Get the free Sales Tax Certificates

Get, Create, Make and Sign sales tax certificates

Editing sales tax certificates online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sales tax certificates

How to fill out sales tax certificates

Who needs sales tax certificates?

A Comprehensive Guide to Sales Tax Certificates Form

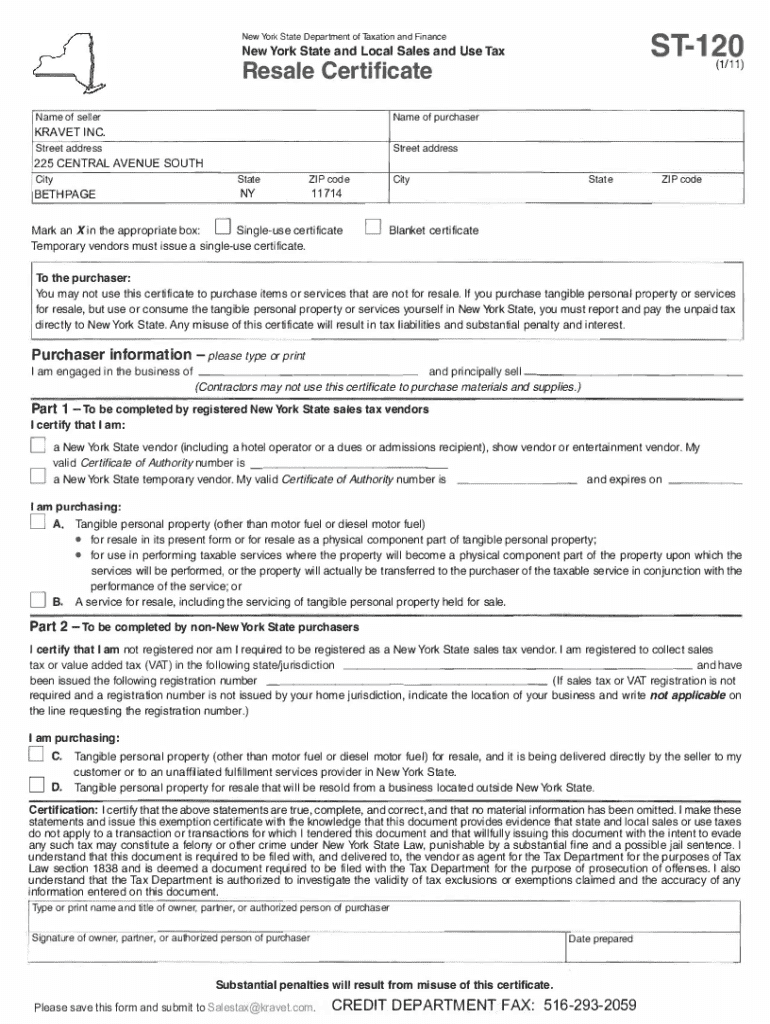

Understanding sales tax certificates

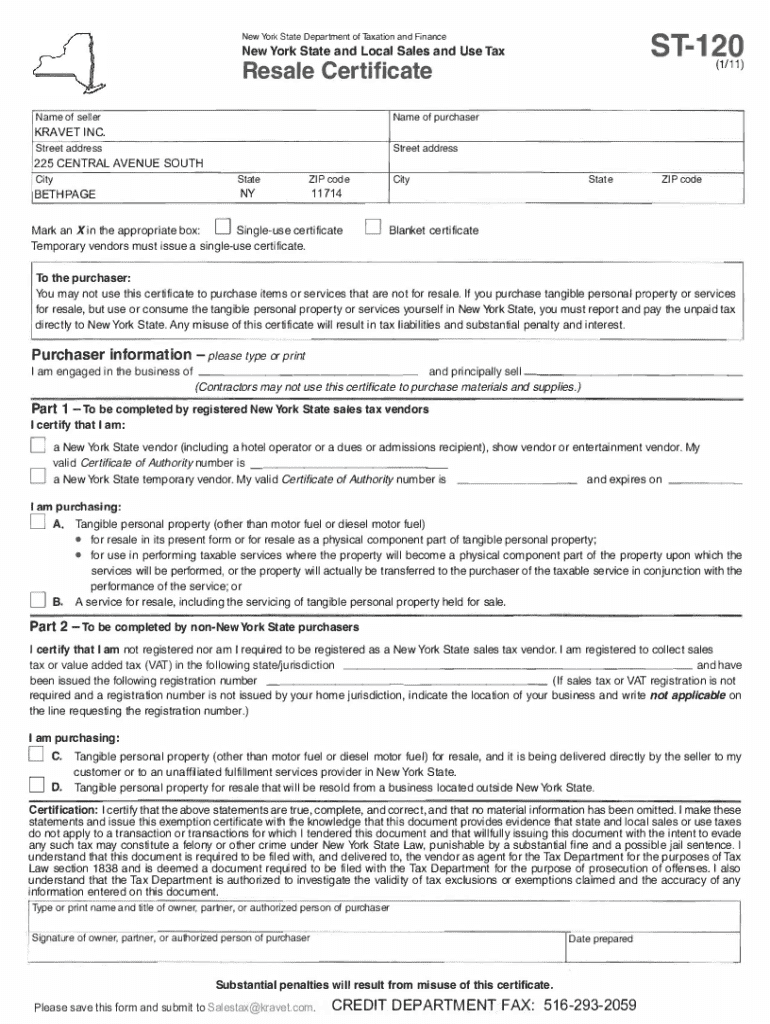

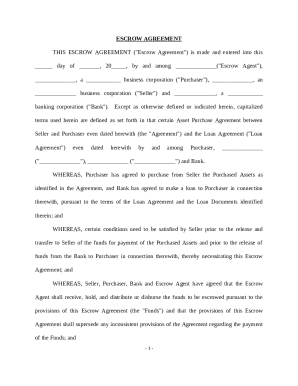

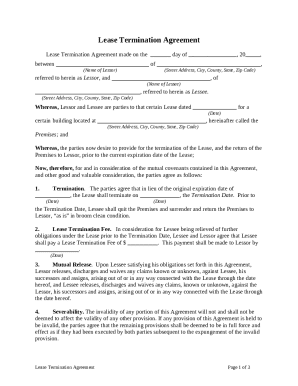

Sales tax certificates are essential documents that enable businesses to purchase goods without paying sales tax. They provide immunity from tax liabilities for qualifying transactions such as resales or exempted purchases. Without a properly filled sales tax certificate form, sellers are compelled to collect sales tax from purchasers, leading to unnecessary costs.

The importance of sales tax certificates in business transactions cannot be overstated. They ensure compliance with state regulations, preventing potential audits and penalties. Furthermore, they facilitate seamless operations between purchasers and sellers by offering proof that a purchase qualifies as tax-exempt. There are primarily two types of sales tax certificates:

Who needs a sales tax certificate?

Understanding the key stakeholders in the sales tax certificate process clarifies who needs to be involved. The main entities include purchasers, sellers, and exempt entities such as nonprofit organizations and government agencies. Each of these players must understand their roles to ensure that sales tax certificates are utilized correctly.

