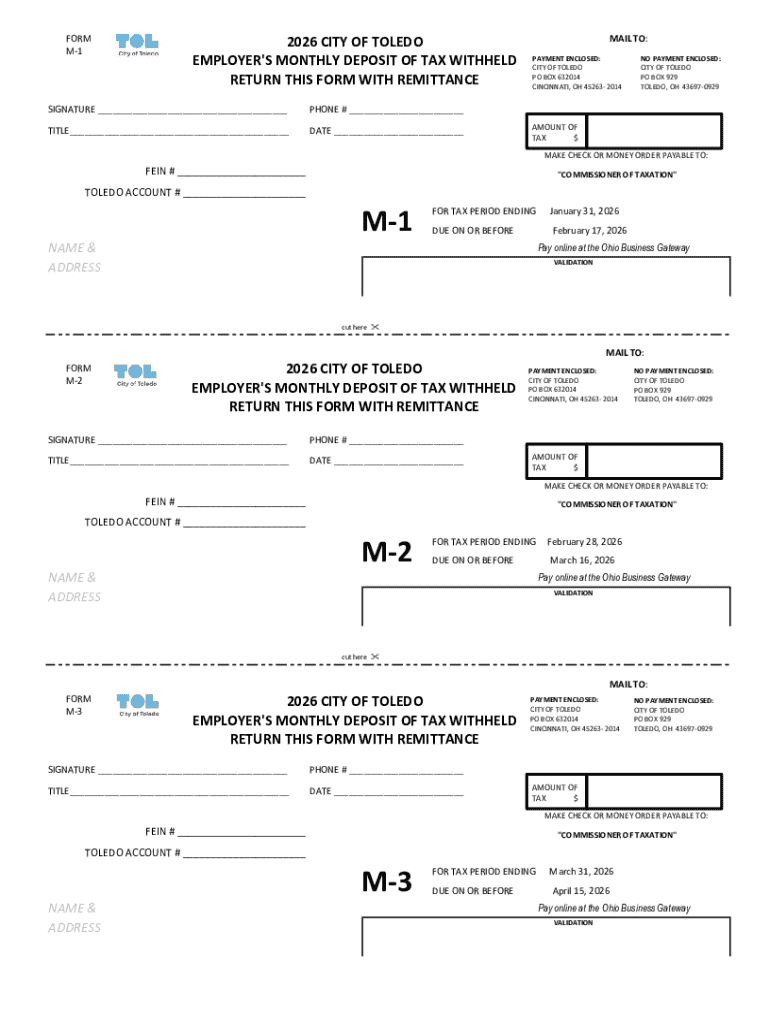

Get the free EMPLOYER'S MONTHLY RETURN OF TAX WITHHELD ...

Get, Create, Make and Sign employer039s monthly return of

How to edit employer039s monthly return of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employer039s monthly return of

How to fill out employer039s monthly return of

Who needs employer039s monthly return of?

