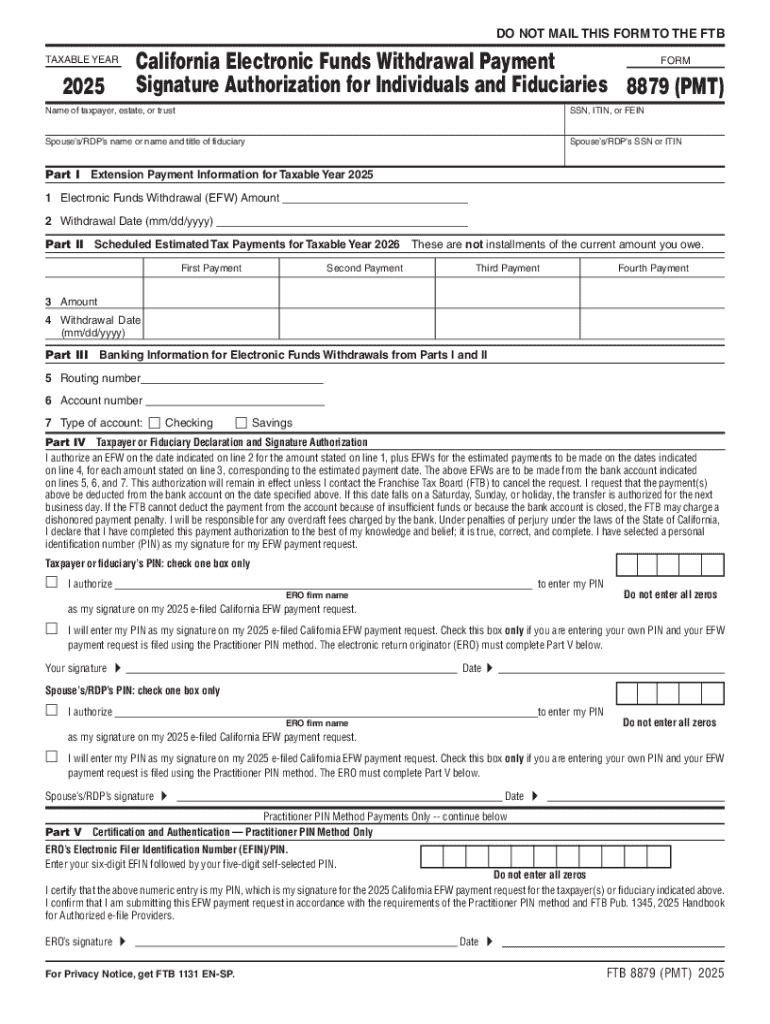

Get the free 2025 Form 8879 (PMT) California Electronic Funds Withdrawal Payment Signature Author...

Get, Create, Make and Sign 2025 form 8879 pmt

How to edit 2025 form 8879 pmt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form 8879 pmt

How to fill out 2025 form 8879 pmt

Who needs 2025 form 8879 pmt?