Scenarios that require sales tax certificates arise frequently in business transactions. For instance, when a retailer buys products from a supplier with the intention to resell, they must present a resale certificate. Similarly, if a nonprofit organization is purchasing rations for community assistance without the intention of resale, they must provide an exemption certificate to avoid incurring tax liabilities.

State-specific regulations

Sales tax certificates are governed by state laws, which can vary significantly. Some states have adopted streamlined regulations simplifying the process of issuing and accepting these certificates. For example, states like California and Texas have published their own guidelines, which may differ in terms of specific documentation or processes required.

Variations in regulations may include differing acceptable formats for certificates, different deadlines for submissions, and unique record-keeping requirements. Businesses should consult their state's revenue department for specific guidelines regarding sales tax certificates, and it’s beneficial to keep abreast of any changes in tax law.

Step-by-step guide to completing a sales tax certificate

Filling out a sales tax certificate may seem daunting, but following a structured approach can simplify the process. Start by gathering necessary information including your business details, tax identification numbers, and any specific information that may be required by the state.

Here's a breakdown of the steps to follow:

Common challenges and solutions

Navigating the world of sales tax certificates brings its share of challenges. One common issue revolves around tax liability errors, which can lead to unexpected costs. If a seller accepts a certificate that’s incomplete or incorrectly filled, they may face penalties from the state.

