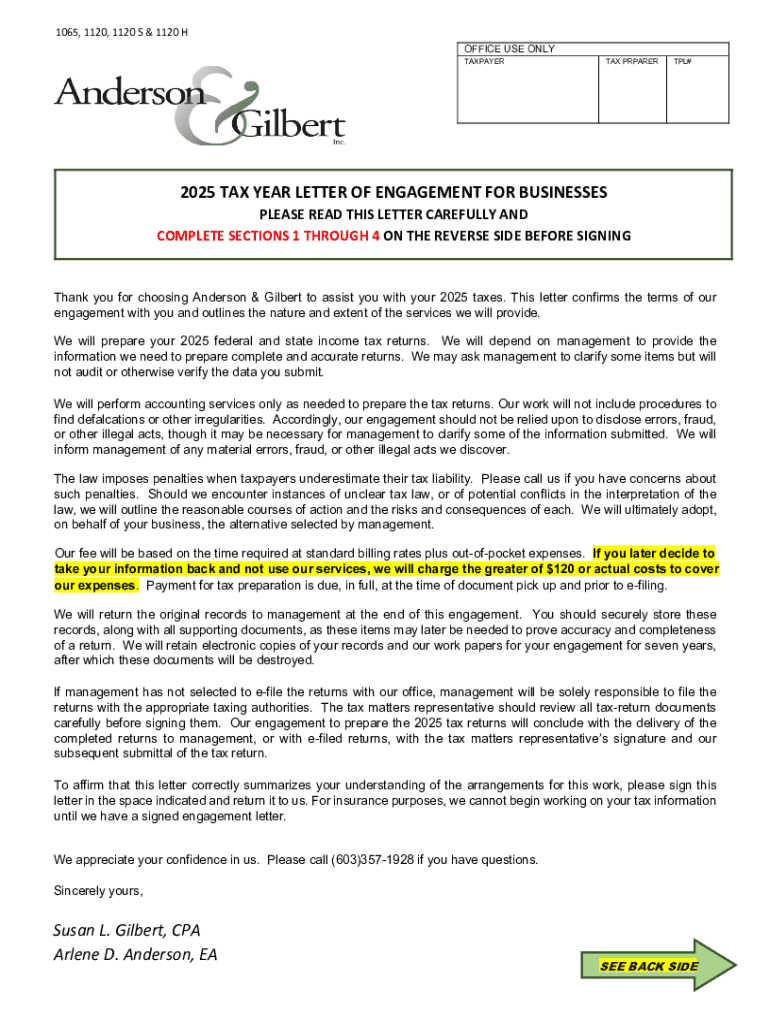

Get the free 2025 S Corporation Tax Return Engagement LetterForm ...

Get, Create, Make and Sign 2025 s corporation tax

How to edit 2025 s corporation tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 s corporation tax

How to fill out 2025 s corporation tax

Who needs 2025 s corporation tax?

Comprehensive Guide to the 2025 S Corporation Tax Form

Understanding the 2025 S Corporation Tax Form

The 2025 S Corporation Tax Form is a crucial document for businesses that have elected S corporation status. This specific form, often referred to as Form 1120-S, is designed to report the income, deductions, gains, losses, and other financial activities of the S corporation. Unlike traditional corporations, S corporations enjoy special tax advantages that allow income to pass through directly to shareholders, avoiding double taxation at the corporate level.

The S corporation structure is attractive to many businesses because it combines the liability protection of a corporation with the tax benefits of a partnership. By being classified as an S corporation, shareholders can avoid corporate tax on the income of the business while still enjoying protection from personal liability. This distinction sets S corporations apart from C corporations and LLCs, making it essential for owners to understand the implications of using the 2025 S Corporation Tax Form.

Key changes to the 2025 S Corporation Tax Form

As tax laws evolve, the 2025 S Corporation Tax Form reflects several key updates that impact its completion and submission. Significant changes in tax regulations can alter the landscape for S corporations, necessitating detailed attention to new guidelines provided by the IRS. For 2025, business owners should stay updated on any amendments to tax law that may directly affect their filing process and compliance requirements.

In 2025, business owners must pay close attention to new reporting requirements included in the S Corporation Tax Form. These may include additional sections to report specific business activities, as well as changes in existing deductions, credits, and distributions. Staying compliant with these new requirements not only ensures accurate reporting but also helps avoid scrutiny from the IRS, which has increased enforcement on accurate and thorough tax filings.

