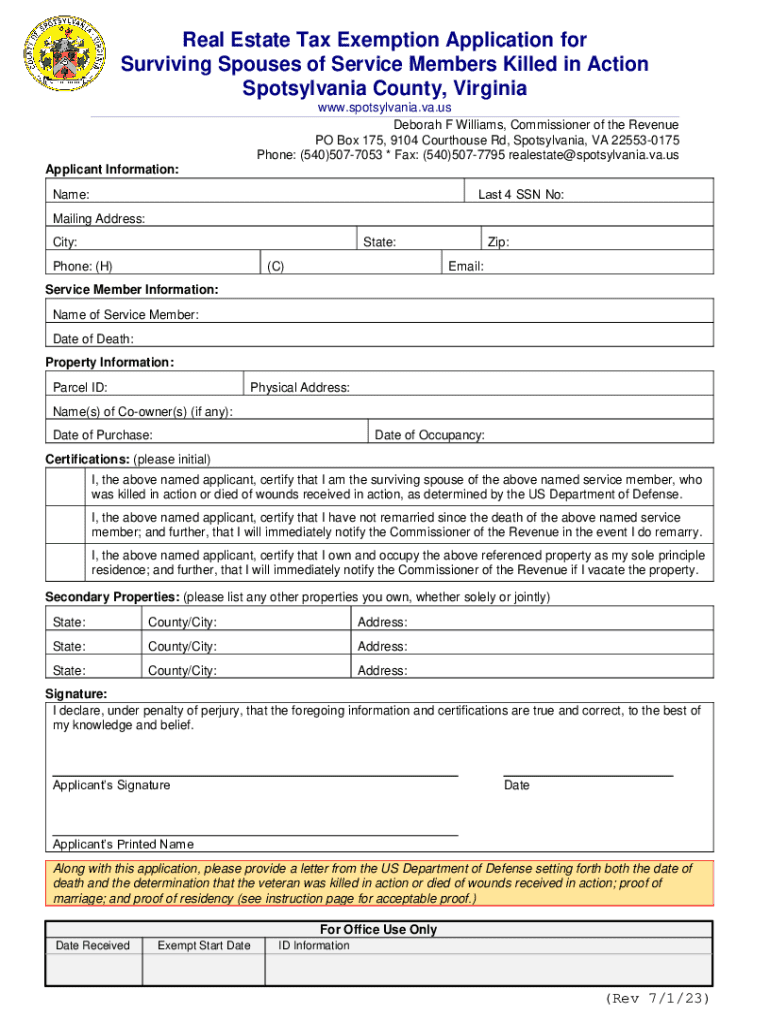

Get the free Real Estate Tax Exemption Application for Surviving Spouses of ...

Get, Create, Make and Sign real estate tax exemption

Editing real estate tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out real estate tax exemption

How to fill out real estate tax exemption

Who needs real estate tax exemption?

Understanding Real Estate Tax Exemption Forms: A Comprehensive Guide

Understanding real estate tax exemptions

Real estate tax exemptions provide financial relief to property owners by allowing them to reduce the amount of property tax they owe. By taking advantage of these exemptions, individuals can lower their financial burden, making home ownership more affordable. Tax exemptions can vary significantly in scope, eligibility, and application processes, which is why understanding the specific implications of these forms is crucial for any property owner.

For example, a homestead exemption may assist primary residents by reducing their home’s assessed value, while other exemptions could be designed specially for veterans or individuals with disabilities. The potential savings can significantly enhance one's ability to maintain or upgrade their property, thereby contributing to overall community wellbeing.

Overview of the real estate tax exemption process

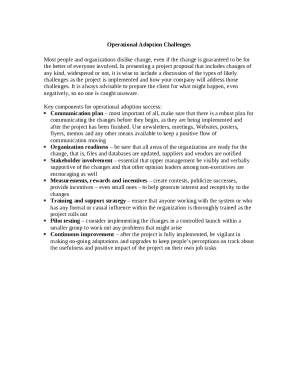

The process of applying for a real estate tax exemption can seem daunting due to the various terms and deadlines involved. Understanding key terminology is essential: exemptions refer to reductions in taxable value, eligibility outlines who can benefit from these exemptions, and assessments are valuations made by government organizations to determine property value.

Moreover, staying mindful of deadlines is critical; each state has specific filing periods, and missing these deadlines can result in penalties or the forfeiture of potential tax savings. Typically, exemption applications must be submitted within a certain timeframe after property acquisition or during specific assessment periods to be eligible for the next tax cycle.

