Get the free Citrus County Tax Collector: Home

Get, Create, Make and Sign citrus county tax collector

Editing citrus county tax collector online

Uncompromising security for your PDF editing and eSignature needs

How to fill out citrus county tax collector

How to fill out citrus county tax collector

Who needs citrus county tax collector?

Navigating the Citrus County Tax Collector Form: A Comprehensive How-To Guide

Overview of Citrus County Tax Collector Office

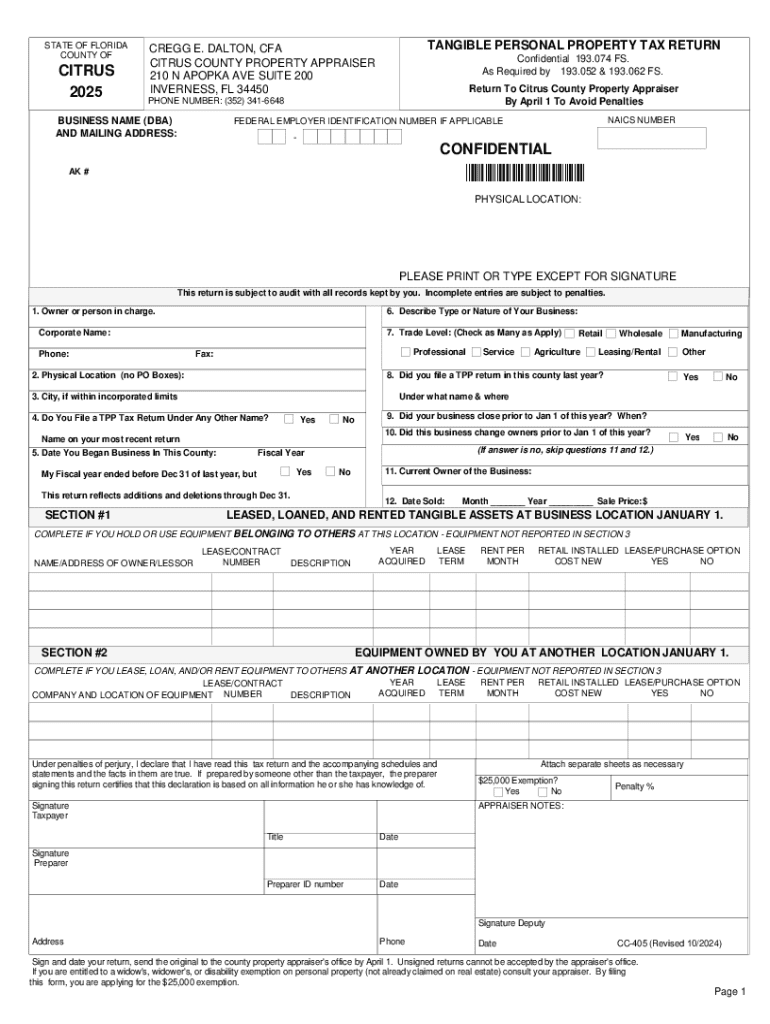

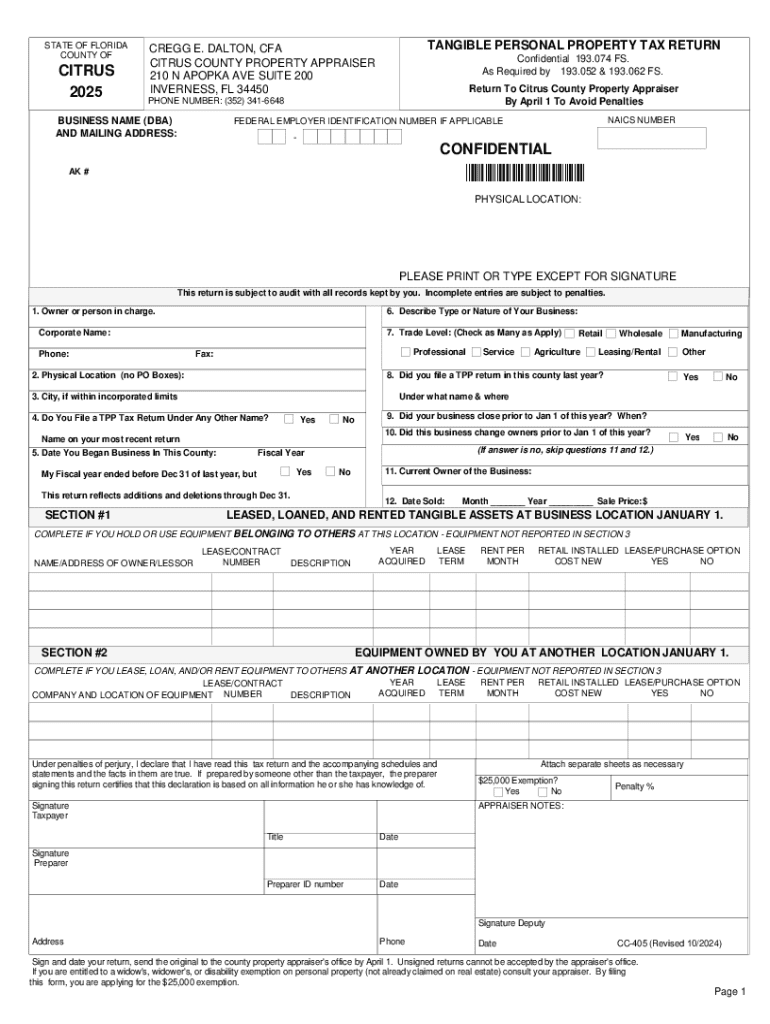

The Citrus County Tax Collector's Office plays a crucial role in the management of tax-related services for its residents. Established to facilitate the efficient collection of property taxes, the office ensures that all financial obligations are met in accordance with state laws. This vital function not only helps sustain local government operations but also supports public services that enhance community well-being.

Residents and businesses rely heavily on accurate and timely tax collection processes. The Citrus County Tax Collector Form's proper completion is essential in this context, allowing individuals to effectively manage their tax responsibilities. Understanding this form and how to navigate its requirements can lead to smoother civic processes and compliance with Florida's tax laws.

Understanding Citrus County Tax Collector Forms

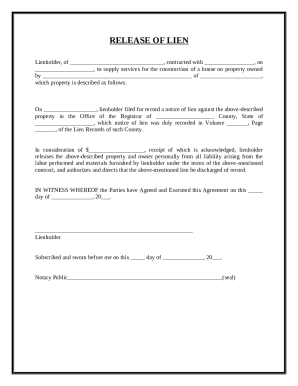

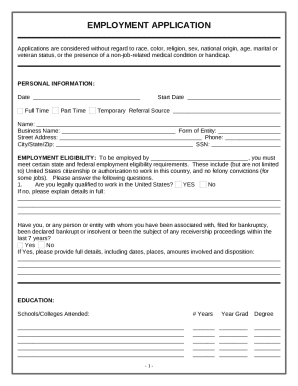

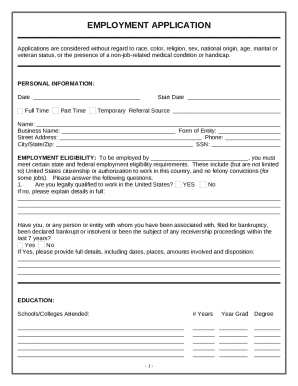

Citrus County offers various tax collector forms, each designed to cater to specific tax needs. Understanding these forms is crucial for residents, as they streamline processes like property tax assessments, motorist services, and business tax receipts. Each form serves distinct functions, allowing individuals and businesses to fulfill their tax obligations accurately and efficiently.

For instance, the property tax forms allow homeowners to calculate and remit dues based on property values assessed by the property appraiser. Motorist services forms include applications for driver's licenses and ID cards, ensuring that residents have appropriate identification. Familiarizing yourself with the key functions of each form can significantly ease the tax filing process.