Step-by-step instructions for completing the 2025 S Corporation Tax Form

Completing the 2025 S Corporation Tax Form involves several steps, starting with the compilation of necessary documentation. Owners should gather essential documents such as financial statements for the year, previous tax returns, and relevant records of income and expenses. Keeping these documents organized ensures a smoother filing process. Utilizing cloud-based platforms like pdfFiller can significantly enhance the ease of access and editing needed for these files.

To complete the form, here is a line-by-line guide to assist you in filling it out accurately. Start with providing your business's basic information, followed by a comprehensive report of your corporation's income. Ensure that income sources—like sales revenue and dividends—are accurately documented. Next, detail your business expenses. Accurate reporting of salaries, rent, and interest paid is crucial for maximizing deductions. Don’t forget to report any distributions made to shareholders and to include required as well as signature and certification information.

Common mistakes to avoid when completing the form include misreporting income, overlooking expenses, and failing to understand the implications of distributions versus salaries. By securing accurate numbers and checking entries meticulously, you can avoid these pitfalls and ensure a correct filing.

Strategies for maximizing tax benefits as an S Corporation in 2025

Understanding reasonable compensation is critical for S corporation shareholders. The IRS has stipulated guidelines regarding what constitutes reasonable compensation, particularly for active shareholders who also work within the business. A common pitfall is underpaying oneself in wages to avoid taxation, which can attract scrutiny from the IRS. Thus, it’s beneficial to align compensation with industry standards and individual contributions to the corporation.

Advanced tax planning techniques can also help S corporations maximize their tax benefits. For example, exploring tax credits specifically available to S corporations can yield significant savings. Additionally, understanding the implications of taking distributions as dividends versus salaries can shape the financial strategy of the business, influencing tax obligations and cash flow management. Consult tax professionals for tailored strategies that fit within the legal structure of S corporations.

Managing your 2025 S Corporation Tax Filing with pdfFiller

Using pdfFiller to manage your 2025 S Corporation Tax Form can provide distinct advantages. This cloud-based platform simplifies the process of filling out, editing, and signing tax forms electronically, ensuring a streamlined approach to tax management. Alleviating the complications often associated with paper forms not only saves time but also enhances accuracy in data entry, which is crucial for successful tax reporting.

Navigating pdfFiller is straightforward. Users can fill out fields, add signatures, and share documents for collaboration seamlessly. Team-based functionalities allow multiple stakeholders to contribute to the tax preparation process concurrently, making it ideal for businesses where teamwork is essential in managing finances. The platform affords easy access from anywhere, enabling users to work remotely with ease and efficiency.

Frequently asked questions (FAQs) about the 2025 S Corporation Tax Form

As business owners prepare to file the 2025 S Corporation Tax Form, numerous questions may arise. A pivotal concern is what happens if the filing deadline is missed. Penalties can accumulate quickly, stressing the importance of timely submission. Another common question deals with shareholder deductions: whether individuals can claim personal deductions on S Corp income—which is subject to unique tax treatment and shareholder roles.

Recordkeeping is essential for IRS verification. Business owners should retain all supporting documents for a period of at least three years, creating a robust audit trail. Lastly, if changes or errors are discovered post-filing, understanding the steps to amend a previously filed S Corp tax return is critical. The amendment process provides correction avenues but must be executed correctly to avoid complications.

The future of S corporations and tax compliance

With the landscape of tax compliance always shifting, understanding trends in IRS enforcement can help S corporations prepare for future audits. The IRS has increasingly prioritized oversight of S corporations, making it essential for business owners to ensure their tax practices align with evolving regulations. As tax compliance becomes stricter, businesses may face more intense scrutiny, necessitating a proactive approach to tax filings.

Looking beyond 2025, anticipated tax law changes may further impact S corporations. Percolating proposals could introduce new regulations affecting revenue recognition, distribution disclosures, and overall tax compliance obligations. Staying informed and adjusting practices in anticipation of these changes will help S corporations not only remain compliant but potentially harness advantages that can be beneficial for growth and sustainability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 2025 s corporation tax electronically in Chrome?

How do I edit 2025 s corporation tax straight from my smartphone?

How do I complete 2025 s corporation tax on an Android device?

What is 2025 s corporation tax?

Who is required to file 2025 s corporation tax?

How to fill out 2025 s corporation tax?

What is the purpose of 2025 s corporation tax?

What information must be reported on 2025 s corporation tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.