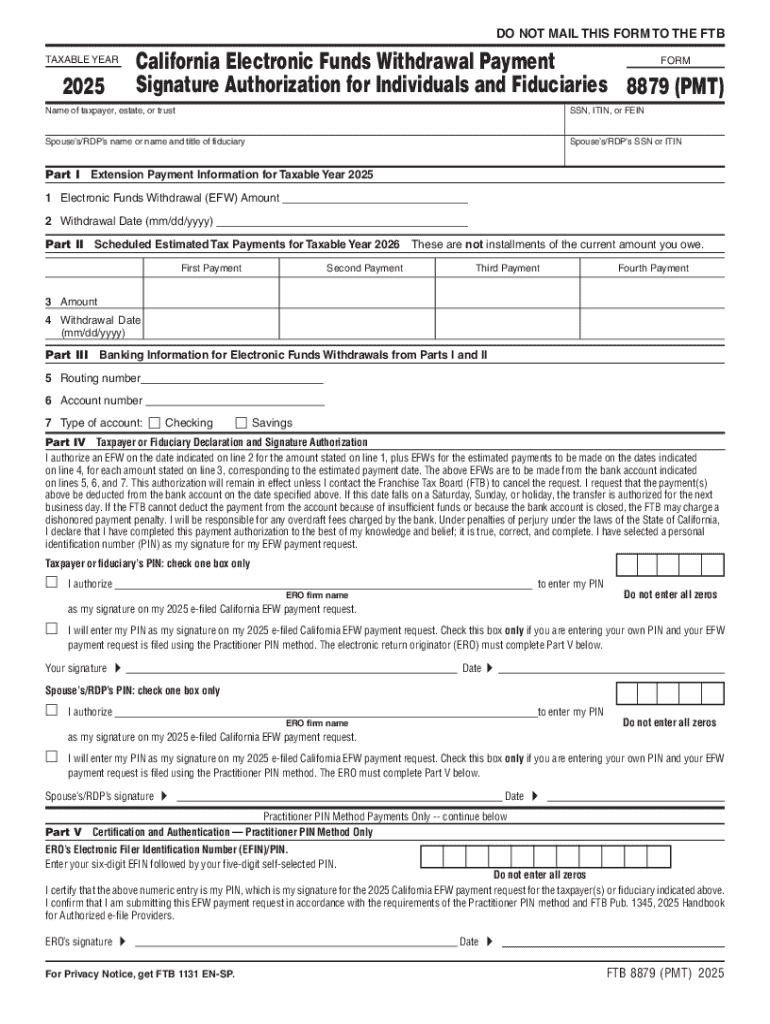

Understanding the 2025 Form 8879 PMT: A Comprehensive Guide

Overview of Form 8879 PMT

The 2025 form 8879 PMT is a crucial document that enables taxpayers to electronically sign their tax returns and authorize their tax preparers to submit them on their behalf. This electronic signature form plays a pivotal role in streamlining the tax filing process, ensuring both compliance and convenience. By allowing taxpayers to confirm their returns digitally, it reflects the evolving landscape of tax submission in an increasingly digital age.

Form 8879 PMT is essential for those who have engaged a tax professional to prepare their returns and who wish to file electronically. Its purpose is to provide the IRS with a formal endorsement of the tax return submitted, effectively linking the taxpayer’s identity with the return being filed. This not only enhances security but reduces the risk of errors associated with traditional paper submissions.

Who should use Form 8879 PMT?

The target audience for Form 8879 PMT primarily includes individual taxpayers who utilize the services of tax professionals, especially those opting for electronic filing. Furthermore, small business owners and self-employed individuals who prepare their taxes through professional services can greatly benefit from this form. Specific scenarios include those with complex tax situations or those seeking the convenience of online filing while ensuring compliance with IRS regulations.

Anyone who is looking to authorize electronic filing but wishes to retain the security of traditional validation by an expert will find Form 8879 PMT indispensable. This includes first-time filers who may find the process daunting and are reliant on professional help to navigate the complexities of tax law.

Key features of Form 8879 PMT

One of the standout features of the 2025 form 8879 PMT is its electronic signature capabilities. This allows taxpayers to provide their consent for e-filing seamlessly. The advantages of utilizing eSignature include not only saving time but also increasing the accuracy of filings by minimizing handwritten errors. With platforms like pdfFiller, the signing process is simplified further, allowing users to sign documents digitally with confidence.

Moreover, pdfFiller enhances user experience with its interactive tools, which enable individuals to fill, sign, and submit forms efficiently. These advanced features offer accessibility to diverse groups by ensuring that tax preparation and submission can be executed smoothly from any location. The user-friendly interface of pdfFiller makes it particularly appealing to those who may not be tech-savvy.

Detailed instructions for completing Form 8879 PMT

Completing the 2025 form 8879 PMT involves a series of clear, concise steps. Firstly, taxpayers must enter their personal information, which includes the name, address, and Social Security Number (SSN). Subsequently, confirming the details of their tax return as prepared by their tax professionals is crucial. This includes understanding each section of the tax return and ensuring that the information accurately reflects their financial situation.

Alongside these entries, taxpayers will typically need to gather documentation such as W-2s, 1099s, and other relevant income verification papers. It's important to organize these documents beforehand, as they will be indispensable in ensuring accuracy. When completing the form, attention must be paid to each field to avoid common mistakes, which can lead to delays in processing.

Tips for accurate completion

To prevent common errors when filling out the 2025 form 8879 PMT, it is advisable to double-check all entries against the corresponding tax documents before submission. Small mistakes, such as incorrect SSNs or minor details, can cause significant delays. Additionally, utilizing the validation features offered by pdfFiller can prove invaluable, as they provide immediate feedback on potential inaccuracies or omissions.

Furthermore, setting aside ample time to review the entire form and its requirements can alleviate unnecessary pressure. Keeping a checklist of all required documents and sections can ensure that nothing is overlooked, providing peace of mind during the filing process.

Managing Form 8879 PMT with pdfFiller

pdfFiller enables seamless management of Form 8879 PMT once completed. After filling out the form, users can easily edit it to add any necessary information or corrections. This flexibility is valuable, particularly as taxpayers may find additional data required after initial completion. Users can also insert electronic signatures fluidly, maintaining compliance without the hassle of physically printing the document.

