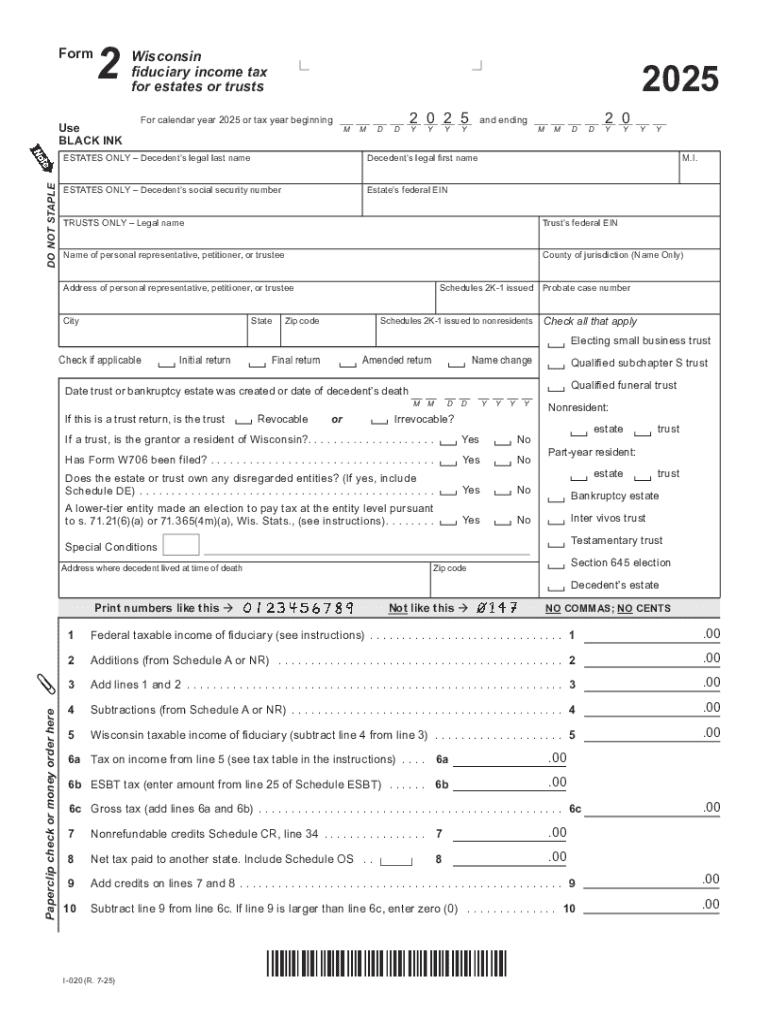

Get the free 2025 I-020 Form 2 Wisconsin fiduciary income tax for estates or trusts (fillable)

Get, Create, Make and Sign 2025 i-020 form 2

How to edit 2025 i-020 form 2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 i-020 form 2

How to fill out 2025 i-020 form 2

Who needs 2025 i-020 form 2?

2025 -020 Form 2 Form: Your Essential How-to Guide

Understanding the 2025 -020 Form 2 Form

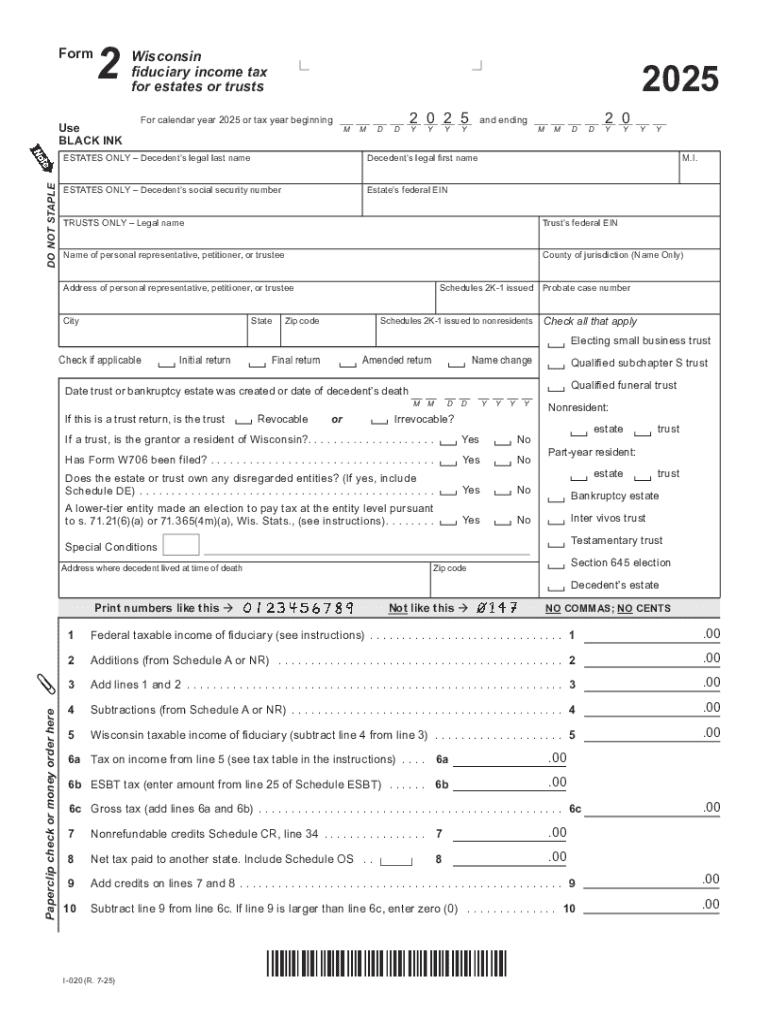

The 2025 i-020 Form 2 is a vital document used primarily for tax reporting and compliance. Its purpose is to collect essential financial data from individuals and organizations, enabling them to report income, deductions, and credits accurately. This form is crucial for maintaining transparency in financial dealings and ensuring adherence to tax obligations.