To avoid these pitfalls, it's crucial to verify the information on certificates thoroughly and keep abreast of state-specific compliance updates. If fraud is suspected (e.g., if a buyer misuses a resale certificate), this could trigger audits, which may cause unnecessary disruptions. Establishing a robust verification process is critical for both sellers and buyers.

Special considerations for drop shipments

Drop shipments complicate sales tax collection because goods are shipped directly from the supplier to the end customer. In these scenarios, determining the applicable sales tax can be particularly challenging. Drop shippers must ensure that the sales tax certificate accurately reflects that the transaction is tax-exempt.

Best practices for managing sales tax certificates in drop shipping include:

Collaborating with vendors

Effective collaboration with vendors is vital in navigating sales tax certificate requirements. Sellers must educate their customers about the necessity of presenting the correct forms to ensure tax exemption. This involves clear communication and can prevent misunderstandings that could lead to compliance issues.

Engaging in proactive dialogue can enhance the efficiency of interactions. Providers should maintain updated knowledge regarding changes in tax regulations which could affect vendors and purchase requirements. Keeping vendor databases current with accurate information about their tax statuses fosters trust and compliance.

Leveraging technology for sales tax management

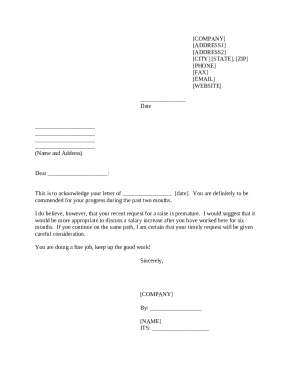

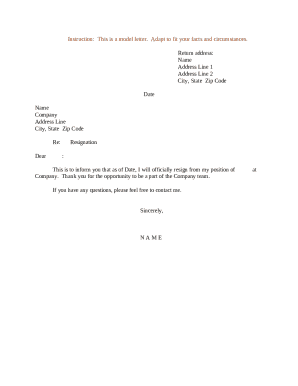

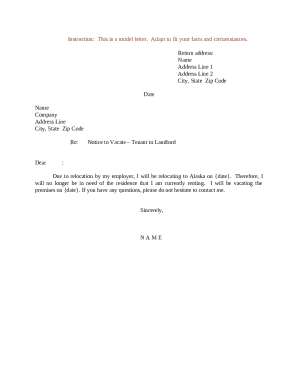

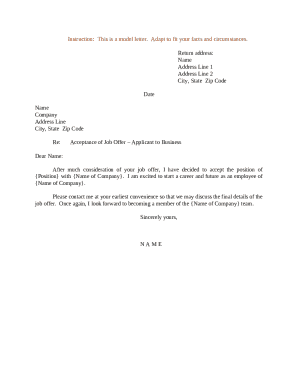

Utilizing technology significantly streamlines the process of managing sales tax certificates. pdfFiller stands out by offering robust functionalities that make it easy to edit, eSign, and collaborate on documents. The platform's seamless PDF editing features help users fill out sales tax certificates accurately, ensuring compliance.

Additionally, eSignature capabilities facilitate faster approvals, essential in a business environment where speed is key. With pdfFiller's document collaboration tools, teams can work together efficiently on sales tax certificate requirements, tracking changes, and ensuring all inputs are correct and compliant.

Case studies: Successful use of sales tax certificates

Various businesses have effectively navigated the complexities of sales tax certificates to their benefit. For example, a regional retailer implemented a systematic approach to collecting and storing sales tax certificates, leading to a significant decrease in audit risks and tax penalties. Their commitment to compliance enhanced their reputation among suppliers and customers alike.

Another case involved a nonprofit organization that streamlined its purchasing processes through the use of exemption certificates. By ensuring that all staff members understood the certificate requirements, they avoided overpayment on essential purchases, freeing up funds for their initiatives.

FAQs about sales tax certificates

Navigating sales tax certificates can raise questions. Here are some common inquiries and responses:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sales tax certificates on a smartphone?

How do I complete sales tax certificates on an iOS device?

How do I fill out sales tax certificates on an Android device?

What is sales tax certificates?

Who is required to file sales tax certificates?

How to fill out sales tax certificates?

What is the purpose of sales tax certificates?

What information must be reported on sales tax certificates?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.