Residents often have the same questions regarding form specifics and processes. Common inquiries may center around eligibility requirements, deadlines, and necessary documentation. To streamline this process, the Citrus County Tax Collector Office provides resources to help clarify these common queries and assist with filling out and submitting forms.

Accessing the Citrus County Tax Collector Form

For your convenience, accessing Citrus County Tax Collector Forms is straightforward. Residents can obtain these forms through two primary channels: the official Citrus County website and in-person visits to county offices. Both options ensure that all forms are readily available, whether you prefer a digital format or a physical copy.

Additionally, using platforms like pdfFiller can enhance your experience. With pdfFiller, you can access various tax forms quickly and customize them digitally. The features allow users to fill out, edit, and sign documents directly online, providing a user-friendly experience. This convenience helps streamline the often tedious process of completing tax-related paperwork.

Overview of the pdfFiller platform

Using pdfFiller to access Citrus County Tax Collector Forms offers several advantages. Its cloud-based platform allows you to access documents from anywhere with an internet connection, making it ideal for busy residents and professionals. With the ability to create, edit, and sign documents electronically, pdfFiller empowers users to manage their tax forms efficiently without the need for printing or physical storage.

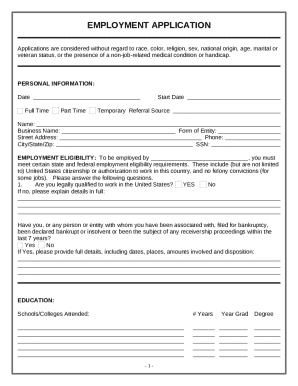

Step-by-step guide to filling out the Citrus County Tax Collector Form

Before diving into the form, preparation is key. Gather all necessary documents, such as previous tax statements, property information, and personal identification like your driver license or ID card. Understanding your tax situation fully will help you avoid potential errors while completing the form. Each type of tax form has specific requirements, so always consult the latest guidelines associated with your respective form.

