Get the free SEC Filing - Investor RelationsAsana, Inc.

Get, Create, Make and Sign sec filing - investor

How to edit sec filing - investor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec filing - investor

How to fill out sec filing - investor

Who needs sec filing - investor?

SEC Filing - Investor Form: A Comprehensive Guide

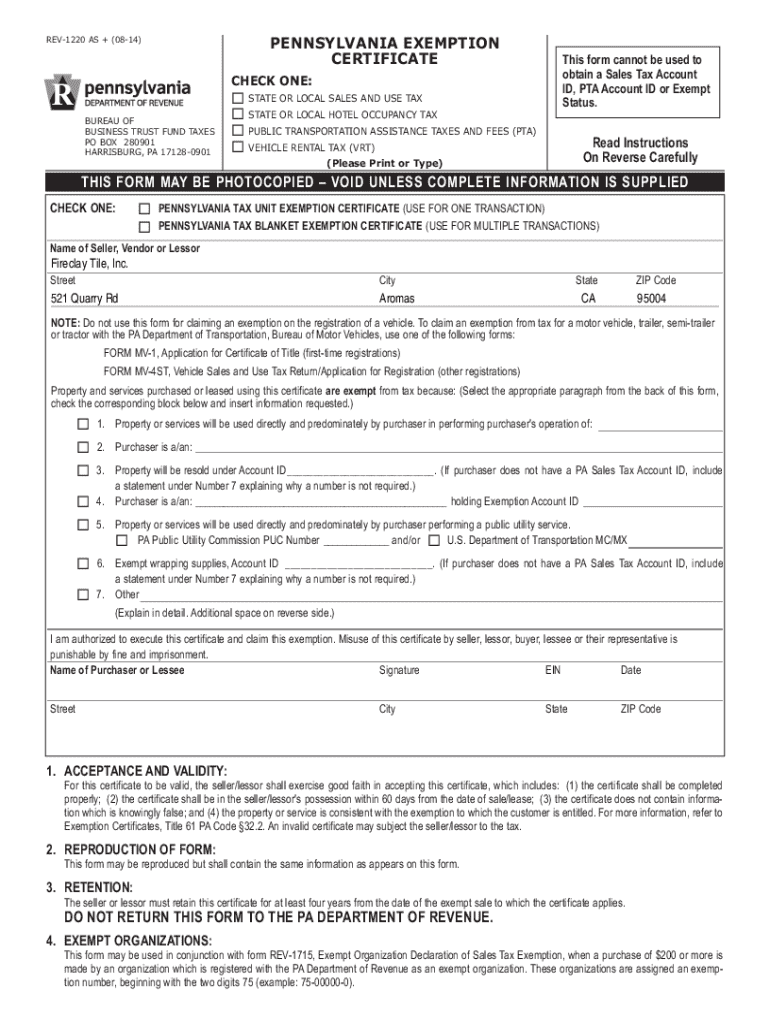

Understanding SEC filings

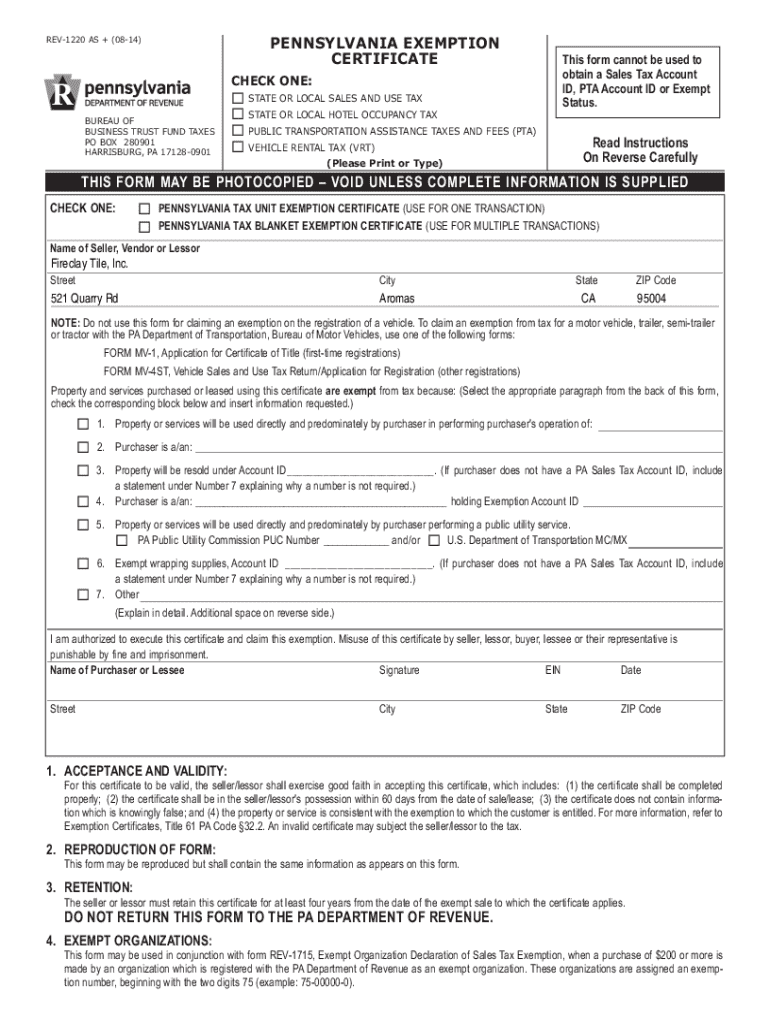

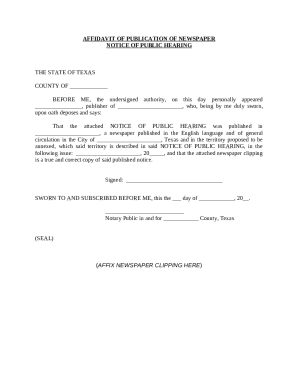

SEC filings are documents that publicly traded companies must submit to the Securities and Exchange Commission (SEC) under the Securities Act of 1933 and the Securities Exchange Act of 1934. These filings serve multiple purposes, such as providing investors with transparent information about a company's financial health, operational activities, and corporate governance.

For investors, SEC filings are essential in making informed decisions regarding investments. Investors can analyze a company's performance, understand risks, and seek insights into management practices, all of which are presented in a standardized format. Companies, too, benefit from these regulations as they enforce accountability and robust disclosure practices, thereby boosting investor confidence.