A comprehensive guide to employer039s monthly return of form

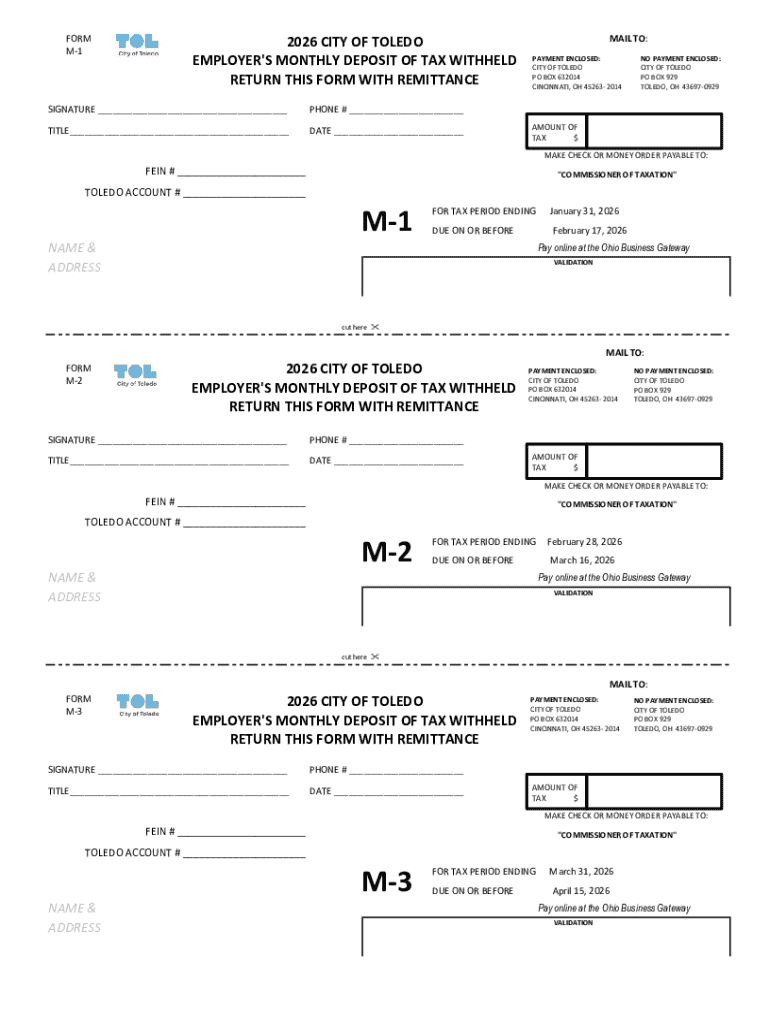

Overview of employer039s monthly return

The employer039s monthly return of form is a critical document that businesses must submit to local tax authorities. It serves as a formal declaration of employee tax withholdings, social security contributions, and other pertinent monetary figures that impact tax obligations. The primary purpose of this form is to ensure that both the employer and the employee comply with local tax laws while facilitating the accurate collection of due taxes.

Accurate reporting through this form is essential; it enhances transparency between employers and tax authorities, helps prevent discrepancies that could lead to audits, and ensures employees receive proper credit for their contributions. Failure to submit this return correctly can result in penalties, which is why understanding its components and processes is fundamental for any employer.

Key components of the monthly return form

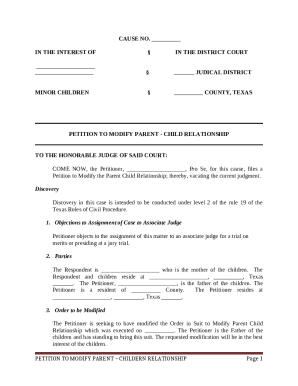

The monthly return of form is structured with specific fields that require detailed input from employers. Understanding these components is crucial for successful completion. Major fields include employer information, which outlines the business name, taxpayer registration number, and contact information, as well as detailed sections for employee contributions.

Employee contributions often reflect the total amount withheld from wages for taxes, social security, and other deductions. Taxable income must be properly reported along with any deductions applicable to each employee. Additionally, employers may need to include attachments such as schedules for explanations of changes, amendments, or supporting documentation structured around certain categories of tax deductions.

Step-by-step instructions for completing the monthly return

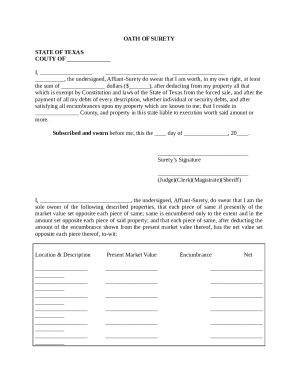

Completing the employer039s monthly return of form efficiently requires a systematic approach. Initially, gather all necessary information such as employee payroll records, current withholding rates, and any changes in employment status or tax regulations. It is essential to ensure that all details are accurate and up to date.

Next, begin filling out the form by entering employer data, ensuring that the business name and taxpayer registration number are correct. For each employee, carefully input financial figures, including gross wages, withholdings, and contributions. It is essential to comply with all legal requirements; hence, double-check for consistency across figures. Avoid common mistakes such as misreporting withholdings or failing to include necessary documentation, as these can lead to fines or audits.

Editing and managing your monthly return with pdfFiller

pdfFiller provides a unique platform to edit and manage the employer039s monthly return of form. With seamless editing features, users can easily modify text and figures directly within the document. If you need to adjust contributions or update employee information, pdfFiller allows you to do so without hassle. Additionally, the platform offers capabilities to add or delete fields, thus providing complete control over the document's layout and content.

Collaborative tools further enhance user experience, allowing team members to share the form seamlessly for real-time editing and feedback. This is particularly beneficial for HR departments or finance teams, who often need to relay information or confirm figures together. By leveraging pdfFiller's cloud-based solutions, users not only improve their document submission process but also maintain a record of changes made over time, increasing visibility for all stakeholders.

