Get the free New Jersey ST-3 Tax Form

Get, Create, Make and Sign new jersey st-3 tax

How to edit new jersey st-3 tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new jersey st-3 tax

How to fill out new jersey st-3 tax

Who needs new jersey st-3 tax?

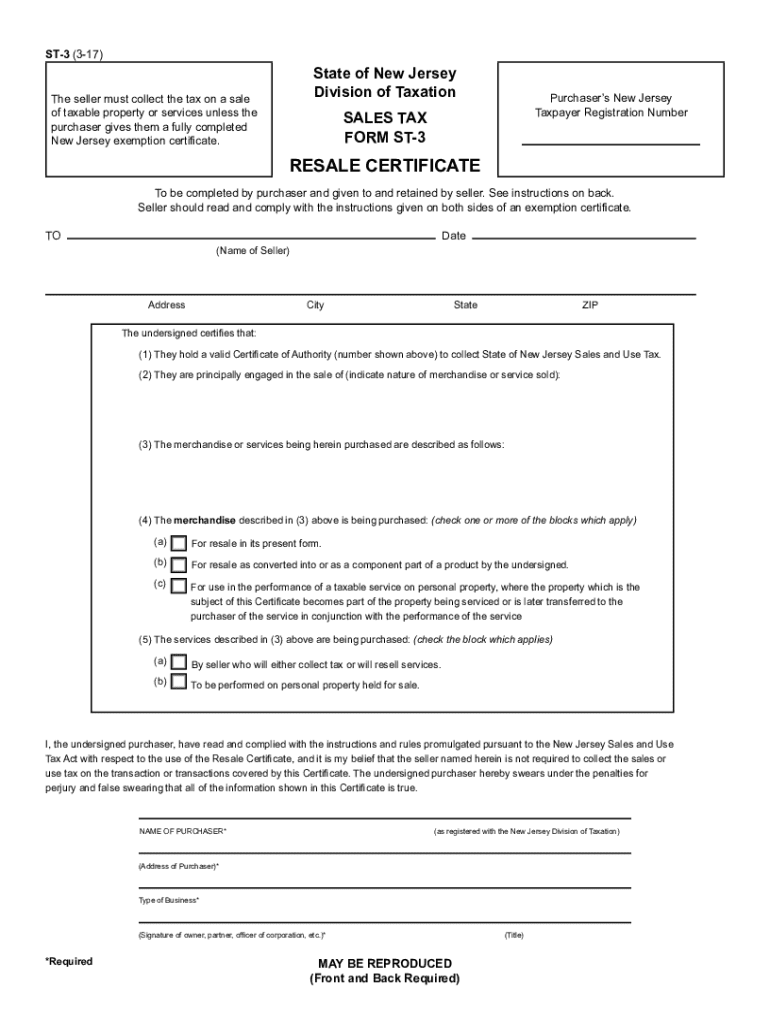

New Jersey ST-3 Tax Form: A Comprehensive How-To Guide

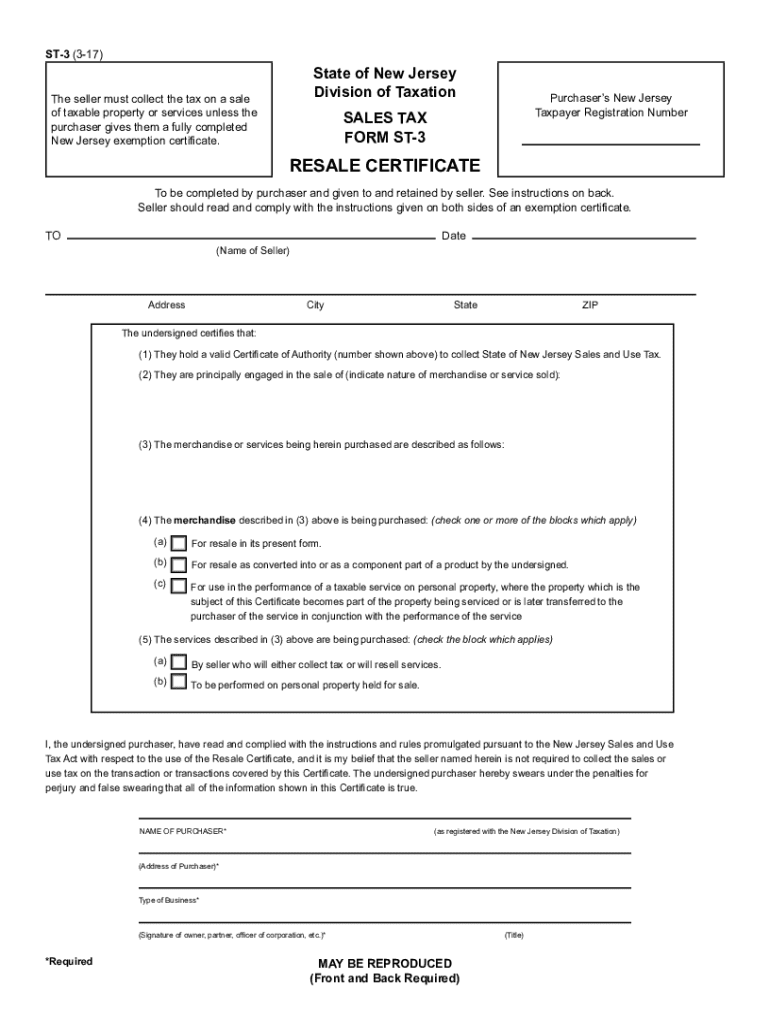

Overview of the New Jersey ST-3 Tax Form

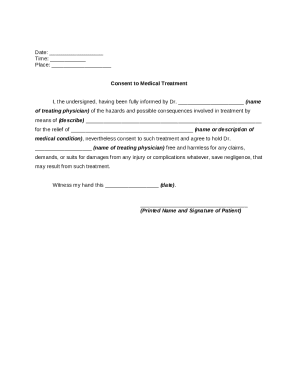

The New Jersey ST-3 Tax Form is essential for those engaging in sales transactions in the state. This form certifies that a seller is providing tax-exempt sales to qualified buyers, allowing both parties to comply with state tax regulations and avoid unnecessary taxation.

