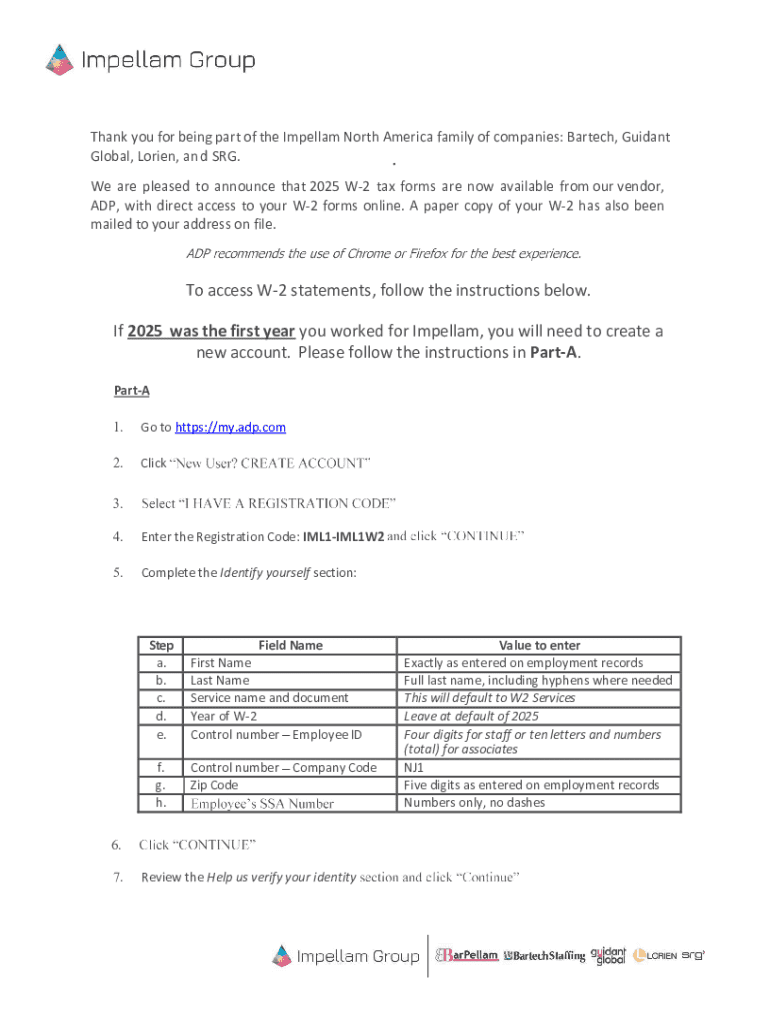

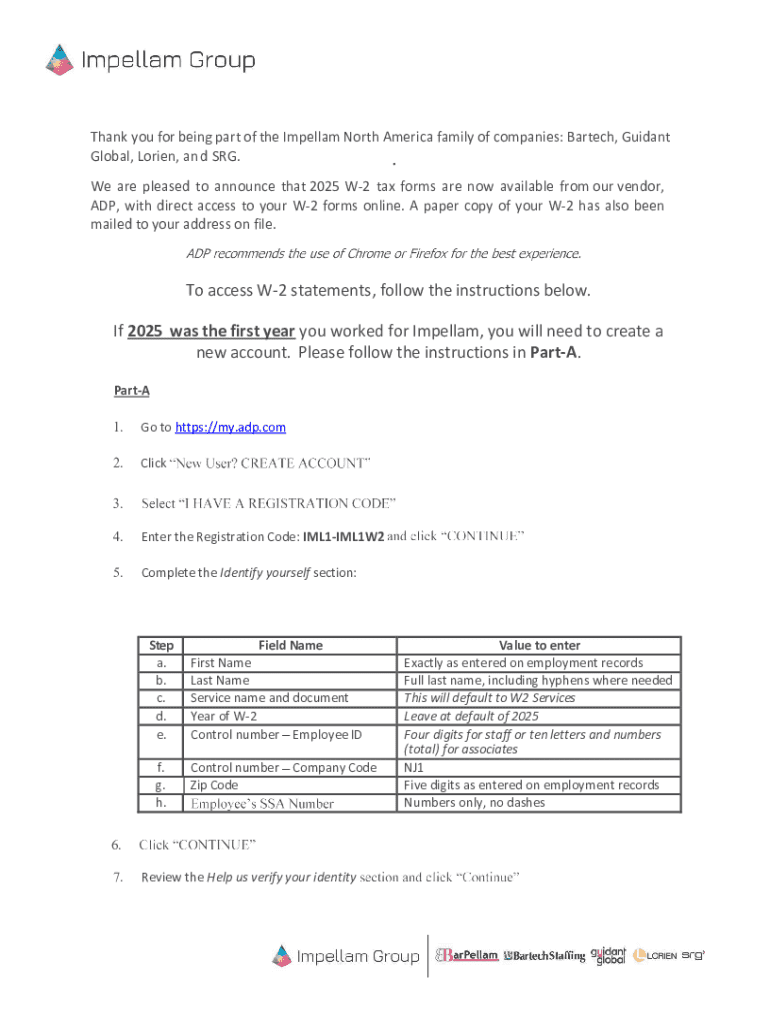

Get the free To access W-2 statements, follow the instructions below. If ...

Get, Create, Make and Sign to access w-2 statements

Editing to access w-2 statements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out to access w-2 statements

How to fill out to access w-2 statements

Who needs to access w-2 statements?