The 2025 version introduces significant updates aimed at simplifying the filing process and enhancing clarity. Notable changes include a revised layout that makes it easier to navigate, more straightforward guidelines for reporting income, and enhanced instructions for claiming deductions and credits. These refinements are designed to benefit users by reducing the chances of errors and improving the overall filing experience.

Who needs to use the 2025 -020 Form 2?

The 2025 i-020 Form 2 is essential for a wide range of individuals and teams, particularly those who have specific eligibility criteria. This includes self-employed individuals, freelancers, and independent contractors who need to report their income accurately. Additionally, small businesses, partnerships, and corporations must complete this form to comply with tax regulations.

Specific situations requiring the i-020 Form 2 include reporting new revenue streams, claiming tax deductions for business expenses, and reconciling previous year's filings. For example, if a freelancer has taken on new clients or incurred significant business costs, they will need to complete this form to reflect these changes adequately.

Document creation: Starting with the 2025 -020 Form 2

To get started with the 2025 i-020 Form 2, users can access the form online through pdfFiller, a leading document management platform. This service not only offers easy access to the necessary forms but also provides robust editing and e-signature capabilities that enhance user experience.

Once on pdfFiller, users can import and upload any relevant previous documents for editing. This feature is particularly useful for those who wish to maintain consistency in their reporting or need to draw from past filings for accurate income and deduction records. Simply log in, choose the 'Upload' button, and select your document to begin.

Detailed step-by-step instructions for filling out the -020 Form 2

Filling out the 2025 i-020 Form 2 efficiently requires attention to detail. Below is a section-by-section breakdown that will guide users in entering their information accurately:

When inputting your data, keep an eye out for common pitfalls. Double-check numbers for accuracy and be cautious of misplacing decimal points, which can lead to significant discrepancies.

Utilizing pdfFiller features for enhanced document management

pdfFiller offers a suite of features that make document management smooth and efficient. For instance, its editing tools allow users to modify text and formatting seamlessly, ensuring that documents align with personal or regulatory standards.

The platform's eSignature capabilities enable users to sign and share documents securely with minimal hassle. With just a few clicks, users can send their completed forms to clients or tax entities for approval. Additionally, pdfFiller allows for real-time collaboration, making it easier for teams to work together, brainstorm, and finalize documents in one centralized location.

Moreover, the cloud storage advantages mean that users can access their documents anytime, anywhere, removing the limitations of traditional document management and ensuring they stay organized and productive.

Common questions and troubleshooting

Navigating the complexities of the 2025 i-020 Form 2 can raise several questions. Here are some frequently asked questions that could aid users in successfully filling out this form:

If you encounter other specific challenges while filling out the form, refer to the pdfFiller help center for troubleshooting tips tailored to your needs.

Beyond the -020 Form 2: Additional related forms and resources

In many cases, users may find themselves needing to access related forms. For example, the Income Tax Forms or various other Deductions are essential for complementing your entries on the 2025 i-020 Form 2.

For further assistance, government agencies and tax services offer valuable resources. By visiting their official websites, users can access up-to-date information about filing requirements and deadlines, ensuring compliance.

User testimonials: Experiences with the 2025 -020 Form 2 through pdfFiller

Real-world examples of user experiences showcase the efficiency of using the 2025 i-020 Form 2 with pdfFiller. Many users have reported a smoother filing process, particularly in terms of editing and collaboration capabilities.

One user shared, 'Using pdfFiller to fill out the i-020 Form 2 eliminated the stress I usually have during tax season. I could access my previous forms easily and made sure everything matched before submitting.' This sentiment is echoed by many who appreciate the platform's user-friendly interface and helpful features.

Best practices for managing your documents with pdfFiller

Effective document management is crucial for anyone using the 2025 i-020 Form 2, especially in a team-oriented environment. Regular document maintenance cannot be overstated. Keeping records tidy ensures that you avoid confusion and can retrieve any document when required.

By adhering to these best practices, users can create a streamlined, organized digital workspace that enhances productivity and efficiency when managing their forms.

Legal and compliance considerations

Understanding the legal implications associated with the 2025 i-020 Form 2 is essential. This form plays a critical role in ensuring compliance with current tax laws. Incorrect filings can lead to severe penalties, making accuracy vital.

Users must ensure that all information provided is truthful and fully represents their financial situation. This not only involves reporting income accurately but also requires detailed documentation of any deductions claimed. It’s advisable for users to consult with tax professionals if uncertain about specific legal regulations or requirements surrounding the i-020 Form 2.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2025 i-020 form 2 straight from my smartphone?

How do I complete 2025 i-020 form 2 on an iOS device?

Can I edit 2025 i-020 form 2 on an Android device?

What is 2025 i-020 form 2?

Who is required to file 2025 i-020 form 2?

How to fill out 2025 i-020 form 2?

What is the purpose of 2025 i-020 form 2?

What information must be reported on 2025 i-020 form 2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.