Anyone who is buying or selling goods that may qualify for sales tax exemptions in New Jersey should file the ST-3 form. It’s particularly useful for wholesalers, manufacturers, and certain nonprofits. Understanding who needs to file this form ensures you remain compliant and avoid potential penalties.

Understanding the ST-3 Tax Form: Definitions and Key Terms

To navigate the New Jersey ST-3 Tax Form effectively, it's crucial to understand some key terms. Sales tax is a percentage imposed on the sale of goods and services, whereas exemptions refer to specific categories of goods or purchasers that are not subject to taxation under certain conditions.

Common misconceptions include thinking that only certain businesses can use the ST-3 form. In reality, any buyer eligible for a tax exemption can submit this form to avoid sales tax on qualifying purchases. Misunderstanding these concepts can lead to incorrect filing or unintentional penalties.

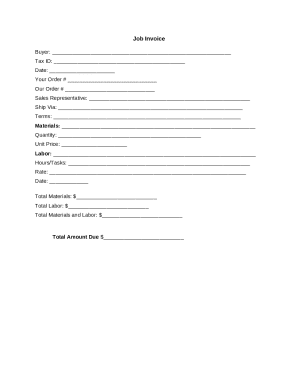

Step-by-step guide to filling out the New Jersey ST-3 form

Filling out the New Jersey ST-3 Tax Form requires careful attention to detail. Here’s a straightforward approach.

Tips for efficiently managing your tax documents

Managing tax documents can be daunting, but with proper organization, it becomes manageable. Utilize a systematic approach to categorize your documents according to type, such as receipts, forms, and exemption certificates. This will save time when it comes to filing.

Leveraging digital tools becomes essential. Cloud solutions for tax management, such as pdfFiller, enable users to access their documents from anywhere. This multi-functional platform supports document creation, editing, signing, and storage, making tax time less stressful.

Common errors and how to avoid them

Errors on the New Jersey ST-3 form can lead to complications. Common mistakes include incorrect dates, missing signatures, and incomplete sections. Each of these errors can delay processing times and may lead to audits.

To avoid these pitfalls, always validate your information. Ensure that all required fields are filled out completely and that names and addresses are current. A final review can save you from many potential headaches post-filing.

Post-submission: What to expect after filing

After submitting your ST-3 form, expect to receive a confirmation of receipt from the New Jersey Division of Taxation. This confirmation serves as proof that your form has been filed correctly.

Depending on your filing situation, you may need to take follow-up actions, such as providing additional documentation if requested. Understanding the potential risks of audits is also essential. Organizing documents and maintaining accurate records can prepare you in case of a review.

Interactive tools for filling out the ST-3 form

Using interactive tools can streamline the process of filling out the ST-3 form. Platforms like pdfFiller offer editing features and electronic signing capabilities, significantly improving your filing experience.

Collaboration is another valuable aspect. With pdfFiller, multiple team members can access and edit the same document in real-time, fostering teamwork and reducing errors. Cloud-based document management is revolutionizing the way we handle tax forms.

Related tax forms and resources

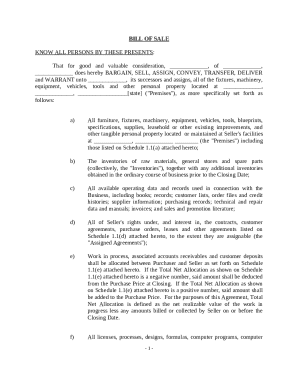

Understanding the differences between the ST-3 form and related tax forms, such as ST-4 and ST-6, is vital for effective tax management. Each of these forms serves unique purposes and has different filing requirements.

For further assistance, utilize the Department of Taxation resources. Their website provides comprehensive information and customer support through hotlines to help clarify any uncertainties about sales tax obligations in New Jersey.

User experiences: Testimonials and case studies

Hearing from those who successfully navigated their ST-3 form can be enlightening. Users often share that the flexibility and user-friendliness of pdfFiller significantly reduced their anxiety about the process.

Testimonials highlight how digital solutions streamlined their document management, provided peace of mind through organization, and sped up their filing process—proving that the right tool can make all the difference.

Conclusion: Navigating New Jersey tax forms with confidence

Completing the New Jersey ST-3 Tax Form doesn’t have to be a cumbersome task. By empowering yourself with the right tools, like pdfFiller's multifaceted platform, filing becomes straightforward and efficient.

Confidence in navigating tax forms ultimately stems from being organized, informed, and connected to the right technology—equipping you to face tax season with peace of mind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new jersey st-3 tax to be eSigned by others?

Can I create an eSignature for the new jersey st-3 tax in Gmail?

How do I edit new jersey st-3 tax on an iOS device?

What is new jersey st-3 tax?

Who is required to file new jersey st-3 tax?

How to fill out new jersey st-3 tax?

What is the purpose of new jersey st-3 tax?

What information must be reported on new jersey st-3 tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.