How-to Guide: Accessing W-2 Statements Form

Understanding W-2 statements

A W-2 form is a tax document that employers are required to provide to their employees by January 31st each year. This form outlines the wages earned and the taxes withheld over the previous calendar year. The key purpose of the W-2 is to report your annual income to both the employee and the IRS, ensuring accurate tax returns and filings.

Typically, a W-2 includes crucial information such as your gross income, federal income taxes withheld, Social Security wages, Medicare wages, and various deductions. Understanding what the W-2 entails is essential for taxpayers to ensure they report their income accurately when filing taxes.

Why you might need access to past W-2 forms

Accessing past W-2 forms is essential for a variety of reasons. The most common is for filing taxes. If you have not been receiving your W-2 forms for multiple years, it’s crucial to get these documents to ensure you are correctly reporting your income and tax obligations.

Additionally, you may need past W-2s if you are applying for loans or mortgages, as lenders often request proof of income. Employment verification is another reason; past employers may require W-2 statements when verifying your employment history for new job applications.

Steps to access your W-2 statements from your employer

The first step in accessing your W-2 form is understanding your employer's policy regarding W-2 distribution. Some employers may provide electronic copies through an online portal, while others may still use paper mail. Reviewing company policy will help set your expectations on how to retrieve the documents.

Once you understand your employer's process, you might need to formally request a copy of your W-2 form. This can typically be done through a simple email or written letter directed to your HR department or payroll administrator. Be specific in your request and include key information such as your full name, Social Security number, employment dates, and any discrepancies you’ve experienced if applicable.

Accessing your W-2 statements from the IRS

If your employer is unable to provide past W-2 forms, you can obtain copies directly from the IRS. You will need to provide your Social Security number, date of birth, address, and the tax year for which you’re requesting the W-2 form. The IRS offers two main methods to access your W-2 copies: online and via paper request.

To make an online request, you can use the IRS’s online tool. This process requires you to create an IRS account if you don’t already have one. Make sure to follow each step carefully. Alternatively, you can fill out Form 4506, a paper form that allows you to request tax documents by mail, including W-2 forms from specific years.

Requesting IRS transcripts for verification

Requesting an IRS transcript can sometimes serve as a substitute for a W-2 form. An IRS transcript provides a summary of your tax return, including all relevant income information reported on various forms, including the W-2. This option is useful if you cannot access your W-2 form for a particular year.

You can request a transcript either online through the IRS website or by calling their toll-free number. Once your identity is verified, you can choose to receive the transcript electronically or by mail. Transcripts are advantageous because they are accepted by many institutions requiring proof of income, though they do not replace the W-2 form itself.

Alternative methods to access past W-2 forms

If you used online tax software in previous years, accessing your W-2 forms may be as simple as logging into your account on that platform. Services like TurboTax or H&R Block often store W-2 information for users, allowing for easy retrieval at tax time. If you have a previous account, check your history for any W-2s associated with it.

Additionally, if your employer is unresponsive or has closed operations, contacting the Social Security Administration (SSA) may be a viable solution. The SSA maintains records of wages reported by employers and can provide copies of W-2 forms upon request.

Common challenges and solutions

One of the major frustrations individuals face when attempting to access W-2 forms is the issue of missing documents. If you’ve never received your W-2, your first step should be to contact your employer directly. If they cannot assist you or no longer exist, proceed with requesting a copy from the IRS or SSA..

If you encounter discrepancies with your W-2 information, document these issues and bring them to your employer's attention as soon as possible. Also, ensure your IRS tax return is accurate while resolving the issue with your employer. Timely follow-up plays a crucial role; keep records of your communications to ensure accountability and reduce delays.

Verifying the information on your W-2 form

Understanding the information reported on your W-2 is vital. The W-2 includes multiple boxes, each designated for specific types of income and withholding information. Reviewing the details in each box will help ensure everything is recorded properly, representing accurate income and tax withholdings.

It is also advisable to cross-reference the details on your W-2 with your pay stubs and tax returns. This process will highlight any discrepancies and allow you to address them before filing your tax returns. Keeping these documents organized can save a lot of stress during tax season.

Managing your W-2s for future use

Once you have obtained your W-2 forms, effective management of these documents is critical for your financial records. Keeping digital copies secured on a platform like pdfFiller helps ensure you can retrieve them easily when needed. You can upload your W-2 forms to organize them efficiently and access them from any device.

Utilizing pdfFiller’s document management capabilities allows for seamless editing and signing of W-2 forms as necessary. Moreover, by collaborating with your financial advisors or team members, you can jointly manage tax documents, making preparation for tax season smooth and stress-free.

Frequently asked questions (FAQs)

Many individuals have questions when it comes to accessing W-2 forms. Common concerns include how to retrieve forms if the employer no longer exists, the timeline for receiving W-2 copies from the IRS, and understanding the differences between W-2 forms and IRS transcripts. Addressing these questions is crucial as it allows taxpayers to prepare well ahead of tax deadlines.

When retrieving past W-2 forms, persistence is key. Always follow up on requests, ensure you’re clear on what you need, and keep records of all communications. Familiarizing yourself with these processes will reduce confusion and ensure you can efficiently manage your tax records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit to access w-2 statements online?

How do I edit to access w-2 statements in Chrome?

How can I fill out to access w-2 statements on an iOS device?

What is to access w-2 statements?

Who is required to file to access w-2 statements?

How to fill out to access w-2 statements?

What is the purpose of to access w-2 statements?

What information must be reported on to access w-2 statements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.