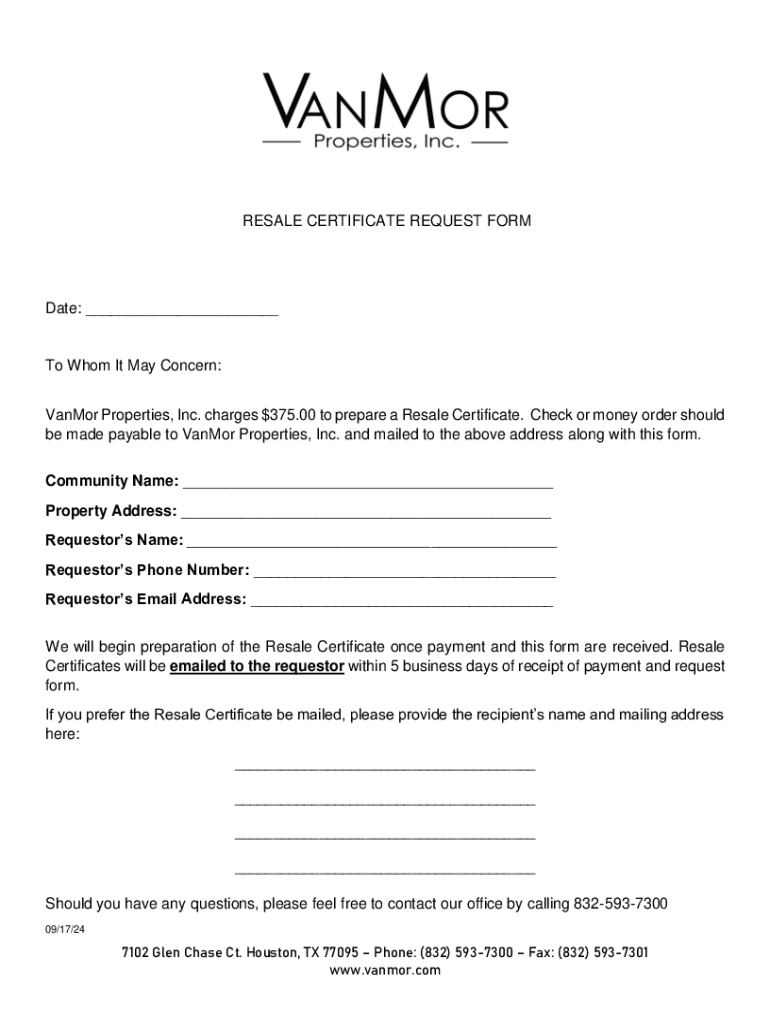

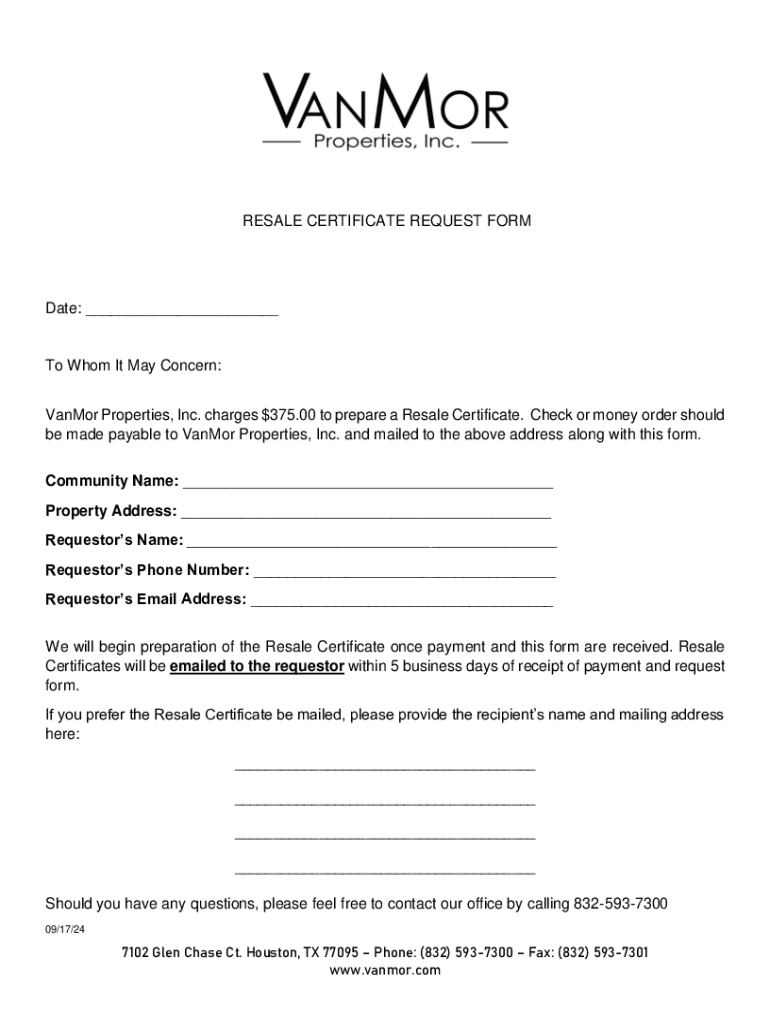

Get the free charges $375

Get, Create, Make and Sign charges 375

How to edit charges 375 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charges 375

How to fill out charges 375

Who needs charges 375?

