Get the free 2025 I-015 Schedule H-EZ Wisconsin homestead credit - easy form (fillable)

Get, Create, Make and Sign 2025 i-015 schedule h-ez

Editing 2025 i-015 schedule h-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 i-015 schedule h-ez

How to fill out 2025 i-015 schedule h-ez

Who needs 2025 i-015 schedule h-ez?

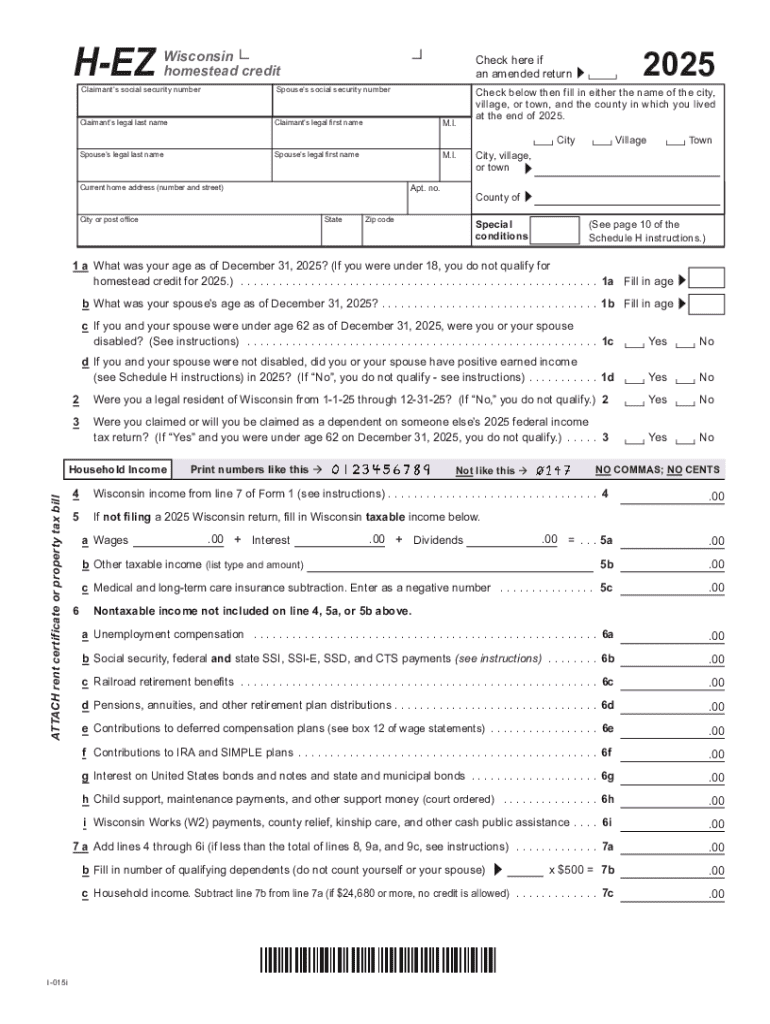

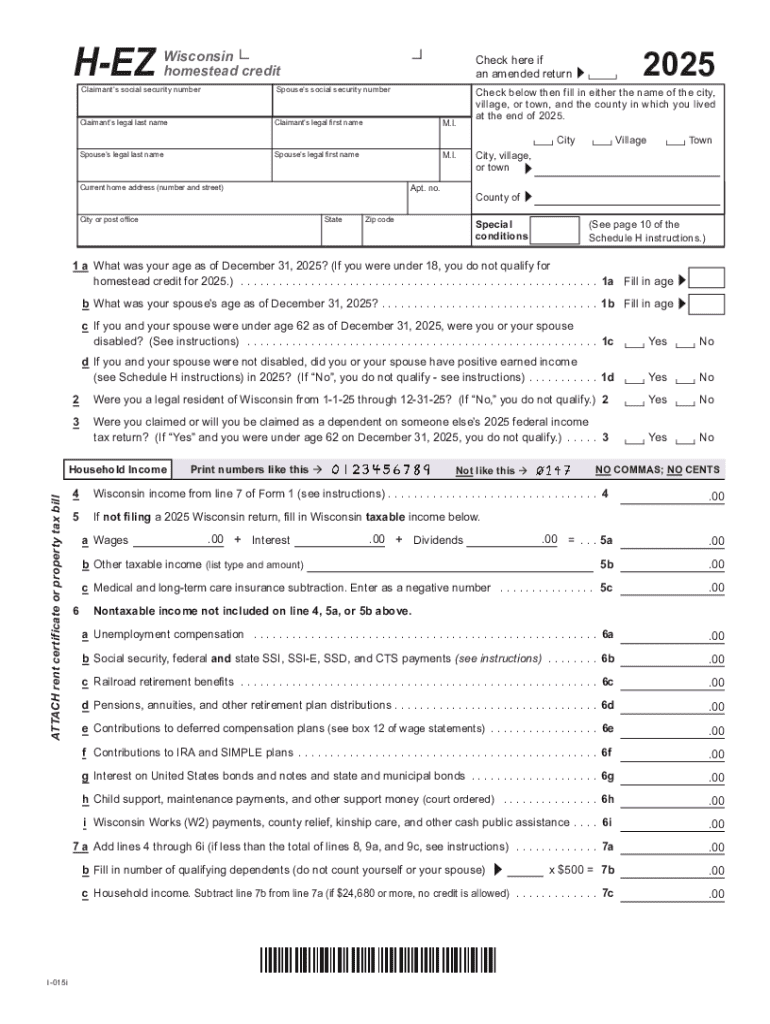

2025 -015 Schedule H-EZ Form: A Comprehensive Guide

Understanding the Schedule H-EZ Form

The Schedule H-EZ Form is a streamlined version of the traditional tax form for household employers to report wages, payroll taxes, and claims for tax breaks. It simplifies the filing process for eligible individuals who meet specific criteria regarding their household employment.

Who should consider using the H-EZ Form? This form is ideally suited for household employers with limited employees, usually fewer than four. Such employers could include those hiring nannies, maids, or caretakers, making it easier for them to manage tax obligations.

The benefits of using the Schedule H-EZ for tax filing are substantial. Primarily, it reduces the complexity of tax calculations, saving time and minimizing errors. Moreover, utilizing this form helps ensure compliance with tax liabilities, potentially safeguarding you against penalties or audits.