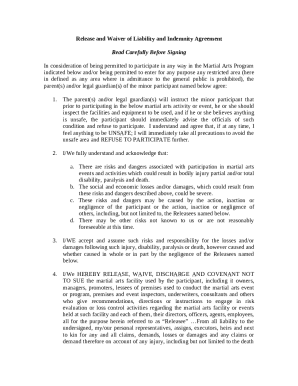

Signing the monthly return form electronically

Employers can leverage electronic signatures when submitting the employer039s monthly return of form, which brings several advantages. Electronic signing not only streamlines the signing process but also enhances security and authentication. With pdfFiller, adding signatures is straightforward—users can either draw their signature or upload an existing one, ensuring that the document meets all compliance standards.

Legal compliance is a significant aspect of eSigning; electronic signatures are approved in many jurisdictions and hold the same legal weight as traditional signatures. By adopting a digital approach, employers can reduce paperwork, expedite the submission process, and keep their records organized in a secure cloud environment, which directly impacts their operational efficiency.

Filing your monthly return

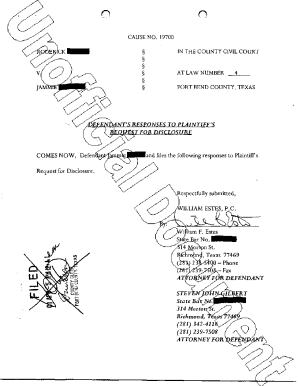

Filing the employer039s monthly return of form involves an understanding of submission procedures and deadlines. Depending on your local jurisdiction, the submission process might vary; hence, it's vital to check local regulations for specific filing requirements. Typically, forms can be submitted online or delivered physically to tax offices. Employers must keep track of which submission method they choose and ensure that they comply with relevant deadlines to avoid penalties.

Once submitted, employers should track their submission status, ensuring they receive confirmation of receipt from tax authorities. If there are mistakes found post-submission, there are usually procedures in place for amendments; however, timing is crucial as certain jurisdictions might impose fines for late changes. Understanding how to navigate these processes can greatly assist employers in staying compliant.

FAQs about the employer039s monthly return

Employers often have questions regarding the employer039s monthly return of form, particularly concerning its completion, filing, and deadlines. One common inquiry includes how to accurately calculate employee contributions; employers should focus on withholding percentages and any state-specific deductions that might apply. Another frequent question revolves around the penalties for late submissions or inaccuracies, which can vary by region, emphasizing the importance of timely and precise reporting.

Others may seek clarification on how to handle employee discrepancies; it’s advisable to maintain open communication with employees about their contributions and regularly update records to minimize issues during reporting. Having a robust system in place for frequently asked questions can aid in alleviating confusion, ensuring that all involved understand their responsibilities and the time-sensitive nature of the monthly return.

Interactive tools and resources

To assist users in navigating the complexities of the employer039s monthly return, various interactive tools are available. Template downloads can be readily accessed to provide a foundational structure for filling out the form. Additionally, calculators are available for determining accurate deductions and contributions based on the latest tax regulations, benefiting employers who may struggle with such calculations.

Moreover, pdfFiller offers links to relevant legislation and regulations to help users stay compliant with continually changing tax laws. These resources are invaluable for businesses, ensuring that they have the necessary tools to manage their documentation effectively and efficiently.

Best practices for maintaining accurate records

Maintaining accurate records is pivotal for a successful submission of the employer039s monthly return. Organizing employee files effectively helps ensure that all documentation is readily accessible. This process also includes establishing protocols for regularly updating employee details, such as changes in wages or benefits, to reflect accurate information on the return.

Utilizing pdfFiller’s document management system enhances organization, allowing users to store, retrieve, and collaborate on files seamlessly. With cloud configuration, this system not only guarantees easy access but also enhances security, ensuring sensitive employer and employee information is protected. Consistency and accuracy in recordkeeping will directly influence the ease with which the monthly return can be produced and submitted.

Additional support and guidance

For further support regarding the employer039s monthly return of form, accessing customer support services is beneficial. pdfFiller provides various channels, including chat support and email, for quick assistance. Additionally, community forums present opportunities to connect with other users facing similar challenges, allowing businesses to share solutions and best practices.

Moreover, tutorials and webinars are available on the pdfFiller platform, providing in-depth insights for users seeking to enhance their understanding of document processes. Whether you're a small business owner or part of a larger team, these resources can significantly streamline your experience with the employer039s monthly return, allowing for a smoother operation overall.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find employer039s monthly return of?

How do I make edits in employer039s monthly return of without leaving Chrome?

How do I edit employer039s monthly return of straight from my smartphone?

What is employer039s monthly return of?

Who is required to file employer039s monthly return of?

How to fill out employer039s monthly return of?

What is the purpose of employer039s monthly return of?

What information must be reported on employer039s monthly return of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.