Types of SEC filings relevant to investors

Several key forms are particularly pertinent to investors looking to gauge the health of a company. The most notable include:

Each of these filing types fulfills different reporting requirements, ranging from annual disclosures of performance metrics to immediate notifications of significant company events, thereby aiding investors in tracking investment changes.

The investor form: A detailed look

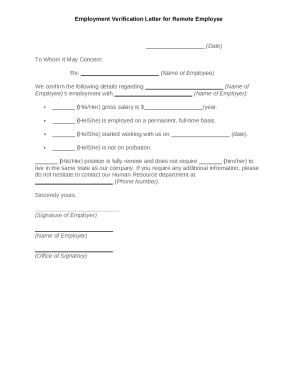

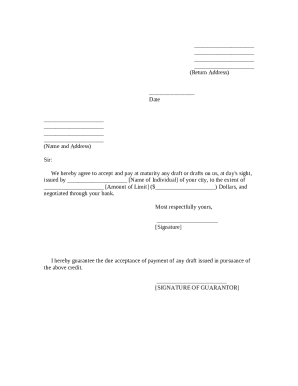

The investor form, as part of SEC filings, serves a specific function to ensure that investors receive relevant and accurate information. Typically, this form is required to be filed by registered investment advisors, broker-dealers, or companies seeking to raise capital through securities offerings.

The necessity of filing the investor form arises under various circumstances, particularly during initial public offerings (IPOs) or when significant changes occur in the company’s structure or finances. This ensures market transparency and compliance with the 33 Act provisions, enhancing investor protection.

