Get the 60 1098 Form - Free to Edit, Download & Print

Get, Create, Make and Sign 60 1098 form

How to edit 60 1098 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 60 1098 form

How to fill out 60 1098 form

Who needs 60 1098 form?

Understanding the 60 1098 Form: A Comprehensive Guide

Understanding 60 1098 form

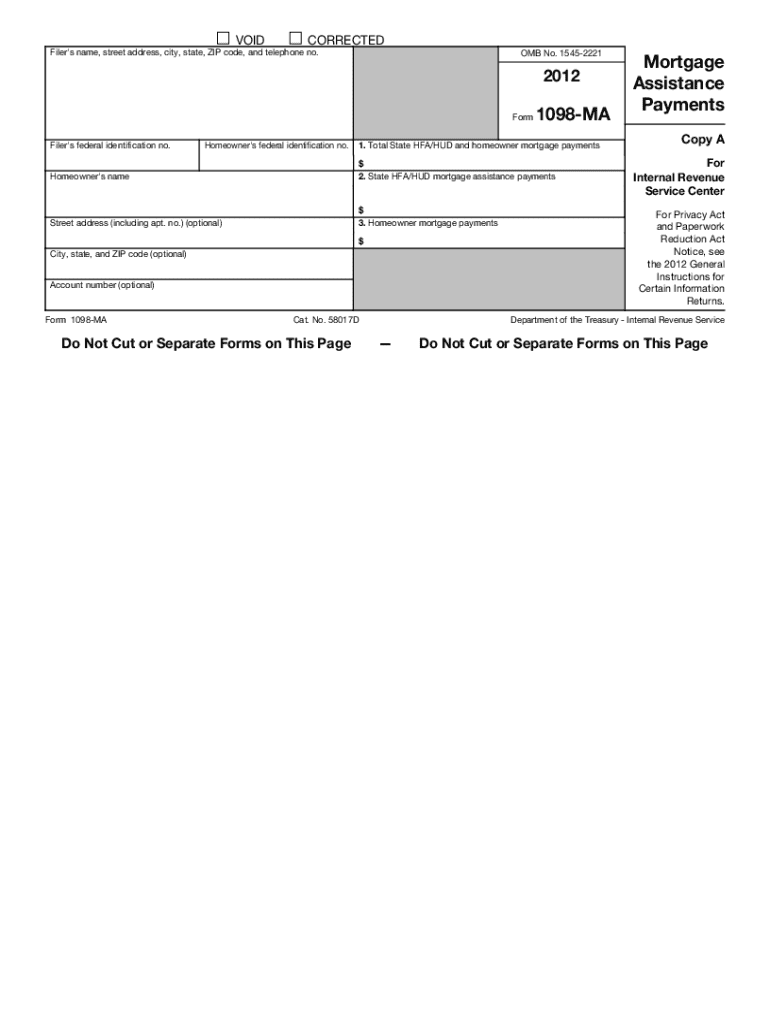

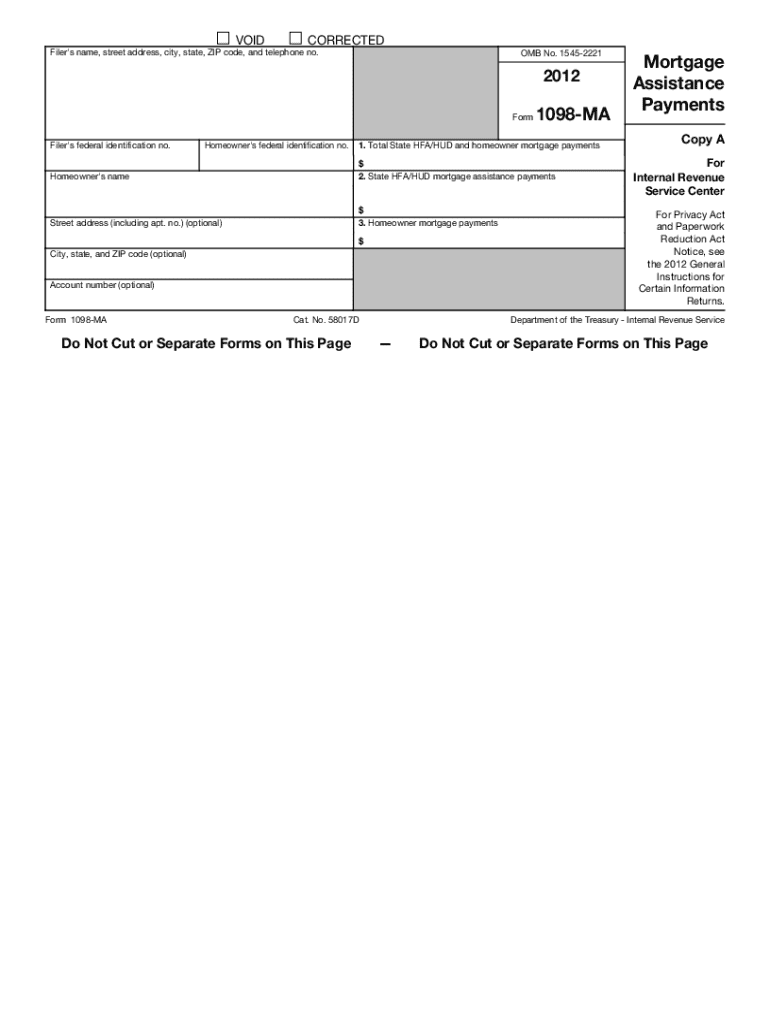

The 60 1098 Form, also known as IRS Form 1098, serves an essential function in tax documentation for individuals and organizations that have incurred mortgage interest. This form provides critical information about the amount of mortgage interest received, which is necessary for both taxpayers and the Internal Revenue Service (IRS) to ensure accurate reporting and compliance with tax laws.