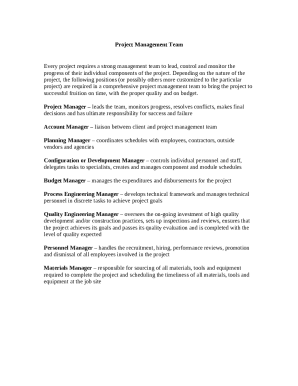

Eligibility criteria for tax exemptions

General qualifications generally require that applicants be homeowners residing at the property they wish to exempt. Furthermore, varying property types—single-family homes, condominiums, and even some rental properties—may qualify under different statutes. Each state will have its own set of regulations, which is why prospective applicants should directly consult local property tax offices or state tax agencies.

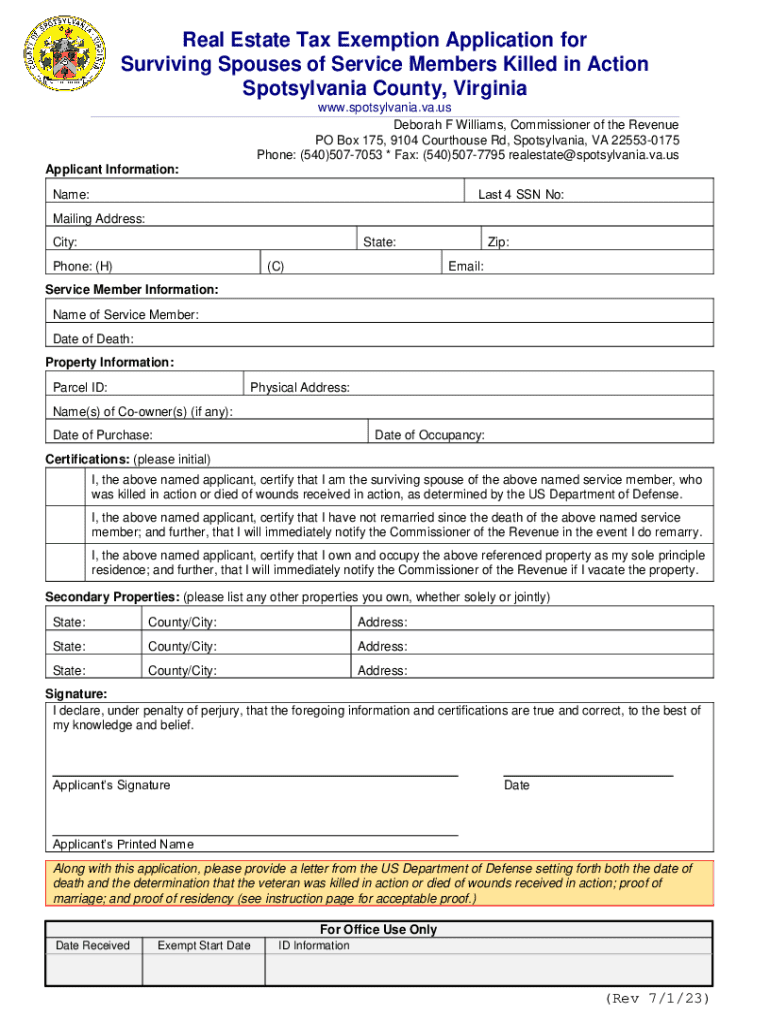

Special categories of exemptions often include those tailored for veterans, senior citizens, or individuals with disabilities. For instance, veterans might receive additional exemptions based on wartime service, while senior citizens might benefit from reduced rates to accommodate fixed retirement incomes. Additionally, understanding who qualifies as an owner for exemption purposes can also influence eligibility—co-ownership or tenants may encounter varied rules.

Different types of real estate tax exemption programs

Tax exemption programs can vary widely between states, yet several common programs exist. The homestead exemption is one of the most widely recognized, often allowing primary residents to reduce the assessed value of their home for tax purposes. Other exemptions, such as those for disabilities or veterans, are designed to assist specific populations, enabling them to manage their property tax load more effectively.

Local governments may also offer additional incentives like property tax deferrals for seniors or exemptions based on income levels, emphasizing the importance of examining state-specific programs as well. Consequently, residents should be proactive in researching available exemptions in their jurisdiction, ensuring they capitalize on the full range of benefits available to them.

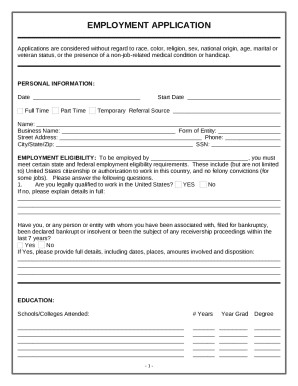

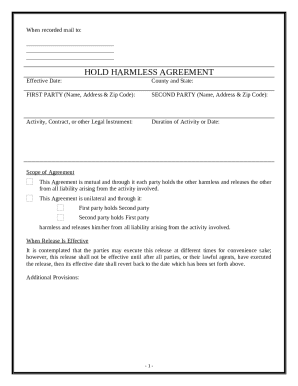

The application process for real estate tax exemption forms

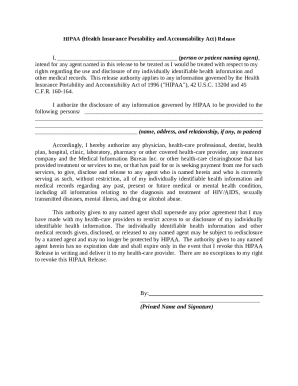

Preparing to apply for a real estate tax exemption requires gathering pertinent information and documentation. Applicants will typically need proof of ownership, such as a deed or mortgage documents, and could be required to submit income statements or tax returns if income-based exemptions apply. Knowing exactly what documentation is needed can streamline the application process, reducing delays and potential rejections.