Key components of the investor form

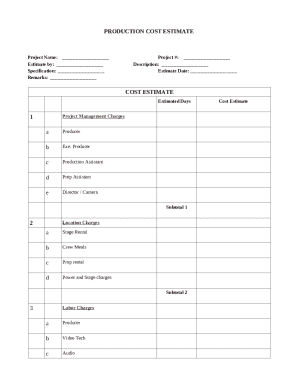

Understanding the key components of the investor form is essential for accurate and effective completion. Key sections generally include:

Accurate data in these sections is vital as inaccuracies can lead to penalties and loss of investor trust. Therefore, companies should prioritize precision in their disclosures to maintain compliance and transparency.

Step-by-step guide to completing the investor form

Completing the investor form may seem daunting, but approaches can simplify this process significantly. It begins with gathering the necessary information.

Gathering necessary information

Before diving into the form, collect the following documents and data:

Ensuring accuracy and completeness is paramount, which means verifying figures against financial statements and cross-referencing information.

Filling out the investor form

Step through the form section by section. Pay close attention to:

Common pitfalls include overlooking required sections or submitting incomplete data. Thoroughly review and check indicated links for accuracy.

Editing and reviewing your submission

Before submitting, utilize pdfFiller tools to enhance workflow efficiency. These tools streamline editing and facilitate solid document management. Key best practices for review include:

Submitting the investor form

Once the investor form is complete, understanding the submission process is crucial. Filings must be done electronically through the SEC's EDGAR system, which requires a registered account.

Key deadlines and compliance considerations include filing within specific time frames post-events (like the occurrence of a material event) and ensuring that your SEC registration is updated.

What happens after submission?

After submission, you’ll receive a confirmation of receipt from the SEC. Subsequently, you can track your filing status through the EDGAR system. Keeping an eye on status updates ensures that your submission has been processed without issues.

eSignature and document management

Utilizing electronic signatures is increasingly important in the realm of SEC filings. eSigning forms accelerates the process while maintaining compliance with SEC regulations. Notably, electronic signatures hold the same legal validity as traditional signatures, offering flexibility and efficiency.

Utilizing pdfFiller for comprehensive document management

pdfFiller stands out as a content management platform that offers powerful features for managing SEC filings. Here’s how pdfFiller enhances your experience:

By utilizing collaborative tools, pdfFiller fosters an environment where teams can efficiently complete forms while maintaining transparency and compliance in their filing processes.

Advanced tips for investors

To maximize your investment potential, understanding regulatory changes is crucial. The SEC frequently updates filing requirements, and staying informed through reliable resources such as official SEC announcements and legal updates will help you maintain compliance.

Additionally, to enhance transparency and compliance, employ strategies that ensure robust disclosures. Consider:

By embracing these strategies, you enhance your ability to maintain high standards in disclosures while ensuring your investor communication remains effective and compliant.

Troubleshooting common issues

Errors or omissions in your filing can pose significant challenges. If you discover a mistake post-submission, prompt action is necessary. Typically, you can file an amended form to correct any inaccuracies, keeping the SEC informed of the changes.

If clarification is needed, reaching out to the SEC is straightforward. Contact the respective SEC office that handles your filings, ensuring to have relevant details of your submission ready to expedite the process.

Real-world examples and case studies

Examining successful investor filings offers invaluable lessons. For instance, many companies have adopted rigorous internal review processes before filing forms. Key takeaways from such case studies include the benefits of early preparation and the significance of collaborative review.

Implementing best practices observed in these case studies can greatly enhance the quality of your investor filings, ensuring compliance while protecting investor interests.

Interactive tools and resources

pdfFiller provides a suite of resources tailored for individuals and teams engaged in SEC filings. From templates to interactive tools designed for seamless document management, using pdfFiller elevates the filing process.

Additional tools to enhance your filing experience

Other third-party resources may also assist with gathering information and ensuring compliance with SEC regulations. Tools that offer real-time updates on regulatory changes or facilitate data collection can significantly streamline your workflow, maximizing efficiency throughout the SEC filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the sec filing - investor in Gmail?

How do I edit sec filing - investor straight from my smartphone?

How do I complete sec filing - investor on an Android device?

What is sec filing - investor?

Who is required to file sec filing - investor?

How to fill out sec filing - investor?

What is the purpose of sec filing - investor?

What information must be reported on sec filing - investor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.