Get the free 2024 Nonrefundable Individual Arizona Form Tax Credits ...

Get, Create, Make and Sign 2024 nonrefundable individual arizona

Editing 2024 nonrefundable individual arizona online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 nonrefundable individual arizona

How to fill out 2024 nonrefundable individual arizona

Who needs 2024 nonrefundable individual arizona?

A Comprehensive Guide to the 2024 Nonrefundable Individual Arizona Form

Understanding nonrefundable tax credits in Arizona

Nonrefundable tax credits are crucial for Arizona taxpayers, as they directly reduce tax liabilities but do not result in a refund if the credit exceeds the amount owed. This means that if your credits are greater than your tax bill, the excess will not be refunded. Instead, these credits offset your tax obligation, ensuring taxpayers only pay what is warranted based on their income and eligible deductions. Understanding this distinction can significantly influence your tax planning and filing strategies.

For the 2024 tax year, several nonrefundable individual tax credits are available, allowing taxpayers to reduce their taxable income based on various eligibility criteria. These include credits for dependents, low-income taxpayers, and specific charitable contributions among others. Knowing which credits you qualify for can lead to substantial tax savings and streamline your overall tax filing process.

Key components of the 2024 nonrefundable individual Arizona form

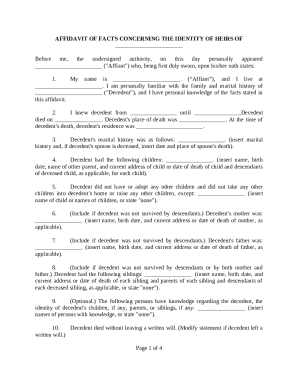

The 2024 Nonrefundable Individual Arizona Form requires specific personal and financial information that is foundational for accurate submission. Essential identification details include your full name, address, Social Security number, and filing status, among others. Furthermore, accurate income reporting is critical, as it affects your eligibility for various tax credits and ultimately influences your tax burden.

In addition to personal information, completing specific sections related to tax credits is vital. The form includes calculation sections for each credit, which require detailed information about your eligibility and the amount you need to claim. Be sure to gather any necessary documentation, such as W-2 forms, 1099s, and records of contributions to charities, before starting the form to simplify the completion process.

Step-by-step guide to completing your Arizona nonrefundable tax form

Completing the 2024 Nonrefundable Individual Arizona Form involves a series of key steps that need careful attention. Start by gathering all necessary documents, including income statements, previous tax returns, and records of deductible expenses. Having these documents handy allows for a more streamlined and efficient completion process.

Next, begin filling out the form with personal information such as your name and address. Make sure to review this section for accuracy before moving on. Step two involves reporting your total income earned throughout the year. In step three, calculate any applicable credits carefully; use calculators if necessary to ensure the accuracy of your claims. Finally, review the completed form for any errors and finalize it for submission, keeping a copy for your records.

Frequently asked questions about the 2024 nonrefundable individual Arizona form

Many taxpayers wonder if they should file this form. Essentially, anyone claiming nonrefundable credits needs to complete this form to accurately reflect their tax obligations. Nonrefundable credits can only reduce your tax liability, but can't result in refund amounts, which often leads to questions about how they affect your overall refund. It's crucial to understand that these credits only reduce what you owe to the state of Arizona; if your credits exceed the tax owed, the excess won’t generate a refund.

Tax situations can change throughout the year due to various factors, including job changes or qualifying for new credits. If you discover an error in your submission, you can amend your tax return using the appropriate forms. Addressing your circumstances promptly will ensure that your calculations remain accurate and reflective of your current situation, thus preventing issues when filing your taxes.

Resources for managing your 2024 tax filing

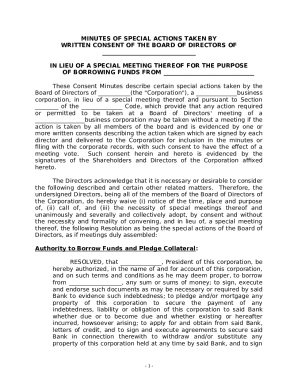

Managing your tax documents is essential for a smooth filing experience. Interactive tools and calculators are available to help taxpayers estimate potential credits and liabilities. Utilizing resources such as pdfFiller can significantly enhance your ability to calculate tax credits and efficiently manage all necessary documentation. These tools provide guidance tailored to your specific situation.