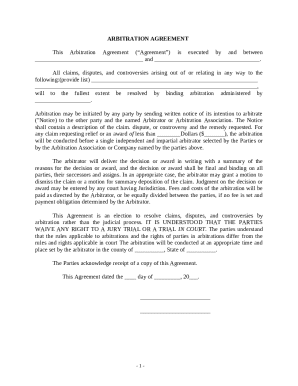

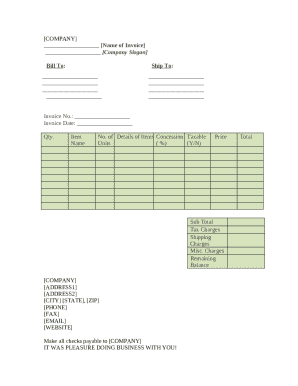

Filling out the tax exemption form can also be straightforward if approached methodically. The form usually contains sections requiring personal information, property details, financial data, and requests for additional documentation. Each section is crucial; for instance, accurate personal identification ensures your tax exemption status is properly tracked by the government organization.

Once completed, applicants have options for submission that often include online portals or mailing physical copies to relevant tax authorities. Online submission can expedite processing times, which is advantageous when deadlines loom.

Utilizing pdfFiller for your tax exemption needs

pdfFiller offers a seamless way for users to create, edit, and manage their tax exemption documents. With its user-friendly interface, individuals can easily navigate through the process of filling out real estate tax exemption forms, making document completion not only straightforward but also efficient. The benefits extend to features that allow for electronic signing and collaboration with family or legal advisors, adding convenience to what can be a time-consuming process.

Further, pdfFiller’s interactive tools can assist users in completing their forms step-by-step, ensuring that all necessary fields are filled accurately. This guidance can be particularly beneficial for first-time applicants or those unfamiliar with specific terms and conditions related to their state’s exemptions.

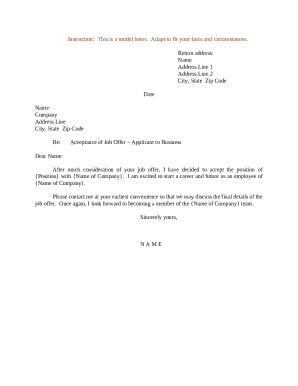

Post-submission steps after applying for exemptions

After submission, it is crucial for applicants to track their application status. Many jurisdictions provide online tools that allow residents to confirm whether their exemption has been officially recognized. By staying proactive, individuals can also rectify any issues that may arise during processing.

Common reasons for denial often include incomplete applications, missing documentation, or ineligibility based on the criteria outlined. If an application is denied, it’s essential to understand the appeals process and the steps required to contest the decision. This often involves resubmitting documentation or supplying further evidence to demonstrate eligibility.

Frequently asked questions about real estate tax exemption forms

Individuals often have similar inquiries regarding eligibility and the application process for real estate tax exemptions. Questions may revolve around who may apply, the timeframes for applications, and whether all property owners in a household must submit separate applications.

Many misconceptions can exist around tax exemptions, such as assuming eligibility depends solely on income, neglecting to account for asset-based qualifications. It's essential to consult local resources or government websites for accurate information tailored to individual circumstances, as rules may vary greatly by location.

Useful tips for maximizing your tax exemption benefits

For first-time applicants, preparation is key. Gathering all necessary information and documentation prior to filling out the real estate tax exemption form can facilitate a smoother process. Moreover, clarity and accuracy in completing the forms cannot be overemphasized, as any errors could lead to delays or denials.

Additionally, staying informed about changes in tax laws can prove beneficial. Tax laws can change frequently, and periodic review of local tax jurisdictions' announcements can equip homeowners with timely updates regarding eligibility or application changes. Knowledge truly is power when it comes to maximizing your potential savings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send real estate tax exemption to be eSigned by others?

How do I make changes in real estate tax exemption?

Can I create an electronic signature for signing my real estate tax exemption in Gmail?

What is real estate tax exemption?

Who is required to file real estate tax exemption?

How to fill out real estate tax exemption?

What is the purpose of real estate tax exemption?

What information must be reported on real estate tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.