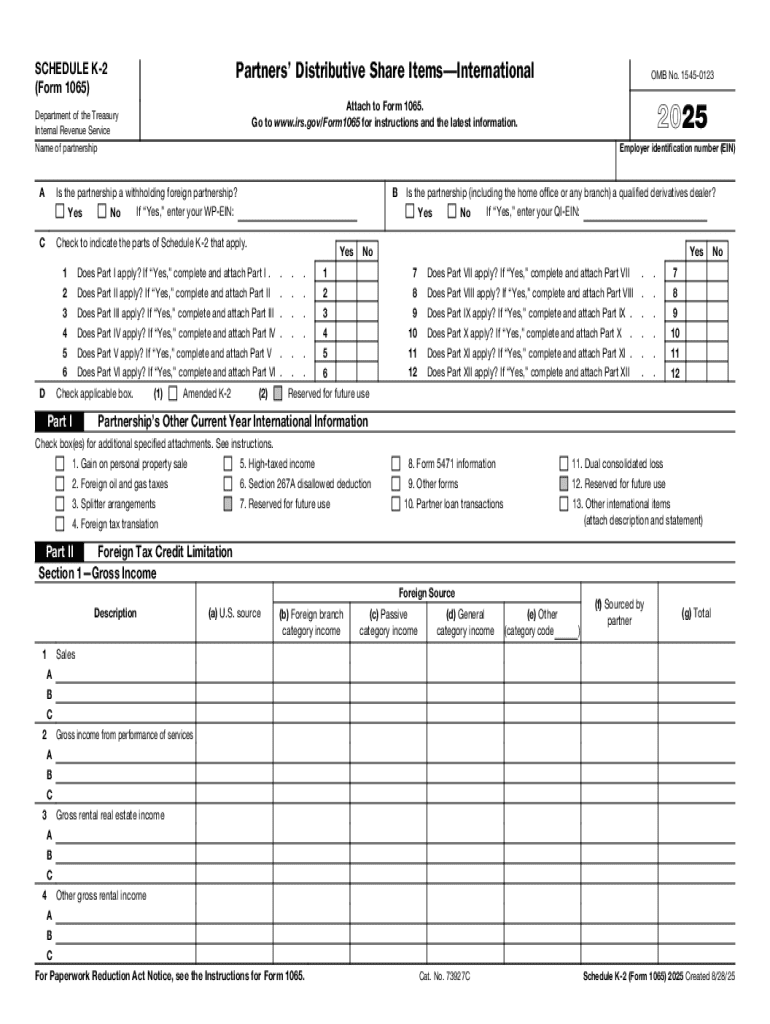

IRS 1065 - Schedule K-2 2025-2026 free printable template

Get, Create, Make and Sign IRS 1065 - Schedule K-2

Editing IRS 1065 - Schedule K-2 online

Uncompromising security for your PDF editing and eSignature needs

IRS 1065 - Schedule K-2 Form Versions

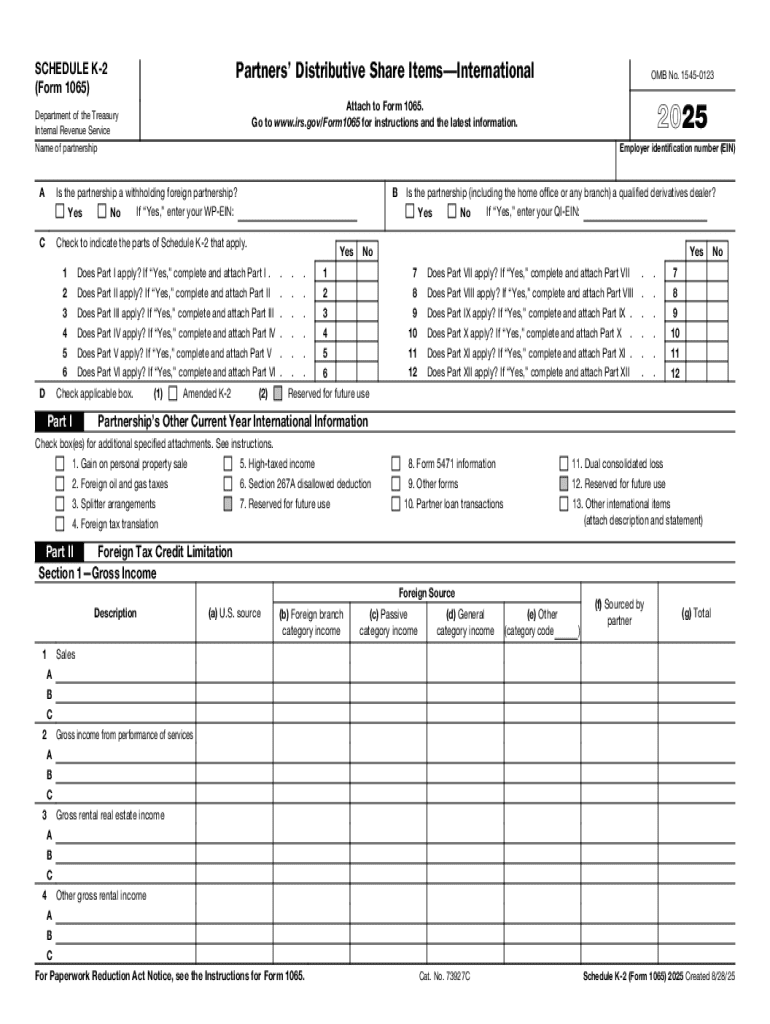

How to fill out IRS 1065 - Schedule K-2

How to fill out 2025 schedule k-2 form

Who needs 2025 schedule k-2 form?

Understanding the 2025 Schedule K-2 Form: A Comprehensive Guide

Overview of Schedule K-2

Schedule K-2 is an essential component in the tax filing process for partnerships and S corporations. This form provides vital information regarding international transactions, foreign income, and other relevant tax data. While Schedule K-1 reports a partner's or shareholder's share of income, deductions, and credits, Schedule K-2 enhances transparency by detailing this information in a nuanced manner.

This form is vital for ensuring compliance with tax laws, particularly as international regulations continue to evolve. Understanding Schedule K-2 not only helps in accurate reporting but also mitigates risks of non-compliance and potential penalties.

Detailed breakdown of the 2025 Schedule K-2 form

The 2025 Schedule K-2 is structured into distinct sections that focus on different aspects of a partner’s or shareholder's tax situation. Each part has specific requirements and significance.

Updates to the Schedule K-2 for 2025 reflect changes in tax laws and IRS guidelines. Understanding these changes is imperative to ensure that the form is filled out correctly and to avoid costly errors.

Step-by-step guide to filling out the Schedule K-2

Filling out the 2025 Schedule K-2 requires methodical preparation. Start by gathering necessary documentation, such as financial statements, prior year tax returns, and related forms.

When completing the form, pay close attention to entering financial data accurately. Each section should be filled out meticulously, and using tools like pdfFiller can significantly simplify data entry, allowing for easier document management and collaboration.

Common pitfalls include incorrectly reported income or misallocated deductions. Double-checking figures and having multiple eyes on the submission can help mitigate these issues. Remember, accuracy is paramount in tax reporting.

Managing and submitting your Schedule K-2