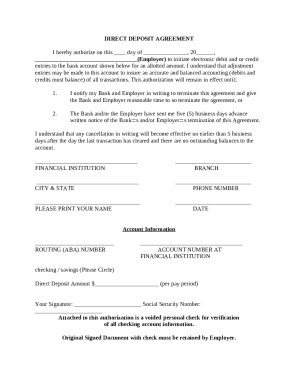

Proper document management solutions are also pivotal. By using platforms like pdfFiller, you can easily collaborate, edit documents, and track any changes made. This can be especially valuable when preparing potential amendments or verifying credit eligibility. Furthermore, eSignature solutions allow you to sign documents electronically, reducing time spent on physical paperwork and expediting your filing process.

Preparing for future tax updates

Tax legislation can change significantly each year. It's crucial to stay informed about any updates to tax credits and forms, especially those that can impact your next filing. Following official channels, such as the Arizona Department of Revenue's website, and signing up for email updates can help you keep track of relevant changes that may affect your tax credits.

Beyond legislative changes, year-round tax preparedness is essential for a hassle-free tax season. Keeping documents organized, maintaining records of income and deductions, and regularly reviewing any potential credits throughout the year will lessen the burden when tax time arrives. Building a system for tracking these items can make a remarkable difference in your overall experience.

Leveraging pdfFiller for your tax filing needs

pdfFiller stands out as an intuitive cloud-based platform that facilitates effortless document management and editing. Its features are specifically designed to enhance the user experience when preparing tax forms, including the 2024 nonrefundable individual Arizona form. Users benefit from robust editing tools, ensuring that they can accurately complete the form while managing any associated requirements throughout the process.

Real user success stories demonstrate how pdfFiller streamlines the tax filing journey. Many users have shared how the platform significantly reduced the time spent on form completion, while the collaboration features allowed for easy sharing with tax professionals for review. By embracing these solutions, users not only improve their efficiency but also reduce the stress associated with tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2024 nonrefundable individual arizona from Google Drive?

How do I execute 2024 nonrefundable individual arizona online?

Can I create an electronic signature for the 2024 nonrefundable individual arizona in Chrome?

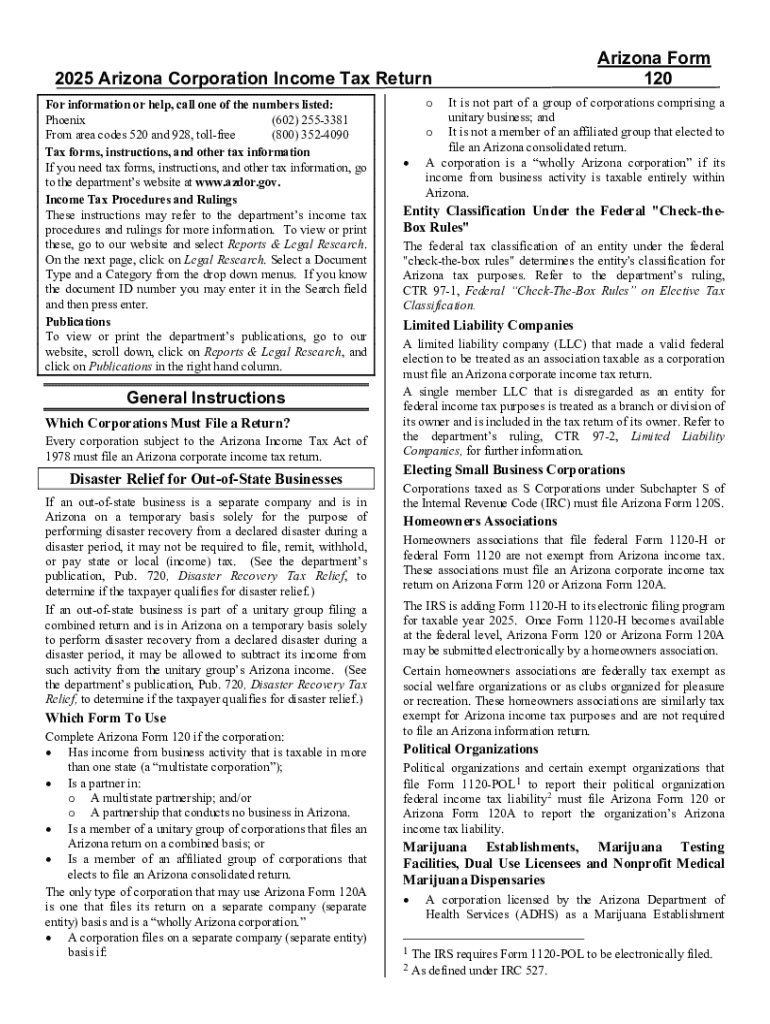

What is 2024 nonrefundable individual arizona?

Who is required to file 2024 nonrefundable individual arizona?

How to fill out 2024 nonrefundable individual arizona?

What is the purpose of 2024 nonrefundable individual arizona?

What information must be reported on 2024 nonrefundable individual arizona?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.