Once you have your documents ready, focus on filling out the relevant sections of the form. For instance, typical sections may include personal information, property details, and calculations for taxes owed. It’s crucial to double-check all entries for accuracy to prevent delays in processing. Here’s a brief overview of what you can expect in each section:

Common mistakes to avoid include overlooking required signatures, miscalculating tax amounts, or providing outdated information. Take time to review each section thoroughly before submission to ensure that everything is accurate and complete.

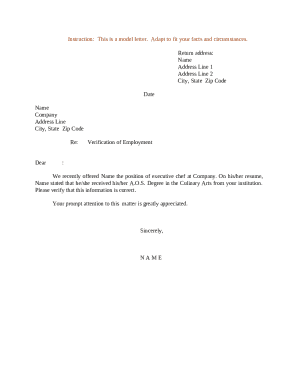

Editing the Citrus County Tax Collector Form online

Editing a Citrus County Tax Collector Form online is simple, especially with tools like pdfFiller. Once you’ve accessed the form, you can easily update your information as needed. This digital platform allows you to make changes quickly, which can be especially useful if you made an error during your initial fill-out.

Using pdfFiller's intuitive interface, you can annotate, highlight, or remove content straightforwardly. The benefits of digital editing over traditional methods are significant; you eliminate the need for physical papers and ink, simplify the process of correcting mistakes, and streamline the overall workflow.

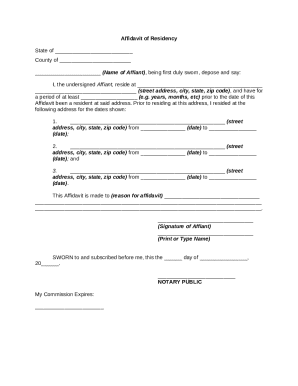

Signing and submitting the Citrus County Tax Collector Form

With pdfFiller, signing your Citrus County Tax Collector Form is hassle-free. It offers various electronic signature options that are legally valid, providing assurance that your document meets all necessary requirements. Understanding how to complete the signing process is crucial to ensure your form is officially recognized.

The steps to sign your form electronically are straightforward. Once you’ve filled out all sections, simply click the designated signature area, follow the prompts to create or upload your signature, and it will be applied to the document. After signing, you will have multiple options for submission, either online through the Citrus County portal or via traditional methods such as mailing or in-person drop-off.

Tracking the status of submitted forms

After submitting your Citrus County Tax Collector Form, it’s important to track its status to ensure that everything is processed correctly. Using pdfFiller, you can easily monitor your submission and receive updates concerning its progress. This feature not only saves time but also provides peace of mind.

In case you need further information or assistance regarding your submitted form, reach out directly to the Citrus County Tax Collector Office. They provide contact information for residents to inquire about their tax documents effectively.

Managing your Citrus County tax records

Keeping accurate tax records is essential for all Citrus County residents. Effective documentation helps not only in annual tax filings but also in resolving any disputes or questions that may arise regarding property taxes or business taxes. pdfFiller serves as a valuable tool for managing these records, streamlining the task of keeping your documents organized.

Using pdfFiller, users can create folders, link documents, and easily retrieve any tax-related forms when needed. This digital document management simplifies the process of staying organized, ultimately translating to a better experience during tax season. Implement these tips to maintain efficient records:

Frequently asked questions (FAQs)

Residents often have various inquiries regarding the Citrus County Tax Collector Forms. These general inquiries may revolve around how to access forms, deadlines for submission, and where to get assistance with specific parts of the application process. Additionally, many residents want to know about the technology used for electronic editing and signing to ensure compliance with legal requirements.

Common troubleshooting issues might include connectivity problems when submitting forms online, questions about eligibility for various tax programs, and information regarding any changes to the tax laws that could impact filing procedures. To assist, the Citrus County Tax Collector Office provides comprehensive resources to clarify these concerns.

Customer testimonials and success stories

Individuals and teams throughout Citrus County have found tremendous value in using pdfFiller for managing their tax forms. Many testimonials highlight how easy it is to edit, eSign, and keep track of forms electronically. This shift from paper to digital has greatly enhanced their experience, saving time and reducing stress during tax season.

Real-life examples show that users have benefited from the systematic approach pdfFiller offers for document management. From receiving timely notifications regarding submission statuses to enjoying the flexibility of working on forms from any location, the convenience and efficiency of this platform have made it a go-to solution for managing Citrus County Tax Collector Forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in citrus county tax collector?

How can I edit citrus county tax collector on a smartphone?

Can I edit citrus county tax collector on an Android device?

What is citrus county tax collector?

Who is required to file citrus county tax collector?

How to fill out citrus county tax collector?

What is the purpose of citrus county tax collector?

What information must be reported on citrus county tax collector?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.