Moreover, the collaborative features offered by pdfFiller permit teams to work concurrently on tax documents. Users can leave comments and track changes, ensuring that everyone involved in the preparation process is on the same page. Such collaborative tools enhance productivity and reduce the likelihood of miscommunication, making it easier for teams to meet deadlines and adhere to all filing requirements.

Storing and accessing Form 8879 PMT

One of the outstanding benefits of using pdfFiller is the secure cloud storage it offers for Form 8879 PMT. This feature allows taxpayers to retain easy access to their documents from anywhere, minimizing potential losses associated with hard copies. Cloud-based storage enhances security by protecting sensitive information through encryption and secure access protocols.

This setup also enables efficient retrieval of past forms if taxpayers need to refer back to their previous submissions when preparing future returns or responding to inquiries from the IRS. This systematic approach not only streamlines tax management but also ensures that users remain organized year-round.

Submitting Form 8879 PMT

The submission process for Form 8879 PMT is straightforward but requires careful attention to detail. Users can submit this form electronically via pdfFiller, which not only simplifies the process but also records the submission for future reference. Before submission, it is crucial to verify that all information is correct and all fields are duly filled out to avert any issues with the IRS.

Important deadlines for submission typically align with tax filing deadlines. Taxpayers must be attentive to these dates to ensure timely filing and avoid potential penalties. After submission, they should expect a confirmation of receipt from the IRS, which serves as proof of their filing. If any discrepancies arise post-submission, following up with the IRS promptly is vital.

What happens after submission?

Once Form 8879 PMT is submitted, taxpayers can expect a confirmation of receipt from the IRS, indicating that the filing has been successfully processed. This step is crucial as it provides validation that their electronic tax returns are on file. In the event that there are issues or discrepancies with the submission, the IRS may reach out to clarify further or request additional documentation.

This is why maintaining a record of all submitted documents is essential. Taxpayers should keep their Form 8879 PMT and any confirmation notes safely stored within their pdfFiller account or another secure location. By being proactive in this regard, individuals can efficiently respond to any inquiries from tax authorities, facilitating smoother resolutions.

Troubleshooting common issues

Encountering issues with Form 8879 PMT can be a source of frustration for many taxpayers. Common problems may arise from e-signature discrepancies or missing information that prevent successful submission. To mitigate these challenges, it is advisable to meticulously review all entries prior to submission, using validation features available in pdfFiller to flag potential errors.

In instances where users face persistent problems, pdfFiller offers accessible help resources that guide them through troubleshooting. Their customer support is dedicated to helping users resolve issues efficiently, ensuring a smoother filing experience.

Related tax resources

Taxpayers utilizing Form 8879 PMT may also find a range of related tax forms and publications beneficial for a comprehensive filing experience. Other forms that often accompany Form 8879 PMT include Form 1040, which serves as the individual income tax return, and various schedules that detail additional income sources or deductions. ...

Educational resources on tax compliance can also enhance understanding. Links to articles, webinars, or guides about the latest tax regulations will empower taxpayers to stay informed and compliant, thus enhancing their overall filing strategy.

User testimonials and success stories

Many users have shared their positive experiences utilizing the 2025 form 8879 PMT through pdfFiller. Testimonials highlight the seamless integration of electronic signatures and the overall efficiency of managing tax documents digitally. Many users note that their experiences have drastically improved compared to traditional paper filing methods, particularly in terms of speed and ease.

Case studies illustrate how teams, especially those in small businesses, have significantly enhanced their document processes through collaboration with pdfFiller. The ability to track changes, collaborate on edits, and securely store tax documents has resulted in marked improvements in efficiency and compliance.

Customize your experience

pdfFiller understands the diverse user base interacting with the 2025 form 8879 PMT. To cater to this diversity, the platform offers multilingual support, ensuring that non-native English speakers can effectively navigate the filing process. This feature helps to dismantle language barriers, enhancing accessibility and user engagement.

Furthermore, the platform allows users to personalize their experience. By setting preferences based on one’s unique needs, individuals can simplify their document management process, making their interaction with tax forms more intuitive and less daunting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2025 form 8879 pmt in Chrome?

How can I edit 2025 form 8879 pmt on a smartphone?

How do I edit 2025 form 8879 pmt on an iOS device?

What is 2025 form 8879 pmt?

Who is required to file 2025 form 8879 pmt?

How to fill out 2025 form 8879 pmt?

What is the purpose of 2025 form 8879 pmt?

What information must be reported on 2025 form 8879 pmt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.