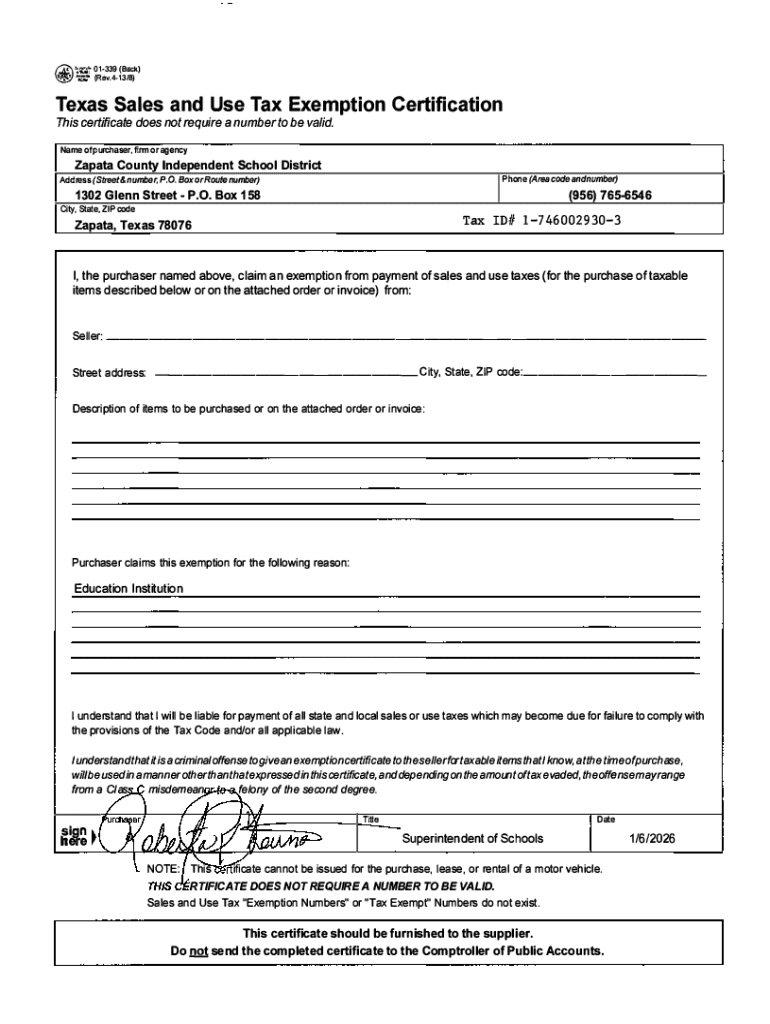

Get the free Appendix IX Texas Sales and Use Tax Exemption ...

Get, Create, Make and Sign appendix ix texas sales

How to edit appendix ix texas sales online

Uncompromising security for your PDF editing and eSignature needs

How to fill out appendix ix texas sales

How to fill out appendix ix texas sales

Who needs appendix ix texas sales?

Comprehensive Guide to Appendix Texas Sales Form

Overview of Appendix Texas Sales Form

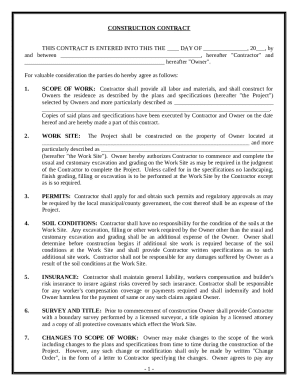

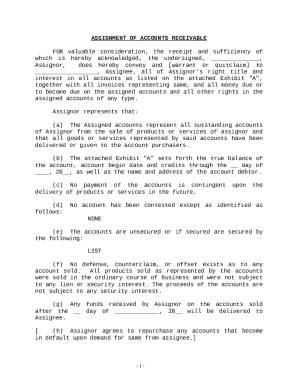

Appendix IX Texas Sales Form is a critical document utilized in various real estate transactions in Texas. This form serves both as an informational release and a legally binding agreement once signed by both parties involved in a sale. The Texas Sales Form is not just a procedural necessity; it plays a vital role in safeguarding the interests of buyers and sellers, providing clarity and a framework for the transaction.

The importance of this form cannot be overstated. It helps prevent misunderstandings by clearly outlining the terms of sale, responsibilities of both parties, and pertinent details related to the property. Appendix IX succinctly captures key elements necessary for a successful transaction, mitigating risks of disputes down the line.

Understanding the components of Appendix

Appendix IX consists of multiple segments crucial for encapsulating the entire scope of the sales agreement. Understanding each section allows both parties to navigate the document effectively and ensure that nothing critical is overlooked.

The primary components of the Texas Sales Form include:

Additionally, legal terminology used within the form may include terms like ‘escrow,’ ‘commission,’ and ‘contingency,’ each of which holds significant importance in the context of property sale.

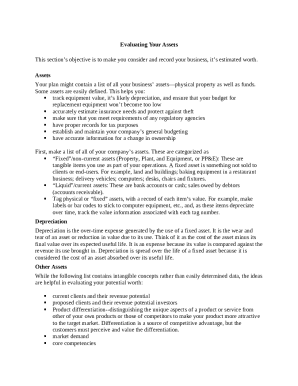

Step-by-step guide to completing Appendix

Filling out the Appendix IX Texas Sales Form can seem daunting, but following a structured approach makes it manageable. Below is a step-by-step guide to ensure accuracy and completeness.