Overview of the 2025 -015 Schedule H-EZ Form

The 2025 i-015 Schedule H-EZ Form includes essential updates that may affect how household employers report their information. Key changes in this version simplify previous reporting requirements, ensuring a smoother filing experience.

Important dates and deadlines for filing are critical to avoid late penalties. Generally, returns should be submitted by April 15, aligning with individual tax returns. Understanding the distinctions between the H-EZ and other schedule forms, such as H or SE, is fundamental. The H-EZ is crafted for simpler situations, while others might apply to more complex scenarios.

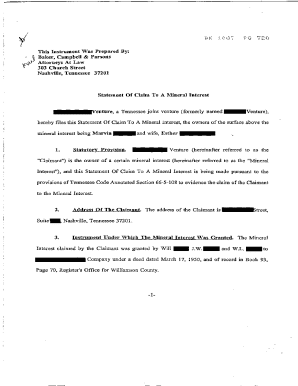

How to access the 2025 -015 Schedule H-EZ Form

Accessing the 2025 i-015 Schedule H-EZ Form has never been easier. The form can be downloaded from platforms like pdfFiller, allowing for immediate access and filling out.

You can opt for online or offline access based on your convenience. While online access offers easy collaboration features, offline forms can cater to those who prefer a traditional paper approach. The interactive features of pdfFiller, including editing and eSigning capabilities, can significantly enhance your experience.