Deciding whether to file electronically or on paper can impact the efficiency of your submission. Electronic filing offers significant advantages, including faster processing times and reduced chances of errors.

Best practices for successful filing include adhering to deadlines and ensuring all required information is included. Utilize tracking features available in platforms like pdfFiller to monitor the status of your submissions effectively.

Understanding related forms and schedules

Filing Schedule K-3 could also be necessary depending on a partnership’s activities. Schedule K-3 provides detailed information on the partner's distributive share of income, which is instrumental in combined reports for complex tax situations.

Comprehensive reporting is crucial for compliance and minimizing tax liabilities. Regular consultations with a tax advisor can help in navigating any complexities involved.

Interactive tools and resources

Utilizing tools like pdfFiller for form management can simplify the overall process of filling out, signing, and collaborating on documents. These features help enhance the user experience, ensuring that submitting the Schedule K-2 is smooth and stress-free.

Access to pdfFiller’s knowledge base can provide invaluable support, with FAQs and tutorials specifically tailored to the nuances of Schedule K-2 filing. Engaging with the community can also provide shared experiences and advice that could enhance your understanding.

Advanced tax planning and considerations

Strategic tax planning using Schedule K-2 can help partnerships minimize tax liabilities. Approaches vary but often include timing income and deductions strategically and maximizing allowable credits. Engaging in early planning can yield significant tax benefits in the long run.

Being proactive about understanding upcoming changes in tax laws will not only prepare you for future filings but ensures compliance with evolving regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 1065 - Schedule K-2 in Gmail?

How do I execute IRS 1065 - Schedule K-2 online?

Can I create an electronic signature for the IRS 1065 - Schedule K-2 in Chrome?

What is 2025 schedule k-2 form?

Who is required to file 2025 schedule k-2 form?

How to fill out 2025 schedule k-2 form?

What is the purpose of 2025 schedule k-2 form?

What information must be reported on 2025 schedule k-2 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.