Filing Form 60 1098 is particularly important in tax returns as it aids in calculating mortgage interest deductions, potentially lowering tax liabilities for taxpayers. As the form provides transitions between various aspects of mortgage management and tax implications, understanding it is crucial for anyone involved in real estate financing.

What is Form 60 1098?

Form 60 1098 is primarily used for reporting mortgage interest payments made by borrowers during the tax year. It includes key features that set it apart from other 1098 forms, such as Form 1098-E, which is used for reporting student loan interest, and Form 1098-T, dedicated to tuition payments made for higher education.

This form is essential for taxpayers who pay mortgage interest, as it provides clear documentation needed to substantiate interest deductions claimed on their tax returns. Individuals and organizations that lend money, like banks or credit unions, are typically required to file this form, ensuring both parties maintain accurate records of financial transactions.

Detailed breakdown of form components

The 60 1098 Form consists of several key sections, each providing crucial financial details. Understanding these sections helps both filers and the IRS reconcile tax reports effectively.

Essential sections of the 60 1098 form

Box 1 reports the total mortgage interest received during the year. This figure is pivotal for the borrower’s tax return, as it denotes the amount eligible for deduction.

Box 2 displays the outstanding mortgage principal at the end of the year, providing insight into the total loan amount still owed.

Box 3 is critical for those who have had a refund of overpaid interest, ensuring borrowers can accurately report any adjustments to their mortgage interest.

Box 4 provides additional information that may be relevant for the taxpayer, such as the lender’s details and other financial data.

Explanation of terms

Key terminology associated with Form 60 1098 includes mortgage interest, which is the cost incurred for borrowing money to purchase a property, and the principal balance, which is the remaining amount of the original loan. Other terms related to mortgage management and tax implications play a crucial role in accurately completing and utilizing this form.

Step-by-step guide to completing Form 60 1098

Completing Form 60 1098 requires precise information gathering and careful attention to detail. Begin by collecting all necessary documents, including previous year’s tax returns, mortgage statements, and any relevant correspondence related to your mortgage.

Collecting required information

Once you have gathered your documents, you can start filling out the form accurately. Here are some tips for completing each section:

Electronically filing the form

E-filing offers a convenient alternative to traditional paper filing. To e-file, access the IRS e-file system or utilize trusted tax preparation software. The process is generally straightforward, offering prompts for key fields and automatically checking for common errors. Paper filing, while still an option, is less efficient and can result in delays; thus, it’s recommended to consider e-filing whenever possible.

Interactive tools for managing your 60 1098 form

Managing your 60 1098 Form can be straightforward with the right tools. For instance, pdfFiller provides a comprehensive platform for editing, signing, and securely sharing PDFs, including tax forms like the 60 1098.

How to use pdfFiller for 60 1098 form management

With pdfFiller, users can easily edit their 60 1098 Forms, adjusting any necessary information before filing. The platform allows for digital signatures, which can expedite the process significantly by eliminating the need for printing and mailing.

Collaboration features enable teams to work together seamlessly on document creation and review. Whether you're part of a finance team preparing tax documents or an individual seeking assistance, pdfFiller fosters an environment conducive to efficient and organized document management.

Understanding related tax implications

Filing Form 60 1098 carries significant tax benefits, particularly in terms of deductions for mortgage interest payments. Homeowners may claim these deductions, leading to potential savings on their tax bills. The interest portion as outlined in Box 1 of Form 60 1098 is particularly critical, as it could mean the difference between a higher tax refund and owing money.

However, taxpayers need to be aware of potential issues, like inaccuracies in reported amounts or late submissions. Common mistakes can include misreporting the interest paid or failing to include required forms. When disputes arise, these can often be resolved through direct communication with the lender or via clarification with the IRS.

Frequently asked questions (FAQs)

What if lose my 60 1098 form?

If you lose your 60 1098 Form, contact your lender promptly for a duplicate. They are required to provide this information to you as per IRS regulations.

How to correct mistakes on my 60 1098 form?

If you spot mistakes on Form 60 1098 after it has been submitted, you’ll need to file a correction with the IRS, which may involve additional documentation. Reach out to your lender for guidance.

What documentation do need to keep?

It’s crucial to maintain copies of your 60 1098 Form as well as all related documentation, including mortgage statements and any correspondence with lenders or the IRS. Keeping thorough records will support your claims and assist in future audits.

Additional considerations

The implications of the 60 1098 Form extend beyond just the current filing year. It affects future filing requirements and financial planning, as consistent reporting of mortgage interest can impact your overall tax strategy.

Moreover, it's essential to understand both state and federal requirements regarding the 60 1098 Form. Each state may have distinct rules related to tax filings, deductions, and reporting which could vary from federal guidelines. Always verify compliance with applicable state laws to avoid penalties.

Conclusion on navigating the 60 1098 form

Understanding the 60 1098 Form is vital for anyone involved in real estate transactions, as it directly influences tax obligations and potential benefits. Being diligent about its accuracy can lead to significant financial implications, particularly in terms of possible deductions.

Utilizing tools like pdfFiller can enhance your efficiency and accuracy when preparing this form. The cloud-based platform offers seamless editing and collaboration features, making it easier than ever to manage your tax documents effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 60 1098 form online?

How do I complete 60 1098 form on an iOS device?

How do I fill out 60 1098 form on an Android device?

What is 60 1098 form?

Who is required to file 60 1098 form?

How to fill out 60 1098 form?

What is the purpose of 60 1098 form?

What information must be reported on 60 1098 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.