IRS 4720 2025-2026 free printable template

Get, Create, Make and Sign IRS 4720

How to edit IRS 4720 online

Uncompromising security for your PDF editing and eSignature needs

IRS 4720 Form Versions

How to fill out IRS 4720

How to fill out 2025 form 4720

Who needs 2025 form 4720?

A comprehensive guide to the 2025 Form 4720 for foundations and managers

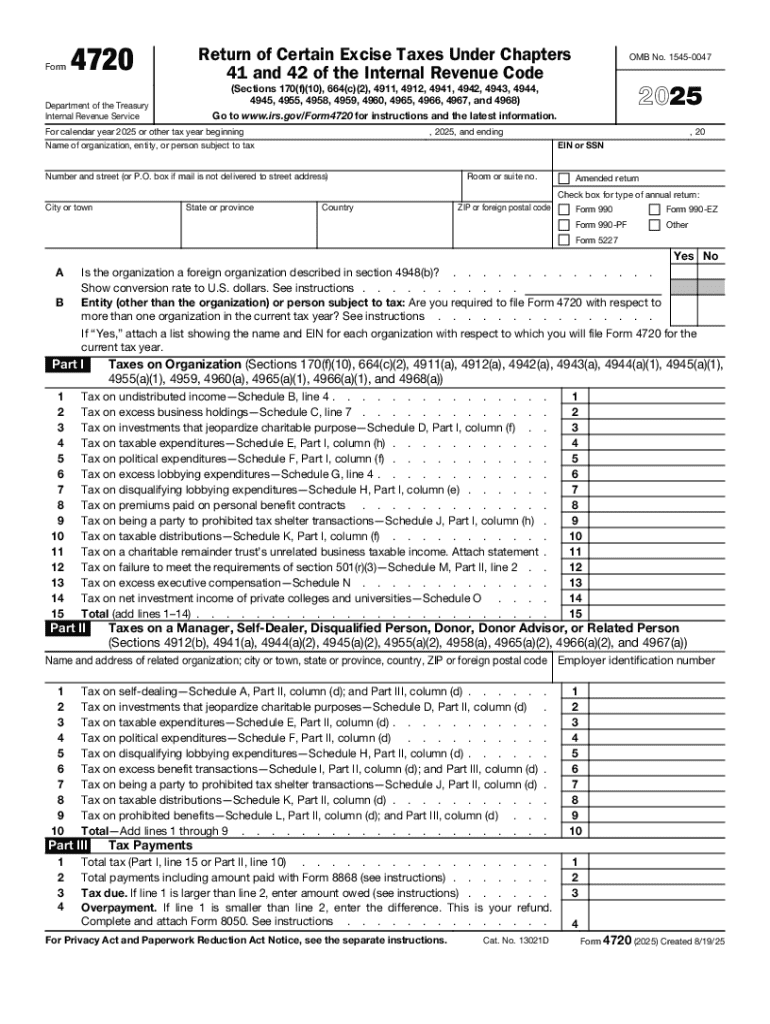

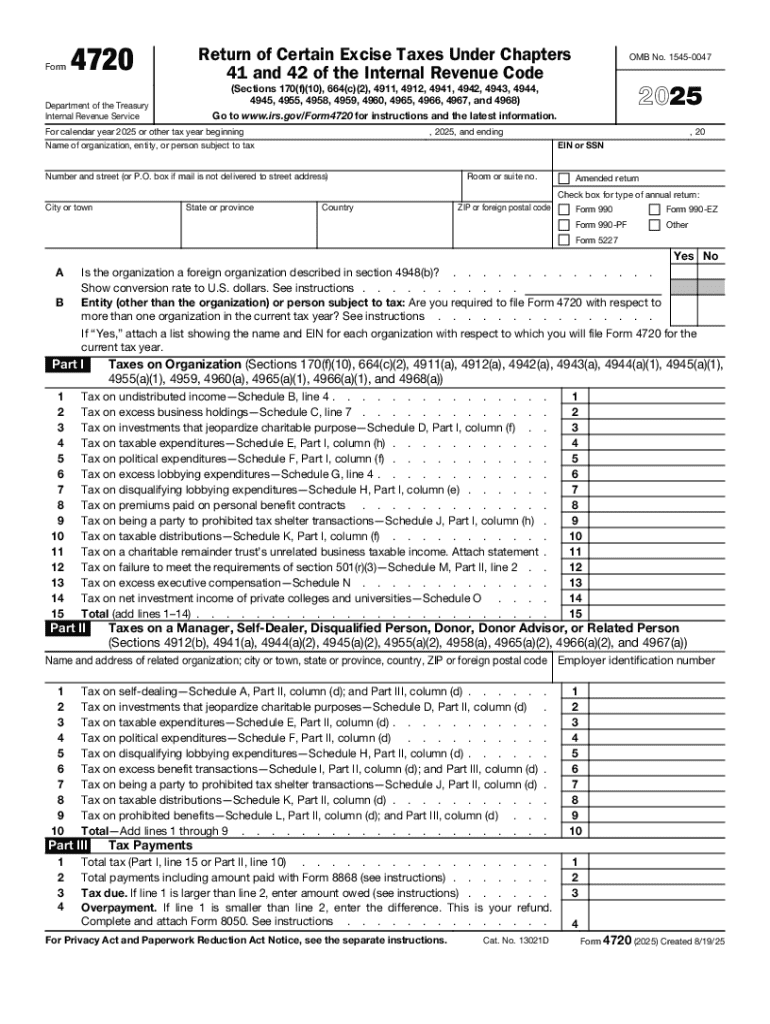

Overview of Form 4720 for 2025

The 2025 Form 4720 is a critical document required by private foundations and certain charitable organizations for tax reporting purposes. This form is used primarily to report excise taxes related to excess benefit transactions and improper distributions. Its primary purpose is to ensure compliance with IRS regulations, safeguarding the integrity of charitable funds while promoting transparency and accountability within the sector.

Understanding the significance of Form 4720 is essential for both foundations and tax managers. It plays a pivotal role in assessing tax liabilities associated with various transactions, maintaining organizational compliance, and avoiding potential penalties. By accurately completing and filing Form 4720, entities ensure that they adhere to federal requirements that govern charitable organizations, thus protecting their tax-exempt status.

Understanding who must file Form 4720 in 2025

In 2025, the following entities are mandated to submit Form 4720: Private foundations are generally required to file this form, particularly if they have engaged in any taxable activities or have had improper distributions during the year. Certain charitable organizations that do not qualify as exempt under 501(c)(3) may also be required to file Form 4720 if they meet specific criteria.

Exceptions to this requirement exist. For example, organizations that are below a certain annual gross receipts threshold may not need to file Form 4720. Additionally, if a foundation operates solely as an educational institution or is classified as a public charity, it might be exempt from this filing obligation. Understanding these exceptions can save organizations from unnecessary filing while ensuring compliance with applicable laws.

Key components of Form 4720

