IRS Instructions Schedule A (990 or 990-EZ) 2025-2026 free printable template

Get, Create, Make and Sign IRS Instructions Schedule A 990 or 990-EZ

How to edit IRS Instructions Schedule A 990 or 990-EZ online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions Schedule A (990 or 990-EZ) Form Versions

How to fill out IRS Instructions Schedule A 990 or 990-EZ

How to fill out 2025 instructions for schedule

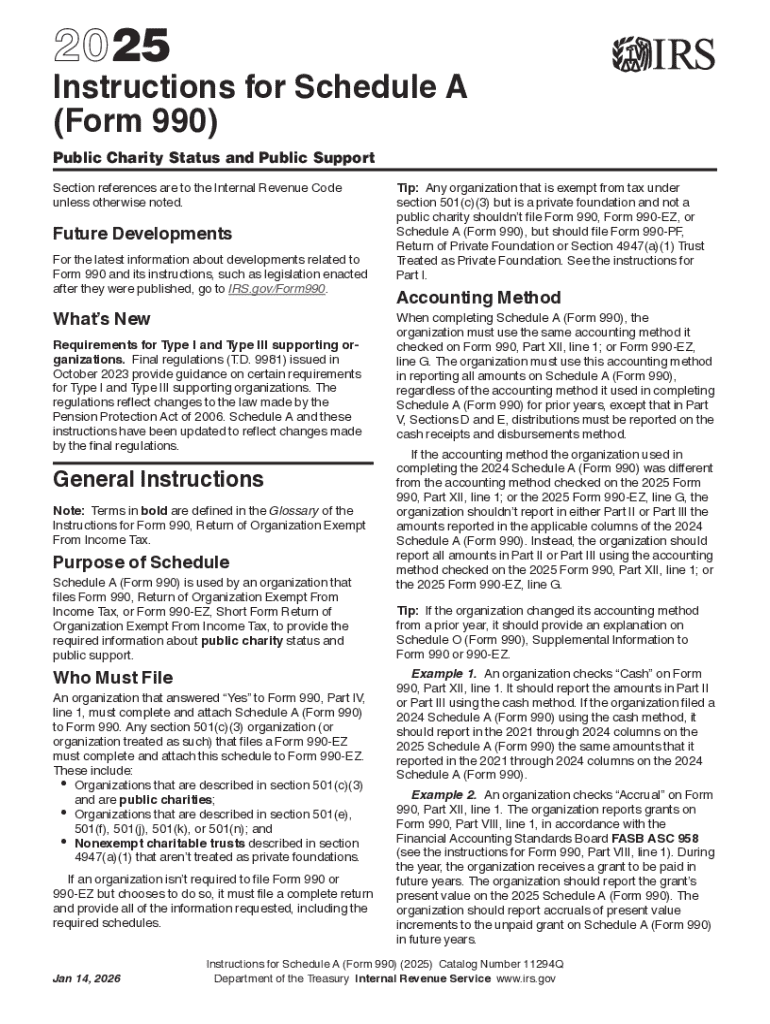

Who needs 2025 instructions for schedule?

2025 Instructions for Schedule Form

Overview of the 2025 schedule form

The 2025 schedule form is a crucial document designed for individuals and businesses to report their financial activities for the tax year. It serves a dual purpose of ensuring compliance with tax regulations and enabling taxpayers to accurately assess their tax liabilities. Completing this form accurately is not just good practice; it’s essential for avoiding penalties and ensuring eligibility for various deductions and credits.

An accurate completion of the schedule form can directly affect an individual or company’s filing status, which is why understanding its requirements is critical. This year's version introduces key changes that reflect the evolving tax landscape and the need for modernization in documenting financial activities.

What’s new in 2025

The 2025 schedule form has undergone several major updates aimed at simplifying the filing process while enhancing the precision of reported data. Major updates include the introduction of new sections designed to capture specific financial details that were previously overlooked.

This year sees revised filing deadlines that align with new federal regulations, requiring taxpayers to submit their forms earlier than in previous years. These alterations not only ensure compliance with up-to-date tax laws but also provide taxpayers with opportunities for benefits that were not available before.