Understanding the Charges 375 Form: A Comprehensive Guide

Understanding the Charges 375 form

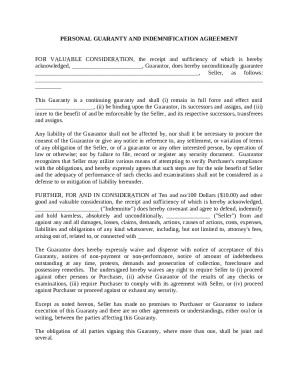

The Charges 375 form is a critical document used primarily in legal and administrative contexts. It serves to formally outline the circumstances and claims involved in a case, ensuring that all involved parties have a clear understanding of the issues at hand. The purpose of this form is to document charges in a structured manner, thereby facilitating efficient processing, communication, and resolution.

In legal scenarios, this form can be vital for both defendants and prosecutors. It helps in maintaining the flow of information regarding the charges laid against an individual, which is essential for any subsequent court proceedings. Its importance extends to administrative offices where accurate record-keeping is paramount.

Key features of the Charges 375 form

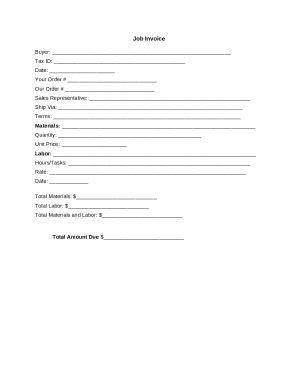

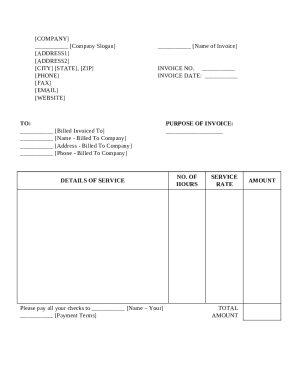

A well-structured Charges 375 form consists of several essential sections, each critical for ensuring comprehensive documentation of the charges. These sections include.

Common mistakes to avoid when filling out the Charges 375 form include providing incomplete personal information, failing to clarify the details of the charges adequately, and neglecting to include relevant witness statements, which can lead to complications in legal proceedings.

Step-by-step guide to filling out the Charges 375 form

Before beginning the process of filling out the Charges 375 form, it's crucial to prepare adequately. Start by gathering all necessary documents related to the case, such as prior communication, tickets if applicable, and any relevant legal statutes for reference.

Understanding the required information for each section helps ensure completeness and accuracy. When filling out the form, break it down section by section.

After completing the form, it’s important to double-check for errors. Verifying the accuracy of information not only avoids delays in processing your case but also enhances credibility during legal reviews.

Editing and customizing your Charges 375 form

Editing your Charges 375 form can enhance its clarity and effectiveness. Utilizing tools like pdfFiller provides various options for making edits. You can highlight key edits, add annotations, or even make comments to draw attention to vital points.

When it comes to signing the form electronically, the process is straightforward. Simply follow the step-by-step guide provided by pdfFiller to ensure your e-signature is legally valid. Electronic signatures are recognized in many jurisdictions, making them a convenient choice.

Managing your completed Charges 375 form

Once your Charges 375 form is completed, saving and storing your document properly is vital. Utilizing cloud storage has several advantages, including easy access from multiple devices and the safety of your data.

Organizing your documents for easy access ensures that you can retrieve them promptly when needed. Sharing the form with relevant parties is just as important. With pdfFiller, you can share your documents securely and take advantage of collaborative features that allow teams to work together efficiently.

Troubleshooting common issues

When filling out or submitting the Charges 375 form, complications can sometimes arise. Should you encounter errors, reach out to the support team at pdfFiller for assistance. They can guide you through any issues related to the form or the editing process.

FAQs regarding the Charges 375 form often include clarifications on complex legal terms or inquiries about processing times. Understanding your rights and options regarding the form is crucial for successfully navigating the system.

Future updates and changes to the Charges 375 form

Staying informed about legal changes related to the Charges 375 form is essential for anyone involved in legal proceedings. Regular updates may alter how charges are documented or processed. pdfFiller consistently enables users to stay updated, ensuring that you have the latest information at your fingertips.

Success stories and best practices

Real-life situations highlight the value of effective document management. Many users have successfully navigated the Charges 375 process by utilizing tools from pdfFiller, simplifying their legal paperwork experience. They emphasize the importance of detailed documentation and prompt submissions.

Tips from experienced users include maintaining organized records and regularly reviewing legal documentation. Using collaborative features available through pdfFiller can also streamline communication with your legal representatives or team members.

Interactive tools available through pdfFiller

pdfFiller provides a robust platform for managing the Charges 375 form with features designed to enhance user experience. From form templates tailored for different jurisdictions to performance analytics for tracking document management, users have access to powerful tools that simplify their workflow.

These interactive tools not only assist in the efficient completion of the Charges 375 form but also ensure that you maintain full control over your document management process, making it an invaluable resource for individuals and teams.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find charges 375?

How do I edit charges 375 in Chrome?

How can I edit charges 375 on a smartphone?

What is charges 375?

Who is required to file charges 375?

How to fill out charges 375?

What is the purpose of charges 375?

What information must be reported on charges 375?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.