Form 4720 is divided into several distinct parts that address different aspects of tax obligations. Part I focuses on the identification of the filing entity, ensuring that the IRS has accurate information regarding the organization. This section requires basic information such as the name, address, and Employer Identification Number (EIN).

Part II addresses excise taxes on improper distributions. This section is crucial for organizations that may have made transactions deemed excessive or inappropriate. Part III relates to taxes based on investment income, requiring organizations to disclose any investment earnings and associated taxes due. Each component serves a unique function, ultimately contributing to the organization's overall tax responsibility.

Detailed instructions for filling out Form 4720

Completing Form 4720 requires careful attention to detail to avoid common errors that could lead to penalties or audits. The first step involves gathering all necessary financial records, including prior filings, current financial statements, and documentation of any transactions that may impact excise taxes.

A step-by-step approach to filling out each section is advisable. Start with Part I by entering the organization's complete information accurately. Move to Part II, where detailed accounts of any improper distributions should be disclosed. In Part III, carefully report the investment income, ensuring accurate figures are reported to avoid discrepancies. Common errors include incorrect EINs, misplaced decimal points in numerical entries, and failing to attach required schedules. Verification before submission can greatly reduce the risk of these mistakes.

What taxes and schedules are related to Form 4720?

Form 4720 is closely associated with various excise taxes that foundations and other organizations may be liable for under specific circumstances. The primary taxes include those levied on improper benefits paid to managers or trustees and charges related to damages incurred from failing to distribute certain amounts of income. Understanding these taxes can assist organizations in managing their financial strategies effectively.

These schedules are critical because they contextualize the excise taxes calculated on Form 4720, enhancing the IRS's understanding of the organization's activities and ensuring that each entity is held accountable for its financial practices.