Editing and signing the Appendix Texas Sales Form

Once you have completed the form, it's time to edit and sign it. pdfFiller provides multiple tools to facilitate this process. Editing PDFs may seem daunting, but the tools available make it easier than ever.

Follow these steps to use pdfFiller for your form:

Collaborating with team members

In many cases, multiple individuals contribute to the completion of the Appendix IX sales form. Effective collaboration is key to ensuring all details are correct and that both parties are on the same page.

Here’s how to leverage pdfFiller's collaboration features:

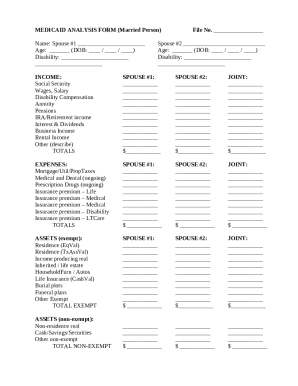

Managing your completed Appendix forms

After completing your Appendix IX Texas Sales Form, proper management of the document is essential to meet legal requirements and protect interests.

Consider these storage and management tips:

Common issues and troubleshooting

While filling out the Appendix IX Texas Sales Form, users often encounter questions or issues. Knowing how to address these can save time and reduce stress.

Here are some common challenges and solutions:

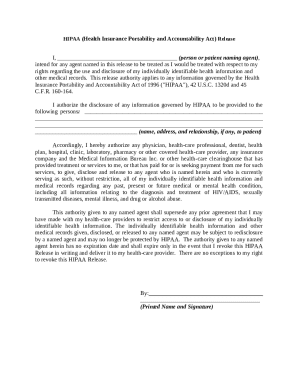

Legal considerations and best practices

Understanding the legal implications of the Appendix IX Texas Sales Form is essential for safeguarding both the buyer's and seller's interests. Awareness of the legal framework can help you navigate the complexities of real estate transactions.

Ensure compliance and protection by:

Summary of key takeaways for users

Completing the Appendix IX Texas Sales Form is critical for successful real estate transactions in Texas. Understanding how to fill it out correctly can save time and legal complications.

Remember these essential points:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send appendix ix texas sales for eSignature?

How do I edit appendix ix texas sales online?

Can I sign the appendix ix texas sales electronically in Chrome?

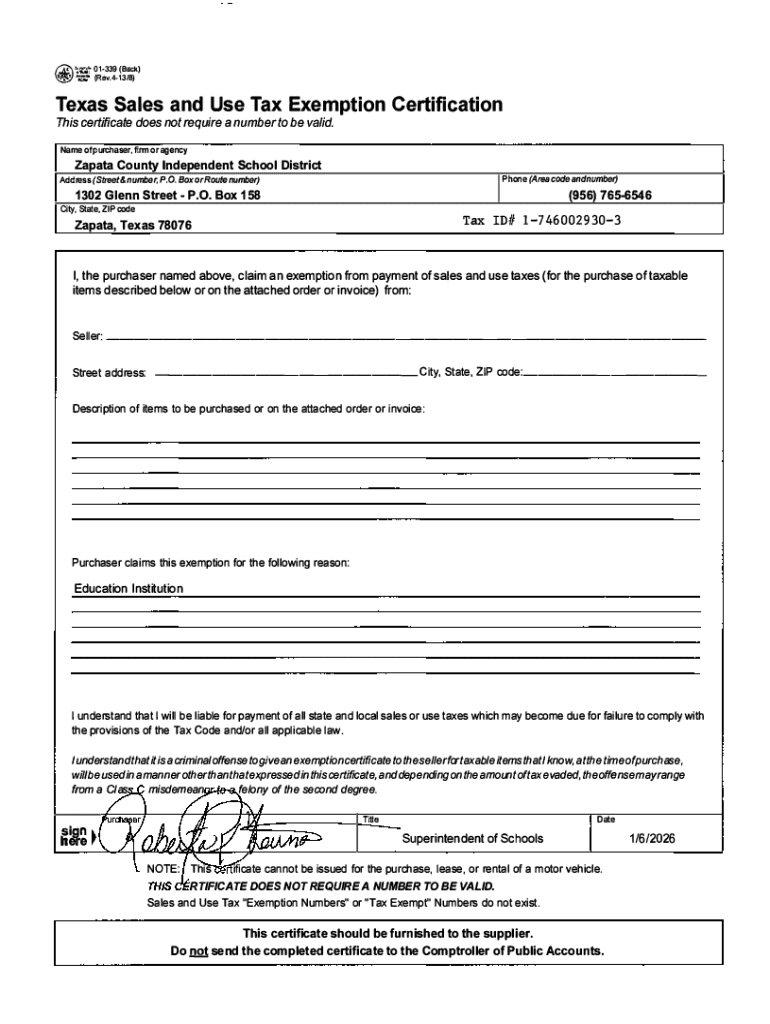

What is appendix ix texas sales?

Who is required to file appendix ix texas sales?

How to fill out appendix ix texas sales?

What is the purpose of appendix ix texas sales?

What information must be reported on appendix ix texas sales?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.