Get the free What is a W-2 Form? How to Read It and When to Expect it.

Get, Create, Make and Sign what is a w-2

How to edit what is a w-2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what is a w-2

How to fill out what is a w-2

Who needs what is a w-2?

What is a W-2 Form: A Comprehensive Guide

Understanding the W-2 form: Definition and purpose

The W-2 form, formally known as the Wage and Tax Statement, is a crucial document issued by employers to report an employee's annual wages and the amount of taxes withheld from their paychecks. This form is vital for employees when filing their annual income tax returns. With the W-2, employees can accurately report their taxable income, which is essential for compliance with various tax obligations.

Employees are the primary recipients of W-2 forms, received from their employers by January 31 of each year. The W-2 provides a comprehensive summary of their earnings, which helps to calculate total gross wages, including any overtime or additional earnings and evaluates how much in taxes—federal, state, and social security—have been withheld over the year.

The W-2 form also plays a significant role within the broader tax system. By collecting accurate income data from employees, the IRS can effectively track individuals’ earnings and ensure proper tax compliance. Without the W-2, it would be challenging to ascertain whether an employee is paying the correct amount of taxes.

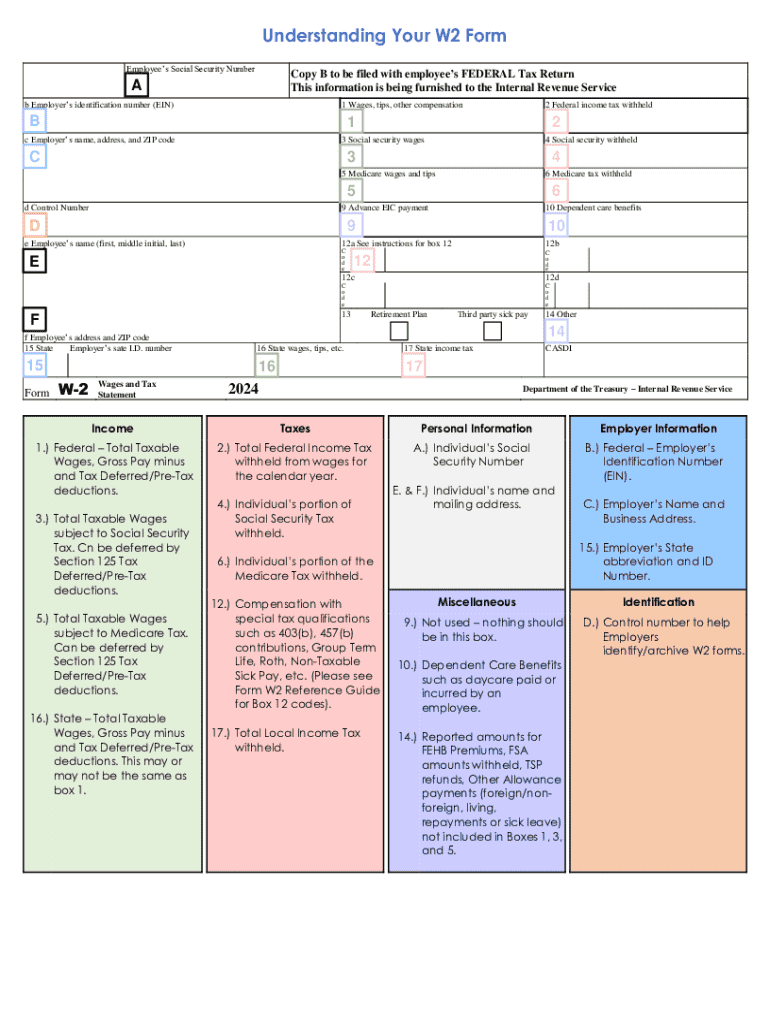

Components of a W-2 form: What you need to know

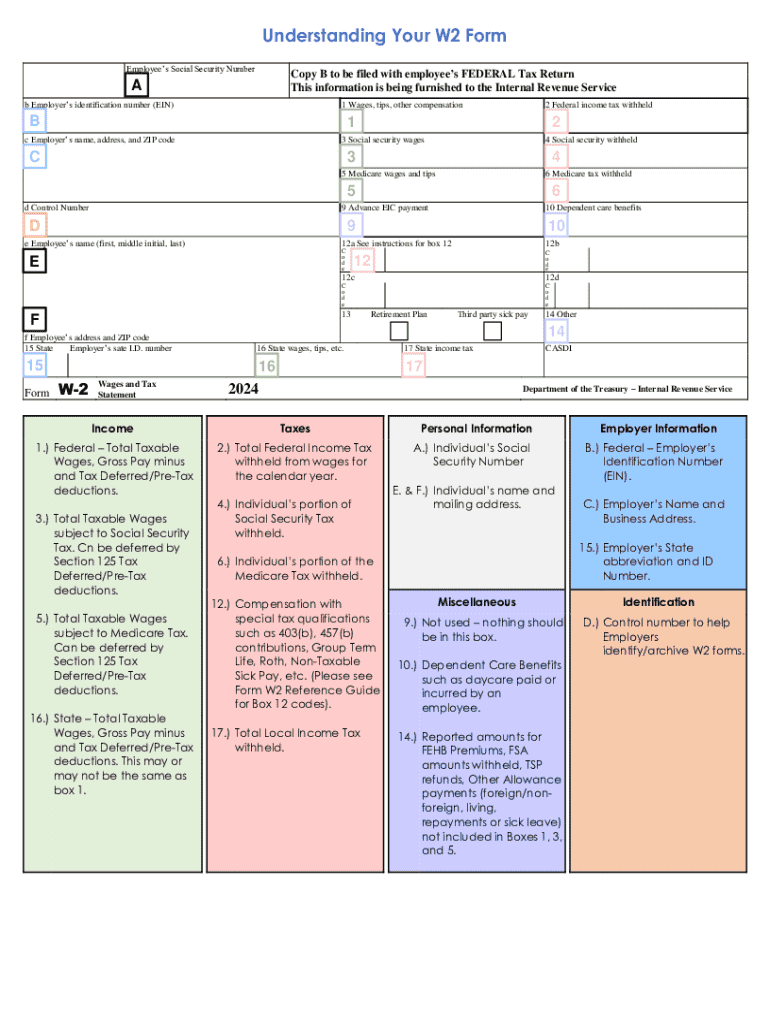

The W-2 form comprises multiple boxes, each containing specific information relevant to both the employer and the employee. Understanding these different sections is crucial for ensuring that you’re aware of your earnings and the taxes deducted from them. For instance, Box 1 indicates total taxable income which includes wages, tips, and other compensations. Box 2 provides detailed information about the federal income tax withheld during the year.

Additionally, Box 3 shows Social Security wages, while Box 4 states the amount withheld for Social Security tax. Similarly, Box 5 reflects Medicare wages, and Box 6 indicates the amount withheld for Medicare tax. Recognizing these distinctions helps you evaluate your financial situation accurately and enables you to double-check your employer’s reporting.

Understanding the common terms and codes associated with the W-2 is equally important. For example, FICA denotes the combined federal payroll taxes for Social Security and Medicare. Knowing the codes and acronyms used can clarify the implications of various deductions and ensure that you fully understand your tax liabilities and contributions.

Receiving and reviewing your W-2 form

Employees should expect to receive their W-2 forms by January 31 each year. Employers are legally required to provide W-2 forms to all employees who earned at least $600 in a given tax year. It's essential to confirm whether your employer offers an electronic version; many employers now provide digital copies through their HR platforms, making it easier to access and store.

Once you receive your W-2, it's crucial to review it carefully for accuracy. Check the basic information such as your name, Social Security Number (SSN), and data reported in the various boxes, especially Boxes 1 through 6 for earnings and withholdings. If discrepancies arise, it's advisable to address them promptly by contacting your employer. Ensuring that your information is correct before filing can prevent potential discrepancies with the IRS.

Addressing any errors immediately is vital. If you discover inaccuracies on your W-2, you should inform your employer and request a correction using Form W-2c. This correction form helps adjust previously reported information to reflect your actual income and taxes withheld.

How to use your W-2 form for tax filing

