulatory considerations must also be addressed. It’s imperative to ensure that any proposed changes adhere to broader tax law frameworks to avoid conflicts that could arise from inconsistencies.

Additionally, addressing common concerns during the amendment process—such as how these changes will affect current liabilities and compliance obligations—is crucial in fostering confidence among stakeholders.

Frequently asked questions (FAQs) about amending Chapter 24

One common question regarding the amendment process is what happens if a proposal is not accepted. In such cases, stakeholders may have the opportunity to revise and resubmit proposals based on feedback received from tax authorities or regulatory bodies.

Another concern often raised relates to the duration of the amendment process. While timelines can vary, stakeholders should expect the process to take several weeks to months, depending on the depth of review required.

Lastly, many parties wonder if there are penalties for not complying with amended provisions. Non-compliance can lead to financial penalties, so it is critical to stay informed and adapt to changes promptly.

Using pdfFiller for document management in the amending process

Utilizing pdfFiller enhances the document management experience during the amendment process. With its robust editing features, users can effortlessly edit and sign documents necessary for proposed changes to Chapter 24. This platform streamlines the workflow, allowing individuals and teams to manage their documents efficiently.

Collaboration among stakeholders is simplified through pdfFiller’s real-time features, which allow multiple users to edit and comment on documents simultaneously. Accessing documents from anywhere ensures that participants can stay engaged in the amendment process, regardless of their location.

Real-world examples of successful amendments

There are many instances where successful amendments to Chapter 24 have had profound impacts. For example, previous amendments have simplified tax collection for small businesses, alleviating a burden that previously caused significant complications.

Through case studies, stakeholders can learn vital lessons from past amendments regarding best practices that encourage compliance and streamline processes. These historical examples provide valuable insights that can be beneficial during future amendment efforts.

Monitoring changes post-amendments

Stakeholders should remain vigilant after amendments are enacted. Staying updated on future changes to Chapter 24 can be achieved by subscribing to official tax authority notifications, which often include amendments and procedural updates.

Setting reminders for updates and compliance deadlines is also essential. By tracking these timelines, stakeholders can ensure they remain compliant and can take advantage of any newly available tax benefits or provisions.

Conclusion

Understanding and effectively managing amendments to Chapter 24 is crucial for anyone involved in tax operations. With the dynamic nature of taxation regulations, being proactive and well-informed can help mitigate risks and enhance compliance.

Utilizing interactive tools available on pdfFiller for better document management further simplifies this process, allowing users to feel empowered while adjusting to the dynamic landscape of tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify amending chapter 24 of without leaving Google Drive?

How do I make edits in amending chapter 24 of without leaving Chrome?

Can I edit amending chapter 24 of on an iOS device?

What is amending chapter 24 of?

Who is required to file amending chapter 24 of?

How to fill out amending chapter 24 of?

What is the purpose of amending chapter 24 of?

What information must be reported on amending chapter 24 of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.