Get the free 2024 Form W-4. Employee's Withholding Certificate

Get, Create, Make and Sign 2024 form w-4 employee039s

How to edit 2024 form w-4 employee039s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 form w-4 employee039s

How to fill out 2024 form w-4 employee039s

Who needs 2024 form w-4 employee039s?

Comprehensive Guide to the 2024 Form W-4 Employee's Form

Understanding the 2024 form W-4 employee's form

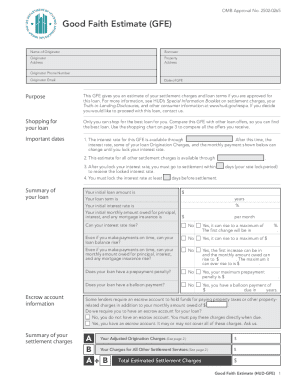

The 2024 Form W-4 Employee’s Form plays a crucial role in determining how much federal income tax is withheld from your paycheck. This form allows employees to inform their employers of their tax situations, ensuring that enough tax is withheld throughout the year to avoid owing at tax time. In 2024, the form has undergone notable changes, simplifying the process while enhancing clarity for employees.

Key changes in the 2024 form compared to previous years include revised instructions and an emphasis on accuracy for high earners and those with complex tax situations. The IRS aims to make withholding adjustments simpler, thus promoting better tax compliance and reducing surprises at year-end.

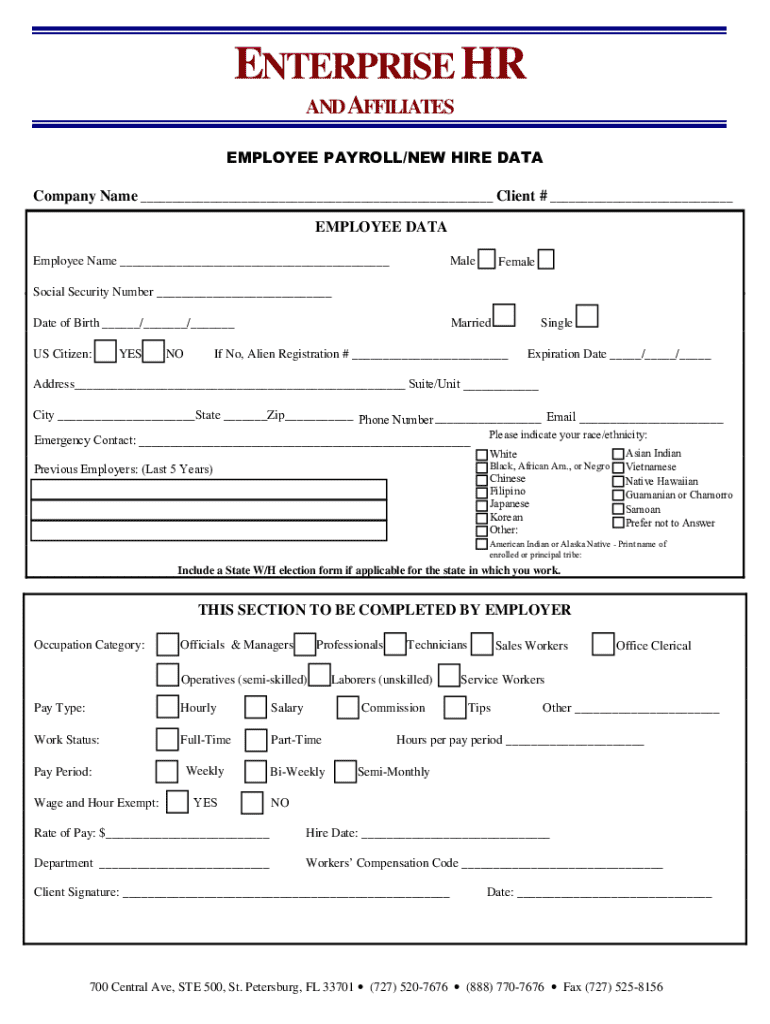

Essential elements of the 2024 W-4 form

When diving into the 2024 W-4 form, it’s important to understand its essential elements. Each section serves a specific purpose and aids in accurate withholding.

Step-by-step instructions on completing the 2024 W-4

Completing the 2024 W-4 form may seem daunting, but with a step-by-step approach, it becomes manageable. Here’s how to do it.

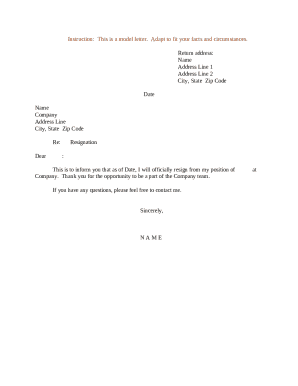

Understanding how to submit your W-4

Once your 2024 W-4 form is complete, submitting it to your employer is the next step. There are a few methods to consider regarding delivery.

Managing withholding and future changes

Managing your tax withholding is an ongoing task. Throughout the year, your circumstances may change, making it vital to keep your W-4 up to date.

Common mistakes and FAQs about the 2024 W-4

Even with detailed guidelines, mistakes can occur when filling out your W-4. Familiarizing yourself with common errors and seeking answers to frequently asked questions can mitigate issues.

Utilizing pdfFiller's tools for W-4 management

pdfFiller offers a suite of tools to help manage your W-4 form seamlessly on any device. These features support easy editing, signing, and collaboration.

Final thoughts on the 2024 form W-4

Completing the 2024 W-4 accurately is crucial for managing your tax withholding effectively. Your financial health relies on ensuring the IRS receives the correct amounts throughout the year, preventing undue stress come tax season.

Regularly review and update your form in light of new life events or changes in financial circumstances. The great flexibility of the W-4 can be a valuable tool in shaping your tax outcome with informed and timely adjustments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2024 form w-4 employee039s directly from Gmail?

How do I edit 2024 form w-4 employee039s in Chrome?

Can I edit 2024 form w-4 employee039s on an iOS device?

What is 2024 form w-4 employee039s?

Who is required to file 2024 form w-4 employee039s?

How to fill out 2024 form w-4 employee039s?

What is the purpose of 2024 form w-4 employee039s?

What information must be reported on 2024 form w-4 employee039s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.