Using your W-2 form for tax filing is a straightforward process. The information contained within significantly streamlines your tax preparation, whether you file your taxes independently or through a tax professional. You will include the figures from your W-2 in your tax return, ensuring an accurate declaration of your earnings and taxes paid.

When proceeding with your tax filing, you can either use tax preparation software or work with a tax consultant to assist you through the process. Tax software typically provides an option to import W-2 data directly, which can be a timesaver and minimize the risk of entry errors. If you prefer enlisting professional help, ensure they thoroughly understand your W-2 and any unique considerations associated with your earnings or tax situation.

To prevent errors, it’s advisable to follow common tips when entering W-2 data into online software. For example, ensure that the amounts you input from Boxes 1, 2, and 3 match precisely with your W-2 form. Misreported figures can lead to complications down the line, including longer processing times for your tax return.

Frequently asked questions about W-2 forms

A common concern employees face is what to do if they do not receive their W-2 form. If you have not received your W-2 by mid-February, the first step is to contact your employer directly. Employers are required to resend W-2 forms upon request. If you're still unable to obtain a W-2 from your employer, you might also report your earnings using Form 4852, a substitute for the W-2, but this requires you to estimate the wages and withholdings accurately.

Another frequent query is regarding correcting errors on your W-2. If you identify mistakes post-filing your taxes, it’s crucial to have a corrected W-2 issued. Your employer must complete Form W-2c to rectify any discrepancies. Filing your taxes with incorrect information could cause delays in processing and might require you to amend your return, potentially leading to penalties.

Related links and resources to enhance your understanding

Understanding the nuances surrounding W-2 forms is easier with the right resources. The IRS official page dedicated to the W-2 form offers comprehensive insights and downloadable forms, ensuring that users have access to the most relevant and updated information. Bookmarking these resources can prove invaluable during tax season, as they provide clarity on completing forms correctly.

In addition, specialized platforms like pdfFiller offer interactive tools to assist users in managing W-2 forms. With features designed for editing, signing, and collaborating on documents, pdfFiller empowers you with efficient document handling right from your computer or mobile device. This flexibility serves well for individuals or teams needing access to W-2 management from anywhere.

Managing your W-2 information efficiently

Storing your W-2 forms securely is a crucial step in maintaining your financial records. It’s essential to retain copies of your W-2 forms for at least three years from the date of your tax return filing, especially since this information is needed if you face an audit. Many choose to store their W-2s in both physical and digital formats to be better prepared for any future inquiries.

For digital storage, consider utilizing cloud-based solutions like pdfFiller, which not only allows for easy storage but also offers features for efficient document editing and sharing. You can easily organize your W-2 forms by tax year, ensuring a streamlined reference system for all your tax documents. The convenience of being able to access your documents from any device enhances your ability to manage your financial records effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send what is a w-2 for eSignature?

How do I execute what is a w-2 online?

Can I edit what is a w-2 on an Android device?

What is a W-2?

Who is required to file a W-2?

How to fill out a W-2?

What is the purpose of a W-2?

What information must be reported on a W-2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.