Important due dates for Form 4720 filing in 2025

Understanding the filing deadlines for Form 4720 in 2025 is crucial to avoid late penalties. Generally, organizations must file Form 4720 by the 15th day of the fifth month following the end of their tax year. For most organizations operating on a calendar year, this date falls on May 15, 2025. However, if this date falls on a weekend or a holiday, organizations will need to submit the form the following business day.

Failing to meet this deadline could result in significant penalties. Late filings may incur fines that accumulate daily until the form is submitted, creating a substantial financial burden for organizations already managing tight budgets. Hence, it’s beneficial to mark potential deadlines in advance and plan accordingly.

Extensions and planning windows

If more time is needed to prepare Form 4720, organizations can apply for an extension. Typically, an automatic six-month extension can be secured by filing Form 8868, which gives organizations additional time to gather necessary information and complete the filing accurately. This extension can be particularly helpful for organizations facing complexities in financial reporting or above-mentioned concerns regarding improper distributions.

Best practices for tax planning encourage organizations to start their preparation process early. Regularly reviewing financial activities throughout the year helps in identifying potential issues that may arise during the filing process. Furthermore, consulting with tax professionals can provide invaluable insights into effective strategies that ensure compliance and enhance financial management.

Interactive tools for managing Form 4720

Utilizing interactive tools can significantly streamline the process of completing Form 4720. Services like pdfFiller offer robust solutions that allow users to fill, edit, and eSign the form with ease. The platform is designed for real-time collaboration, allowing teams to work together seamlessly, irrespective of their physical locations.

The document management options provided by pdfFiller also ensure that users maintain organized records of all filings. Features such as cloud storage enhance accessibility, making it simpler to retrieve documents when needed. In addition, pdfFiller caters to frequently asked questions about the Form 4720, aiding users in navigating potential uncertainties with ease.

Case studies: success stories with Form 4720

Examining case studies can provide valuable insights into how various foundations effectively navigate the complexities of Form 4720. For instance, one private foundation employed a proactive approach to ensure compliance. By regularly reviewing their financial practices and maintaining detailed records of distributions and investments, they easily completed Form 4720 without any discrepancies. This diligence not only spared them from penalties but also enhanced their credibility among stakeholders.

Conversely, organizations that neglected regular oversight often made costly errors on their filings, resulting in audits and subsequent penalties. These lessons underline the importance of strict adherence to compliance standards and continuous financial monitoring, demonstrating that successful management of Form 4720 is achievable with the right strategies in place.

Frequently asked questions (FAQs) about Form 4720

A common concern regarding the filing of Form 4720 is the fear of potential penalties for errors or late submissions. To mitigate this, organizations are encouraged to stay informed about deadlines and required documentation. Additionally, questions often arise around who qualifies as a manager for the purposes of excise taxation, emphasizing the need for clear definitions and guidelines. Resources like the IRS website and tax professionals can assist in clarifying these concerns, providing further guidance on compliance.

Furthermore, there are specific inquiries about the implications of improper distributions on the organization's tax status. Addressing such concerns can help foundations ensure better compliance and avoid needless complications, making it essential to have knowledgeable resources available to them.

Navigating Form 4720 with confidence

Successfully managing Form 4720 not only ensures compliance but also builds trust with stakeholders involved in the organization’s mission. By leveraging the available tools and resources, foundations can navigate this complex landscape with greater ease. It is vital for organizations to educate their teams regarding filing requirements and make use of collaborative software, such as pdfFiller, to enhance the efficiency of their processes.

Ultimately, organizations should view Form 4720 not as a burden but as a pathway to maintaining their tax-exempt status and fulfilling their charitable mission. Employing sound financial practices and keeping up to date with regulations enables organizations to thrive, ensuring they can focus on making a positive impact in their communities.

People Also Ask about

What is an example of an excise tax?

What is excise tax in Texas?

What is a US 4720 form?

What is the difference between tax and excise tax?

What is an excise tax What is the purpose of it?

Who pays excise tax in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IRS 4720 online?

Can I create an electronic signature for signing my IRS 4720 in Gmail?

How do I edit IRS 4720 on an Android device?

What is 2025 form 4720?

Who is required to file 2025 form 4720?

How to fill out 2025 form 4720?

What is the purpose of 2025 form 4720?

What information must be reported on 2025 form 4720?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.