General information about the schedule form

Registering for the 2025 schedule form requires adherence to specific eligibility criteria, which can vary based on an individual’s or company’s financial situation. For instance, individuals with income from multiple sources, contractors, and those involved in partnerships will require particular attention when preparing their documentation.

Additionally, knowledge about related forms and the necessary documentation is crucial to ensuring a smooth filing process. It is common for individuals to overlook essential supporting documents, which can lead to inaccurate submissions or delays.

Step-by-step instructions for completing the schedule form

Completing the 2025 schedule form can be simplified into a systematic approach that ensures thoroughness and accuracy. This step-by-step guidance begins with gathering necessary personal and financial data to support all entries.

In Step 1, gather essential documents, which include tax returns from previous years, W-2s, 1099 forms, and any other financial statements relevant to your income reporting.

eSigning and submitting your schedule form

Utilizing electronic signatures (eSigning) is increasingly favored for its convenience and efficiency. The pdfFiller platform offers a streamlined process for eSigning, making it easier than ever to finalize your schedule form without the hassle of printing and mailing.

After preparing your document, you can utilize pdfFiller’s features to eSign your form quickly. It's crucial to follow the outlined submission methods closely, whether opting for a digital route or a physical mailing to ensure successful processing by tax authorities.

Collaboration and document management features

The contemporary approach to tax preparation often involves collaboration. pdfFiller enhances this by enabling users to share the schedule form with advisors or team members for collective input. This feature is particularly useful for businesses that may require input from various stakeholders.

With pdfFiller’s tracking changes and comments feature, maintaining version control becomes seamless, ensuring that everyone involved is on the same page and that the most current version is being used.

Troubleshooting common issues

The path to successfully completing and submitting the 2025 schedule form may not be devoid of challenges. It’s common for users to face issues ranging from misunderstandings about specific sections to technical glitches during e-filing.

Implementing a troubleshooting mindset is beneficial, and knowing where to seek help can save time and stress. pdfFiller provides a customer support resource, along with an extensive FAQ section to aid users in quickly resolving their issues.

Related forms and documents

Navigating tax documentation often requires familiarity with various related forms. Users should not only focus on the schedule form but also be aware of auxiliary forms such as the 1040 to ensure a comprehensive filing.

Access to historical versions of the schedule form can also be advantageous for understanding how requirements and shape have evolved over the years, providing insight into compliance and tax strategies.

Frequently asked questions (FAQs)

Understanding the intricate details of the 2025 schedule form can lead to many questions. From clarifying complex instructions to addressing concerns regarding filing status and compliance, having a clear set of FAQs is essential for users.

These FAQs help demystify common misconceptions, providing clarity on a range of topics such as eligibility, required documentation, and potential penalties for incorrect submissions.

Tools and resources provided by pdfFiller

pdfFiller’s platform is replete with interactive tools designed for seamless document management. These tools not only facilitate the creation of the 2025 schedule form but also enhance overall productivity through cloud-based solutions that enable remote access.

User testimonials bear witness to the effectiveness of pdfFiller’s offerings, showcasing how businesses and individuals have optimized their document creation processes through the platform.

Additional insights on document management

A fundamental aspect of the filing process is ensuring document security. pdfFiller prioritizes document security measures, establishing protocols that protect sensitive data throughout the filing phase.

Moreover, by enhancing compliance and encouraging effective record-keeping practices, pdfFiller’s solutions promote long-term benefits. These encompass aiding users in managing their documentation effectively, ultimately ensuring peace of mind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IRS Instructions Schedule A 990 or 990-EZ?

Can I create an electronic signature for the IRS Instructions Schedule A 990 or 990-EZ in Chrome?

How do I fill out IRS Instructions Schedule A 990 or 990-EZ using my mobile device?

What is 2025 instructions for schedule?

Who is required to file 2025 instructions for schedule?

How to fill out 2025 instructions for schedule?

What is the purpose of 2025 instructions for schedule?

What information must be reported on 2025 instructions for schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.