Step-by-step instructions for completing the Schedule H-EZ Form

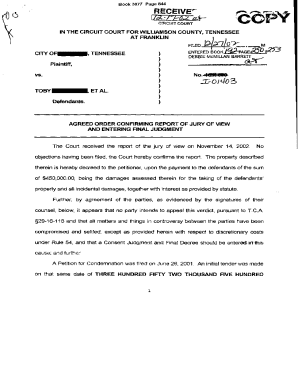

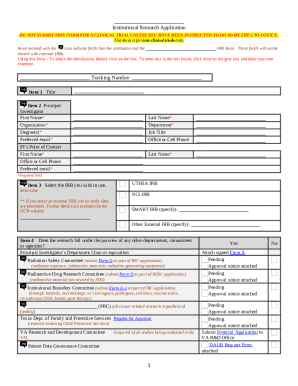

Completing the Schedule H-EZ Form meticulously is vital. Begin with Section 1: Personal Information where you fill out your name, contact details, and Tax Identification Number. Accuracy here sets the tone for your entire submission.

Moving to Section 2: Income Reporting, you'll declare all earnings. Be thorough—include wages paid to household employees and any additional taxable income. Calculating your adjusted gross income correctly is crucial as it impacts potential deductions.

Section 3: Deductions and Credits is where you can optimize your tax return. Familiarize yourself with common deductions applicable to the H-EZ form, such as dependent care credits. Understanding these deductions can substantially reduce your overall tax liability.

Finally, in Section 4: Submission Process, review your form meticulously to ensure all details are accurate. Utilizing pdfFiller’s eSigning tool can make this process smooth, allowing you to submit your completed form efficiently.

Editing and managing your Schedule H-EZ Form

After filling out your Schedule H-EZ Form, utilizing pdfFiller’s editing tools is essential for managing your submissions effectively. These tools allow you to make necessary changes quickly, ensuring that your forms are always current.

Collaborating with others is made simple with pdfFiller's sharing features. This is particularly useful if you need assistance or want a second opinion before finalizing your submission. Once you’re satisfied, save and store your form for future reference, ensuring you have everything you need for next tax season.

Frequently asked questions (FAQs)

What if you made a mistake on your H-EZ form? Fortunately, pdfFiller ensures you can rectify any error. Simply edit your form before resubmittal. If you need to amend a prior submission, the process can easily be initiated through the platform.

Key differences between the H-EZ and other tax schedules also warrant attention. The H-EZ is streamlined for simplicity, particularly benefiting those with straightforward compliance needs, whereas other schedules may accommodate more intricate financial situations.

Advanced tips for optimizing your filing

To optimize your filing of the 2025 i-015 Schedule H-EZ Form, consider utilizing pdfFiller’s templates. Templates can save time and help ensure your entries are consistent, further preventing mistakes.

Adopting sound tax strategies is essential for maximizing deductions. Keep thorough records of your expenses throughout the year to ensure that none go unclaimed. Finally, keeping your documents organized enables a smoother process when it comes time to file.

Current updates and trends related to the H-EZ form

Staying informed about the current updates and trends in regulations affecting the Schedule H-EZ Form is crucial for every filer. Recent changes may impact how certain deductions are interpreted or claimed, reflecting adjustments in tax policy.

Additionally, exploring similar forms may aid your decision in case your tax situation shifts. Being aware of other forms and new templates recently uploaded onto pdfFiller can enhance user experience, offering you tools that suit your evolving requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2025 i-015 schedule h-ez directly from Gmail?

Can I create an electronic signature for signing my 2025 i-015 schedule h-ez in Gmail?

How can I edit 2025 i-015 schedule h-ez on a smartphone?

What is 2025 i-015 schedule h-ez?

Who is required to file 2025 i-015 schedule h-ez?

How to fill out 2025 i-015 schedule h-ez?

What is the purpose of 2025 i-015 schedule h-ez?

What information must be reported on 2025 i-015 schedule h-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.